2025 MOTHER Fiyat Tahmini: Piyasa Trendleri ve Kripto Para Büyüme Potansiyelinin Geleceğine Yönelik Analiz

Giriş: MOTHER'ın Piyasa Konumu ve Yatırım Değeri

Solana blokzincirindeki bir meme coin olan MOTHER IGGY (MOTHER), piyasaya girdiğinden bu yana kripto para pazarında dikkat çekici bir ivme yakaladı. 2025 yılı itibarıyla MOTHER’ın piyasa değeri 4.709.111 $’a ulaştı, dolaşımda yaklaşık 965.377.460 token bulunuyor ve fiyatı yaklaşık 0,004878 $ seviyesinde seyrediyor. “Solana tabanlı meme token” olarak tanımlanan bu varlık, meme coin ekosistemi ve topluluk etkileşiminde giderek daha önemli bir konum elde ediyor.

Bu makalede, MOTHER’ın 2025’ten 2030’a fiyat trendleri; tarihsel örüntüler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik parametreler ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. MOTHER Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

MOTHER’ın Tarihsel Fiyat Gelişim Seyri

- 2024: MOTHER, 12 Haziran’da 0,2266 $ ile tüm zamanların en yüksek seviyesine ulaşarak fiyat tarihine önemli bir not düştü.

- 2025: Piyasa geriledi ve MOTHER, 7 Nisan’da 0,00313 $ ile tüm zamanların en düşük seviyesini gördü.

MOTHER Güncel Piyasa Durumu

11 Ekim 2025 itibarıyla MOTHER, 0,004878 $ seviyesinden işlem görüyor ve bu, tüm zamanların zirvesine göre ciddi bir değer kaybına işaret ediyor. Son dönemde token yüksek dalgalanma yaşadı:

- Son 24 saatte MOTHER fiyatı %17,38 oranında sert düştü.

- Geçen hafta fiyat %31,0099 geriledi.

- 30 günlük performans %38,84 düşüş gösteriyor.

- Yıl başından bu yana MOTHER, değerinin %93,96’sını kaybetti.

Güncel piyasa değeri 4.709.111,25 $ ve 24 saatlik işlem hacmi 37.761,39 $. MOTHER’ın dolaşımdaki arzı 965.377.460,01 token olup, toplam arzın %97,51’ini oluşturan 989.998.941,76 tokene yakındır.

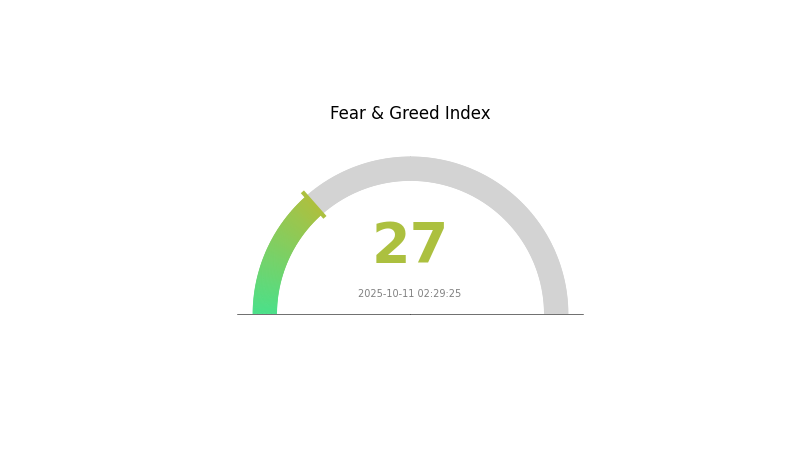

Kripto para piyasası şu an “Korku” bölgesinde; VIX endeksi 27 ile yatırımcıların temkinli ve riskten sakınan bir tutum sergilediğini gösteriyor.

