2025 LEO Price Prediction: Bullish Trends and Potential Catalysts for the Crypto Asset

Introduction: LEO's Market Position and Investment Value

UNUS-SED-LEO (LEO), as the core utility token of the iFinex ecosystem, has established itself as a significant player in the cryptocurrency market since its inception in 2019. As of 2025, LEO's market capitalization has reached $8.89 billion, with a circulating supply of approximately 922,430,409 tokens and a price hovering around $9.635. This asset, often referred to as the "Bitfinex powerhouse," is playing an increasingly crucial role in enhancing user experiences across iFinex's trading platforms, products, and services.

This article will provide a comprehensive analysis of LEO's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LEO Price History Review and Current Market Status

LEO Historical Price Evolution Trajectory

- 2019: Initial launch, price started at $1

- 2021: Bull market surge, price reached $3.92

- 2022: Market downturn, price dropped to $3.14

- 2024: Recovery phase, price climbed to $8.57

LEO Current Market Situation

As of October 15, 2025, LEO is trading at $9.635, ranking 25th in the crypto market with a market capitalization of $8.89 billion. The token has shown significant growth over the past year, with a 57.34% increase. In the last 24 hours, LEO has experienced a slight dip of 0.18%, trading between $9.577 and $9.663. The current price is close to its all-time high of $10.14, recorded on March 10, 2025. With a circulating supply of 922,430,408.9 LEO tokens, representing 92.24% of the total supply, the token maintains a strong market presence.

Click to view the current LEO market price

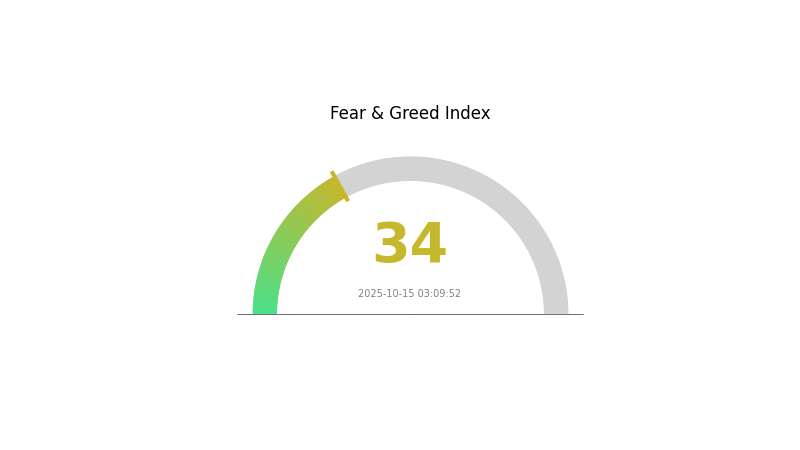

LEO Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, as indicated by the Fear and Greed Index standing at 34. This suggests that investors are cautious and uncertainty prevails in the market. During such times, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. While fear can present buying opportunities for some, it's essential to assess your risk tolerance and investment strategy carefully. Remember, market sentiment can shift quickly, so stay informed and consider diversifying your portfolio to mitigate risks.

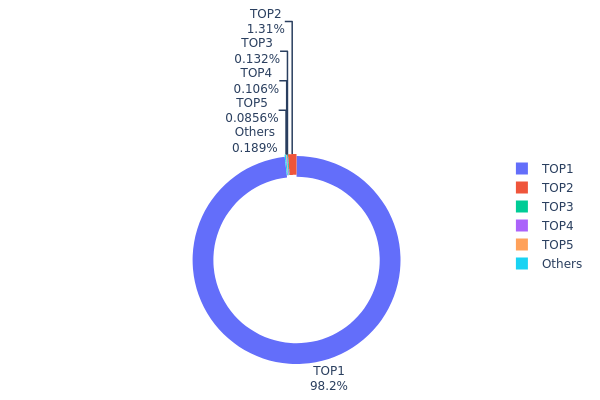

LEO Holdings Distribution

The address holdings distribution data for LEO reveals a highly concentrated ownership structure. The top address holds an overwhelming 98.18% of the total supply, equivalent to 648 million LEO tokens. This extreme concentration is followed by a significant drop, with the second-largest holder possessing only 1.30% of the supply. The remaining top addresses hold fractions of a percent, with the collective "Others" category accounting for a mere 0.21% of the total.

This distribution pattern indicates a centralized control over LEO tokens, which could have significant implications for market dynamics. Such concentration may lead to increased volatility and susceptibility to large price swings, as actions taken by the dominant address could have outsized effects on the market. Additionally, this structure raises concerns about the token's resistance to market manipulation and its overall decentralization ethos.

From a market perspective, this concentration suggests a potentially fragile on-chain structure. While it may provide some stability in terms of reduced selling pressure from smaller holders, it also presents risks of sudden, large-scale movements that could disrupt the market equilibrium. Investors and analysts should closely monitor any changes in this distribution, as shifts could signal important developments in LEO's market structure and future prospects.

