2025 M Fiyat Tahmini: BMW'nin Lüks Sedan Fiyatlandırmasını Belirleyen Piyasa Trendleri ve Etkenlerin Analizi

Giriş: M’in Piyasa Konumu ve Yatırım Değeri

MemeCore (M), Meme 2.0 dönemi için inşa edilen ilk Layer 1 blokzinciri olarak ortaya çıktığından beri büyük bir tanınırlık elde etti. 2025 yılı itibarıyla MemeCore’un piyasa değeri 3,29 milyar dolara ulaşırken, dolaşımdaki token sayısı yaklaşık 1,68 milyar ve fiyatı 1,96 dolar civarında seyrediyor. “Viral ekonomi öncüsü” olarak anılan bu varlık, meme coin’lerin sürdürülebilir kültürel ve ekonomik değerler haline gelmesinde giderek daha önemli bir rol oynuyor.

Bu makale, MemeCore’un 2025’ten 2030’a kadar olan fiyat eğilimlerini; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında derinlemesine analiz ederek yatırımcılara profesyonel fiyat öngörüleri ile uygulanabilir yatırım stratejileri sunacaktır.

I. M Fiyat Geçmişi ve Mevcut Piyasa Durumu

M Tarihsel Fiyat Seyri

- 2025: MemeCore, Meme 2.0 için ilk Layer 1 blokzinciri olarak piyasaya sürüldü; fiyatı 18 Eylül’de tüm zamanların en yüksek seviyesi olan 2,9647 dolara ulaştı

- 2025: Piyasa düzeltmesiyle birlikte 29 Eylül’de fiyatı tüm zamanların en düşük seviyesi olan 1,5569 dolara geriledi

- 2025: Kademeli toparlanma ve istikrarla fiyat 1,9 ile 2,2 dolar arasında dalgalandı

M Mevcut Piyasa Durumu

15 Ekim 2025 itibarıyla MemeCore (M), 1,9615 dolar seviyesinde işlem görüyor ve son 24 saatte %3,12 oranında değer kaybetti. Token’ın piyasa değeri 3.289.977.297 dolar olup, genel kripto para sıralamasında 42. sırada yer alıyor. Son 24 saatteki işlem hacmi ise 579.429 dolar ile orta düzeyde bir piyasa hareketliliğine işaret ediyor.

Şu anki fiyat, yaklaşık bir ay önceki 2,9647 dolarlık tüm zamanların en yüksek seviyesinden belirgin bir düşüşü yansıtıyor. Ancak, halen 1,5569 dolarlık tüm zamanların en düşük seviyesinin oldukça üzerinde. Token’ın dönemsel performansı ise karmaşık bir tablo çiziyor: Son bir saatte %2,56, geçen hafta %5,12 ve son 30 günde %20,58 değer kaybı yaşandı.

Kısa vadeli düşüşlere karşın, M uzun vadede dikkat çekici bir büyüme sergiledi ve son bir yılda %2.767,74’lük bir artış kaydetti. Bu, son dalgalanmalara rağmen projenin başlangıcından bu yana güçlü bir performans gösterdiğini açıkça gösteriyor.

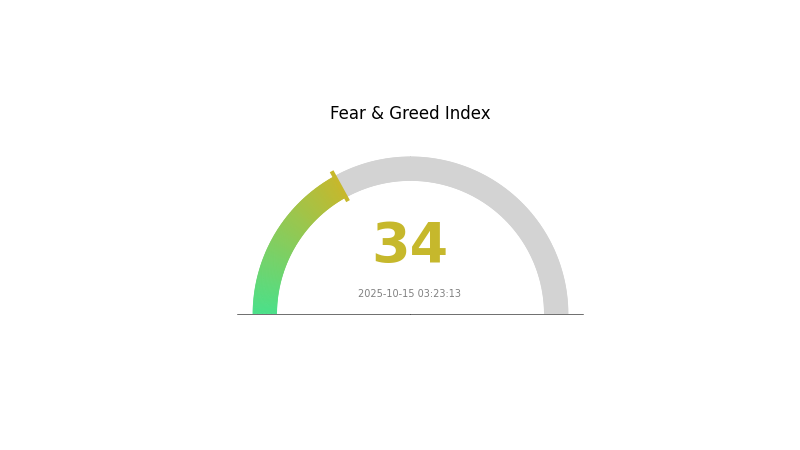

Kripto para piyasasında mevcut duyarlılık temkinli; VIX endeksi 34’e ulaşmış durumda ve piyasada “Korku” modunu gösteriyor. Bu genel piyasa korkusu, M fiyatındaki son baskılara katkıda bulunuyor olabilir.

