2025 MICHI Fiyat Tahmini: Piyasa Analizi ve Bu Yükselen Dijital Varlığın Geleceğine Yönelik Değerlendirme

Giriş: MICHI'nin Piyasadaki Konumu ve Yatırım Potansiyeli

MICHI (MICHI), Solana blokzinciri üzerinde öne çıkan bir meme token olarak, ilk çıkışından bu yana yoğun ilgiyle karşılaştı. 2025 yılı itibarıyla MICHI'nin piyasa değeri 9.175.774 ABD doları, dolaşımdaki miktarı yaklaşık 555.770.695 token ve fiyatı yaklaşık 0,01651 ABD doları seviyesindedir. “İnternetin en çok meme yapılan kedisi” olarak anılan bu varlık, hem meme kültüründe hem de kripto para ekosisteminde önemli bir konum edinmektedir.

Bu makalede, MICHI'nin 2025-2030 dönemindeki fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik unsurlar ışığında kapsamlı biçimde analiz edilecek, yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. MICHI Fiyat Geçmişi ve Mevcut Piyasa Görünümü

MICHI Tarihsel Fiyat Seyri

- 2024: Lansman ve ilk dalga, fiyat 13 Kasım'da 0,5915 ABD doları ile tüm zamanların zirvesini gördü

- 2025: Piyasa düzeltmesi, fiyat 7 Nisan'da 0,01317 ABD doları ile en düşük seviyeye indi

- 2025: Kademeli toparlanma, şu anda fiyat 0,01651 ABD doları civarında dengelenmiş durumda

MICHI Güncel Piyasa Durumu

9 Ekim 2025 tarihi itibarıyla MICHI, 0,01651 ABD dolarından işlem görmektedir. Token, zirve seviyesinden ciddi bir düşüş yaşarken, 24 saatlik işlem hacmi 42.589,96 ABD dolarıdır. MICHI'nin piyasa değeri 9.175.774 ABD doları olup, küresel kripto para sıralamasında 1.465. sıradadır.

Token, farklı zaman aralıklarında negatif fiyat hareketleri göstermiştir:

- 1 saat: -0,24%

- 24 saat: -5,65%

- 7 gün: -15,32%

- 30 gün: -27,99%

- 1 yıl: -93,30%

Piyasa genelinde düşüş eğilimi hakim olsa da, MICHI'nin dolaşımdaki arzı 555.770.695 adet olup, bu rakam toplam arzın %55,58'ini oluşturmaktadır. Tam seyreltilmiş piyasa değeri ise 16.510.000 ABD doları seviyesindedir.

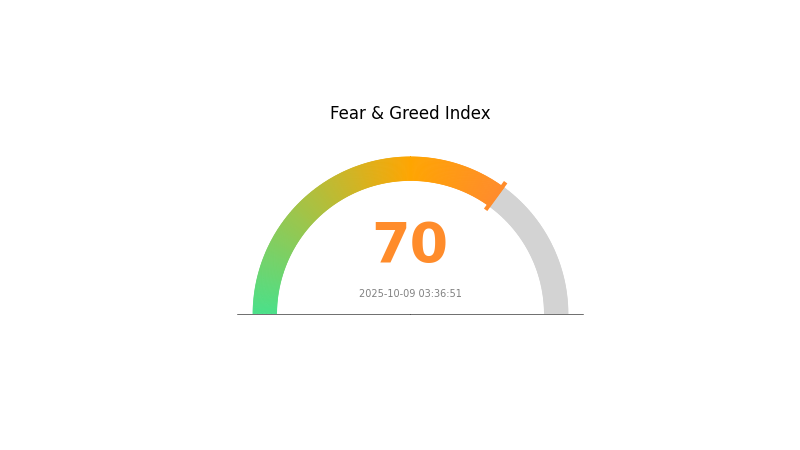

Kripto piyasasında güncel hissiyat “Açgözlülük” olarak tanımlanmakta; VIX endeksi ise 70 seviyesinde ve aşırı ısınmış bir piyasa ortamına işaret etmektedir.

