2025 MLC Price Prediction: Future Market Trends and Investment Opportunities

Introduction: MLC's Market Position and Investment Value

My Lovely Coin (MLC), as a promising Web3 mobile gaming token, has made significant strides since its inception. As of 2025, MLC's market capitalization has reached $32,365,847, with a circulating supply of approximately 79,856,519 coins, and a price hovering around $0.4053. This asset, hailed as the "Earth's Guardian Token," is playing an increasingly crucial role in the intersection of blockchain gaming and environmental protection.

This article will comprehensively analyze MLC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. MLC Price History Review and Current Market Status

MLC Historical Price Evolution Trajectory

- 2025: MLC launched and reached its all-time high of $0.7526 on May 21

- 2025: Market correction occurred, price dropped to its all-time low of $0.16 on July 10

- 2025: Recovery phase, price rebounded to current level of $0.4053

MLC Current Market Situation

As of October 2, 2025, MLC is trading at $0.4053. The token has shown significant volatility in recent months, with a 57.91% increase over the past 30 days and a 235.76% surge over the last year. However, it has experienced a 10.79% decline in the past week. The 24-hour trading volume stands at $134,000.97, indicating moderate market activity. MLC's market capitalization is currently $32,365,847.55, ranking it 869th in the cryptocurrency market. The circulating supply is 79,856,519.98 MLC, representing 34.72% of the total supply of 230,000,000 MLC.

Click to view the current MLC market price

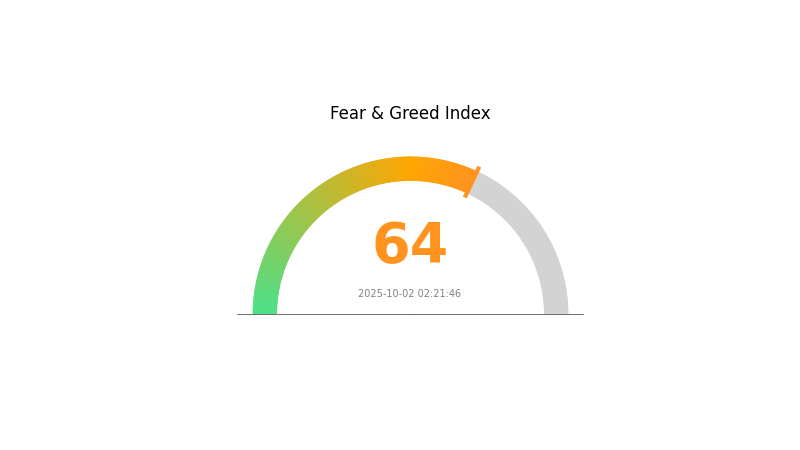

MLC Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently exhibiting signs of greed, with the Fear and Greed Index reaching 64. This suggests a bullish sentiment among investors, potentially driven by recent market gains or positive news. However, it's crucial to remain cautious, as extreme greed can lead to overvaluation and increased volatility. Traders should consider diversifying their portfolios and setting stop-loss orders to protect against sudden market shifts. As always, thorough research and risk management are essential in navigating the dynamic crypto landscape.

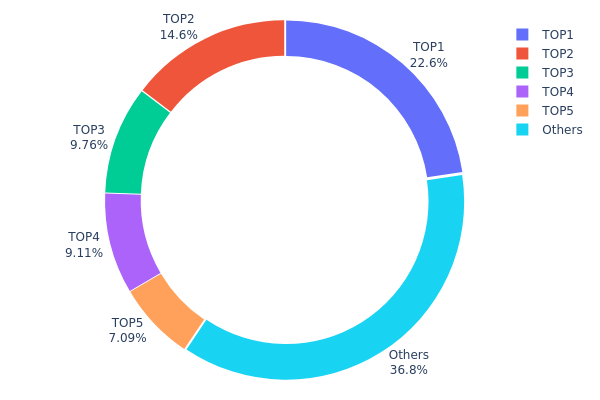

MLC Holdings Distribution

The address holdings distribution data for MLC reveals a significant concentration of tokens among a few top addresses. The top address holds 22.61% of the total supply, with the top 5 addresses collectively controlling 63.17% of MLC tokens. This high concentration suggests a relatively centralized ownership structure.

Such a concentrated distribution can have notable implications for the MLC market. It potentially exposes the token to increased volatility and susceptibility to price manipulation, as large holders could significantly impact market dynamics through their trading activities. Furthermore, this concentration may raise concerns about the token's decentralization ethos and overall market stability.

However, it's worth noting that 36.83% of tokens are distributed among other addresses, indicating some level of broader market participation. This distribution pattern reflects a market structure that balances between major stakeholders and a wider community of holders, though with a clear tilt towards concentration.

