2025 MAJOR Fiyat Tahmini: Token için Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

Giriş: MAJOR'ın Piyasadaki Konumu ve Yatırım Potansiyeli

Major (MAJOR), Telegram üzerinde öncü bir Oyna-Kazan oyunu olarak, lansmanından bu yana 70 milyonun üzerinde kullanıcıya ulaşmıştır. 2025 yılı itibarıyla Major'ın piyasa değeri 10.183.000 $ seviyesinde, yaklaşık 85.000.000 dolaşımdaki token ile fiyatı 0,1198 $ civarında seyretmektedir. "TON platformu yaygınlaştırıcısı" olarak tanımlanan bu varlık, Telegram ekosisteminde ve genel blokzincir sektöründe giderek daha önemli bir rol üstleniyor.

Bu makalede, Major'ın 2025 ile 2030 yılları arasındaki fiyat hareketleri kapsamlı biçimde incelenerek, geçmiş piyasa örüntüleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullarla birlikte yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. MAJOR Fiyat Geçmişi ve Güncel Piyasa Durumu

MAJOR Tarihsel Fiyat Seyri

- 2024: MAJOR 0,5 $ seviyesinde piyasaya sürüldü, 28 Kasım'da tüm zamanların en yüksek seviyesi olan 1,54344 $'a ulaştı

- 2025: Piyasa düzeltmesiyle fiyat, 11 Mart'ta tüm zamanların en düşük seviyesi olan 0,09831 $'a geriledi

- 2025: Kademeli toparlanmayla mevcut fiyat yaklaşık 0,1198 $ civarında istikrar kazandı

MAJOR Güncel Piyasa Görünümü

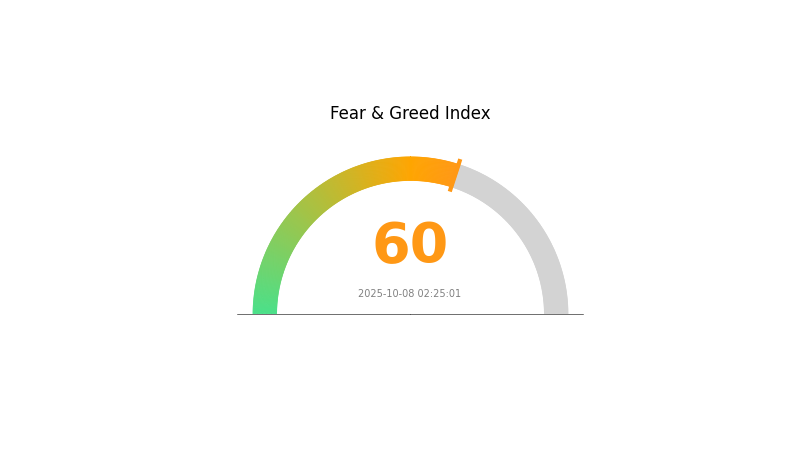

8 Ekim 2025 itibarıyla MAJOR, 0,1198 $ fiyatından işlem görüyor ve 24 saatlik işlem hacmi 127.155,15 $. Token, son 24 saatte %4,66 oranında değer kaybetti. MAJOR'ın piyasa değeri 10.183.000 $ olup, kripto para piyasasında 1.406'ncı sırada yer alıyor. Dolaşımdaki arz 85.000.000 MAJOR coin iken, maksimum arz 100.000.000 coin. Son düşüşe rağmen MAJOR, son 1 saatte %0,43 artış göstererek dirençli bir performans sergiledi. Ancak, token son bir yılda %85,30 değer kaybederek önemli zorluklarla karşılaştı. MAJOR için mevcut piyasa hissiyatı açgözlülüğe eğilimli olup, VIX endeksi 60 seviyesinde.

Güncel MAJOR piyasa fiyatını görüntüleyin

MAJOR Piyasa Hissiyatı Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında açgözlülük baskın; Korku ve Açgözlülük Endeksi 60 seviyesinde. Bu durum, yatırımcıların piyasanın potansiyeline giderek daha iyimser yaklaştığını gösteriyor. Bununla birlikte, aşırı iyimserliğe kapılmadan temkinli olmak önemlidir. Piyasalar öngörülemez olduğundan, yatırım kararlarınızı kendi araştırmanızla desteklemeniz önerilir. Portföyünüzü çeşitlendirmeniz ve bu açgözlü piyasa koşullarında net risk yönetimi stratejileri oluşturmanız önerilir.

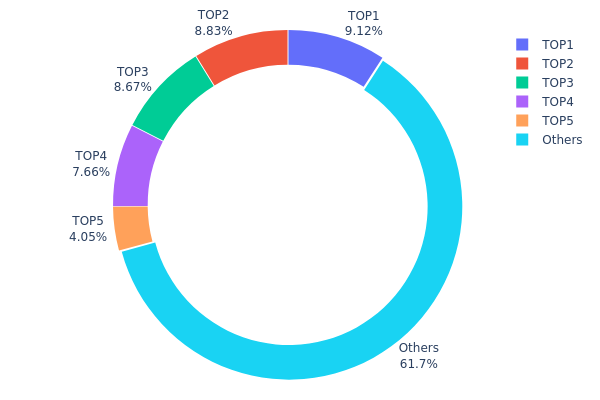

MAJOR Varlık Dağılımı

Adres varlık dağılımı, MAJOR tokenlerinin farklı cüzdanlar arasında ne kadar yoğunlaştığını gösteriyor. Analiz, üst düzey sahiplerde orta derecede bir yoğunlaşma olduğunu ortaya koyuyor. İlk 5 adres toplam arzın %38,29'unu kontrol ederken, en büyük sahip %9,11'lik bir paya sahip.

Bu dağılım, aşırı merkezileşmeden uzak, dengeli bir sahiplik yapısı sunuyor. Büyük yatırımcıların payı yüksek olsa da, tokenlerin çoğunluğu (%61,71) çok sayıda küçük adrese dağılmış durumda. Bu yapı, tekil balinaların büyük satışlarının piyasaya etkisini azaltarak istikrara katkı sağlayabilir. Yine de üst düzey sahiplerin koordineli işlemleri fiyatları etkileyebilir.

Mevcut MAJOR token dağılımı, orta düzeyde merkeziyetsizlik gösteriyor. Büyük pay sahiplerinin varlığı ile geniş tabanlı küçük yatırımcıların dengesi, uzun vadede piyasa istikrarını ve organik fiyat oluşumunu destekleyebilir.

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | UQAEi4...zPkU7i | 9.000,01K | 9,11% |

| 2 | UQB7Uw...wqOEz1 | 8.710,85K | 8,82% |

| 3 | UQDDsF...aoBFto | 8.552,81K | 8,66% |

| 4 | UQBmoe...5E5Uii | 7.557,97K | 7,65% |

| 5 | UQCTkT...CngrdP | 4.000,00K | 4,05% |

| - | Diğerleri | 60.872,71K | 61,71% |

II. MAJOR'ın Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Geçmiş örüntü: Önceki arz değişiklikleri fiyatlarda hareketlilik sağladı

- Mevcut etki: Yaklaşan arz değişikliklerinin beklenen etkisi

Makroekonomik Koşullar

- Parasal politika etkisi: Küresel merkez bankalarının politika beklentileri

- Enflasyon koruma özellikleri: Enflasyonist ortamlardaki performansı

- Jeopolitik etkenler: Uluslararası gelişmelerin etkisi

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem uygulamaları: Temel DApp ve ekosistem projeleri

III. MAJOR 2025-2030 Fiyat Öngörüsü

2025 Görünümü

- Korunaklı tahmin: 0,06829 $ - 0,11981 $

- Tarafsız tahmin: 0,11981 $ - 0,14317 $

- İyimser tahmin: 0,14317 $ - 0,16654 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Potansiyel büyüme dönemi

- Fiyat aralığı tahminleri:

- 2027: 0,16837 $ - 0,21748 $

- 2028: 0,10804 $ - 0,26911 $

- Temel katalizörler: Artan benimseme ve teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,23277 $ - 0,26303 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,26303 $ - 0,29329 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,29329 $ - 0,32353 $ (olağanüstü piyasa koşulları varsayımıyla)

- 2030-12-31: MAJOR 0,32353 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,16654 | 0,11981 | 0,06829 | 0 |

| 2026 | 0,2076 | 0,14317 | 0,10595 | 19 |

| 2027 | 0,21748 | 0,17539 | 0,16837 | 46 |

| 2028 | 0,26911 | 0,19643 | 0,10804 | 63 |

| 2029 | 0,29329 | 0,23277 | 0,13734 | 94 |

| 2030 | 0,32353 | 0,26303 | 0,17886 | 119 |

IV. MAJOR Profesyonel Yatırım Stratejisi ve Risk Yönetimi

MAJOR Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Telegram ekosistemine inanan ve uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde MAJOR token satın alın

- Düzenli alım için maliyet ortalaması planı oluşturun

- Tokenleri güvenli bir cüzdanda ve düzenli yedeklemelerle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve potansiyel giriş/çıkış noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını takip edin

- Swing trade için anahtar noktalar:

