2025 MNT Fiyat Tahmini: Mantle Network Token'a Yönelik Piyasa Analizi ve Olası Büyüme Dinamikleri

Giriş: MNT'nin Piyasa Konumu ve Yatırım Değeri

Mantle (MNT), zincir üstü finans alanında öncü ve sürdürülebilir bir merkez olarak 2023’teki kuruluşundan bu yana kayda değer ilerlemeler kaydetmiştir. 2025 yılı itibarıyla, Mantle’ın piyasa değeri 4,37 milyar dolara ulaşmış; yaklaşık 3,25 milyar adet dolaşımdaki token ile fiyatı 1,34 dolar seviyesinde seyretmektedir. Yeni nesil bankacılık çözümü olarak anılan bu varlık, blokzincir tabanlı finansal hizmetlerde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, Mantle’ın 2025-2030 yılları arasındaki fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önünde bulundurularak kapsamlı şekilde analiz edilecek. Yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. MNT Fiyat Geçmişi ve Güncel Piyasa Durumu

MNT Fiyatının Tarihsel Gelişimi

- 2023: İlk lansman, başlangıç fiyatı 0,25 dolar

- 2023: 31 Temmuz’da tüm zamanların en düşük noktası, 0,0658 dolar

- 2024: 8 Nisan’da tüm zamanların zirvesi, 1,5103 dolar

MNT Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla, MNT 1,3433 dolardan işlem görmekte ve 4,37 milyar dolarlık piyasa değeriyle kripto para piyasasında 40. sırada yer almaktadır. Token, son saat içinde %2,31, son 24 saatte %10,24 ve son bir yılda %139,28 oranında büyüyerek farklı zaman dilimlerinde güçlü bir performans sergilemiştir.

Mevcut fiyat, ilk arz fiyatına göre %437,32 oranında artış göstermiştir. Dolaşımdaki MNT miktarı 3.252.944.055’tir, toplam arz ise 6.219.316.794’tür. Dolaşım oranı %52,30’dur.

MNT’nin son 24 saatteki işlem hacmi 6.928.823 dolara ulaşmıştır. Token, şu anda tüm zamanların en yüksek seviyesine oldukça yakın işlem görmekte olup, bu da piyasa genelinde olumlu bir yatırımcı algısına işaret etmektedir.

Güncel MNT piyasa fiyatını görüntüleyin

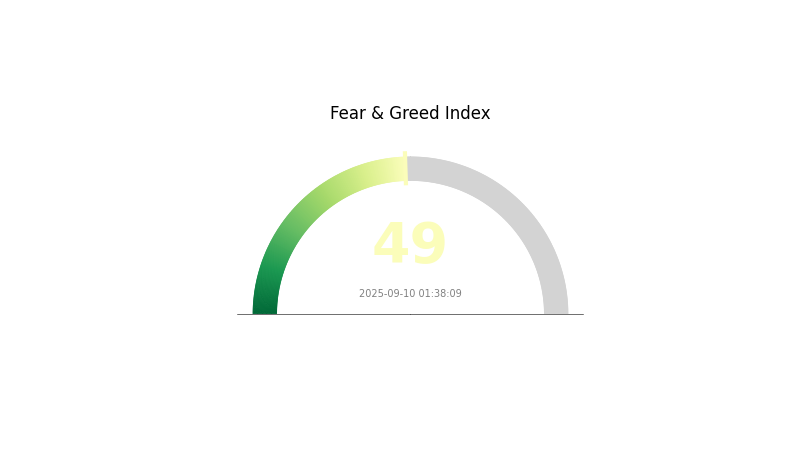

MNT Piyasa Duyarlılığı Göstergesi

10 Eylül 2025 Korku & Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto para piyasasının genelinde bugün denge hakim; Korku & Açgözlülük Endeksi 49 değerinde ve bu, piyasada nötr bir bakış açısının ağırlık kazandığını gösteriyor. Yatırımcılar şu anda ne aşırı temkinli ne de aşırı riskli davranıyor. Bu tür denge ortamları, sıklıkla önemli piyasa hareketlerinden önce görülür. Yatırımcıların dikkatli hareket etmeleri ve bu nötr havanın ani gelişmeler ya da haberlerle hızla değişebileceğini göz önünde bulundurmaları kritik önem taşımaktadır. Belirsizlik dönemlerinde portföyün dengede tutulması ve sağlam risk yönetimi uygulanması çok önemlidir.

