2025 MINA Fiyat Tahmini: Hafif Blockchain’in Büyüme Potansiyeli ve Piyasa Trendleri Analizi

Giriş: MINA'nın Piyasa Konumu ve Yatırım Potansiyeli

Dünyanın en hafif blokzincir protokollerinden biri olan Mina (MINA), 2021'deki çıkışından bu yana kayda değer başarılar elde etti. 2025 yılı itibarıyla Mina'nın piyasa değeri 135.605.162 $'a ulaştı, dolaşımdaki token miktarı yaklaşık 1.257.931.425 ve fiyatı 0,1078 $ civarında seyrediyor. “Dünyanın en hafif blokzinciri” olarak tanınan bu varlık, gerçek dünya ile kripto para arasında özel ve gizli bir geçit oluşturma konusunda giderek daha stratejik bir rol üstleniyor.

Bu makalede, Mina'nın fiyat hareketleri 2025-2030 döneminde detaylı biçimde incelenerek; geçmiş trendler, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik unsurlar bir arada ele alınacak ve yatırımcılara profesyonel fiyat tahminleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. MINA Fiyat Geçmişi ve Mevcut Piyasa Durumu

MINA Tarihsel Fiyat Gelişimi

- 2021: MINA piyasaya girdi, 1 Haziran'da tüm zamanların en yüksek seviyesi olan 9,09 $'a ulaştı

- 2023: Piyasa düşüşüyle fiyat ciddi oranda geriledi

- 2025: Düşüş devam etti, fiyat 11 Ekim'de en düşük seviye olan 0,063436 $'ı gördü

MINA Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla MINA 0,1078 $ seviyesinden işlem görüyor, 24 saatlik işlem hacmi 436.713 $. Son 24 saatte token %0,18 artış gösterdi. MINA'nın piyasa değeri 135.605.007 $ ile kripto para piyasasında 352. sırada yer alıyor. Dolaşımdaki arz 1.257.931.425 MINA, toplam arz ise 1.257.932.865 MINA. Son bir yılda %81,28 ve son 30 günde %40,43 değer kaybeden token, süregelen düşüş trendini yansıtıyor. Mevcut fiyat, zirvesinin %98,81 altında ve uzun süreli piyasa düzeltmesine işaret ediyor.

Güncel MINA piyasa fiyatını görmek için tıklayın

MINA Piyasa Duyarlılığı Göstergesi

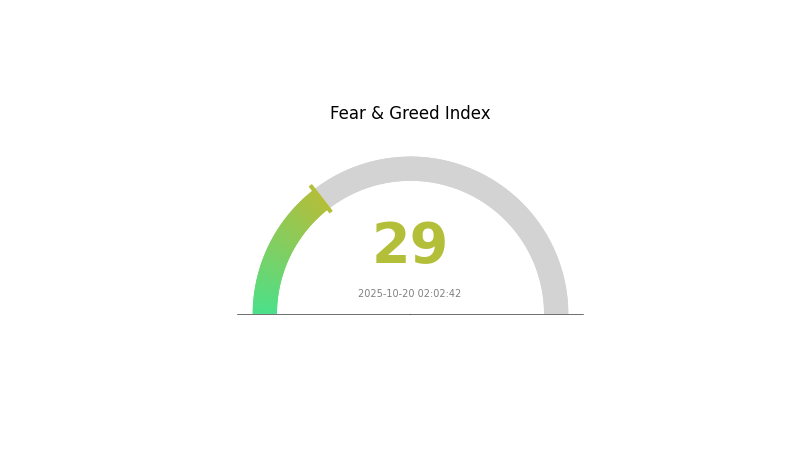

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

MINA için piyasa duyarlılığı “Korku” bölgesinde ve endeks değeri 29. Bu, yatırımcıların temkinli davrandığını gösteriyor. Böyle zamanlarda bazı yatırımcılar, “Başkaları açgözlü olduğunda kork, başkaları korktuğunda açgözlü ol” prensibiyle potansiyel alım fırsatı görebilir. Ancak, yatırım kararı öncesinde detaylı araştırma yapmak ve risk toleransını dikkate almak gereklidir. Gate.com’da güncel kalın, bilinçli işlem yapın.