- Telegram kullanıcı artışı ve etkileşim istatistiklerini izleyin

- TON blockchain gelişmelerini takip edin

MAJOR Risk Yönetimi Çerçevesi

(1) Varlık dağılımı ilkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için önceden belirlenmiş çıkış noktaları oluşturun

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı çözümü: Resmi TON cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü parolalar kullanın

V. MAJOR Potansiyel Riskler ve Zorluklar

MAJOR Piyasa Riskleri

- Oynaklık: Kripto sektöründe yüksek fiyat dalgalanmaları sık görülür

- Rekabet: Telegram veya TON blokzincirindeki diğer Oyna-Kazan oyunları

- Piyasa duyarlılığı: Genel kripto piyasası trendlerine bağlılık

MAJOR Mevzuat Riskleri

- Belirsiz düzenlemeler: Küresel kripto mevzuatında olası değişiklikler

- Telegram politikaları: Telegram'ın kripto uygulamalarına yaklaşımında değişiklikler

- TON blokzincir uyumu: TON ekosisteminin düzenleyici zorlukları

MAJOR Teknik Riskleri

- Akıllı kontrat açıklıkları: MAJOR token kontratında potansiyel hatalar

- Ölçeklenebilirlik sorunları: TON blokzincirinin artan kullanıcı trafiğini yönetme kapasitesi

- Entegrasyon zorlukları: Telegram ile entegrasyon sürecindeki teknik problemler

VI. Sonuç ve Eylem Önerileri

MAJOR Yatırım Potansiyeli Değerlendirmesi

MAJOR, Telegram ekosistemindeki büyük kullanıcı tabanını avantaja dönüştürüp benzersiz bir fırsat sunar. Ancak, piyasa oynaklığı ve mevzuat belirsizliği nedeniyle çeşitli zorluklar mevcut.

MAJOR Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Ekosistemi tanımak için küçük ve ulaşılabilir yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Risk toleransınıza göre orta ölçekli dağılımı düşünün ✅ Kurumsal yatırımcılar: Ayrıntılı inceleme yapın ve MAJOR'u çeşitlendirilmiş bir kripto portföyünde değerlendirin

MAJOR Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden MAJOR token alım-satımı

- Stake programlarına katılım: Uygunsa stake programlarına katılım

- Oyun içi katılım: Telegram'daki MAJOR oyununa katılarak token kazanma

Kripto para yatırımları ciddi risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk toleranslarını göz önünde bulundurarak karar vermeli ve uzmanlardan destek alınmalıdır. Asla kaybetmeyi göze almayacağınız tutarda yatırım yapmayın.

SSS

MAJOR coin için fiyat beklentisi nedir?

Major'ın, 1 Kasım 2025'te 0,09318 $ seviyesine gerilemesi ve %25,13 oranında düşüş göstermesi öngörülüyor. Bu negatif tahmin teknik analiz bulgularına dayanmaktadır.

Bir Major tokenin değeri nedir?

Ekim 2025 itibarıyla bir Major token 0,122 $ değerindedir. Son 24 saatte fiyat %0,08 gerilemiş olup, işlem hacmi 1.079.772 $'dır.

En yüksek fiyat öngörüsüne sahip kripto para hangisidir?

Bitcoin (BTC), 2025 yılı için en yüksek fiyat beklentisine sahip kripto paradır. Yatırımcılar arasında hâlâ en çok tercih edilen varlık ve yükselişini sürdürmektedir.

Major coin nedir?

Major coin, dijital para sektöründe liderliği ve tarihi önemiyle öne çıkan Bitcoin'dir.

Hamster Kombat Günlük Kombinasyon & Şifre Cevabı 06 Kasım 2025 — Sıfırlama gerçekleşmeden önce ödüllerinizi alın

Hamster Kombat Günlük Kombinasyon ve Şifre Cevabı 07 Kasım 2025

Hamster Kombat Günlük Kombinasyon ve Şifre Cevabı 23 Kasım 2025

Hamster Kombat Günlük Kombinasyonu ve Şifre Cevabı 25 Kasım 2025

Hamster Kombat Günlük Kombinasyon ve Şifre Yanıtı 29 Kasım 2025

Hamster Kombat Günlük Kombinasyon & Şifre Cevabı 28 Kasım 2025

Raoul Pal, neden çoğu coinden kaçındığını ve Kripto Varlıklara sıkı bir şekilde inandığını açıkladı.

Satoshi’den Bitcoin’e Dönüşüm: Temel Bilgiler Açıklandı

Güvenli Kripto Para Saklama için En Çok Tercih Edilen Cihazlar

DeFi Likidite Havuzlarında Geçici Kayıp Nedir?

En İyi NFT Üretici Araçlarıyla Dijital Sanat Oluşturma Konusunda Kapsamlı Rehber