Güncel M piyasa fiyatını görmek için tıklayın

Piyasa Duyarlılık Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık şu anda “Korku” bölgesinde ve yatırımcılar arasında temkinli bir hava hakim. Bu korku etkisindeki ortam, uzun vadeli yatırımcılar için potansiyel alım fırsatları sunabilir. Ancak, yatırım kararı almadan önce detaylı araştırma yapmak ve dikkatli davranmak gerekir. Piyasa duyarlılığı hızla değişebilir; bu nedenle, piyasa koşullarını değerlendirirken sadece Korku ve Açgözlülük Endeksi’ni değil, çok sayıda faktörü göz önünde bulundurmak gerekir.

M Varlık Dağılımı

Adres bazında varlık dağılımı grafiği, M token sahipliğinin yoğunluğu hakkında önemli bilgiler sağlar. Mevcut verilere göre, büyük miktarda token bulunduran adreslerin olmaması, M’in oldukça merkeziyetsiz bir yapıya sahip olduğunu gösteriyor. Büyük bireysel sahiplerin eksikliği, tek bir varlığın fiyatı manipüle etme ya da ani dalgalanmalara yol açma riskini azaltıyor.

M token’larının birçok adrese dengeli şekilde dağılması, piyasa yapısında daha fazla istikrar sağlar. Bu, daha çeşitli bir kullanıcı tabanına ve potansiyel olarak daha yaygın bir benimsenmeye işaret eder; fiyat hareketleri de birkaç büyük oyuncudan ziyade gerçek arz-talep dengesiyle şekillenir. Ayrıca, merkeziyetsiz sahiplik yapısı M ekosisteminin genel dayanıklılığını artırır ve büyük hesapların veya toplu piyasa hareketlerinin etkisini sınırlar.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. M’in Gelecek Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: Başlıca merkez bankalarının faiz adımları, kısa vadede en önemli belirleyici olacak.

- Enflasyona Karşı Koruma Özellikleri: Altın, enflasyona karşı koruma aracı olarak güç kazandı ve fiyatı enflasyon beklentileriyle birlikte yükseldi.

- Jeopolitik Faktörler: Jeopolitik riskler ve bunların seyri, M’in fiyatında anahtar etki yaratacak.

Teknik Gelişim ve Ekosistem Oluşumu

- ETF Girişleri: Altın ETF’lerine olan girişler son dönemde rekor seviyelere ulaştı ve bu ürünler talebin önemli bir kaynağı haline geldi.

- Merkez Bankası Alımları: Merkez bankalarının 2025’te yaklaşık 900 ton altın alması bekleniyor ve bu da talebi artıracaktır.

III. 2025-2030 Dönemi İçin M Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 1,28 - 1,50 dolar

- Tarafsız tahmin: 1,80 - 2,00 dolar

- İyimser tahmin: 2,20 - 2,25 dolar (olumlu piyasa koşulları halinde)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 1,70 - 2,87 dolar

- 2027: 2,21 - 3,36 dolar

- Temel katalizörler: Artan benimsenme ve teknolojik ilerlemeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 3,50 - 4,50 dolar (istikrarlı piyasa büyümesi halinde)

- İyimser senaryo: 4,50 - 5,00 dolar (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 5,50 - 5,71 dolar (çığır açıcı yenilikler ve kitlesel benimsenme durumunda)

- 31 Aralık 2030: M 4,08 dolar (olası yıl sonu fiyatı)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.2458 | 1.97 | 1.2805 | 0 |

| 2026 | 2.86674 | 2.1079 | 1.7074 | 7 |

| 2027 | 3.35788 | 2.48732 | 2.21372 | 26 |

| 2028 | 3.65325 | 2.9226 | 1.81201 | 48 |

| 2029 | 4.86613 | 3.28793 | 2.6961 | 67 |

| 2030 | 5.70784 | 4.07703 | 2.81315 | 107 |

IV. M için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

M Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli değer yatırımcıları ve blokzincir teknolojisi meraklıları

- Operasyon önerileri:

- Piyasa düşüşlerinde M token biriktirin

- Kısmi kar almak için hedef fiyatlar belirleyin

- Token’ları güvenli, saklama anahtarının kontrolü sizde olan cüzdanlarda tutun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüş noktalarını belirlemek için kullanın