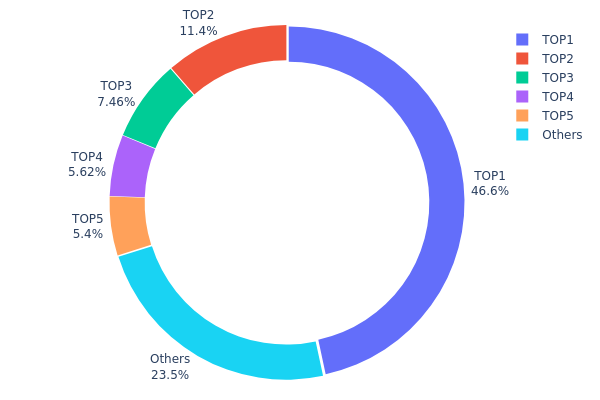

MNT Varlık Dağılımı

MNT’nin adres bazlı varlık dağılımı yüksek oranda yoğunlaşmış bir sahiplik yapısı sergiliyor. En büyük adres, toplam arzın %46,62’sini elinde tutarken, ilk beş adresin toplam kontrol oranı %76,44’e ulaşıyor. Bu yoğunlaşma, tokenin merkeziyetsizlik ilkesiyle çelişmekte ve piyasa manipülasyonu riskini artırmaktadır.

Böylesi bir sahiplik yoğunluğu, büyük cüzdan hareketlerinde yüksek oynaklık yaratabileceği için piyasa dinamiklerini doğrudan etkileyebilir. Az sayıdaki adresin elinde büyük miktarda token bulundurması, projenin yönetişiminde ve fiyat hareketlerinde orantısız etki yaratabilir.

Bu dağılım şekli, MNT’nin zincir üstü yapısının oynaklığa açık ve ani değişimlere daha yatkın olduğuna işaret ediyor. Merkeziyetsizlik prensibine uymayan bu durum, yatırımcı güvenini ve Mantle ekosisteminin sürdürülebilirliğini olumsuz etkileyebilir.

Güncel MNT Varlık Dağılımını inceleyin

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7860...7db73d | 2.900.022,41K | 46,62% |

| 2 | 0x2ebf...ae277f | 706.717,70K | 11,36% |

| 3 | 0x5a07...dc5e78 | 463.932,76K | 7,45% |

| 4 | 0xc54c...15a8fb | 349.427,93K | 5,61% |

| 5 | 0xe1ab...b09215 | 335.994,17K | 5,40% |

| - | Diğerleri | 1.463.221,84K | 23,56% |

II. MNT'nin Gelecekteki Fiyatını Etkileyen Başlıca Faktörler

Arz Mekanizması

- Azami Arz: MNT’nin azami arzı 6.219.316.795 token ile sınırlandırılmıştır.

- Güncel Etki: Dolaşımdaki token miktarı 3.252.944.055 MNT olup, mevcut sınırlı arzın fiyat üzerinde kıtlık desteği yaratması muhtemeldir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurum Benimsemesi: Mantle Network, yükselen bir Katman 2 çözümü olarak, orta ve uzun vadede kurumsal entegrasyon için ciddi potansiyele sahiptir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: MNT, küresel ekonomik ortamda olası bir enflasyon koruması olarak değerlendirilebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Katman 2 Çözümü: Mantle, Ethereum için bir Katman 2 ölçeklendirme çözümü olarak konumlanmakta ve ölçeklenebilirlik ihtiyacı arttıkça, uzun vadeli değeri üzerinde büyük etki yaratabilir.

