2025 MSN Price Prediction: Analyzing Market Trends and Future Prospects for Microsoft's Network

Introduction: MSN's Market Position and Investment Value

Meson Network (MSN), as a pioneer in creating an efficient bandwidth marketplace on Web3, has been making significant strides since its inception. As of 2025, MSN's market capitalization has reached $157,105, with a circulating supply of approximately 17,456,150 tokens, and a price hovering around $0.009. This asset, often referred to as the "Web3 bandwidth solution," is playing an increasingly crucial role in decentralized storage, computation, and the emerging Web3 Dapp ecosystem.

This article will provide a comprehensive analysis of MSN's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MSN Price History Review and Current Market Status

MSN Historical Price Evolution Trajectory

- 2024: Initial launch, price peaked at $13.638 on April 29

- 2025: Market downturn, price dropped significantly to $0.007028 on September 10

MSN Current Market Situation

As of November 1, 2025, MSN is trading at $0.009, representing a 99.93% decline from its all-time high. The token has experienced a sharp 18.6% decrease in the past 24 hours and a 20.72% drop over the last week. The current market capitalization stands at $157,105, with a circulating supply of 17,456,150 MSN tokens out of a total supply of 100,000,000. The 24-hour trading volume is $25,708, indicating relatively low liquidity. The token's market dominance is currently at 0.000022%, suggesting a very small presence in the overall cryptocurrency market.

Click to view the current MSN market price

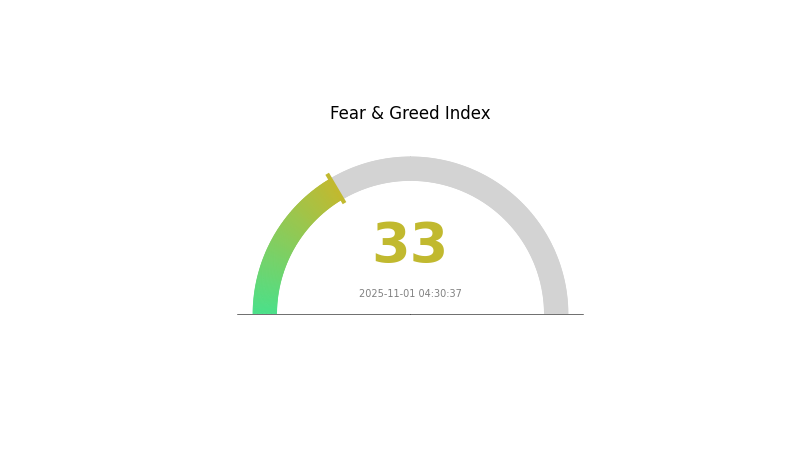

MSN Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 33, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider diversifying their portfolios to mitigate risks. As always, Gate.com offers a range of tools and resources to help navigate these uncertain market conditions.

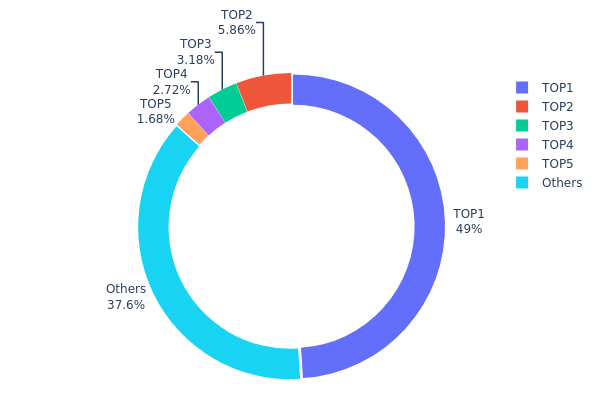

MSN Holdings Distribution

The address holdings distribution data for MSN reveals a highly concentrated ownership structure. The top address holds a substantial 48.95% of the total supply, amounting to 51,401.86K tokens. This significant concentration in a single address raises concerns about potential market manipulation and price volatility. The next four largest addresses collectively hold an additional 13.44% of the supply, bringing the total concentration in the top 5 addresses to 62.39%.

This level of concentration suggests a relatively low degree of decentralization for MSN. The disproportionate holding by the top address could potentially impact market dynamics, as any large-scale movement of these tokens could lead to significant price fluctuations. Furthermore, the concentration of power in few hands may raise questions about the token's governance structure and its ability to resist centralized control.

While 37.61% of the supply is distributed among other addresses, the current distribution pattern indicates a need for improved token dispersion to enhance market stability and reduce manipulation risks. This concentration level may deter some investors concerned about potential whale influence on the MSN ecosystem.