Güncel MICHI piyasa fiyatını görmek için tıklayın

MICHI Piyasa Hissiyat Göstergesi

2025-10-09 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi verisi için tıklayın

Kripto piyasasında açgözlülük hakim durumda; Korku ve Açgözlülük Endeksi 70’e ulaşmış ve yatırımcılar giderek daha iyimser bir tutum sergiliyor. Bu durum fiyatları yukarı çekebilir; ancak, aşırı açgözlülük sonrası düzeltme riski göz ardı edilmemelidir. Yatırımcılar, kâr realize etmeyi veya pozisyonlarını hedge etmeyi değerlendirmelidir. Piyasa hissiyatı hızla değişebilir; bu nedenle güncel kalın ve riskinizi dikkatle yönetin. Gate.com platformu, bu koşullarda etkin işlem yapmanızı sağlayacak çeşitli araçlar sunmaktadır.

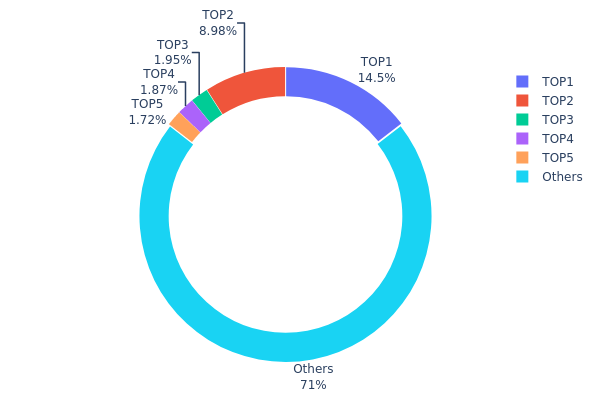

MICHI Varlık Dağılımı

Adres varlık dağılımı verileri, MICHI tokenlarının farklı cüzdanlarda nasıl yoğunlaştığını gösteriyor. Analize göre, en büyük 5 adres toplam arzın yaklaşık %28,95’ini elinde tutuyor; en büyük adresin oranı %14,45, ikinci sıradaki ise %8,97 seviyesinde.

Bu dağılım, sahipliğin dengeli olduğunu gösteriyor; tokenların %71,05’i ilk 5 adres dışındaki cüzdanlarda bulunuyor. Zirvede bir miktar yoğunlaşma olsa da, aşırı birikim söz konusu değil. Bu durum, büyük ölçekli alım veya satışların fiyat üzerinde aşırı baskı yaratmasını engelleyerek piyasa istikrarına katkı sağlar.

Mevcut dağılım, MICHI'nin zincir üstü yapısında orta düzeyde merkeziyetsizlik olduğunu gösteriyor. Bu, projenin olası piyasa manipülasyonlarına karşı dayanıklılığı açısından olumlu bir gösterge olarak değerlendirilebilir; yine de yatırımcılar, varlık dağılımında ani değişikliklere karşı dikkatli olmalıdır.

Güncel MICHI Varlık Dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 80.359,27K | 14,45% |

| 2 | FixDET...Stuuph | 49.881,21K | 8,97% |

| 3 | F3eYgp...1gpJeU | 10.840,30K | 1,95% |

| 4 | 5PAhQi...cnPRj5 | 10.407,82K | 1,87% |

| 5 | E2RvJg...qnatYy | 9.537,28K | 1,71% |

| - | Diğerleri | 394.734,91K | 71,05% |

II. MICHI'nin Gelecekteki Fiyatını Belirleyen Temel Unsurlar

Piyasa Hissiyatı

- Yatırımcı Güveni: Yatırımcıların algısı ve güveni, MICHI fiyatının seyrini doğrudan etkiler. Geniş çaplı benimsenme veya önemli teknolojik gelişmeler hakkındaki olumlu haberler, piyasa iyimserliğini artırır.

- Piyasa Talebi: Daha fazla topluluk üyesi ve bireysel yatırımcının alıcıya dönüşmesi tüm projeler için kritiktir; zira fiyat hareketleri ağırlıklı olarak alım baskısına bağlıdır.

Makroekonomik Ortam

- Ekonomik Eğilimler: Makroekonomik gelişmeler, MICHI'nin farklı para birimleri karşısındaki değerini etkileyebilir.