MINA Varlık Dağılımı

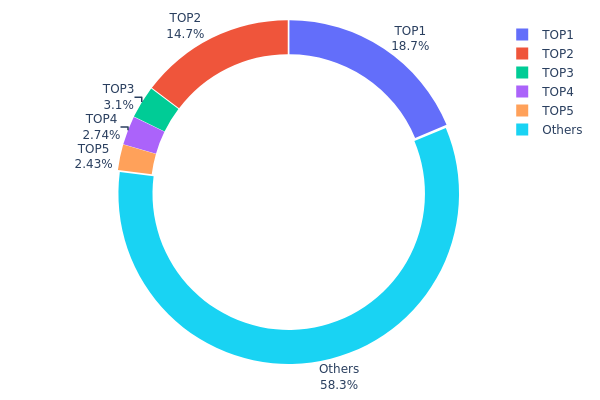

MINA adres varlık dağılımı, üst düzey sahiplerde belirgin bir yoğunlaşmaya işaret ediyor. İlk iki adres toplam arzın %33,38’ini elinde bulundururken, paylar sırasıyla %18,69 ve %14,69. Bu yüksek yoğunlaşma piyasa manipülasyonu ve oynaklık riskini artırıyor.

İlk beş adresin elinde yaklaşık %41,63 MINA bulunurken, kalan %58,37 diğer adreslere dağılmış durumda. Bu dağılım, MINA’da orta seviyede bir merkezileşme olduğunu gösteriyor ve büyük sahiplerin hareketleri fiyat oynaklığını tetikleyebilir.

Kripto varlıklarda belli bir yoğunlaşma yaygın olsa da, MINA’nın mevcut dağılımı daha fazla merkeziyetsizliğe ihtiyaç olduğunu ortaya koyuyor. Büyük sahipler, yönetişim ve ağ güncellemelerini etkileyebilir; bu nedenle piyasa yapısını daha iyi analiz için üst adreslerin aktiviteleri yakından izlenmelidir.

Güncel MINA Varlık Dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | B62qrQ...6g1ny9 | 235.134,22K | 18,69% |

| 2 | B62qjs...6f7npr | 184.871,09K | 14,69% |

| 3 | B62qmj...SVovgT | 38.965,73K | 3,09% |

| 4 | B62qp3...x8CxV3 | 34.486,47K | 2,74% |

| 5 | B62qiW...CSCVt5 | 30.547,14K | 2,42% |

| - | Diğerleri | 733.910,22K | 58,37% |

II. MINA'nın Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Makroekonomik Çerçeve

- Enflasyona Karşı Koruma: MINA, sınırlı arzı ve merkeziyetsiz yapısı sayesinde pek çok kripto varlık gibi enflasyona karşı koruma aracı olarak değerlendirilmektedir.

Teknolojik Gelişmeler ve Ekosistem Oluşumu

-

Sıfır Bilgi Kanıtları: MINA, gelişmiş gizlilik ve ölçeklenebilirlik sunan zk-SNARKs teknolojisini kullanır. Bu yapı, platforma daha fazla kullanıcı ve geliştirici çekebilir.

-

Ekosistem Uygulamaları: MINA, platformunda merkeziyetsiz uygulama (dApp) geliştirilmesini destekler; bu da token’ın benimsenmesini ve kullanım alanını artırabilir.

III. MINA 2025-2030 Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,10358 $ - 0,11 $

- Tarafsız tahmin: 0,1079 $ - 0,12 $

- İyimser tahmin: 0,12 $ - 0,12301 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Beklentisi

- Piyasa fazı: Artan volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,08697 $ - 0,19218 $

- 2028: 0,11137 $ - 0,17121 $

- Başlıca tetikleyiciler: Teknolojide ilerleme, yaygın kullanım ve genel kripto piyasası trendleri

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,16872 $ - 0,18306 $ (istikrarlı büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 0,18306 $ - 0,19771 $ (piyasa performansı ve kullanımda güçlü artış varsayımıyla)

- Dönüşüm senaryosu: 0,19771 $ üzeri (büyük ortaklıklar veya teknolojik atılımlar gibi aşırı olumlu ortamlar)

- 31 Aralık 2030: MINA 0,18306 $ (2025 seviyesine kıyasla %69 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,12301 | 0,1079 | 0,10358 | 0 |

| 2026 | 0,1651 | 0,11545 | 0,11083 | 6 |

| 2027 | 0,19218 | 0,14028 | 0,08697 | 29 |

| 2028 | 0,17121 | 0,16623 | 0,11137 | 53 |

| 2029 | 0,1974 | 0,16872 | 0,10292 | 56 |

| 2030 | 0,19771 | 0,18306 | 0,12814 | 69 |

IV. MINA Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MINA Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitlesi: Blokzincir inovasyonuna uzun vadeli maruz kalmak isteyen yatırımcılar

- Strateji önerileri:

- Piyasa düşüşlerinde MINA biriktirin

- Fiyat hedefleri belirleyin, portföyü düzenli aralıklarla dengeleyin

- Token’ları güvenli, gözetim dışı cüzdanda saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve dönüş noktalarını tespit edin