Güncel MOTHER piyasa fiyatını görmek için tıklayın

MOTHER Piyasa Duyarlılığı Göstergesi

2025-10-11 Korku ve Açgözlülük Endeksi: 27 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto para piyasası şu anda korku döneminden geçiyor ve duyarlılık endeksi 27 seviyesinde. Bu, yatırımcılar arasında temkinli bir havanın hakim olduğunu gösteriyor. Böyle dönemlerde sürekli bilgi sahibi olmak ve araştırmaya dayalı kararlar almak büyük önem taşıyor. Piyasa duyarlılığının hızla değişebileceğini, korku dönemlerinin ise uzun vadeli yatırımcılar açısından fırsatlar sunabileceğini unutmayın. Trendleri izleyin, portföyünüzü çeşitlendirin ve riski etkin yönetin. Yatırım kararı vermeden önce mutlaka kapsamlı bir araştırma yapın.

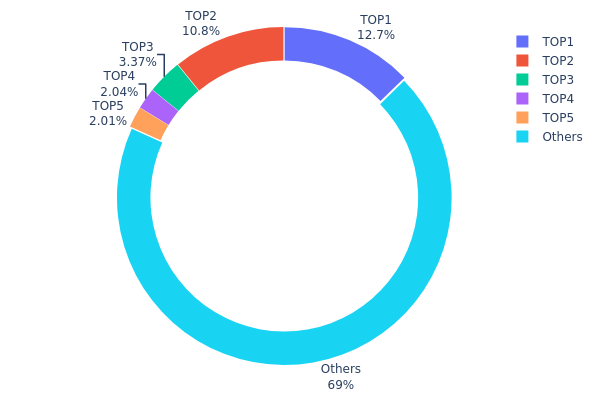

MOTHER Varlık Dağılımı

MOTHER’ın adres bazlı varlık dağılımı, orta derecede yoğunlaşmış bir sahiplik yapısı sergiliyor. En büyük iki adres, toplam arzın sırasıyla %12,69 ve %10,84’ünü elinde tutuyor; bu da neredeyse tokenların dörtte biri anlamına geliyor. Sonraki üç büyük adres ise %2-3,36 aralığında paya sahipken, kalan %69,08’lik token ise diğer adresler arasında dağılmış durumda.

Bu dağılım, toplam arzın yaklaşık %30,92’sinin ilk beş adreste toplandığı belirli bir merkezileşmeye işaret ediyor. Böyle bir yoğunlaşma, büyük sahiplerin piyasa üzerinde fiyat oynaklığı yaratabilecek işlemler yapabilmesine zemin hazırlayabilir. Diğer taraftan, tokenların üçte ikisinin küçük adreslerde olması, bu yoğunlaşmadan doğabilecek risklerin dengelenmesini de sağlıyor.

Mevcut dağılım, merkezi ve merkeziyetsiz sahiplik arasında bir denge oluşturuyor. Büyük sahiplerin varlığı volatiliteyi artırabilirken, küçük adreslere yayılmış önemli bir oran, genel piyasa istikrarına ve manipülasyona karşı direnç kazandırıyor. Bu yapı, MOTHER’ın hem kurumsal hem de bireysel yatırımcı ilgisiyle olgunlaşan bir piyasa olduğunu gösteriyor.

Güncel MOTHER Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 122.596,57K | 12,69% |

| 2 | DMe3dd...x4vGH3 | 104.656,48K | 10,84% |

| 3 | Cw32Ny...YLwZeh | 32.509,75K | 3,36% |

| 4 | u6PJ8D...ynXq2w | 19.688,96K | 2,03% |

| 5 | Gb6jp6...9FCGQD | 19.370,07K | 2,00% |

| - | Diğerleri | 666.555,63K | 69,08% |

II. MOTHER’ın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Federal Reserve’in politika değişiklikleri, MOTHER’ın fiyatında önemli etki yaratabilir. Şu anda şahin bir FED yetkilisi faiz indirimleri konusundaki tavrını yeniden değerlendiriyor ve bu, para politikası kararlarını etkileyebilir.