Teknik Gelişim ve Ekosistem İnşası

- Teknolojik Yenilik: Ciddi teknolojik atılımlar, benimsenmeyi hızlandırıp piyasa iyimserliğini artırarak MICHI fiyatını önemli ölçüde etkileyebilir.

- Ağ Performansı: Solana'nın yüksek işlem kapasitesi sayesinde MICHI gibi meme coinler hızla ölçeklenebilir, büyük toplulukları destekler ve yoğun talep anlarında yavaşlama yaşanmaz.

Düzenleyici Çerçeve

- Politika ve Düzenleme: Regülasyonlar, MICHI'nin fiyat dalgalanmalarını doğrudan etkileyebilir; benimsenme, işlem hacmi ve piyasa hissiyatını değiştirebilir.

III. MICHI 2025-2030 Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,01025 - 0,01653 ABD doları

- Tarafsız tahmin: 0,01653 - 0,02083 ABD doları

- İyimser tahmin: 0,02083 - 0,02634 ABD doları (güçlü piyasa ivmesi ve olumlu MICHI ekosistem gelişimiyle)

2027-2028 Beklentisi

- Piyasa fazı: Benimsenmenin arttığı büyüme dönemi olası

- Fiyat aralığı tahmini:

- 2027: 0,01711 - 0,03264 ABD doları

- 2028: 0,02068 - 0,03005 ABD doları

- Kilit katalizörler: Yeni kullanım alanları, teknolojik gelişmeler ve piyasada genel toparlanma

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,02881 - 0,03357 ABD doları (istikrarlı büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 0,03832 - 0,04934 ABD doları (ekosistemin hızlı büyümesi ve piyasa iyimserliğiyle)

- Dönüştürücü senaryo: 0,05000+ ABD doları (oldukça elverişli piyasa ve MICHI'de yenilikçi gelişmelerle)

- 2030-12-31: MICHI 0,04934 ABD doları (iyimser trend sürerse potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,02083 | 0,01653 | 0,01025 | 0 |

| 2026 | 0,02634 | 0,01868 | 0,01681 | 13 |

| 2027 | 0,03264 | 0,02251 | 0,01711 | 36 |

| 2028 | 0,03005 | 0,02757 | 0,02068 | 67 |

| 2029 | 0,03832 | 0,02881 | 0,02219 | 74 |

| 2030 | 0,04934 | 0,03357 | 0,02484 | 103 |

IV. MICHI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MICHI Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına sahip ve risk toleransı yüksek olanlar

- Stratejik öneriler:

- Piyasa geri çekilmelerinde MICHI biriktirin

- Kişisel finansal hedeflerinize göre önceden belirlenmiş çıkış noktaları oluşturun

- Tokenlarınızı saklama hizmeti olmayan bir cüzdanda güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş seviyelerini belirlemede kullanılır

- Relative Strength Index (RSI): Aşırı alım veya aşırı satım koşullarını ölçer

- Vadelide al-sat için önemli noktalar:

- MICHI'nin genel piyasa trendleriyle olan korelasyonunu izleyin

- Aşağı yönlü risk için kesin stop-loss emirleri kullanın

MICHI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü MICHI olmalı

- Agresif yatırımcılar: %5-10 arasında MICHI ayrılabilir

- Profesyonel yatırımcılar: Detaylı analiz sonrası %15’e kadar çıkabilir

(2) Riskten Korunma Yaklaşımları

- Diversifikasyon: MICHI varlıklarını diğer kripto ve geleneksel yatırımlarla dengeleyin

- Stop-loss emirleri: Olası kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Aktif alım-satım için Gate Web3 Wallet

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, güçlü şifreler tercih edin ve yazılımı düzenli olarak güncelleyin

V. MICHI İçin Potansiyel Riskler ve Zorluklar

MICHI Piyasa Riskleri

- Yüksek volatilite: MICHI fiyatı ciddi dalgalanmalara açık

- Kısıtlı likidite: Büyük işlem hacimleri fiyatı etkileyebilir

- Meme coin hissiyatı: Yatırımcı algısı hızla değişebilir

MICHI Düzenleyici Riskler

- Belirsiz yasal çerçeve: Meme coin'ler için daha sıkı regülasyonlar gelebilir

- Platformdan çıkarılma riski: Düzenleyici endişelerle işlem platformlarından kaldırılma ihtimali