Click to view the current MSN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdecd...beeb0e | 51401.86K | 48.95% |

| 2 | 0x0529...c553b7 | 6153.17K | 5.86% |

| 3 | 0x0d07...b492fe | 3342.20K | 3.18% |

| 4 | 0x93ae...1462f8 | 2857.14K | 2.72% |

| 5 | 0x91d4...c8debe | 1764.23K | 1.68% |

| - | Others | 39481.39K | 37.61% |

II. Key Factors Affecting MSN's Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: Central banks are closely monitoring international commodity prices and domestic service price trends. The current rise in international oil prices is considered a short-term phenomenon with limited impact on domestic prices.

-

Inflation Hedging Properties: Investors are paying attention to economic growth and inflation trends. The central bank predicts that the year-on-year growth rates of domestic CPI and core CPI will continue to decline to 1.89% and 1.79% respectively next year.

-

Geopolitical Factors: International political situations, such as policies of major countries like the United States, are becoming important variables affecting economic growth and market trends.

Technological Development and Ecosystem Building

-

Data-Driven Innovation: The advancement of technologies such as artificial intelligence, big data, cloud computing, and the Internet of Things is showing significant data-biased technological progress characteristics. This is expected to drive long-term economic growth by applying data elements to various aspects of production, distribution, exchange, and consumption.

-

Digital Infrastructure: There is a growing emphasis on accelerating the construction of new infrastructure, especially digital infrastructure. This includes expanding data centers and improving data processing capabilities.

-

Ecosystem Applications: The development of data-intensive industries is being actively promoted. Key sectors include telecommunications, information technology, and services. There are also plans to implement special industrial internet development projects in typical industries such as healthcare, education, and automobile manufacturing.

III. MSN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00762 - $0.00886

- Neutral prediction: $0.00886 - $0.00944

- Optimistic prediction: $0.00944 - $0.01002 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00838 - $0.01386

- 2028: $0.00775 - $0.01304

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00904 - $0.01369 (assuming steady market growth)

- Optimistic scenario: $0.01369 - $0.01684 (assuming strong market performance)

- Transformative scenario: Above $0.01684 (extremely favorable market conditions)

- 2030-12-31: MSN $0.01684 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01002 | 0.00886 | 0.00762 | -1 |

| 2026 | 0.00982 | 0.00944 | 0.00651 | 4 |

| 2027 | 0.01386 | 0.00963 | 0.00838 | 6 |

| 2028 | 0.01304 | 0.01175 | 0.00775 | 30 |

| 2029 | 0.01499 | 0.01239 | 0.00892 | 37 |

| 2030 | 0.01684 | 0.01369 | 0.00904 | 52 |

IV. MSN Professional Investment Strategies and Risk Management

MSN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MSN during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

MSN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. MSN Potential Risks and Challenges

MSN Market Risks

- High volatility: Price fluctuations can be extreme

- Limited liquidity: May face challenges in executing large trades

- Competition: Other blockchain projects may offer similar solutions

MSN Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny

- Compliance issues: May face challenges in adhering to evolving regulations

- Cross-border restrictions: Possible limitations on international usage

MSN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability challenges: May face issues with network congestion

- Interoperability concerns: Integration with other blockchain networks

VI. Conclusion and Action Recommendations

MSN Investment Value Assessment

MSN presents a unique value proposition in the Web3 bandwidth marketplace but faces significant short-term volatility and regulatory uncertainties. Long-term potential exists, but investors should be prepared for high risk.

MSN Investment Recommendations

✅ Beginners: Start with small positions and focus on learning ✅ Experienced investors: Consider allocating a portion of high-risk portfolio ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

MSN Trading Participation Methods

- Spot trading: Buy and sell MSN on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities with MSN

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

Based on current market trends and expert analysis, it's unlikely that Hamster Kombat coin will reach $1 in the near future. Predictions suggest it may not hit this price point even by 2030.

Can Microsoft stock reach $1 000?

Yes, Microsoft stock could reach $1,000 with sustained growth in AI and cloud computing. Strong financials and market conditions support this potential milestone.

What is the 12 month forecast for Moderna stock?

Based on analyst predictions, the 12-month forecast for Moderna stock ranges from $203.88 to $270. The stock is currently trading below its key moving averages.

What are the long-term prospects for MSN stock?

MSN stock is projected to trade between $0.34 and $0.56 in 2025, with forecasts indicating gradual growth in the long term.

Share

Content