- Ekosistem Uygulamaları: Mantle, ekosistemini aktif biçimde büyütmekte ve ağ üzerinde daha fazla Merkeziyetsiz Uygulama ve proje geliştirilmesi potansiyeline sahiptir.

III. 2025-2030 Arası MNT Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,99 - 1,20 dolar

- Nötr tahmin: 1,20 - 1,50 dolar

- İyimser tahmin: 1,50 - 1,65 dolar (sürekli piyasa toparlanması ve kullanıcı tabanında büyüme ile mümkün)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Konsolidasyon sürecini takiben kademeli büyüme

- Fiyat aralığı tahmini:

- 2027: 1,28 - 1,75 dolar

- 2028: 1,06 - 1,78 dolar

- Başlıca katalizörler: Teknolojik ilerlemeler, genel piyasa dinamikleri ve potansiyel stratejik iş birlikleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,70 - 2,00 dolar (istikrarlı piyasa büyümesi ve benimseme varsayımıyla)

- İyimser senaryo: 2,00 - 2,25 dolar (benimsemenin hızlanması ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 2,25 dolar ve üzeri (çığır açan gelişmeler ve kitlesel benimsemeyle)

- 31 Aralık 2030: MNT 1,98 dolar (ortalama tahminlere dayalı olası yıl sonu kapanış fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Yıllık Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,6498 | 1,3413 | 0,99256 | 0 |

| 2026 | 1,83953 | 1,49555 | 1,39086 | 11 |

| 2027 | 1,75091 | 1,66754 | 1,284 | 24 |

| 2028 | 1,7776 | 1,70923 | 1,05972 | 27 |

| 2029 | 2,21413 | 1,74341 | 1,44703 | 30 |

| 2030 | 2,2558 | 1,97877 | 1,00917 | 48 |

IV. MNT İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MNT Yatırım Stratejileri

(1) Uzun Vadeli Yatırım Stratejisi

- Uygun olduğu yatırımcı profili: Sürdürülebilir zincir üstü finans alanında uzun vadeli yatırım hedefleyenler

- Temel uygulama önerileri:

- Piyasa düşüşlerinde kademeli olarak MNT alımı yapın

- Portföyünüzde hedef bir dağılım belirleyin ve periyodik olarak yeniden dengeleyin

- Tokenleri güvenli, saklayıcı olmayan cüzdanlarda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Başlıca teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI (Göreceli Güç Endeksi): Alım/satım aşırılıklarını tespit edin

- Dalga alım-satımı için önemli noktalar:

- Direnç seviyesinin aşılması ile oluşan kırılmalara odaklanın

- Aşağı yönlü riski sınırlamak için zarar-durdur emirleri kullanın

MNT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Korumacı yatırımcılar: Kripto portföyünüzün %1-3’ü arasında

- Daha atak yatırımcılar: %5-10 arası

- Profesyonel yatırımcılar: Maksimum %15’e kadar

(2) Riskten Korunma Yöntemleri

- Varlık çeşitlendirmesi: Yatırımınızın farklı kripto varlıklarına yayılması

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonlarını değerlendirin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan tercihi, Gate Web3 Wallet

- Uzun vade için donanım cüzdanı

- Güvenlik için iki faktörlü kimlik doğrulama ve güçlü parola kullanımı

V. MNT'nin Karşılaşabileceği Potansiyel Riskler ve Zorluklar

MNT Piyasa Riskleri

- Fiyat oynaklığı: Kripto piyasalarında yüksek volatilite normaldir

- Rekabet: Yeni zincir üstü finans platformlarının yükselişi

- Likidite: Zor dönemlerde likiditenin azalması riski

MNT Regülasyon Riskleri

- Regülasyon belirsizliği: Gelişen uluslararası regülasyonlar faaliyeti etkileyebilir

- Uyum süreci: Farklı coğrafyalardaki değişken regülasyonlara uyum sağlama zorluğu

- Hukuki risk: Olası yaptırım ve sınırlama riski

MNT Teknik Riskleri

- Akıllı sözleşme açıkları: İstismar veya hata ihtimali

- Ölçeklenebilirlik problemleri: Yüksek ağ yükünü karşılayabilme

- Uyumluluk sorunları: Farklı blokzincirlerle entegre olabilme kabiliyeti

VI. Sonuç ve Eylem Önerileri

MNT Yatırım Değeri Analizi

Mantle (MNT), sürdürülebilir zincir üstü finans merkezi olarak uzun vadeli cazip bir değer sunuyor. Ancak, kısa vadeli fiyat oynaklığı ve regülasyon belirsizlikleri önemli riskler içermektedir.