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım koşullarını izleyin

- Dalgalı ticaret için temel noktalar:

- Piyasa trendiyle uyumlu hareket edin

- Risk yönetimi için zarar-durdur emirleri oluşturun

M Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı kripto varlıklarına yayın

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve düzenli güvenlik denetimleri uygulayın

V. M için Potansiyel Riskler ve Zorluklar

M Piyasa Riskleri

- Yüksek oynaklık: Meme coin’ler ani fiyat dalgalanmalarına açıktır

- Piyasa duyarlılığı değişimi: Sosyal medya trendlerindeki değişiklikler değeri etkileyebilir

- Rekabet: Yeni meme coin’ler pazar payını azaltabilir

M Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Meme coin’lere yönelik artan denetim olasılığı

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen düzenlemeler

- Vergi etkileri: Kripto varlıklara yönelik değişen vergi politikaları

M Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ağ tıkanıklığı: Yüksek işlem hacmi gecikmelere neden olabilir

- Ölçeklenebilirlik sorunları: İşlem kapasitesinde sınırlamalar

VI. Sonuç ve Eylem Önerileri

M Yatırım Değeri Değerlendirmesi

MemeCore (M), gelişen meme coin sahasında yenilikçi viral ekonomi modeliyle uzun vadeli potansiyel sunan özgün bir seçenek olarak öne çıkıyor. Ancak kısa vadeli oynaklık ve düzenleyici belirsizlikler önemli riskler teşkil ediyor.

M Yatırım Önerileri

✅ Yeni başlayanlar: Kripto portföyünün yalnızca küçük bir kısmını (%1-2) ayırmalı, önceliği bilgi edinmeye vermeli ✅ Deneyimli yatırımcılar: %3-5 arası bir pay ayırıp pozisyonları aktif şekilde yönetmeli ✅ Kurumsal yatırımcılar: Yüksek riskli kripto portföylerinde %5-10 arası değerlendirme yapmalı

M Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden M token’larının doğrudan alım-satımı

- Vadeli işlemler: Gate.com’da sürekli kontratlarla kaldıraçlı pozisyonlara erişim

- Staking: Varsa getiri potansiyeli sunan fırsatlara katılım

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

M hissesi için öngörü nedir?

Analistler, M hissesi için “Tut” notu öngörüyor. Fiyat son dönemde gerilese de, gelecekteki performans değişebilir. Detaylar için güncel piyasa raporlarını inceleyin.

Moderna hissesi için 12 aylık öngörü nedir?

Son tahminlere göre, Moderna hissesinin 12 aylık ortalama öngörüsü 206,72 dolar; tahminler 100 ile 270 dolar arasında değişiyor.

Macy’s şu anda alınacak iyi bir hisse mi?

Evet, Macy’s hissesi cazip bir alım olarak değerlendiriliyor. A Değer notu ile “Güçlü Al” tavsiyesi almış durumda ve değerinin altında olduğu, büyüme potansiyeli taşıdığı düşünülüyor.

2026 için M&M fiyat hedefi nedir?

Analist tahminlerine göre, 2026 yılında M&M fiyat hedefinin 3.030 INR ile 4.000 INR arasında, ortalama hedefin ise 3.663,89 INR olması bekleniyor.

Bitcoin'in 1 Milyon Doları Bulma Olasılığı

2025 BEER Fiyat Tahmini: Zanaat Bira Balonu Nihayet Patlayacak mı?

Meme Coin Nedir? Meme Token’lara Kolay Bir Rehber

2025 DON Fiyat Tahmini: Kripto Piyasalarda Merkeziyetsiz Oracle’ların Geleceğine Yön Vermek

2025 PUFF Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 BUBB Fiyat Tahmini: Büyümeyi Destekleyen Yükseliş Eğilimleri ve Piyasa Dinamikleri

Dijital sanat NFT’leri oluşturmak için en iyi araçlar: Kapsamlı bir rehber

NFT Nadirliğini Anlamak: Puanlama Sistemleri ve Değer Değerlendirmesi Kılavuzu

Ethereum Gas Maliyetlerini Anlamak ve Ücretleri Azaltmaya Yönelik İpuçları

Öne Çıkan Önemli NFT Sanatçıları

Fantom Blockchain Teknolojisini Anlamak: Temel Özellikler Açıklandı