2025 LOE Fiyat Tahmini: Kripto Para Yatırımlarının Geleceğinde Yol Bulmak

Giriş: LOE’nin Piyasa Konumu ve Yatırım Potansiyeli

Legends of Elysium (LOE), 2021’den bu yana blokzincir oyun sektöründe Trading Card & Board Game türlerini birleştiren Free-To-Play modeliyle öncü konumda yer alıyor. 2025 itibarıyla LOE’nin piyasa değeri 158.553 dolar, dolaşımdaki miktarı yaklaşık 95.399.273 token ve fiyatı 0,001662 dolar seviyesinde bulunuyor. “Web3 oyun inovasyonu” olarak tanımlanan bu varlık, oyun dünyasının dönüşümüne öncülük ederek oyuncuları web3 ekosistemine dahil etmede giderek daha önemli bir rol üstleniyor.

Bu makale, LOE’nin 2025-2030 arasındaki fiyat hareketlerini; geçmiş veriler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte analiz ederek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunacaktır.

I. LOE Fiyat Geçmişi ve Güncel Piyasa Durumu

LOE Tarihsel Fiyat Seyri

- 2024: 29 Mart’ta lansman, fiyat tüm zamanların zirvesi olan 0,447 dolara ulaştı

- 2025: Belirgin piyasa düşüşü, 27 Ekim’de en düşük seviye olan 0,001378 dolara geriledi

- 2025: Fiyat toparlanıyor, 1 Kasım’da 0,001662 dolardan işlem görüyor

LOE Güncel Piyasa Görünümü

1 Kasım 2025 itibarıyla LOE, 0,001662 dolardan işlem görüyor ve son 24 saatte %1,71 artış gösterdi. Ancak token, daha uzun vadeli periyotlarda ciddi kayıplar yaşadı; son bir haftada %10,71, son 30 günde ise %34,76 değer kaybetti. En çarpıcı düşüş ise bir yıllık perspektifte yaşandı; LOE geçen yıla göre %89,85 değer kaybetti.

Piyasa değeri şu anda 158.553,59 dolar ve LOE, küresel kripto para sıralamasında 4.599’uncu sırada. Dolaşımdaki miktar 95.399.273,32 LOE token ile toplam arzın %47,7’sini oluşturuyor; projenin tam seyreltilmiş değeri ise 332.400 dolar.

Son 24 saatteki işlem hacmi 9.937,34 dolar seviyesinde olup, bu durum piyasanın orta düzeyde hareketli olduğuna işaret ediyor. Token’ın rekor fiyatı 0,447 dolar ile 29 Mart 2024’te, en düşük fiyatı ise 27 Ekim 2025’te 0,001378 dolar olarak kaydedildi.

Güncel LOE fiyatını görüntülemek için tıklayın

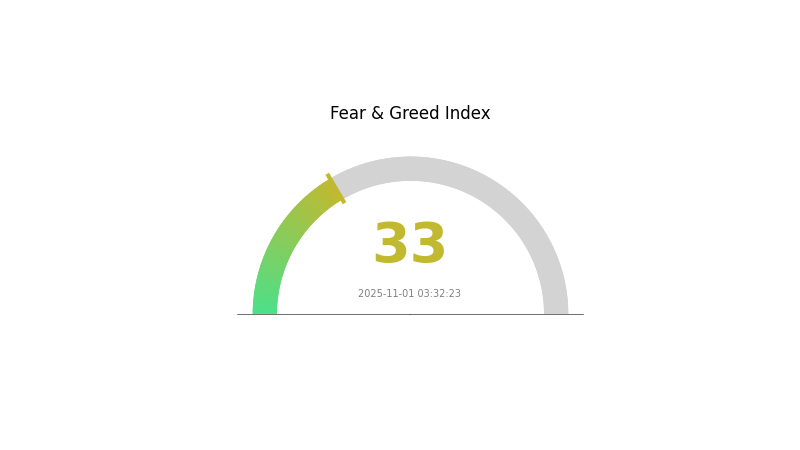

LOE Piyasa Duyarlılık Endeksi

2025-11-01 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; Korku ve Açgözlülük Endeksi 33 ile piyasada korku hakim. Bu durum, yatırımcıların alım konusunda çekingen davrandığını ve fırsat kolladıklarını gösteriyor. Karşıt yatırımcılar için bu tür korku ortamı alım fırsatı anlamına gelebilir; ancak detaylı araştırma yapmak ve riskleri etkin yönetmek kritik önemdedir. Gate.com, yatırımcıların belirsiz piyasa koşullarında yön bulmasına yardımcı olacak çeşitli araç ve kaynaklar sunar. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel kalın, sorumlu işlem yapın.

