2025 MEDPrice Prediction: Analyzing Market Trends and Growth Potential for Medical Token Economy

Introduction: MED's Market Position and Investment Value

MediBloc (MED), as an open information service platform based on blockchain technology, has been integrating and managing medical information securely since its inception in 2017. As of 2025, MediBloc's market capitalization has reached $47,245,380, with a circulating supply of approximately 10,080,089,735 tokens, and a price hovering around $0.004687. This asset, known as the "medical data management innovator," is playing an increasingly crucial role in healthcare information services.

This article will comprehensively analyze MediBloc's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. MED Price History Review and Current Market Status

MED Historical Price Evolution Trajectory

- 2020: Market low point, price reached $0.00161437 on March 13

- 2021: Bull market peak, price hit all-time high of $0.351852 on April 2

- 2025: Bearish trend, price declined to $0.004687

MED Current Market Situation

As of September 30, 2025, MED is trading at $0.004687, ranking 706th in the cryptocurrency market. The token has experienced a 2% decrease in the last 24 hours and a significant 48.9% drop over the past year. MED's current market capitalization stands at $47,245,380, with a circulating supply of 10,080,089,735 tokens. The 24-hour trading volume is $24,251, indicating relatively low liquidity. Despite the recent downtrend, MED's price remains well above its all-time low, suggesting some level of market resilience.

Click to view the current MED market price

MED Market Sentiment Indicator

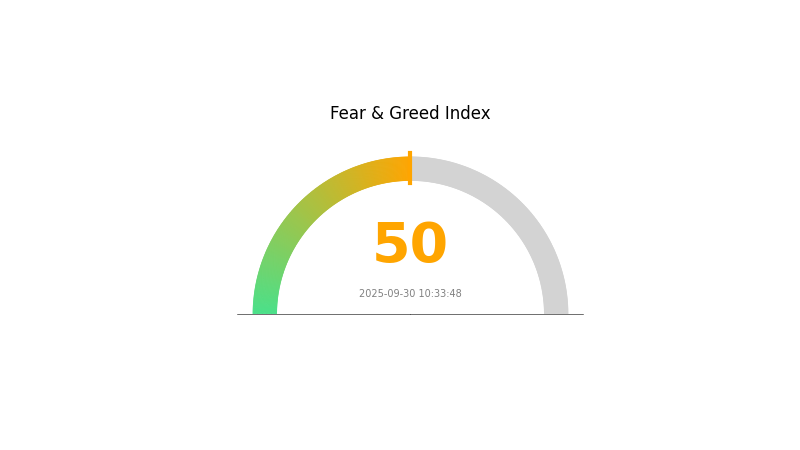

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index holding steady at 50. This neutral position suggests investors are neither overly pessimistic nor excessively optimistic about current market conditions. While caution is still advised, the equilibrium in market sentiment may present opportunities for strategic trading. As always, it's crucial to conduct thorough research and manage risks effectively when engaging in cryptocurrency investments.

MED Holdings Distribution

The address holdings distribution data for MED reveals an interesting pattern in token concentration. With no specific addresses holding significant percentages, it suggests a relatively decentralized distribution of MED tokens across the network. This absence of large individual holders indicates a reduced risk of market manipulation by a single entity.

Such a distribution pattern can be interpreted as a positive sign for MED's market structure. It potentially contributes to greater price stability, as there are no dominant players who could significantly impact the market through large-scale buying or selling actions. This decentralized holding pattern also aligns well with the principles of blockchain technology, potentially enhancing the project's credibility among investors and users.

However, it's important to note that while this distribution suggests a degree of decentralization, it doesn't guarantee complete market fairness or immunity to coordinated actions. The overall market dynamics of MED will still be influenced by various factors beyond just token distribution.

Click to view the current MED holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future MED Price

Supply Mechanism

- Historical Patterns: Historically, rising gold prices have led to reduced jewelry demand. Increased jewelry demand may actually be a bearish signal for gold prices, as jewelry demand typically recovers only when gold prices fall.

Macroeconomic Environment

-

Monetary Policy Impact: Global economic recovery has exceeded earlier expectations, benefiting from rising vaccination rates, continued policy support, and gradual adaptation to "living with the pandemic". However, recovery paces vary significantly across regions, with emerging market economies generally lagging behind.

-

Inflation Hedging Properties: Core goods price inflation has fallen to (or below) trend levels, but services price inflation remains above pre-pandemic average levels, especially in the US and Eurozone. In Europe and Latin America, some countries are experiencing particularly high inflation rates.

Technical Development and Ecosystem Building

- Ecosystem Applications: The main revenue source for digital media and technology companies like Trump Media is digital advertising. Therefore, advertiser demand is a key factor affecting stock price performance. Increased political activity or corporate spending targeting specific audience platforms may provide upside potential.

III. MED Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00384 - $0.00469

- Neutral prediction: $0.00469 - $0.00537

- Optimistic prediction: $0.00537 - $0.00604 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00459 - $0.00733

- 2028: $0.00571 - $0.00877

- Key catalysts: Increased adoption, technological advancements, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.00547 - $0.00793 (assuming steady market growth)

- Optimistic scenario: $0.00793 - $0.00944 (assuming strong market performance and increased MED utility)

- Transformative scenario: Above $0.00944 (assuming breakthrough developments and widespread adoption)

- 2030-12-31: MED $0.00944 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00604 | 0.00469 | 0.00384 | 0 |

| 2026 | 0.00655 | 0.00537 | 0.00435 | 14 |

| 2027 | 0.00733 | 0.00596 | 0.00459 | 27 |

| 2028 | 0.00877 | 0.00664 | 0.00571 | 41 |

| 2029 | 0.00817 | 0.0077 | 0.00462 | 64 |

| 2030 | 0.00944 | 0.00793 | 0.00547 | 69 |

IV. MED Professional Investment Strategy and Risk Management

MED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MED during market dips

- Set price targets for partial profit-taking

- Store MED in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

MED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MED

MED Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

MED Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrencies

MED Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Possible transaction delays during high activity

- Scalability challenges: Potential limitations in handling increased adoption

VI. Conclusion and Action Recommendations

MED Investment Value Assessment

MED offers potential in the healthcare blockchain space but faces significant market and regulatory risks. Long-term value proposition remains speculative, with short-term volatility expected.

MED Investment Recommendations

✅ Beginners: Start with small positions, focus on education ✅ Experienced investors: Consider as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

MED Trading Participation Methods

- Spot trading: Buy and sell MED on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore DeFi opportunities involving MED tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is MED stock a buy?

Yes, MED stock is considered a buy. Analysts give it a consensus Buy rating, with 30% recommending a Strong Buy. However, always consider current market conditions before investing.

What is the stock price forecast for outset medical in 2025?

Based on current projections, the average stock price forecast for Outset Medical in 2025 is $12.67, with a potential high of $25.06 and a low of $0.2791.

What is the price target for Meta 2025?

Based on financial analysts' forecasts, the price target for Meta in 2025 is $696.89, indicating no change from the current stock price.

How much is Medtronics stock forecasting for 2025?

Medtronics stock is forecasted to reach an average price of $89.94 in 2025, with a potential high of $114.93 and a low of $64.95.

Share

Content