2025 KYVE Fiyat Tahmini: Web3 Veri Çözümleri Popülerlik Kazanırken Piyasa Yükseliş Eğiliminde

Giriş: KYVE'nin Piyasa Konumu ve Yatırım Potansiyeli

KYVE Network (KYVE), merkeziyetsiz arşiv ağı olarak kuruluşundan bu yana veri akışlarını kalıcı kaynaklara dönüştürmektedir. 2025 yılı itibarıyla KYVE'nin piyasa değeri 5.495.853 ABD dolarıdır; dolaşımdaki arz yaklaşık 1.061.180.523 token, fiyat ise 0,005179 ABD doları civarında seyretmektedir. "Veri arşivleme çözümü" olarak bilinen bu varlık, blokzincir veri depolama ve yönetiminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, KYVE'nin 2025-2030 yılları arasındaki fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortamla birlikte kapsamlı biçimde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. KYVE Fiyat Geçmişi ve Güncel Piyasa Durumu

KYVE Tarihsel Fiyat Değişimi

- 2024: KYVE, 27 Ocak'ta 0,2 ABD doları ile tüm zamanların en yüksek seviyesine ulaşarak proje için önemli bir dönüm noktası yaşadı

- 2025: Piyasa düşüş döngüsüne girdi, KYVE'nin fiyatı yıl boyunca geriledi

- 2025: KYVE, 11 Ekim'de 0,004514 ABD doları ile tüm zamanların en düşük seviyesine indi ve zirveden ciddi bir düşüş gösterdi

KYVE Güncel Piyasa Durumu

11 Ekim 2025 tarihinde KYVE, 0,005179 ABD doları seviyesinden işlem görüyor ve piyasa değeri 5.495.853,93 ABD doları. Token son dönemde ciddi dalgalanmalar yaşadı; 24 saatlik fiyat değişimi -%13,41, 7 günlük düşüş ise -%20,57. Mevcut fiyat, bir yıl öncesine göre %74,97 azalmış durumda ve uzun süren bir düşüş trendine işaret ediyor. KYVE'nin son 24 saatteki işlem hacmi 40.255,75 ABD doları ile orta düzeyde bir piyasa aktivitesi sergiliyor. Dolaşımdaki arz 1.061.180.523 KYVE, toplam arz ise 1.000.000.000 KYVE. Tam seyreltilmiş piyasa değeri 5.179.000 ABD doları, mevcut piyasa değerinin teorik üst sınıra yakın olduğunu gösteriyor. KYVE'nin piyasa hakimiyeti %0,00013; genel kripto piyasasında küçük bir niş konumda.

Güncel KYVE piyasa fiyatını görüntüleyin

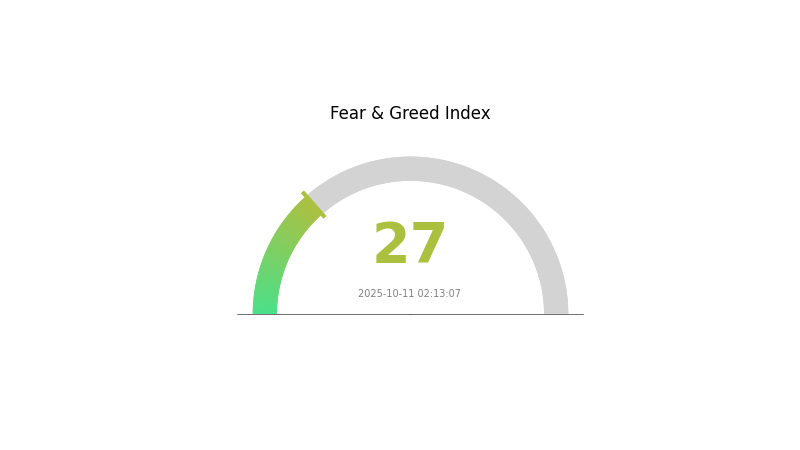

KYVE Piyasa Duyarlılık Göstergesi

11 Ekim 2025 Korku ve Açgözlülük Endeksi: 27 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görüntüleyin

Kripto para piyasasında şu anda korku hakim ve Korku ve Açgözlülük Endeksi 27 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını ve çoğunluğun aksine hareket etmeye istekli olanlar için potansiyel alım fırsatları doğurduğunu gösteriyor. Ancak piyasa duyarlılığının hızla değişebileceği unutulmamalı. Her zaman kapsamlı araştırma yapmak ve risk yönetimi uygulamak, kripto piyasasında başarılı olmanın anahtarıdır. Güncel kalın, portföyünüzü çeşitlendirerek olası düşüş riskini azaltın.

KYVE Varlık Dağılımı

KYVE'nin adres varlık dağılımı verileri, token yoğunluğunda kendine özgü bir desen sergiliyor. Bu metrik, farklı adreslerdeki tokenlerin dağılımını göstererek projenin merkeziyetsizliği ve piyasa dinamikleri hakkında anlık bir görünüm sağlıyor.