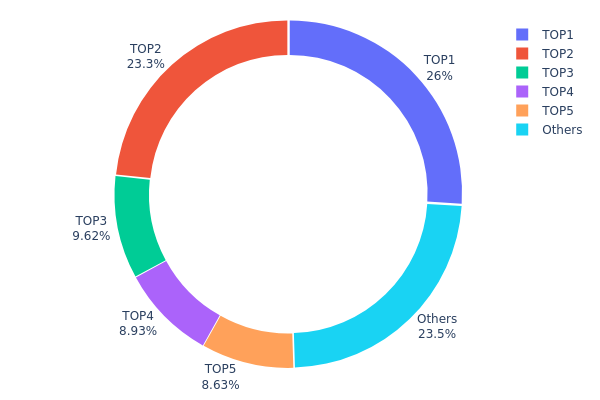

LOE Varlık Dağılımı

LOE’nin adres varlık dağılımı, tokenların büyük kısmının az sayıdaki adreste yoğunlaştığını gösteriyor. İlk 5 adres toplam arzın %76,47’sini elinde bulundururken, en büyük sahip %26’lık paya sahip. Bu yüksek konsantrasyon, merkeziyetsizlik ve piyasa manipülasyonu riskleri açısından endişe yaratıyor.

Böylesi bir dağılım yapısı fiyat oynaklığına ve yoğun satışlara karşı duyarlılığı artırır. En büyük sahipler, token’ın piyasa dinamiklerinde belirleyici rol oynayabilir; likidite ve fiyat istikrarını etkileyebilir. Ayrıca, bu yoğunlaşma, merkezileşme algısı nedeniyle küçük yatırımcıların ilgisini azaltabilir.

Kripto projelerinde belli oranda konsantrasyon olağandır; ancak LOE’nin mevcut dağılımı, piyasa dayanıklılığı ve merkeziyetsizlik için token dağılımının iyileştirilmesi gerektiğini gösteriyor. Proje ilerledikçe, bu dağılımdaki değişimi izlemek; uzun vadeli sürdürülebilirlik ve piyasa sağlığı açısından önem taşıyor.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xe33b...adfcdb | 52.000,00K | 26,00% |

| 2 | 0x65d5...59c7e8 | 46.607,77K | 23,30% |

| 3 | 0xf067...b98e47 | 19.242,59K | 9,62% |

| 4 | 0x0d07...b492fe | 17.850,29K | 8,92% |

| 5 | 0xfa1b...97e250 | 17.267,42K | 8,63% |

| - | Diğerleri | 47.031,94K | 23,53% |

II. LOE’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Faktörler

-

Para Politikası Etkisi: ABD Merkez Bankası’nın (Fed) olası faiz indirim beklentileri, döviz değerlerini ve yatırım akışını kayda değer biçimde etkiler. Yaklaşan faiz indirimi beklentileri LOE’nin fiyatında dalgalanmalara yol açabilir.

-

Enflasyona Karşı Dayanıklılık: LOE’nin enflasyonist ortamlardaki performansı kritik önemdedir. Mevcut enflasyon trendleri ve olası etkileri yakından izlenmelidir.

-

Jeopolitik Unsurlar: Uluslararası gerginlikler ve ticaret politikaları (gümrük vergileri gibi) küresel ekonomiyi ve LOE fiyat hareketlerini doğrudan etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: LOE’ye bağlı merkeziyetsiz uygulamalar (DApps) ve ekosistem projelerinin büyümesi, token’ın ilerideki değerini ve kullanımını artırabilir.

III. LOE 2025-2030 Fiyat Öngörüleri

2025 Beklentisi

- Temkinli öngörü: 0,00153 - 0,00167 dolar

- Tarafsız öngörü: 0,00167 - 0,00196 dolar

- İyimser öngörü: 0,00196 - 0,00225 dolar (pozitif piyasa duyarlılığı ve geniş benimseme gerektirir)

2027-2028 Beklentisi

- Piyasa aşaması: Artan benimsemeyle büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,00150 - 0,00262 dolar

- 2028: 0,00197 - 0,00273 dolar

- Başlıca katalizörler: Teknolojik ilerleme, piyasa kabulünün genişlemesi ve potansiyel işbirlikleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00258 - 0,00310 dolar (düzenli piyasa büyümesi ve benimseme halinde)

- İyimser senaryo: 0,00310 - 0,00361 dolar (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00361 - 0,00415 dolar (çığır açan kullanım alanları ve ana akım entegrasyon halinde)

- 2030-12-31: LOE 0,00415 dolar (çok olumlu koşullarda olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00225 | 0,00167 | 0,00153 | 0 |

| 2026 | 0,00253 | 0,00196 | 0,00155 | 17 |

| 2027 | 0,00262 | 0,00224 | 0,0015 | 34 |

| 2028 | 0,00273 | 0,00243 | 0,00197 | 46 |

| 2029 | 0,00361 | 0,00258 | 0,0015 | 55 |

| 2030 | 0,00415 | 0,0031 | 0,00285 | 86 |

IV. LOE’de Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LOE Yatırım Yaklaşımı

(1) Uzun Vadeli Saklama Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde LOE token biriktirin

- Kısmi kar alma için fiyat hedefleri belirleyin

- Token’ları güvenli bir Gate Web3 cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend yönünü ve olası destek/direnç seviyelerini tespit etmek için

- RSI (Göreli Güç Endeksi): Aşırı alım veya aşırı satım bölgelerini belirlemeye yardımcı olur