Click to view the current LEO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc61b...ce193c | 648000.00K | 98.18% |

| 2 | 0x742d...38f44e | 8616.76K | 1.30% |

| 3 | 0x7713...7635ec | 868.17K | 0.13% |

| 4 | 0xe623...cef0d2 | 700.09K | 0.10% |

| 5 | 0xf9b3...098057 | 564.96K | 0.08% |

| - | Others | 1250.02K | 0.21000000000001% |

II. Key Factors Influencing LEO's Future Price

Supply Mechanism

- Token Burn Program: Bitfinex's token burn program impacts LEO's supply and price

- Current Impact: The clarity and effectiveness of the token burn program continue to influence LEO's price

Institutional and Whale Dynamics

- Institutional Holdings: Large-scale inflow of institutional funds affects LEO's price movements

- Corporate Adoption: Bitfinex's operational stability is a crucial factor for LEO's adoption and value

Macroeconomic Environment

- Inflation Hedging Properties: LEO's performance in inflationary environments may impact its price

- Geopolitical Factors: International situations and economic factors can influence LEO's long-term value

Technical Development and Ecosystem Building

- On-chain Activity: Increased on-chain activity, similar to BNB Chain's experience, could positively impact LEO's price

- Ecosystem Applications: Development of DApps and ecosystem projects on Bitfinex may affect LEO's utility and value

III. LEO Price Prediction 2025-2030

2025 Outlook

- Conservative prediction: $6.16 - $9.63

- Neutral prediction: $9.63 - $10.69

- Optimistic prediction: $10.69 - $15.04 (requires continued market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $9.57 - $18.65

- 2028: $12.65 - $19.37

- Key catalysts: Broader crypto market growth, LEO token burn mechanism, expansion of Gate.com's ecosystem

2030 Long-term Outlook

- Base scenario: $21.61 - $25.72 (assuming steady growth in crypto adoption)

- Optimistic scenario: $25.72 - $30.47 (assuming widespread institutional adoption and favorable regulations)

- Transformative scenario: $30.47+ (extreme favorable conditions such as mass adoption and integration into traditional finance)

- 2030-12-31: LEO $21.61 (potential 124% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 10.69263 | 9.633 | 6.16512 | 0 |

| 2026 | 15.04097 | 10.16282 | 6.40257 | 5 |

| 2027 | 18.6508 | 12.60189 | 9.57744 | 30 |

| 2028 | 19.37667 | 15.62634 | 12.65734 | 62 |

| 2029 | 25.72721 | 17.50151 | 12.25105 | 81 |

| 2030 | 30.47625 | 21.61436 | 11.8879 | 124 |

IV. Professional Investment Strategies and Risk Management for LEO

LEO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate LEO tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor iFinex ecosystem developments for potential price catalysts

- Set stop-loss orders to manage downside risk

LEO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance LEO holdings with other crypto assets

- Options strategies: Consider using options to hedge downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for LEO

LEO Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Liquidity: Potential challenges in large-volume trading during market stress

- Competition: Other exchange tokens may impact LEO's market position

LEO Regulatory Risks

- Regulatory scrutiny: Increased oversight of exchange tokens by regulators

- Compliance changes: Potential impact of evolving global crypto regulations

- Geopolitical factors: International tensions affecting iFinex operations

LEO Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token contract

- Blockchain congestion: High Ethereum network fees affecting token transfers

- Technological obsolescence: Risk of being outpaced by newer token models

VI. Conclusion and Action Recommendations

LEO Investment Value Assessment

LEO offers potential long-term value as a utility token within the iFinex ecosystem, but faces short-term risks from market volatility and regulatory uncertainties.

LEO Investment Recommendations

✅ Beginners: Consider small, regular purchases to build a position over time ✅ Experienced investors: Implement a balanced approach with strategic entry/exit points ✅ Institutional investors: Conduct thorough due diligence and consider LEO as part of a diversified crypto portfolio

LEO Trading Participation Methods

- Spot trading: Purchase LEO tokens on Gate.com

- Staking: Explore staking options if offered by iFinex platforms

- DeFi integration: Monitor for potential DeFi applications involving LEO tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Leo coin a good investment?

Based on current predictions for 2025, LEO coin appears bearish, suggesting it may not be an ideal investment at this time. However, crypto markets can be volatile, so always do your own research before investing.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed by Ethereum (ETH) and Solana (SOL). Analysts expect BTC to reach new all-time highs.

Who owns Leo Token?

Leo Token is owned by iFinex, the parent company of Bitfinex. It's used for fee discounts on their platforms, with plans to repurchase and burn 80% of tokens.

Is Leo a meme coin?

Yes, LEO is a meme coin created to onboard new users to the Stacks blockchain. It's named after Muneeb's pet and remains a meme coin as of 2025.

Share

Content