2025 LAUNCHCOIN Price Prediction: Analyzing Market Trends and Future Growth Potential for this Emerging Digital Asset

Introduction: LAUNCHCOIN's Market Position and Investment Value

LaunchCoin (LAUNCHCOIN), as the first token to complete a presale on Clout, has made significant strides since its inception. As of 2025, LaunchCoin's market capitalization has reached $71,510,995, with a circulating supply of approximately 999,874,095.94 tokens, and a price hovering around $0.07152. This asset, known as the "Pioneer of Clout," is playing an increasingly crucial role in the social token ecosystem.

This article will comprehensively analyze LaunchCoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. LAUNCHCOIN Price History Review and Current Market Status

LAUNCHCOIN Historical Price Evolution

- 2025: Initial launch and presale completion on Clout, price fluctuated significantly

- 2025 May 19: Reached all-time high of $0.2999

- 2025 August 22: Experienced all-time low of $0.04004

LAUNCHCOIN Current Market Situation

As of September 28, 2025, LAUNCHCOIN is trading at $0.07152. The token has shown positive momentum in the short term, with a 7.21% increase in the last 24 hours and a 4.01% gain over the past week. However, it has experienced a slight decline of 1.61% in the last 30 days.

The current price represents a significant recovery from its all-time low but remains well below the all-time high. With a market capitalization of $71,510,995.34 and a fully diluted valuation of $71,520,000, LAUNCHCOIN ranks 551st in the cryptocurrency market.

The token's circulating supply is 999,874,095.94 LAUNCHCOIN, which is 99.99% of its total supply of 1,000,000,000. This high circulation ratio indicates that almost all tokens are in the market.

Trading volume in the last 24 hours stands at $2,817,366.07, suggesting moderate market activity. The token's market dominance is currently at 0.0017%, reflecting its relatively small share in the overall cryptocurrency market.

Click to view the current LAUNCHCOIN market price

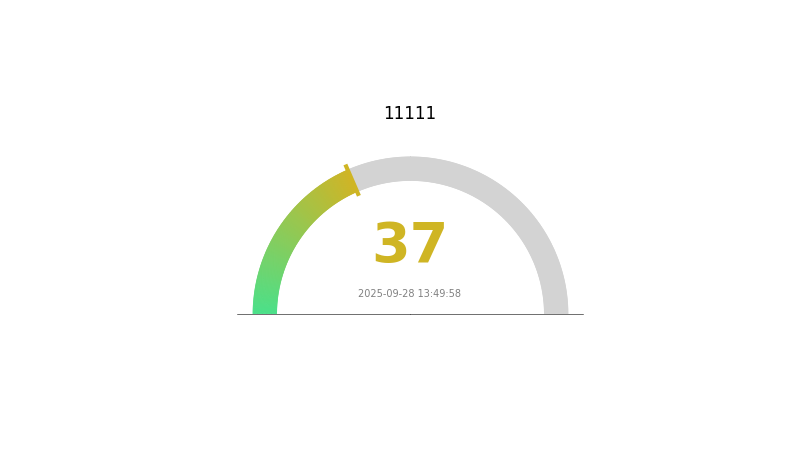

LAUNCHCOIN Market Sentiment Indicator

2025-09-28 Fear and Greed Index: 37 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 37. This suggests that investors are cautious and uncertain about market conditions. During such times, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, market sentiment can shift rapidly, and opportunities may arise even in fearful markets. Stay informed and consider diversifying your portfolio to mitigate risks. As always, use Gate.com for secure and efficient trading.

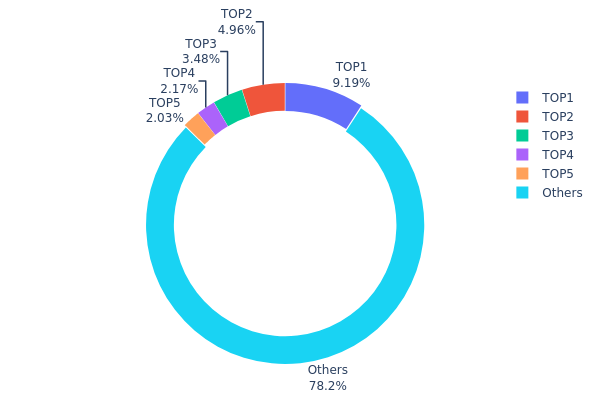

LAUNCHCOIN Holdings Distribution

The address holdings distribution data for LAUNCHCOIN reveals a moderately concentrated ownership structure. The top address holds 9.18% of the total supply, with the next four largest holders controlling between 2% to 5% each. Collectively, the top 5 addresses account for 21.82% of LAUNCHCOIN's circulating supply.

This distribution pattern suggests a relatively balanced ecosystem, with no single entity holding an overwhelming majority. However, the concentration among the top holders could potentially influence market dynamics. The presence of 78.18% distributed among "Others" indicates a significant level of decentralization, which is generally favorable for market stability and resistance to manipulation.

While the current distribution does not raise immediate red flags, it's worth monitoring the top holders' activities, as coordinated actions could impact price volatility. Overall, LAUNCHCOIN's holdings distribution reflects a moderately decentralized structure, balancing between major stakeholders and a broader community of holders.

Click to view the current LAUNCHCOIN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 91851.92K | 9.18% |

| 2 | 44P5Ct...J4Dyra | 49607.68K | 4.96% |

| 3 | A77HEr...oZ4RiR | 34844.66K | 3.48% |

| 4 | EiiAnQ...GP11xw | 21738.08K | 2.17% |

| 5 | CiffG2...vuvCmA | 20310.21K | 2.03% |

| - | Others | 781519.76K | 78.18% |

II. Key Factors Influencing LAUNCHCOIN's Future Price

Supply Mechanism

- Token Mechanism: LAUNCHCOIN is positioned as the governance and incentive hub for the platform, closely tied to the projects launching on the platform.

- Current Impact: The clear token mechanism is expected to positively influence LAUNCHCOIN's price as it strengthens its role within the ecosystem.

Institutional and Whale Dynamics

- Whale Activity: Significant whale investor participation has been observed, with large purchases influencing price movements.

- Trading Volume: LAUNCHCOIN has experienced notable increases in trading volume, with some days seeing surges of over 500%.

Macroeconomic Environment

- Geopolitical Factors: As of 2025 Q2, geopolitical conflicts and trade tensions are reshaping market dynamics, potentially impacting LAUNCHCOIN's price.

Technical Development and Ecosystem Building

- Product Integration: The introduction of real products, including contributions from Web2 creators, is a key growth factor for LAUNCHCOIN.

- Ecosystem Applications: The platform is fostering innovation in SocialFi, which could drive demand for LAUNCHCOIN.

III. LAUNCHCOIN Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.03662 - $0.07181

- Neutral forecast: $0.07181 - $0.08115

- Optimistic forecast: $0.08115 - $0.09048 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $0.06252 - $0.12131

- 2028: $0.08371 - $0.15346

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.13039 - $0.13756 (assuming steady market growth and adoption)

- Optimistic scenario: $0.14473 - $0.19258 (assuming strong market performance and increased utility)

- Transformative scenario: $0.19258 - $0.22000 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: LAUNCHCOIN $0.19258 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09048 | 0.07181 | 0.03662 | 0 |

| 2026 | 0.10549 | 0.08115 | 0.06735 | 13 |

| 2027 | 0.12131 | 0.09332 | 0.06252 | 30 |

| 2028 | 0.15346 | 0.10731 | 0.08371 | 50 |

| 2029 | 0.14473 | 0.13039 | 0.08866 | 82 |

| 2030 | 0.19258 | 0.13756 | 0.1128 | 92 |

IV. LAUNCHCOIN Professional Investment Strategy and Risk Management

LAUNCHCOIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Believe platform

- Operational suggestions:

- Accumulate LAUNCHCOIN during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor Believe platform developments for potential price catalysts

- Set strict stop-loss orders to manage downside risk

LAUNCHCOIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance LAUNCHCOIN with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for LAUNCHCOIN

LAUNCHCOIN Market Risks

- Volatility: High price fluctuations typical in the crypto market

- Liquidity: Potential challenges in large volume trades

- Competition: Other social tokens may impact LAUNCHCOIN's market share

LAUNCHCOIN Regulatory Risks

- Uncertain regulations: Potential for new crypto regulations affecting social tokens

- Platform compliance: Believe's adherence to evolving regulatory requirements

- Cross-border restrictions: Possible limitations on international trading

LAUNCHCOIN Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Scalability issues: Challenges in handling increased network activity

- Blockchain dependencies: Reliance on Solana network performance and upgrades

VI. Conclusion and Action Recommendations

LAUNCHCOIN Investment Value Assessment

LAUNCHCOIN presents a unique opportunity in the social token space, with potential for long-term growth tied to the Believe platform's success. However, investors should be aware of short-term volatility and regulatory uncertainties.

LAUNCHCOIN Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the Believe ecosystem ✅ Experienced investors: Consider a balanced approach with regular DCA and profit-taking ✅ Institutional investors: Conduct thorough due diligence on Believe's growth metrics and user adoption

LAUNCHCOIN Trading Participation Methods

- Spot trading: Available on Gate.com for direct LAUNCHCOIN purchases

- DCA strategy: Set up recurring buys to average out price volatility

- Staking: Explore potential staking options if offered by the Believe platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is launchcoin a good investment?

Launchcoin shows potential. Predictions suggest it could reach $0.093 by 2025, with an average forecast of $0.106. Consider current market trends for a more informed decision.

How much is the launch coin coin?

As of 2025-09-28, Launch Coin is priced at $0.07748, showing a 1.3% increase in the last hour and a 15.4% rise in the past day.

Is launch coin on solana?

Yes, Launch coin is built on the Solana blockchain. It leverages Solana's fast and low-cost transaction capabilities, operating on its scalable network.

Is launch coin on Binance?

Yes, Launch Coin is available for trading on Binance. You can easily purchase it using a debit or credit card through the 'Buy Crypto' option.

Share

Content