- RSI (Göreli Güç Endeksi): Aşırı alım ve aşırı satım seviyelerini izleyin

- Dalgalı işlemde öne çıkanlar:

- Piyasa duyarlılığı ve haber tetikleyicilerini takip edin

- Risk yönetimi için zarar durdurma emirleri kullanın

MINA Risk Yönetimi Modeli

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara bölün

- Zarar durdurma emirleri: Kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama etkinleştirin, güçlü şifreler kullanın

V. MINA Potansiyel Riskler ve Zorluklar

MINA Piyasa Riskleri

- Yüksek volatilite: Fiyatlar kısa sürede büyük dalgalanma gösterebilir

- Sınırlı benimseme: Ekosistemin beklenenin altında büyümesi değeri etkileyebilir

- Rekabet: Diğer hafif blokzincir protokolleri pazar payı kazanabilir

MINA Düzenleyici Riskler

- Belirsiz mevzuat: Kripto düzenlemelerinin değişmesi MINA’nın faaliyetlerini etkileyebilir

- Uyum zorlukları: Gelecekteki mevzuata uyumda zorluklar yaşanabilir

- Sınır ötesi kısıtlamalar: Uluslararası mevzuat farklılıkları küresel benimsemeyi sınırlayabilir

MINA Teknik Riskler

- Sıfır bilgi kanıtı açıkları: Temel kriptografide güvenlik zaafları doğabilir

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe performansın korunmasında beklenmedik sorunlar çıkabilir

- Akıllı kontrat riskleri: Snapps ekosisteminde hata veya istismar riski bulunabilir

VI. Sonuç ve Eylem Önerileri

MINA Yatırım Değeri Analizi

MINA uzun vadede hafif, gizliliğe odaklı blokzincir çözümü olarak potansiyel sunar. Kısa vadede ise volatilite ve benimseme belirsizlikleri ciddi riskler taşır.

MINA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzü çeşitlendirin, MINA’ya küçük ve uzun vadeli pozisyonlar ekleyin

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın

✅ Kurumsal yatırımcılar: MINA’yı geleneksel blokzincir ölçeklenebilirlik risklerine karşı koruma olarak değerlendirin

MINA Ticaret Katılımı Yöntemleri

- Spot alım-satım: Gate.com üzerinden MINA alın ve tutun

- Staking: MINA’nın proof-of-stake konsensüsüne katılarak ödül kazanın

- DeFi entegrasyonu: MINA’nın Snapp ekosisteminde geliştirilen yeni DeFi uygulamalarını keşfedin

Kripto para yatırımları son derece yüksek risk taşır; bu içerik yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli hareket etmeli ve profesyonel danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Mina coin’in geleceği var mı?

Evet, Mina coin’in ilerleyen yıllarda güçlü bir potansiyeli bulunuyor. Yenilikçi sıfır bilgi kanıtı teknolojisi ve hafif blokzincir mimarisi, ölçeklenebilirlik ve gizlilik odaklı uygulamalar için onu kripto ekosisteminde avantajlı bir konuma taşıyor.

Mina iyi bir yatırım mı?

Evet, Mina yenilikçi teknolojisi ve ölçeklenebilir blokzincir yapısıyla kripto piyasasında umut vaat eden bir yatırım olarak öne çıkıyor.

Mana coin 1 $’a ulaşır mı?

Evet, MANA, metaverse alanında artan benimsenme ve güçlü ekosistem büyümesiyle 2025 yılına kadar 1 $ seviyesine ulaşabilir.

2025’te Mana’nın fiyatı ne olur?

Piyasa trendleri ve uzman öngörülerine göre, Mana sanal gerçeklik ve metaverse teknolojilerinin yaygınlaşmasıyla 2025’te 2,50 $ ile 3,00 $ aralığına çıkabilir.

U ve DOT: Motosiklet Kasklarında Farklı Güvenlik Standartları Nelerdir?

2025 VFY Fiyat Tahmini: Virtual Finance Yield Token’ın Piyasa Eğilimleri ve Gelecek Büyüme Potansiyelinin Değerlendirilmesi

ZEC'nin Son Dönemdeki Fiyat Artışı, Zincir Üstü Metri̇kleri̇ ve Borsa Akışlarını Nasıl Etkiledi̇?

Bir Kripto Para Projesinin Temel Analizi: Dikkate Almanız Gereken 5 Temel Faktör

2025 VFY Fiyat Tahmini: Değişen kripto ekosisteminde VFY'nin piyasa trendleri ve gelecekteki değer potansiyelinin analizi

Zcash (ZEC) Temelleri Açısından Gelecekte Ne Vaat Ediyor?

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi