2025 LTC Price Prediction: Analyzing Potential Growth Factors and Market Trends for Litecoin

Introduction: LTC's Market Position and Investment Value

Litecoin (LTC), as one of the earliest and most established cryptocurrencies, has achieved significant milestones since its inception in 2011. As of 2025, Litecoin's market capitalization has reached $7.49 billion, with a circulating supply of approximately 76.4 million coins, and a price hovering around $98.06. This asset, often referred to as "digital silver," is playing an increasingly crucial role in digital payments and as a store of value.

This article will comprehensively analyze Litecoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. LTC Price History Review and Current Market Status

LTC Historical Price Evolution

- 2011: Litecoin launched, initial price around $4.3

- 2017: Bull market, price reached $375.29 in December

- 2018: Bear market, price dropped to $23.13 by end of year

- 2021: New all-time high of $410.26 on May 10

LTC Current Market Situation

As of October 15, 2025, Litecoin (LTC) is trading at $98.06. The cryptocurrency has experienced a slight decline of 0.23% in the past 24 hours. LTC's market capitalization stands at $7,492,312,492, ranking it 27th in the global cryptocurrency market. The 24-hour trading volume is $11,905,993, indicating moderate market activity.

LTC has shown mixed performance across different time frames. While it has gained 1.40% in the last hour, it has seen significant losses of 16.50% over the past week and 14.91% over the last 30 days. However, LTC has demonstrated strong yearly performance with a 47.07% increase.

The current price is well below its all-time high of $410.26, recorded on May 10, 2021, but significantly higher than its all-time low of $1.15, set on January 14, 2015. With a circulating supply of 76,405,389 LTC and a maximum supply of 84,000,000 LTC, about 90.96% of the total supply is currently in circulation.

Click to view the current LTC market price

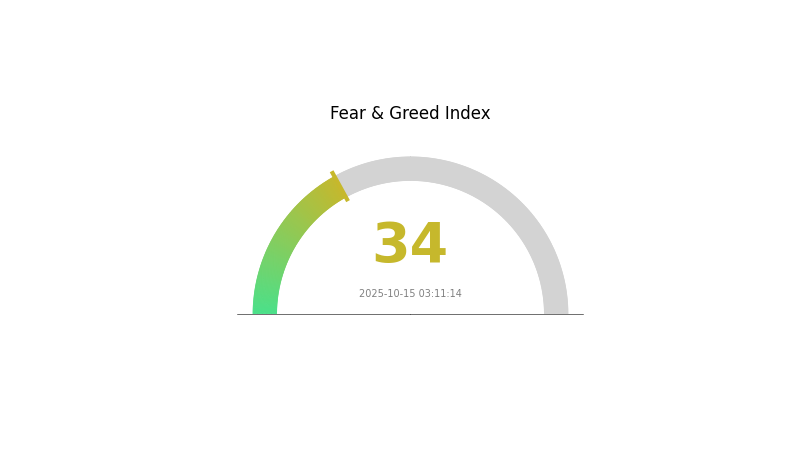

LTC Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market, including LTC, is currently experiencing a period of fear. With a Fear and Greed Index of 34, investors are showing caution. This sentiment often presents opportunities for long-term investors to accumulate assets at potentially lower prices. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiments can shift rapidly in the crypto space.

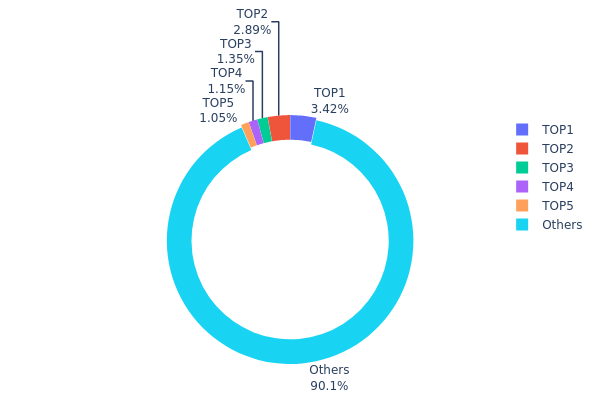

LTC Holdings Distribution

The address holdings distribution chart for Litecoin (LTC) provides valuable insights into the concentration of wealth within the network. According to the data, the top 5 addresses collectively hold 9.82% of the total LTC supply, with the largest address containing 3.41% of all coins. This distribution suggests a relatively decentralized structure, as no single address holds a dominant position in the market.

The current holdings distribution indicates a healthy level of decentralization for LTC. With 90.18% of the supply distributed among numerous smaller holders, the risk of market manipulation by large individual players is significantly reduced. This broad distribution can contribute to greater price stability and resilience against sudden large-scale sell-offs or accumulations.

However, it's worth noting that the presence of a few addresses holding over 1% of the supply each could still have some influence on short-term market dynamics. Overall, the current LTC address distribution reflects a mature market structure with a good balance between larger stakeholders and a diverse base of smaller holders, which is generally indicative of a robust and decentralized network.