-

Enflasyona Karşı Koruma Özelliği: Çekirdek TÜFE enflasyonu, MOTHER fiyatının ana itici güçlerinden biri olmaya devam ediyor. Ağustos ayı çekirdek kişisel tüketim harcamaları enflasyonunun kontrol altında olması ve fiyatların aylık %0,15 artması bekleniyor.

-

Jeopolitik Faktörler: Küresel ekonomik koşullar, büyüme veya durgunluk dahil, MOTHER fiyatını etkileyecek. Gıda ve yakıt gibi volatil bileşenleri etkileyen jeopolitik ve mevsimsel etmenler de makroekonomik ortamı dolaylı etkileyebilir.

III. 2025-2030 MOTHER Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00417 $ - 0,00490 $

- Tarafsız tahmin: 0,00490 $ - 0,00586 $

- İyimser tahmin: 0,00586 $ - 0,00682 $ (pozitif piyasa duyarlılığı ve artan benimsenme şartıyla)

2027-2028 Görünümü

- Piyasa evresi: Yüksek volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00422 $ - 0,00785 $

- 2028: 0,00462 $ - 0,00835 $

- Başlıca katalizörler: Teknolojik gelişmeler, daha geniş piyasa kabulu ve muhtemel regülasyon netliği

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00762 $ - 0,00934 $ (istikrarlı piyasa büyümesi ve benimsenmeyle)

- İyimser senaryo: 0,00934 $ - 0,01105 $ (güçlü piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: 0,01105 $ - 0,01186 $ (çığır açan yenilikler ve yaygın benimsenmeyle)

- 2030-12-31: MOTHER 0,01186 $ (iyimser projeksiyonlara göre potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00682 | 0,0049 | 0,00417 | 0 |

| 2026 | 0,00603 | 0,00586 | 0,00539 | 20 |

| 2027 | 0,00785 | 0,00595 | 0,00422 | 21 |

| 2028 | 0,00835 | 0,0069 | 0,00462 | 41 |

| 2029 | 0,01105 | 0,00762 | 0,00602 | 56 |

| 2030 | 0,01186 | 0,00934 | 0,0085 | 91 |

IV. MOTHER Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MOTHER Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Yüksek volatiliteye toleransı olanlar

- İşlem önerileri:

- Fiyat düşüşlerinde MOTHER biriktirin

- Uzun vadeli fiyat hedefi belirleyin ve sadık kalın

- Token’ları güvenli, Solana ile uyumlu cüzdanda tutun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını görmek için

- RSI: Aşırı alım/satım durumlarını takip etmek için

- Dalgalı al-sat için ana noktalar:

- Kritik destek/dirençlerde fiyat hareketini izleyin

- Fiyat hareketlerinin teyidi için işlem hacmini takip edin

MOTHER Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcı: Kripto portföyünün %1-2’si

- Saldırgan yatırımcı: Kripto portföyünün %3-5’i

- Profesyonel yatırımcı: Kripto portföyünün %5-10’u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı meme coin ve diğer kripto varlıklara yayarak riski azaltın

- Zarar durdur emirleri: Olası kayıpları sınırlamak için otomatik satış emri kurun

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet önerilir

- Soğuk saklama: Uzun vade için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama açın, güçlü şifre kullanın ve yazılımı güncel tutun

V. MOTHER’ın Olası Riskleri ve Zorlukları

MOTHER Piyasa Riskleri

- Yüksek volatilite: Meme coin’lerde sert fiyat dalgalanmaları yaygın

- Piyasa duyarlılığı: Fiyatlar sosyal medya ve ünlü etkilerine duyarlı

- Sınırlı kullanım alanı: Gerçek dünyada kullanımın azlığı uzun vadeli değeri etkileyebilir

