2025 MAG7SSI Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: MAG7SSI's Market Position and Investment Value

MAG7SSI (MAG7SSI), as a flagship investment product designed to capture systematic β returns in the crypto industry, has achieved significant recognition since its inception. As of 2025, MAG7SSI's market capitalization has reached $131,278,026, with a circulating supply of approximately 169,347,298 tokens, and a price hovering around $0.7752. This asset, known as a "diversified crypto portfolio," is playing an increasingly crucial role in providing exposure to the most robust and influential assets in the crypto space.

This article will comprehensively analyze MAG7SSI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MAG7SSI Price History Review and Current Market Status

MAG7SSI Historical Price Evolution

- 2025: MAG7SSI launched at $1, reaching its all-time high of $4.1541 on January 26

- 2025: Market downturn, price dropped to its all-time low of $0.5498 on April 7

- 2025: Gradual recovery, current price stabilized around $0.7752

MAG7SSI Current Market Situation

As of November 16, 2025, MAG7SSI is trading at $0.7752. The token has experienced a slight increase of 0.02% in the last 24 hours, but shows a significant decline of 15.32% over the past 30 days. The current market capitalization stands at $131,278,026, ranking 330th in the crypto market. With a circulating supply equal to its total supply of 169,347,298.9470623 tokens, MAG7SSI has a fully diluted market cap of $131,278,026. The 24-hour trading volume is $23,784.44, indicating moderate market activity. The token is currently trading 81.34% below its all-time high and 41% above its all-time low, suggesting a potential for recovery but also highlighting the volatility in the crypto market.

Click to view the current MAG7SSI market price

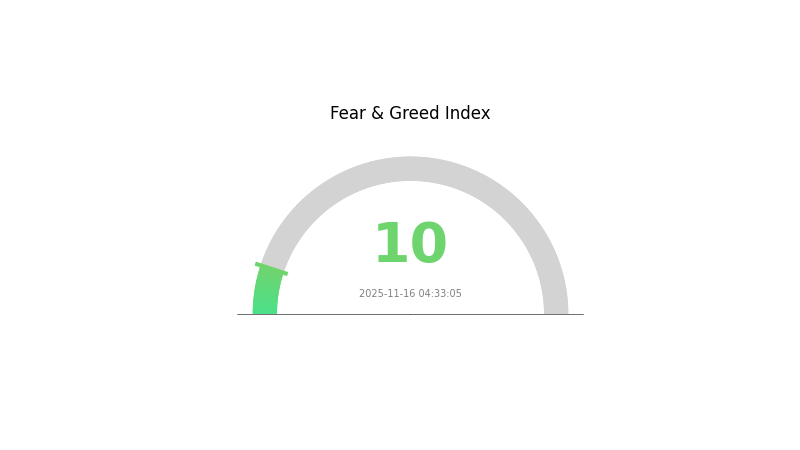

MAG7SSI Market Sentiment Indicator

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index hitting a low of 10. This level of pessimism often indicates a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and this extreme fear could be a precursor to a market reversal or further decline. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times.

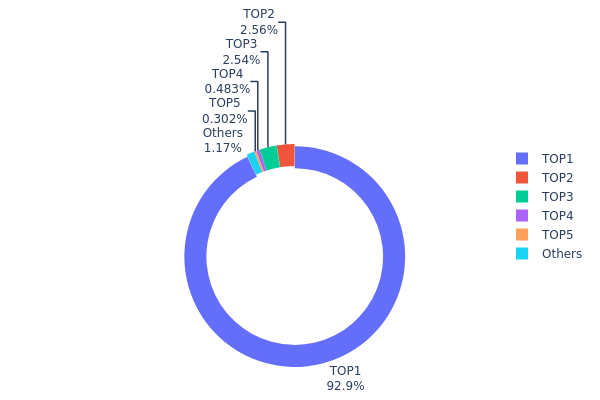

MAG7SSI Holdings Distribution

The address holdings distribution data for MAG7SSI reveals a highly concentrated ownership structure. The top address holds an overwhelming 92.94% of the total supply, equivalent to 157,398,570 tokens. This extreme concentration raises significant concerns about centralization and potential market manipulation. The second and third largest holders possess only 2.56% and 2.53% respectively, while the remaining addresses collectively account for less than 2% of the total supply.

Such a skewed distribution pattern could have profound implications for MAG7SSI's market dynamics. The dominant address has the potential to exert substantial influence over price movements, potentially leading to increased volatility and susceptibility to large-scale dumping events. This concentration also poses risks to the token's liquidity and overall market stability, as any significant actions by the top holder could dramatically impact the entire ecosystem.

From a broader perspective, this distribution pattern indicates a low level of decentralization and raises questions about the token's governance structure and long-term sustainability. It underscores the importance of monitoring large address movements and emphasizes the need for increased distribution to enhance market resilience and reduce manipulation risks.

Click to view the current MAG7SSI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3d8f...91530b | 157398.57K | 92.94% |

| 2 | 0x2cd5...875530 | 4340.08K | 2.56% |

| 3 | 0xd364...a29444 | 4296.83K | 2.53% |

| 4 | 0x10fa...f5a15f | 818.49K | 0.48% |

| 5 | 0xb331...78d2a5 | 510.77K | 0.30% |

| - | Others | 1982.56K | 1.19% |

II. Key Factors Affecting MAG7SSI's Future Price

Supply Mechanism

- Deflationary Model: MAG7SSI implements a deflationary model, gradually reducing the total supply over time.

