2025 MFER Fiyat Tahmini: Bu Meme Token Yeni Zirvelere Ulaşır mı, Yoksa Gözden Mi Düşer?

Giriş: MFER'in Piyasa Konumu ve Yatırım Değeri

mfercoin (MFER), eşler arası elektronik bir mfer sistemi olarak kuruluşundan bu yana önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla MFER’in piyasa değeri 4.582.991 $’a ulaşmış, dolaşımdaki arzı yaklaşık 999.998.066 adet olup fiyatı 0,004583 $ seviyesindedir. Genellikle “meme ilhamlı token” olarak anılan bu varlık, dijital varlık ekosisteminde giderek daha belirgin bir rol üstlenmektedir.

Bu makalede, MFER’in 2025-2030 yılları arasındaki fiyat eğilimleri kapsamlı biçimde analiz edilecek; tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bir araya getirilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. MFER Fiyat Geçmişine Genel Bakış ve Güncel Piyasa Durumu

MFER’in Tarihsel Fiyat Gelişimi

- 2024: MFER, 31 Mart’ta 0,2988 $ ile zirveye çıkarak proje için önemli bir dönüm noktası oluşturdu.

- 2025: Piyasa düşüş eğilimine girdi ve yıl boyunca MFER fiyatı ciddi şekilde geriledi.

- 2025: MFER, 11 Ekim’de 0,004224 $ ile dip seviyesine indi ve zirveden sert bir düşüş yaşadı.

MFER Güncel Piyasa Durumu

12 Ekim 2025 itibarıyla MFER, 0,004583 $ fiyatından işlem görüyor ve son 24 saatte %0,35’lik hafif bir toparlanma gösteriyor. Ancak, token uzun vadede ciddi değer kaybına uğradı; son bir hafta içinde %25,59, son 30 günde ise %41,94 değer kaybetti. Yıl başından bu yana performans ise özellikle dikkat çekici; %84,48’lik bir düşüş söz konusu.

MFER’in şu anki piyasa değeri 4.582.991 $ ve küresel kripto para piyasasında 1782. sırada yer alıyor. Tokenın 24 saatlik işlem hacmi 26.281 $ olup, bu rakam düşük likiditeye işaret etmektedir. Dolaşımdaki toplam miktar 999.998.066,04 MFER olup, toplam arz 1.000.000.000’a çok yakındır; bu da projenin tokenlarının neredeyse tamamının piyasaya sürüldüğünü gösterir.

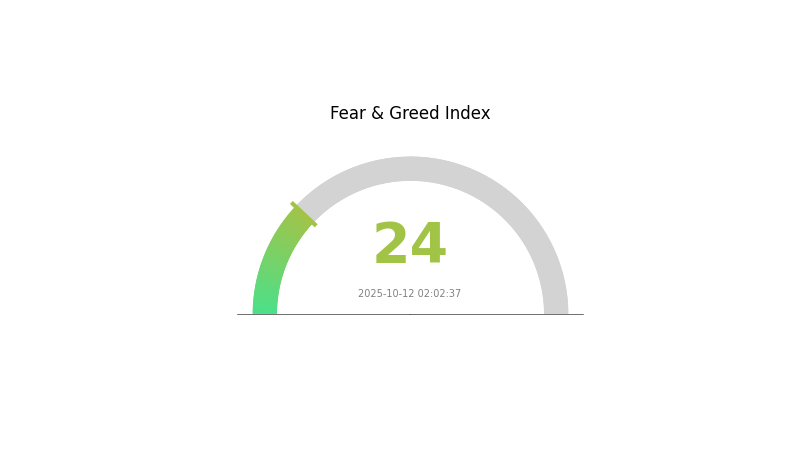

Kripto para piyasasında genel olarak şu anda “Aşırı Korku” hakim; VIX endeksi 24 seviyesinde ve bu durum MFER fiyatı üzerinde ek baskı oluşturuyor olabilir.

Güncel MFER piyasa fiyatını görüntülemek için tıklayın

MFER Piyasa Duyarlılık Göstergesi

2025-10-12 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasası şu anda aşırı korku döneminden geçiyor; Korku ve Açgözlülük Endeksi 24’e kadar düştü. Bu durum, yatırımcıların güven eksikliğini ve aşırı satım koşullarını işaret ediyor. Geçmişte, bu düzeydeki aşırı korku genellikle piyasa toparlanmalarının öncesinde görülmüştür. Yine de yatırımcıların temkinli hareket etmesi ve kararlarını detaylı araştırmalarla desteklemesi gerekir. Unutmayın, korku zamanında fırsatlar oluşabilir ancak bu volatil ortamda risk yönetimi büyük önem taşır.