- Dalgalı işlem için anahtar noktalar:

- Trend teyidi için işlem hacmini takip edin

- Aşağı yönlü riski sınırlandırmak için zarar-durdur emirleri kullanın

LOE Risk Yönetimi Yapısı

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Kripto ve geleneksel varlıklar arasında yatırım dağıtımı

- Düzenli Alım Stratejisi: Volatilitenin etkisini azaltmak için belirli aralıklarla sabit tutarda yatırım yapmak

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü parola kullanımı ve yazılım güncelleme

V. LOE için Olası Riskler ve Zorluklar

LOE Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasasında sık görülen sert fiyat dalgalanmaları

- Sınırlı likidite: Büyük miktarlı işlemlerde fiyatın etkilenme riski

- Piyasa duyarlılığı: Haber ve sosyal medya ile hızlı değişim

LOE Regülasyon Riskleri

- Belirsiz regülasyon ortamı: LOE’nin işleyişi veya alım-satımı üzerinde yeni regülasyonların olası etkisi

- Sınır ötesi uyum: Uluslararası regülasyonlara uyum zorlukları

- Vergi etkileri: Değişen vergi yasalarının LOE sahiplerine etkisi

LOE Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda olası güvenlik açıkları

- Ağ tıkanıklığı: Yoğun trafik dönemlerinde işlem gecikmeleri

- Teknolojik eskime: Daha gelişmiş yeni blokzincir projeleri karşısında geride kalma riski

VI. Sonuç ve Eylem Önerileri

LOE Yatırım Değeri Analizi

LOE, blokzincir oyun sektöründe yüksek risk-yüksek getiri potansiyeli taşıyor. Büyük büyüme fırsatları sunsa da, yatırımcıların yüksek oynaklık ve ciddi kayıplara hazırlıklı olması gerekir.

LOE Yatırım Stratejisi Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve blokzincir oyunları ile kripto piyasası hakkında temel bilgi edinin ✅ Deneyimli yatırımcılar: LOE’yi çeşitlendirilmiş portföyünüzde küçük bir oranla değerlendirin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, LOE’yi genel blokzincir oyun yatırımı stratejinizin bir parçası olarak düşünün

LOE İşlem Katılımı Yöntemleri

- Spot işlem: Gate.com’da doğrudan LOE token alım-satımı

- Staking: Mevcut programlara katılarak pasif gelir elde etme

- Play-to-Earn: Legends of Elysium oyununda oynayarak LOE token kazanma

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

LOW hissesi alınmalı mı?

Mevcut veriler ışığında, LOW uzun vadeli gelir büyümesi beklentilerinin düşük olması nedeniyle alıma uygun değildir. Alternatif yatırım seçeneklerini değerlendirin.

LOW için fiyat hedefi nedir?

Analist tahminlerine göre LOW için ortalama fiyat hedefi 282,59 dolar, en yüksek hedef ise 325,00 dolardır.

2025’te borsa yükselir mi?

Evet, borsanın 2025’te genel olarak büyümesi bekleniyor ve teknoloji ile sağlık sektörleri öne çıkıyor. Ancak ekonomik faktörler nedeniyle oynaklık gözlenebilir.

En iyi düşük fiyatlı hisse hangisi?

MFG, UMC, EBR, AEG, ELP ve GGB; alım tavsiyesi alan ve umut vadeden düşük fiyatlı hisselerdir. Yatırım öncesinde güncel fiyatları mutlaka kontrol edin.

2025 BIGTIME Fiyat Tahmini: Oyun Token’ının gelecekteki değerini belirleyecek büyüme potansiyeli ile piyasa faktörlerinin kapsamlı analizi

2025 GAME2 Fiyat Tahmini: Oyun Tokeni'nin Piyasa Trendleri ve Gelecekteki Değerleme Potansiyelinin Analizi

2025 MAVIA Fiyat Tahmini: Gelecek Büyüme Analizi ve Yatırımcılar İçin Potansiyel Getiri Oranı

2025 FOREST Fiyat Tahmini: Sürdürülebilir ormancılığın geleceğini belirleyen piyasa trendleri ve çevresel faktörlerin detaylı analizi

2025 WOD Fiyat Tahmini: World of Demons Tokenleri İçin Piyasa Trendleri ve Uzman Tahminleri Analizi

Ember Sword (EMBER) iyi bir yatırım mı?: Bu blokzincir tabanlı MMORPG tokeninin potansiyeli ve risklerinin analizi

2025’te kripto para ekosistemindeki en önemli güvenlik riskleri ve akıllı sözleşme açıkları nelerdir?

Token ekonomisi modeli nedir ve dağıtım, enflasyon ve yönetişim arasındaki dengeyi nasıl kurar?

2025 yılında SEC denetimi ve KYC/AML politikalarının uygulanması, kripto projelerinin uyum süreçlerini ve düzenleyici risklerini doğrudan etkileyebilir.

BABYTRUMP Tokenlarını Güvenli Şekilde Satın Almak İçin Kapsamlı Bir Rehber