- Historical Pattern: Previous supply reductions have typically led to price appreciation as scarcity increases.

- Current Impact: The ongoing deflationary mechanism is expected to create upward pressure on MAG7SSI's price, assuming demand remains stable or grows.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have recently increased their MAG7SSI holdings, signaling growing institutional interest.

- Corporate Adoption: Tech giant MicroStrategy has announced plans to add MAG7SSI to its corporate treasury, potentially inspiring other companies to follow suit.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's stance on interest rates will likely influence MAG7SSI's price, with lower rates potentially driving investors towards crypto assets.

- Inflation Hedging Properties: MAG7SSI has shown some correlation with inflation rates, potentially positioning it as a hedge against currency devaluation.

- Geopolitical Factors: Ongoing global tensions and economic uncertainties may increase MAG7SSI's appeal as a decentralized, borderless asset.

Technological Developments and Ecosystem Building

- Layer 2 Scaling: The upcoming implementation of Layer 2 solutions is expected to significantly improve MAG7SSI's transaction speed and reduce fees.

- Smart Contract Upgrades: Planned improvements to MAG7SSI's smart contract functionality could expand its use cases in DeFi and NFT markets.

- Ecosystem Applications: Several prominent DApps are being developed on the MAG7SSI network, including decentralized exchanges and lending platforms, which could drive adoption and utility.

III. MAG7SSI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.66667 - $0.7752

- Neutral prediction: $0.7752 - $0.9419

- Optimistic prediction: $0.9419 - $1.10854 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation

- Price range forecast:

- 2027: $0.95374 - $1.26399

- 2028: $1.07381 - $1.55643

- Key catalysts: Increased adoption and market maturity

2030 Long-term Outlook

- Base scenario: $1.39737 - $1.64396 (assuming steady market growth)

- Optimistic scenario: $1.64396 - $1.79192 (assuming strong market performance)

- Transformative scenario: $1.79192+ (under extremely favorable conditions)

- 2030-12-31: MAG7SSI $1.64396 (112% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.10854 | 0.7752 | 0.66667 | 0 |

| 2026 | 1.35629 | 0.94187 | 0.62163 | 21 |

| 2027 | 1.26399 | 1.14908 | 0.95374 | 48 |

| 2028 | 1.55643 | 1.20653 | 1.07381 | 55 |

| 2029 | 1.90644 | 1.38148 | 0.87033 | 78 |

| 2030 | 1.79192 | 1.64396 | 1.39737 | 112 |

IV. Professional Investment Strategies and Risk Management for MAG7SSI

MAG7SSI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking diversified crypto exposure

- Operational suggestions:

- Accumulate MAG7SSI tokens during market dips

- Regularly rebalance portfolio to maintain desired allocation

- Store tokens in a secure hardware wallet or reputable custody solution

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

MAG7SSI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of crypto portfolio

- Moderate investors: 10-20% of crypto portfolio

- Aggressive investors: 20-30% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MAG7SSI with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MAG7SSI

MAG7SSI Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades without significant price impact

- Correlation risk: High correlation with overall crypto market movements

MAG7SSI Regulatory Risks

- Regulatory uncertainty: Changing global regulations may impact MAG7SSI's operations

- Compliance challenges: Adapting to evolving regulatory requirements across jurisdictions

- Legal status: Potential classification as a security in some regions

MAG7SSI Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Blockchain congestion: Network slowdowns or high fees during peak periods

- Oracle manipulation: Risks associated with price feed accuracy and reliability

VI. Conclusion and Action Recommendations

MAG7SSI Investment Value Assessment

MAG7SSI offers diversified exposure to top crypto assets, potentially providing a balanced risk-reward profile for investors seeking broad market participation. However, it carries inherent risks associated with the volatile crypto market and regulatory uncertainties.

MAG7SSI Investment Recommendations

✅ Beginners: Consider small, regular investments to build exposure gradually ✅ Experienced investors: Integrate MAG7SSI as part of a diversified crypto portfolio ✅ Institutional investors: Explore MAG7SSI for broad market beta exposure, complemented with proper risk management strategies

MAG7SSI Participation Methods

- Spot trading: Purchase MAG7SSI tokens on Gate.com

- DeFi platforms: Explore liquidity provision or yield farming opportunities (if available)

- Derivatives: Consider MAG7SSI futures or options for advanced trading strategies (where offered)

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which crypto will boom in 2025 prediction forbes?

Forbes predicts Ethereum, Bitcoin, and Solana will likely boom in 2025 due to increased adoption and technological advancements in the crypto space.

Will Siacoin ever recover?

Yes, Siacoin has potential to recover. As the decentralized storage market grows and Sia technology improves, Siacoin's value may increase in the long term.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

What will the price of Siacoin be in 2030?

Based on market trends and potential adoption, Siacoin could reach $0.50 to $1 by 2030, reflecting significant growth in the decentralized storage sector.

Share

Content