2025 MSN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Currency

Introduction: MSN's Market Position and Investment Value

Meson Network (MSN), as a decentralized bandwidth marketplace on Web3, has made significant strides since its inception. As of 2025, Meson Network's market capitalization stands at $172,955.5342, with a circulating supply of approximately 17,456,150 tokens, and a price hovering around $0.009908. This asset, often referred to as the "Web3 bandwidth solution," is playing an increasingly crucial role in decentralized storage, computation, and the emerging Web3 Dapp ecosystem.

This article will comprehensively analyze Meson Network's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MSN Price History Review and Current Market Status

MSN Historical Price Evolution Trajectory

- 2024: Project launch, price reached all-time high of $13.638 on April 29

- 2025: Market downturn, price dropped to all-time low of $0.007028 on September 10

- 2025: Gradual recovery, current price stabilized around $0.009908

MSN Current Market Situation

As of November 1, 2025, MSN is trading at $0.009908, experiencing a 7.13% decrease in the last 24 hours. The token's market capitalization stands at $172,955.5342, ranking it at 4504th position in the overall cryptocurrency market. MSN's 24-hour trading volume is $23,961.452965, indicating moderate market activity. The current price represents a significant decline of 92.86% from its all-time high, suggesting a bearish long-term trend. Short-term price movements show negative momentum across various timeframes, with 1-hour, 7-day, and 30-day changes all in the red. The circulating supply of 17,456,150 MSN tokens represents 17.46% of the total supply, indicating potential for future token releases.

Click to view the current MSN market price

MSN Market Sentiment Indicator

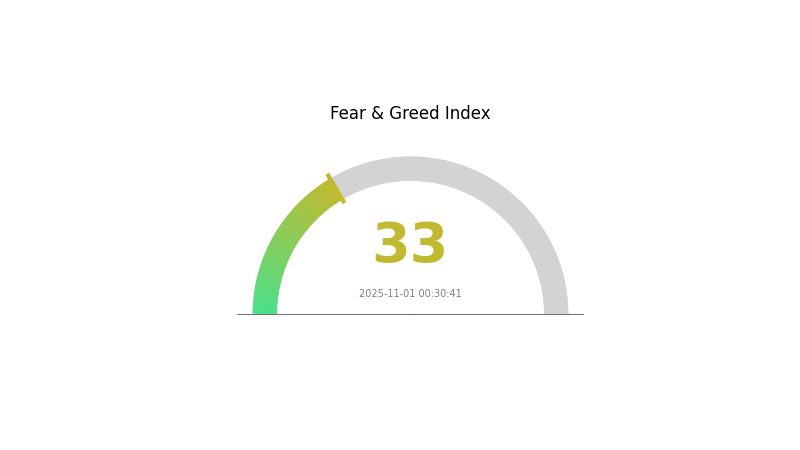

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of fear, with the Fear and Greed Index registering at 33. This indicates a cautious sentiment among investors, possibly due to recent market fluctuations or external factors affecting the crypto landscape. During such periods, some traders may view this as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

MSN Holdings Distribution

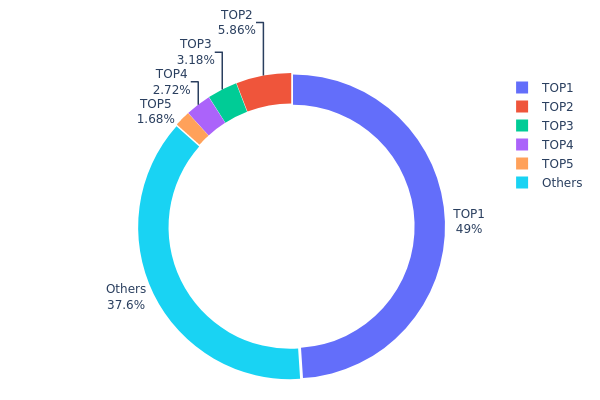

The address holdings distribution data for MSN reveals a highly concentrated ownership structure. The top address holds a staggering 48.95% of the total supply, indicating a significant concentration of power within the network. The subsequent four largest addresses collectively hold an additional 13.44%, bringing the total held by the top five addresses to 62.39%.

This level of concentration raises concerns about the decentralization and potential market manipulation of MSN. With nearly half of the supply controlled by a single entity, there is an increased risk of price volatility and market instability. The dominant address could potentially exert substantial influence over the token's price movements and overall market dynamics.