- Vergi yükümlülükleri: Gelişen vergi mevzuatı MICHI yatırımcılarını etkileyebilir

MICHI Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda oluşabilecek güvenlik açıkları

- Ağ tıkanıklığı: Solana'da yoğun trafik dönemlerinde işlem zorlukları yaşanabilir

- Solana bağımlılığı: MICHI'nin performansı Solana ekosisteminin sağlığına bağlıdır

VI. Sonuç ve Eylem Önerileri

MICHI Yatırım Değeri Analizi

MICHI, meme coin segmentinde yüksek risk-yüksek getiri fırsatı sunar. Topluluk ilgisi ve meme çekiciliğiyle yüksek kazanç potansiyeli taşısa da, yatırımcıların aşırı volatilite ve olası kayıplara karşı hazırlıklı olması gerekir.

MICHI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: MICHI'yi çeşitlendirilmiş portföyün küçük bir bölümü olarak değerlendirin, eğitim ve risk yönetimine odaklanın ✅ Deneyimli yatırımcılar: Sıkı risk kontrolü uygulayın, MICHI'yi kısa ve orta vadeli ticaret fırsatı olarak düşünün ✅ Kurumsal yatırımcılar: Dikkatli hareket edin, kapsamlı analiz yapın ve MICHI'yi alternatif varlık stratejisinin küçük parçası olarak değerlendirin

MICHI İşlem Katılım Yöntemleri

- Spot işlem: MICHI tokenlerini Gate.com üzerinden doğrudan alın

- Limit emirleri: Giriş ve çıkış noktalarını yönetmek için belirli alım-satım fiyatları belirleyin

- Dolar-maliyet ortalaması: Fiyat dalgalanma riskini azaltmak için MICHI tokenlerini zamanla kademeli biriktirin

Kripto para yatırımları çok yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleransları doğrultusunda temkinli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Michi yükselecek mi?

Evet, Michi'nin yükselmesi bekleniyor. Mevcut piyasa eğilimleri ve analizlere göre, 2025'te 0,02594 ABD dolarına ulaşabilir.

Michi bir meme coin mi?

Evet, Michi bir kedi temalı meme coindir. Oyunbaz yapısı ve kedi konseptiyle kripto topluluğunda popülerlik kazanmıştır.

2025'te hangi meme coin patlama yapacak?

Dogecoin ve Shiba Inu’nun, Bitcoin’in beklenen yükselişi sonrası 2025’te değer kazanması muhtemel. Bu meme coin'ler genellikle Bitcoin yeni rekorlar kırdıktan kısa süre sonra ciddi kazançlar sağlar.

Michi'nin fiyatı nedir?

2025-10-09 tarihinde Michi ($MICHI) fiyatı 0,0301615 ABD dolarıdır. Bu değer güncel piyasa verilerine göre değişkenlik gösterebilir.

2025 WIF Fiyat Tahmini: WIF Token’ın Piyasa Trendleri ve Gelecekteki Büyüme Potansiyeli Analizi

2025 WIF Fiyat Tahmini: Piyasa Trendleri ve Köpek Temalı Token’ın Potansiyel Büyüme Faktörlerinin Analizi

2025 PONKE Fiyat Tahmini: Gelişen Dijital Varlıkta Piyasa Trendleri, Teknik Göstergeler ve Büyüme Potansiyelinin Analizi

2025 WEN Fiyat Öngörüsü: Bu Gelişmekte Olan Kripto Paranın Gelecekteki Eğilimleri ve Piyasa Potansiyelinin Analizi

Moo Deng (MOODENG): $140M Solana Hippo Token'un Tam Analizi

Kripto Yeniden Yükselecek mi?

DeFi Ekosisteminde Flash Krediler: Teminatsız Borçlanmaya Dair Bir İnceleme

Layer 1 Blokzincirlerinin Temel Özelliklerini Anlamak

NFT Nadirlik Analizi: Başarılı Stratejiler ve Öneriler

NFT üreticileriyle dijital sanat oluşturmak için öne çıkan araçlar

Ethereum İşlem Maliyetlerini En Aza İndirmek: Eksiksiz Bir Kılavuz