Click to view the current MLC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe0bf...2c1ff4 | 52010.57K | 22.61% |

| 2 | 0xfa88...39c7cf | 33626.19K | 14.62% |

| 3 | 0x576b...018a58 | 22441.47K | 9.75% |

| 4 | 0x82ae...05b7c7 | 20961.18K | 9.11% |

| 5 | 0x51e1...84d1f9 | 16301.94K | 7.08% |

| - | Others | 84658.65K | 36.83% |

II. Key Factors Affecting MLC's Future Price

Supply Mechanism

- Market Dynamics: The price of MLC is influenced by market supply and demand, investor sentiment, and overall market conditions.

- Current Impact: Storage product prices have been consistently rising, with expectations of continued growth in the future.

Macroeconomic Environment

- Inflation Hedging Properties: MLC market is expected to continue growing, potentially serving as a hedge against inflation.

Technological Development and Ecosystem Building

- AI-Driven Demand: The growth of artificial intelligence applications is contributing to increased demand for storage solutions, which could positively impact MLC prices.

- Cloud Infrastructure: The expansion of cloud infrastructure and advanced consumer electronics is driving demand in the semiconductor and storage markets, which may indirectly affect MLC prices.

III. MLC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.35684 - $0.38000

- Neutral prediction: $0.38000 - $0.42000

- Optimistic prediction: $0.42000 - $0.42578 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.31547 - $0.62138

- 2028: $0.43425 - $0.69809

- Key catalysts: Project upgrades, expanding use cases, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.62389 - $0.69563 (assuming steady project growth and market stability)

- Optimistic scenario: $0.76738 - $0.9878 (assuming widespread adoption and favorable market conditions)

- Transformative scenario: Above $1.00 (breakthrough technological advancements or major partnerships)

- 2030-12-31: MLC $0.69563 (71% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.42578 | 0.4055 | 0.35684 | 0 |

| 2026 | 0.54033 | 0.41564 | 0.2577 | 2 |

| 2027 | 0.62138 | 0.47798 | 0.31547 | 17 |

| 2028 | 0.69809 | 0.54968 | 0.43425 | 35 |

| 2029 | 0.76738 | 0.62389 | 0.43048 | 53 |

| 2030 | 0.9878 | 0.69563 | 0.59825 | 71 |

IV. Professional Investment Strategies and Risk Management for MLC

MLC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a strong belief in the long-term potential of Web3 gaming and environmental projects

- Operational suggestions:

- Accumulate MLC tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure wallets with regular security audits

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps in identifying overbought/oversold conditions

- Key points for swing trading:

- Monitor game adoption rates and user growth metrics

- Stay updated on partnerships and ecosystem developments

MLC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming and environmental tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for MLC

MLC Market Risks

- Volatility: Gaming tokens can experience significant price swings

- Competition: Emerging Web3 games could impact MLC's market share

- User adoption: Slow growth in player base could affect token value

MLC Regulatory Risks

- Gaming regulations: Changes in laws governing online gaming and cryptocurrencies

- Environmental claims: Potential scrutiny of real-world tree planting initiatives

- Token classification: Risk of being classified as a security in certain jurisdictions

MLC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token's underlying code

- Scalability issues: Challenges in handling increased user load on the Polygon network

- Integration problems: Difficulties in implementing new features or partnerships

VI. Conclusion and Action Recommendations

MLC Investment Value Assessment

MLC presents an intriguing investment opportunity at the intersection of Web3 gaming and environmental conservation. The project's unique approach to combining mobile gaming with real-world impact has significant long-term potential. However, investors should be aware of the high volatility and regulatory uncertainties in the crypto gaming sector.

MLC Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding the game mechanics and token utility ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading around major project milestones ✅ Institutional investors: Conduct thorough due diligence on the team, technology, and market positioning before considering larger allocations

MLC Participation Methods

- Direct purchase: Buy MLC tokens on Gate.com

- Gameplay earnings: Participate in the My Lovely Planet game to earn MLC tokens

- Staking: Look for potential staking opportunities to earn passive income on MLC holdings

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Predicting a 1000x crypto is challenging, but emerging AI and Web3 projects show potential. Look for innovative tokens with strong teams and real-world use cases.

Will Litecoin reach $50,000?

No, Litecoin is unlikely to reach $50,000. While some growth is possible, current market analysis and expert predictions suggest LTC will not approach that price level in the foreseeable future.

What are the risks of buying MXC?

Buying MXC involves unsystematic risk from project-specific events and market volatility. Research thoroughly before investing.

How much will 1 Litecoin be worth in 2025?

Based on expert projections, 1 Litecoin could be worth between $139.89 and $483.89 in 2025, reflecting potential market growth and increased adoption.

Share

Content