MFER Varlık Dağılımı

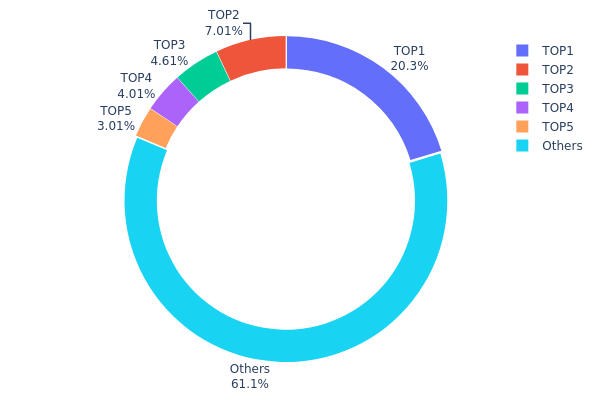

MFER’in adres varlık dağılımı verileri, orta derecede yoğunlaşmış bir sahiplik yapısı olduğunu gösteriyor. En büyük adres, toplam arzın %20,29’unu elinde tutarken, onu izleyen dört büyük adres toplamda %18,62’lik paya sahip. Bu yoğunluk, büyük yatırımcıların piyasa üzerinde etkili olabileceğini gösteriyor.

Bununla birlikte, MFER tokenlarının %61,09’u çok sayıda farklı adrese dağılmış durumda ve bu da belirli bir merkeziyetsizlik sağlıyor. Bu dağılım, büyük yatırımcıların etkisini dengeleyerek piyasa istikrarına katkı sunabilir. Ancak üst sıralardaki yoğunluk, büyük adreslerin toplu alım-satım kararlarında fiyat oynaklığını artırabilir.

Mevcut dağılım, merkezi etkilerle geniş yatırımcı katılımı arasında bir denge oluşturuyor. Üstteki adresler piyasa dinamiklerini etkileyebilecek güçte olsa da, küçük adreslerdeki dağılım yatırımcı tabanının çeşitliliğine işaret ediyor. Bu yapı tokenın dayanıklılığını destekleyebilir ancak büyük adres hareketlerinin olası piyasa etkileri açısından yakından izlenmesi gereklidir.

Güncel MFER Varlık Dağılımı’nı görmek için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7ec1...5c4185 | 202.963,48K | 20,29% |

| 2 | 0xb08a...0a313b | 70.127,78K | 7,01% |

| 3 | 0xd3e0...20cd97 | 46.118,31K | 4,61% |

| 4 | 0xb733...086a18 | 40.069,52K | 4,00% |

| 5 | 0xd5eb...102286 | 30.060,52K | 3,00% |

| - | Diğerleri | 610.658,20K | 61,09% |

II. MFER’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Sabit Arz: MFER’in toplam arzı sabittir, bu durum kıtlık yaratarak fiyat üzerinde etkili olabilir.

- Tarihsel Desen: Geçmişteki arz değişimleri, NFT piyasasında fiyat hareketlerini etkilemiştir.

- Mevcut Etki: Sabit arz, talebin artması halinde fiyat istikrarı veya değer artışı sağlayabilir.

Kurumsal ve Whale Dinamikleri

- Kurumsal Yatırımlar: Büyük kurumların MFER üzerindeki payı şimdilik sınırlı olsa da, NFT’lere artan ilgi bu tabloyu değiştirebilir.

- Kurumların Benimsemesi: Şu ana kadar MFER’in önemli bir kurumsal benimsenmesi raporlanmamıştır.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Dijital bir varlık olarak MFER, enflasyona karşı korunma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler, yatırımcıların NFT gibi alternatif varlıklara ilgisini artırabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- NFT Teknolojisi Gelişmeleri: NFT altyapısında yaşanan ilerlemeler, MFER’in işlevselliğine ve değerine olumlu katkı sağlayabilir.

- Ekosistem Uygulamaları: NFT tabanlı uygulama ve platformlardaki büyüme, MFER’in kullanım alanını ve talebini artırabilir.

III. 2025-2030 Dönemi için MFER Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00385 $ - 0,00459 $

- Tarafsız tahmin: 0,00459 $ - 0,00553 $

- İyimser tahmin: 0,00553 $ - 0,00647 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasanın evre beklentisi: Potansiyel büyüme dönemi

- Fiyat tahmini aralıkları:

- 2027: 0,00519 $ - 0,00794 $

- 2028: 0,00478 $ - 0,00984 $

- Temel tetikleyiciler: Benimsemenin artması, proje gelişmeleri, genel kripto piyasası eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00843 $ - 0,00995 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00995 $ - 0,01134 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,01134 $ - 0,01147 $ (olağanüstü proje gelişmeleri varsayımıyla)

- 2030-12-31: MFER 0,00995 $ (muhtemel ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00647 | 0,00459 | 0,00385 | 0 |

| 2026 | 0,00669 | 0,00553 | 0,00282 | 20 |

| 2027 | 0,00794 | 0,00611 | 0,00519 | 33 |

| 2028 | 0,00984 | 0,00703 | 0,00478 | 53 |

| 2029 | 0,01147 | 0,00843 | 0,00481 | 83 |

| 2030 | 0,01134 | 0,00995 | 0,00587 | 117 |

IV. MFER Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MFER Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- Temel öneriler:

- Piyasa düşüşlerinde MFER biriktirin

- Uzun vadeli fiyat hedefleri belirleyip düzenli olarak gözden geçirin

- MFER’i güvenli bir kişisel cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım sinyallerini belirleyin