MNT Yatırım Önerileri

✅ Yeni başlayanlar: Çeşitlendirilmiş bir kripto portföyünün küçük bir bölümünde değerlendirilebilir

✅ Deneyimli yatırımcılar: Uzun vadeli bakış açısıyla ortalama maliyet yöntemi uygulanabilir

✅ Kurumsal yatırımcılar: Kapsamlı inceleme yaparak, büyük pozisyonlar için OTC işlemleri değerlendirin

MNT İşlem Seçenekleri

- Spot işlemler: Gate.com’da MNT alım-satımı

- Staking: Pasif gelir için staking programlarına katılmak

- DeFi entegrasyonu: Mantle ekosistemi içinde getiri fırsatlarını değerlendirmek

Kripto para yatırımları son derece yüksek risk barındırır; bu makalede yer alan bilgiler yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını gözeterek karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Yatırımlarınızda kaybetmeyi göze alabileceğiniz tutarın üzerinde risk almayın.

Sıkça Sorulan Sorular

MNT'nin geleceği nasıl?

MNT’nin geleceği umut veriyor: 2029 için 3,50-5,00 dolar seviyeleri öngörülmekte. Bu, ekosistemdeki büyümenin ve Layer-2 çözümlerinin yaygınlaşmasının devam etme varsayımına dayanmaktadır; MNT blokzincir ölçeklendirme alanında önemli bir aktör olabilir.

Mantle alınır mı?

Evet, Mantle (MNT) makul bir alım olasılığı taşıyor. Mevcut piyasa eğilimleri olumlu olup, 2025’te 1,30 doların üzeri seviyelerde seyretmesi beklenmektedir.

Memecoin 2025 tahmini nedir?

Memecoin (MEME) için 2025’te %20,22 artış ve ortalama 0,004676 dolar fiyat tahmini söz konusu; piyasa duyarlılığı ise nötr seviyededir.

Mr Mint’in 2025 fiyat tahmini nedir?

Mr Mint’in 2025 fiyat tahmini, mevcut trendler ve yıllık %5 büyüme baz alınarak 0,263252 dolar seviyesindedir.

2025 NEAR Fiyat Tahmini: NEAR Protocol Ekosisteminde Bir Sonraki Boğa Koşusunu Belirleyecek Faktörlerin Kapsamlı Analizi

2025 INJ Fiyat Tahmini: Injective Protocol’un Piyasa Trendleri ve Büyüme Potansiyelinin Kapsamlı Analizi

2025 AURORA Fiyat Tahmini: Layer-2 Çözümü İçin Gelecek Trendler ve Piyasa Potansiyeli Analizi

2025 CELR Fiyat Tahmini: Celer Network Token’ının Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

Celestia (TIA) iyi bir yatırım mı?: Bu layer-1 blockchain projesinin potansiyeli ve riskleri üzerine analiz

Aptos (APT) iyi bir yatırım mı?: Bu gelişmekte olan blockchain platformunun potansiyelini ve risklerini değerlendirmek

Arbitrum'da Test Amaçlı Ücretsiz ETH: Adım Adım Kılavuz

Hamster Kombat Günlük Kombinasyonu & Şifre Cevabı 12 Aralık 2025

Bondex Origin Exchange’in Açılış Tarihi Açıklandı

EGRAG Kripto Varlıkları kimdir ve onun Kripto Varlıklar tahminleri neden önemlidir?

Yaklaşan Ethereum 2.0 Güncellemesi: Beklenen Tarihler ve Ayrıntılar