Veri analizi, KYVE tokenlerinin dengeli şekilde dağıldığını gösteriyor. En üst adreslerde aşırı büyük sahip olmaması, önemli bir yoğunlaşmanın olmadığını ve piyasa istikrarı için olumlu bir tablo sunduğunu gösteriyor. Bu dağılım, dalgalanmanın azalmasına ve büyük yatırımcıların piyasa üzerindeki manipülasyon riskinin düşmesine katkı sağlayabilir.

Mevcut adres dağılımı, KYVE ekosisteminde olumlu bir merkeziyetsizlik düzeyini yansıtıyor ve ağın dayanıklılığını artırıyor. Ancak zincir üstü veriler sadece genel piyasa görünümünün bir kısmını temsil eder; zincir dışı varlıklar veya borsa cüzdanları da dolaşım ve fiyat dinamiklerinde etkili olabilir.

Güncel KYVE Varlık Dağılımı'nı görüntüleyin

| En Çok | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. KYVE'nin Gelecek Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Büyümesi

-

Merkeziyetsiz Veri Depolama: KYVE Network, veri sağlayıcıların hizmet sunabildiği merkeziyetsiz bir veri depolama çözümüdür. Web3 ekosisteminde önemli bir ihtiyacı karşıladığından, bu teknik yenilik KYVE'nin gelecekteki fiyatı üzerinde etkili olabilir.

-

Ekosistem Uygulamaları: Web3 altyapısının bir unsuru olarak, KYVE'nin fiyatı ekosistemde merkeziyetsiz uygulamaların (DApp) geliştirilmesi ve benimsenmesiyle doğrudan etkilenebilir. Bu uygulamaların büyümesi, KYVE token talebini artıracaktır.

Makroekonomik Ortam

- Kripto Piyasasıyla Korelasyon: KYVE'nin fiyat hareketleri, kısa ve orta vadede genel kripto para piyasası trendleriyle yakından bağlantılı olacaktır. Web3 ekosistemi geliştikçe, KYVE ve benzeri projelerin Bitcoin'den bağımsız fiyat hareketleri sergileme ihtimali güçlenebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Web3 alanında önde gelen kurumların KYVE'yi benimsemesi fiyat üzerinde önemli bir itici güç yaratabilir. Şirketler merkeziyetsiz veri depolama çözümlerinin değerini fark ettikçe KYVE token talebi artacaktır.

III. KYVE 2025-2030 Fiyat Öngörüleri

2025 Görünümü

- Temkinli tahmin: 0,00359 - 0,00631 ABD doları

- Nötr tahmin: 0,00631 - 0,0075 ABD doları

- İyimser tahmin: 0,0075 - 0,00946 ABD doları (Güçlü piyasa toparlanması ve yaygın benimseme gerektirir)

2027-2028 Görünümü

- Piyasa beklentisi: Benimsenmenin arttığı potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00434 - 0,01104 ABD doları

- 2028: 0,00836 - 0,0125 ABD doları

- Kilit katalizörler: Proje gelişmeleri, genel kripto trendleri ve olası ortaklıklar

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01105 - 0,01238 ABD doları (istikrarlı büyüme ve benimseme)

- İyimser senaryo: 0,01371 - 0,01696 ABD doları (hızlı benimseme ve olumlu piyasa koşulları)

- Dönüştürücü senaryo: 0,02000 - 0,02500 ABD doları (çığır açıcı gelişmeler ve kitlesel benimseme)

- 2030-12-31: KYVE 0,01696 ABD doları (iyimser projeksiyona göre potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,0075 | 0,00631 | 0,00359 | 21 |

| 2026 | 0,00946 | 0,0069 | 0,00545 | 33 |

| 2027 | 0,01104 | 0,00818 | 0,00434 | 57 |

| 2028 | 0,0125 | 0,00961 | 0,00836 | 85 |

| 2029 | 0,01371 | 0,01105 | 0,00807 | 113 |

| 2030 | 0,01696 | 0,01238 | 0,00842 | 139 |

IV. KYVE Profesyonel Yatırım Stratejileri ve Risk Yönetimi

KYVE Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: Merkeziyetsiz veri depolamanın uzun vadeli potansiyeline inanan yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde KYVE token biriktirin

- Ağ yönetimine katılmak için tokenleri stake edin

- Tokenleri güvenli, saklama hizmeti olmayan cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirler

- RSI: Aşırı alım veya aşırı satım koşullarını gösterir

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- KYVE'nin kripto piyasası trendleriyle korelasyonunu izleyin

- Aşağı yönlü riski sınırlamak için zarar durdur emirleri kullanın

KYVE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyoneller: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı blokzincir veri depolama projelerine dağıtın