Click to view the current LTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | MQd1fJ...qDbPQS | 2611.45K | 3.41% |

| 2 | ltc1qr...h5pp4t | 2205.01K | 2.88% |

| 3 | MLj1bg...nXXV3E | 1033.08K | 1.35% |

| 4 | MS56eJ...pTzZ5V | 878.22K | 1.14% |

| 5 | LiDY79...4sRoKf | 800.00K | 1.04% |

| - | Others | 68882.35K | 90.18% |

II. Key Factors Influencing LTC's Future Price

Supply Mechanism

- Halving: LTC undergoes halving every four years, reducing block rewards and potentially impacting price due to supply scarcity.

- Historical Pattern: Previous halvings have shown a tendency to influence price positively in the long term.

- Current Impact: The most recent halving in August 2023 reduced block rewards to 6.25 LTC, potentially contributing to future price appreciation.

Institutional and Whale Dynamics

- Institutional Holdings: Increasing institutional interest in LTC as a complementary asset to Bitcoin.

- Corporate Adoption: Growing acceptance of LTC as a payment method by online platforms and merchants due to its fast transaction speeds and low fees.

Macroeconomic Environment

- Inflation Hedge Properties: LTC is increasingly viewed as a potential hedge against inflation, similar to Bitcoin but with added utility for smaller transactions.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions may drive interest in alternative assets like LTC.

Technological Development and Ecosystem Building

- Lightning Network: Implementation of the Lightning Network enhances LTC's scalability and enables faster, cheaper micro-transactions.

- SegWit (Segregated Witness): Activation of SegWit has improved block utilization and increased transaction throughput.

- Ecosystem Applications: Ongoing development of DApps and integration with various platforms to expand LTC's utility beyond simple transactions.

III. LTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $83.70 - $90.00

- Neutral prediction: $90.00 - $100.00

- Optimistic prediction: $100.00 - $130.41 (requires sustained market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase with increased volatility

- Price range forecast:

- 2027: $90.78 - $182.92

- 2028: $97.12 - $167.17

- Key catalysts: Halving event, institutional adoption, technological advancements in the Litecoin network

2029-2030 Long-term Outlook

- Base scenario: $150.00 - $165.00 (assuming steady growth and adoption)

- Optimistic scenario: $165.00 - $180.00 (assuming strong market conditions and increased utility)

- Transformative scenario: $180.00 - $188.83 (extreme favorable conditions such as mass adoption and regulatory clarity)

- 2030-12-31: LTC $165.64 (projected average price, indicating significant growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 130.41 | 97.32 | 83.6952 | 0 |

| 2026 | 157.13 | 113.86 | 99.06203 | 16 |

| 2027 | 182.92 | 135.5 | 90.78409 | 38 |

| 2028 | 167.17 | 159.21 | 97.11865 | 62 |

| 2029 | 168.09 | 163.19 | 146.87 | 66 |

| 2030 | 188.83 | 165.64 | 155.7 | 68 |

IV. LTC Professional Investment Strategies and Risk Management

LTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking steady growth

- Operational advice:

- Dollar-cost average into LTC over time

- Hold through market cycles, focusing on fundamentals

- Store in secure cold storage wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversals

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

LTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-7% of portfolio

- Aggressive investors: 7-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for LTC

LTC Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades without price impact

- Correlation risk: High correlation with Bitcoin may limit diversification benefits

LTC Regulatory Risks

- Regulatory uncertainty: Changing government policies could impact LTC's adoption

- Tax implications: Evolving tax laws may affect LTC transactions and holdings

- AML/KYC requirements: Stricter regulations may impact privacy and ease of use

LTC Technical Risks

- Network security: Potential for 51% attacks or other security vulnerabilities

- Scalability challenges: Increasing transaction volume may stress network capacity

- Competition: Emergence of newer, more advanced cryptocurrencies

VI. Conclusion and Action Recommendations

LTC Investment Value Assessment

Litecoin offers a mature, established cryptocurrency with potential for long-term growth, but faces short-term volatility and competitive pressures in the evolving crypto landscape.

LTC Investment Recommendations

✅ Beginners: Start with small, regular investments to gain exposure ✅ Experienced investors: Consider LTC as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate LTC for potential inclusion in crypto index funds

LTC Trading Participation Methods

- Spot trading: Buy and sell LTC on reputable exchanges like Gate.com

- Derivatives: Use futures or options for leveraged exposure or hedging

- Staking: Explore staking options to earn passive income on LTC holdings

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Litecoin go in 2025?

Litecoin could potentially reach $500-$600 by 2025, driven by increased adoption and market growth. However, cryptocurrency prices are highly volatile and unpredictable.

Will Litecoin reach $1000?

Yes, Litecoin could potentially reach $1000 by mid-December 2025, based on current market trends and forecasts. However, this is speculative and depends on various factors.

Is LTC worth buying?

Yes, LTC shows strong potential for growth. Current trends indicate an uptrend, making it an attractive investment option. Consider your risk tolerance and invest wisely.

What is the future of the LTC coin?

LTC's future looks promising with potential price growth and increased adoption. Technological advancements and market trends suggest a positive outlook for Litecoin in the coming years.

Share

Content