- Dalgalı alım-satım için dikkat noktaları:

- Potansiyel kayıpları sınırlamak için stop-loss emirleri kullanın

- Kârı önceden belirlenmiş seviyelerde alın

MFER Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto para arasında dağıtın

- Dolar-maliyet ortalaması: Fiyat oynaklığını dengelemek için düzenli küçük alımlar yapın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü parolalar kullanın

V. MFER İçin Potansiyel Riskler ve Zorluklar

MFER Piyasa Riskleri

- Yüksek volatilite: Küçük hacimli tokenlarda sık görülen sert fiyat dalgalanmaları

- Kısıtlı likidite: Yüksek tutarlı işlemlerde zorluk yaşanabilir

- Piyasa duyarlılığı: Yatırımcı algısındaki ani değişimlere açık

MFER Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Meme coin’lere yönelik daha sıkı düzenlemeler gündeme gelebilir

- Uyumluluk sorunları: Gelecekteki düzenleyici gereksinimlere uyumsuzluk riski

- Sınır ötesi kısıtlamalar: Bazı ülkelerde işlem kısıtları söz konusu olabilir

MFER Teknik Riskler

- Akıllı kontrat açıkları: Token kontratındaki olası açıklar veya hatalar

- Ağ tıkanıklığı: Yüksek ağ yoğunluğunda işlem gecikmeleri yaşanabilir

- Teknolojik eskime: Daha gelişmiş projeler tarafından geride bırakılma riski

VI. Sonuç ve Eylem Önerileri

MFER Yatırım Değeri Değerlendirmesi

MFER, meme coin segmentinde yüksek risk-yüksek getiri potansiyeline sahip bir fırsattır. Kısa vadede önemli kazançlar sağlama imkanı sunarken, temel fayda eksikliği ve spekülatif doğası nedeniyle uzun vadeli değeri belirsizdir.

MFER Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyün çok küçük bir kısmı ile sınırlı kalmalı, hatta hiç dahil olmamalı ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş bir portföyde küçük oranlarla değerlendirilebilir ✅ Kurumsal yatırımcılar: Yüksek riskli tahsisler için temkinli yaklaşım önerilir

MFER Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında MFER alıp satın

- Staking: Proje tarafından sunuluyorsa staking fırsatlarını değerlendirin

- Sosyal alım-satım: Gate.com kopya alım-satım platformunda deneyimli yatırımcıları takip edin

Kripto para yatırımları son derece yüksek risk taşır, bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarını göz önünde bulundurarak dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

2025’te hangi meme coin patlama yapacak (fiyat tahmini)?

2025 yılında Shiba Inu’nun fiyatında ciddi bir artış bekleniyor. Güçlü topluluk desteği ve viral potansiyeliyle önde gelen meme coin olmaya devam ediyor.

Hamster coin fiyatı yükseliyor mu?

Evet, hamster coin fiyatının yükselmesi bekleniyor. Tahminler, 8 Kasım 2025’e kadar 0,093973 $’a ulaşabileceğini ve uzun vadede 0,095464 $’a kadar çıkabileceğini gösteriyor.

Mfer kripto nedir?

Mfer, Mfers NFT ekosistemine bağlı bir meme kripto parasıdır. Eğlence ile faydayı birleştirir ve topluluk katılımı ile NFT alanındaki rolünden değer kazanır.

2030’da hamster kombat coin ne kadar edecek?

İyimser piyasa öngörülerine göre, Hamster Kombat coin 2030 yılında 0,01 $ ile 0,05 $ arasında bir değere ulaşabilir; bu, projenin benimsenmesinin ve büyümesinin devam etmesi durumunda gerçekleşebilir.

The Doge NFT (DOGNFT) Yatırım İçin Uygun mu?: Piyasa Potansiyeli ve Uzun Vadeli Değer Perspektiflerinin Analizi

2025 MILADYCULT Fiyat Tahmini: Dijital sanat ekosisteminde piyasa trendleri, topluluk büyümesi ve yatırım potansiyelinin profesyonel bir şekilde analizi

2025 DOGNFT Fiyat Tahmini: Piyasa Analizi ve Köpek Temalı Dijital Koleksiyonların Büyüme Potansiyeli

PENGU Token'ın elde tutma dağılımı ile fon akışındaki değişimler, 2025 yılında fiyatı üzerinde nasıl bir etki yaratır?

Non-Playable Coin (NPC) iyi bir yatırım mı?: Bu yeni ortaya çıkan kripto varlığın riskleri ve potansiyeli üzerine değerlendirme

2025 LUCIC Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Kripto Sektöründe SPWN Ne İfade Eder?

Gemini, CFTC’den onay aldı; bu gelişme kripto tahmin piyasaları açısından ne ifade ediyor

State Street & Galaxy, 2026'da Solana tabanlı tokenlaştırılmış likidite fonu SWEEP'i piyasaya sunacak

Asya'nın alım gücü, artık Bitcoin fiyatları için temel destek noktası olarak öne çıkıyor

Strategy, MSCI'nin Bitcoin hazinesi bulunan şirketleri büyük endekslerden hariç tutma planına neden karşı çıkıyor?