While the remaining 37.61% is distributed among other addresses, the current distribution structure suggests a relatively low level of decentralization. This concentration may impact MSN's resilience to market shocks and its ability to maintain a stable on-chain structure. Investors and market participants should be aware of these ownership dynamics when considering their involvement with MSN.

Click to view the current MSN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdecd...beeb0e | 51401.86K | 48.95% |

| 2 | 0x0529...c553b7 | 6153.17K | 5.86% |

| 3 | 0x0d07...b492fe | 3342.20K | 3.18% |

| 4 | 0x93ae...1462f8 | 2857.14K | 2.72% |

| 5 | 0x91d4...c8debe | 1764.23K | 1.68% |

| - | Others | 39481.39K | 37.61% |

II. Key Factors Affecting MSN's Future Price

Supply Mechanism

- Market Demand: The increase in market demand is a key factor driving the price of MSN upwards. As more investors and users start paying attention to and purchasing MSN, the price is likely to rise.

Macroeconomic Environment

- Inflation Hedging Properties: In an inflationary environment, MSN's performance may be influenced by overall economic conditions and investor sentiment towards cryptocurrencies as potential inflation hedges.

Technological Development and Ecosystem Building

-

Technological Innovation: As a key factor affecting MSN's future price, ongoing technological advancements and innovations within the Meson Network ecosystem could significantly impact its value and adoption.

-

Ecosystem Applications: The development and growth of major DApps and ecosystem projects built on or utilizing the Meson Network could drive demand for MSN and influence its price.

III. MSN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00694 - $0.00951

- Neutral prediction: $0.00951 - $0.01037

- Optimistic prediction: $0.01037 - $0.01083 (requires significant market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.00592 - $0.01423

- 2028: $0.01083 - $0.01785

- Key catalysts: Improved market sentiment, technological advancements in the MSN ecosystem

2029-2030 Long-term Outlook

- Base scenario: $0.01508 - $0.01734 (assuming steady market growth)

- Optimistic scenario: $0.01734 - $0.01994 (assuming strong market performance and increased adoption)

- Transformative scenario: $0.01994 - $0.02500 (assuming breakthrough innovations and mainstream acceptance)

- 2030-12-31: MSN $0.01994 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01037 | 0.00951 | 0.00694 | -3 |

| 2026 | 0.01083 | 0.00994 | 0.00845 | 0 |

| 2027 | 0.01423 | 0.01039 | 0.00592 | 4 |

| 2028 | 0.01785 | 0.01231 | 0.01083 | 24 |

| 2029 | 0.0196 | 0.01508 | 0.01282 | 52 |

| 2030 | 0.01994 | 0.01734 | 0.0111 | 75 |

IV. Professional Investment Strategies and Risk Management for MSN

MSN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in Web3 technology

- Operation suggestions:

- Accumulate MSN during market dips

- Set a long-term price target based on project milestones

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Meson Network adoption metrics

- Stay updated on Web3 infrastructure developments

MSN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MSN with other Web3 infrastructure tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for MSN

MSN Market Risks

- High volatility: MSN price may experience significant fluctuations

- Competition: Other Web3 bandwidth solutions may emerge

- Adoption risk: Slow uptake of decentralized bandwidth services

MSN Regulatory Risks

- Uncertain regulatory landscape: Potential changes in crypto regulations

- Cross-border compliance: Challenges in operating a global decentralized network

- Data privacy concerns: Potential regulatory scrutiny on bandwidth sharing

MSN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network demand

- Network security: Risks associated with decentralized infrastructure

VI. Conclusion and Action Recommendations

MSN Investment Value Assessment

Meson Network (MSN) presents a innovative solution for Web3 bandwidth markets, but faces significant market, regulatory, and technical risks. Long-term potential exists if adoption grows, but short-term volatility is expected.

MSN Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Evaluate MSN as part of a diversified Web3 infrastructure portfolio

MSN Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- staking: Participate in network security and earn rewards if offered

- Node operation: Run a Meson Network node to contribute bandwidth and earn MSN tokens

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

Yes, Hamster Kombat coin reached $1 in 2024. Analysts predicted a potential surge, and current price trends support this milestone.

What are the long-term prospects for MSN stock?

MSN stock shows promising long-term prospects, with analysts projecting an average price of $0.4241 by 2030, indicating potential for steady growth and value appreciation over the coming years.

Will Mana reach $20?

Mana is unlikely to reach $20 by 2025. Analysts predict it could hit $10 by then, with $20 being a more long-term target.

How much will Mana be worth in 2025?

Based on current predictions, Mana is expected to be worth around $0.24 on average in 2025, with a potential minimum value of $0.23.

Share

Content