MOTHER Regülasyon Riskleri

- Artan denetim: Meme coin’lere daha sıkı düzenleme gelebilir

- Platformdan çıkarılma: Regülasyon kaynaklı büyük borsalardan çıkarılma riski

- Vergilendirme: Farklı ülkelerde belirsiz vergi durumu

MOTHER Teknik Riskler

- Akıllı sözleşme açıkları: Sözleşmede suistimal riski

- Solana ağ sorunları: Solana blokzincirinin performans ve istikrarına bağımlı

- Cüzdan uyumluluğu: Bazı kripto cüzdanlarında sınırlı destek

VI. Sonuç ve Eylem Önerileri

MOTHER Yatırım Değeri Değerlendirmesi

MOTHER IGGY, meme coin piyasasında yüksek riskli ve yüksek getirili bir fırsat sunar. Kısa vadeli yüksek kazançlar mümkün olsa da, sınırlı kullanım ve regülasyon belirsizliği nedeniyle uzun vadeli değeri belirsizdir.

MOTHER Yatırım Önerileri

✅ Yeni başlayanlar: Portföyünüzde küçük bir oranda tutun, eğitime ve risk yönetimine odaklanın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kısa vadeli al-sat fırsatlarını değerlendirin ✅ Kurumsal yatırımcılar: Dikkatli yaklaşın, çeşitlendirilmiş portföyünüzün bir parçası olarak değerlendirin

MOTHER İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com gibi borsalarda MOTHER token alıp satmak

- Limit emirleri: Belirli fiyatlarda otomatik alım-satım için emir girmek

- Dolar maliyeti ortalaması: Volatiliteyi azaltmak için düzenli küçük miktarlarda yatırım yapmak

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profiline göre dikkatli karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

Mother coin’in geleceği nedir?

Mother coin’in geleceği olumlu görünmektedir; tahminler 2025’te fiyatın 0,035888 $’a ulaşabileceğini gösteriyor. Yükseliş trendi, bu kriptonun büyümesi ve piyasa duyarlılığının güçlendiğini işaret ediyor.

Mother crypto şu anda ne kadar?

11 Ekim 2025 itibarıyla Mother Iggy’nin fiyatı 0,006397 $ ve son 24 saatte %1,40 artış gösterdi.

Trump’s coin’in 2026 tahmini nedir?

Piyasa analizlerine göre Trump’s coin’in 2026’da en düşük 8,10 $ ve ortalama 8,44 $ seviyesini göreceği öngörülüyor.

En yüksek fiyat tahminine sahip kripto hangisi?

En yüksek fiyat tahmini Bitcoin’de; zirvede 139.249 $’a ulaşacağı öngörülüyor. Chainlink ise en yüksek tahmini 59,67 $ ile ikinci sırada.

2025 POPCAT Fiyat Tahmini: Dijital Kedi Ekonomisinde Gelecek Piyasa Trendleri ve Yatırım Potansiyelinin Değerlendirilmesi

2025 BOME Fiyat Tahmini: Dalgalı Ekonomide Piyasa Trendleri ve Yatırım Fırsatlarında Yol Almak

2025 PNUT Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Büyüme Potansiyeli ve Piyasa Dinamiklerini Değerlendirme

2025 MYRO Fiyat Tahmini: Gelişen Kripto Para Ekosisteminde Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

XAI gork (GORK) iyi bir yatırım mı?: Açıklanabilir Yapay Zeka pazarında GORK Tokenlarının potansiyelini ve risklerini analiz etmek

2025 PUNDU Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

VC Girişim Sermayesi Web3 Kripto Rolü

MPC Çok Taraflı Hesaplama Blok Zinciri Uygulaması

Bitcoin Musluklarıyla Kripto Para Kazanabileceğiniz En İyi Uygulamalar

EVM Uyumluluğunu Anlamak: Blockchain Ağlarını Keşfetmek

Griffin AI GAIN Token Güvenlik Açığı Kriz Analizi