- Opsiyon stratejileri: Olası fiyat düşüşlerine karşı koruma sağlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Donanım cüzdanları ile güvenli uzun vadeli saklama

- Güvenlik adımları: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. KYVE Potansiyel Riskler ve Zorluklar

KYVE Piyasa Riskleri

- Yüksek oynaklık: KYVE'nin fiyatı ciddi dalgalanmalara açık

- Sınırlı likidite: Büyük işlemler fiyatı etkileyebilir

- Rekabet: Diğer blokzincir veri depolama projeleri pazar payı kazanabilir

KYVE Düzenleyici Riskler

- Belirsiz mevzuat: Merkeziyetsiz ağlara yönelik yeni düzenlemeler gelebilir

- Veri gizliliği: Saklanan verinin niteliğine bağlı denetim riski

- Uluslararası uyum: Farklı ülkelerin veri yasalarına uygunlukta zorluklar

KYVE Teknik Riskler

- Akıllı sözleşme açıkları: Protokol kodunda açıklardan yararlanma riski

- Ölçeklenebilirlik: Artan talebi karşılamada olası sınırlamalar

- Arweave bağımlılığı: Başka bir blokzincir platformuna bağımlılıktan kaynaklı riskler

VI. Sonuç ve Eylem Önerileri

KYVE Yatırım Değeri Analizi

KYVE, merkeziyetsiz veri depolama alanında benzersiz bir değer sunuyor, fakat kısa vadede yüksek oynaklık ve rekabet riski mevcut. Projenin teknik ve düzenleyici engelleri aşması halinde uzun vadeli büyüme potansiyeli ortaya çıkabilir.

KYVE Yatırım Önerileri

✅ Yeni başlayanlar: Kapsamlı araştırma sonrası küçük, uzun vadeli pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimi ile kademeli alım yapın ✅ Kurumsal yatırımcılar: Stratejik ortaklıklar ve opsiyonlu büyük pozisyonlar değerlendirin

KYVE İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden KYVE token alıp tutun

- Stake: Ağ yönetimine katılarak ödül kazanın

- Likidite sağlama: Likidite havuzları varsa katkıda bulunun

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Kyve Crypto nedir?

Kyve Crypto, blokzincir üzerinde verilerin güvenli şekilde saklanması, alınması ve analiz edilmesi için merkeziyetsiz bir veri gölü platformudur; güvenilir içgörüler ve doğrulanabilir veri yönetimi sağlar.

VeChain için 2030 fiyat tahmini nedir?

VeChain'in 2030'da fiyatı 0,50 ABD dolarına ulaşabilir, 1 ABD doları ise uzak bir ihtimaldir. Bu öngörü, kurumsal benimsemenin başarıyla gerçekleşmesi ve yatırımcı ilgisinin canlanması varsayımına dayanıyor.

Hangi kripto paranın en yüksek fiyat tahmini var?

Bitcoin için en yüksek fiyat tahmini yapılmakta ve 122.937 ABD dolarına ulaşabileceği öngörülmektedir. Chainlink ise 59,67 ABD dolarıyla ikinci sıradadır.

XRP için 2030 fiyat tahmini nedir?

Mevcut piyasa trendleri ve büyüme projeksiyonlarına göre, XRP'nin 2030 yılı fiyat aralığı 90 - 120 ABD doları olarak tahmin edilmektedir.

Pocket Network (POKT) İyi Bir Yatırım mı?: Bu merkeziyetsiz altyapı protokolünün uzun vadeli potansiyeli nasıl analiz edilir?

PEAQ (PEAQ) Yatırım İçin Mantıklı mı?: Bu Gelişen Blockchain Tokeninin Olası Getirileri ve Riskleri Üzerine Analiz

FIL vs NEAR: Merkeziyetsiz Depolama ve Akıllı Sözleşmeler İçin İki Önde Gelen Blockchain Protokolünün Karşılaştırılması

Streamr (DATA) iyi bir yatırım mı?: Web3 ekosisteminde yer alan bu veri pazarı tokeninin potansiyelini ve risklerini değerlendiriyoruz

Deeper Network (DPR) yatırım açısından uygun mu?: Bu merkeziyetsiz VPN tokeninin potansiyelini ve risklerini değerlendiriyoruz

meson.network (MSN) yatırım için uygun mu?: Web3 ekosisteminin değişen yapısında bu merkeziyetsiz CDN tokeninin potansiyelini değerlendiriyoruz

Yaratıcılığınızı Açığa Çıkarın: Dijital NFT'lerinizi Tasarlamak İçin En İyi Yapay Zekâ Araçları

CME Global Futures Kripto Pazar Hub'u

GameFi'ye Giriş: Yeni Başlayanlar için Rehber

VC Girişim Sermayesi Web3 Kripto Rolü

MPC Çok Taraflı Hesaplama Blok Zinciri Uygulaması