2025 KRL Fiyat Tahmini: Gelişen Kripto Ekosisteminde Piyasa Analizi ve Büyüme Potansiyeli

Giriş: KRL'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Kryll (KRL), alım-satım stratejilerini özelleştirmek ve otomatikleştirmek için tasarlanmış bir platform olarak, 2018’deki başlangıcından bu yana önemli ilerlemeler kaydetti. 2025 yılı itibarıyla Kryll’in piyasa değeri 11.981.077 $’a ulaşırken, yaklaşık 40.245.472 adet dolaşımdaki token ile fiyatı 0,2977 $ seviyesinde işlem görüyor. “Alım-satım strateji oluşturucu” olarak anılan bu varlık, otomatik kripto para alım-satım alanında giderek daha kritik bir rol üstleniyor.

Bu makale, Kryll’in 2025-2030 dönemindeki fiyat eğilimlerini, geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birleştirerek profesyonel fiyat öngörüleri ve yatırımcılar için pratik stratejiler sunacaktır.

I. KRL Fiyat Geçmişi ve Güncel Piyasa Durumu

KRL Tarihsel Fiyat Değişimi

- 2020: KRL, kripto piyasasında yaşanan düşüş sırasında 3 Nisan 2020’de tüm zamanların en düşük seviyesi olan 0,00474521 $’a geriledi.

- 2021: KRL, genel kripto boğa piyasasında 7 Kasım 2021’de tüm zamanların en yüksek seviyesi olan 4,75 $’ı gördü.

- 2025: KRL, fiyatında dalgalanmalar yaşadı ve şu anda 0,2977 $ seviyesinden işlem görüyor.

KRL Güncel Piyasa Görünümü

8 Ekim 2025 itibarıyla KRL, 0,2977 $ fiyatında işlem görüyor ve 24 saatlik işlem hacmi 19.349,79 $. Son 24 saatte token fiyatında %0,89’luk hafif bir gerileme yaşandı. KRL’nin güncel piyasa değeri 11.981.077 $ olup kripto para piyasasında 1.332’nci sırada yer alıyor.

Dolaşımdaki arz 40.245.472,60 KRL olup bu rakam maksimum arzın %81,44’ünü (49.417.348 KRL) oluşturuyor. Son bir haftada KRL %0,51 oranında hafif bir yükseliş gösterirken, son 30 günde %10,93’lük kayda değer bir düşüş yaşandı.

Mevcut 0,2977 $ fiyatı, 4,75 $’lık zirveye göre ciddi bir gerileme anlamına geliyor ve bu da KRL için zorlu bir piyasa ortamı olduğunu gösteriyor. Ancak, tüm zamanların en düşük seviyesinin oldukça üzerinde olması, piyasada belirli bir istikrar ve büyüme sağlandığını gösteriyor.

Güncel KRL piyasa fiyatını görmek için tıklayın

KRL Piyasa Duyarlılık Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto para piyasasında şu anda açgözlülük hakim. Korku ve Açgözlülük Endeksi’nin 60 seviyesinde olması, yatırımcı güveninin ve iyimserliğin arttığına işaret ediyor. Ancak, aşırı açgözlülük piyasa değerlemelerinde şişkinliğe ve olası düzeltmelere yol açabileceğinden dikkatli hareket edilmelidir. Yatırımcılar, portföylerini çeşitlendirmeli ve zarar durdurma emirleriyle risklerini yönetmelidir. Piyasa duyarlılığı hızla değişebileceği için güncel kalmak ve stratejinizi buna göre ayarlamak önemlidir. Gate.com, bu koşullarda etkin işlem yapmanız için kapsamlı araçlar ve kaynaklar sunar.

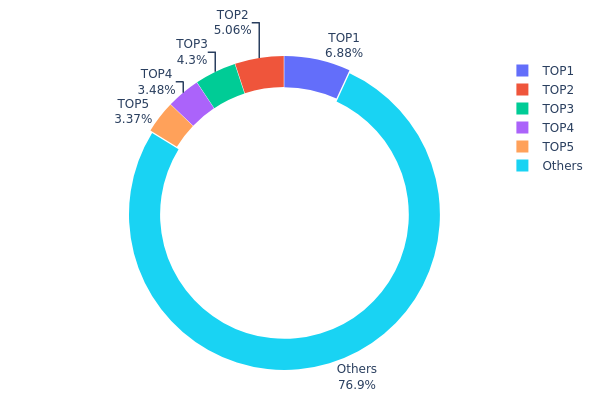

KRL Varlık Dağılımı

Adres bazlı dağılım verileri, KRL tokenlarının farklı cüzdanlar arasında ne kadar yoğunlaştığını gösterir. Analiz, KRL’de orta derecede yoğunlaşmış bir dağılım olduğunu ortaya koyuyor. İlk 5 adres toplam arzın %23,07’sini elinde tutarken, en büyük adresin payı %6,88. Bu oranlar, merkeziyetsizlik ile belirgin paydaş varlığı arasında bir denge bulunduğunu gösteriyor.

En büyük sahiplerin önemli pozisyonlarına rağmen, tokenların %76,93’ü diğer adresler arasında dağılmış durumda; bu da görece sağlıklı bir yayılımı ifade ediyor. Bu dağılım, herhangi bir büyük sahip tarafından fiyat manipülasyonu riskini azaltarak piyasa istikrarına katkı sağlayabilir. Yine de, ilk adreslerin koordineli hamleleri piyasa üzerinde etkili olabilir.

Mevcut sahiplik yapısı, KRL için orta düzeyde bir merkeziyetsizliği yansıtıyor. Hem büyük paydaşlar hem de geniş küçük yatırımcı tabanı, olgunlaşan bir ekosisteme ve daha dayanıklı bir zincir üstü yapıya işaret ediyor.

Güncel KRL Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xacd8...6dafef | 3.400,13K | 6,88% |

| 2 | 0xe9ca...49756a | 2.500,00K | 5,05% |

| 3 | 0x5578...b59946 | 2.127,15K | 4,30% |

| 4 | 0x2ea5...386f62 | 1.721,75K | 3,48% |

| 5 | 0x9b02...8333c5 | 1.663,60K | 3,36% |

| - | Diğerleri | 38.004,72K | 76,93% |

II. KRL'nin Gelecekteki Fiyatını Belirleyen Ana Etkenler

Arz Mekanizması

- Token Kullanımı: KRL, Kryll ekosisteminin temel fayda token’ı olup, çeşitli özellik ve hizmetlere erişim sağlar.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Borsa Listelenmeleri: Kaliteli merkezi borsalarda (CEX) olası listelenmeler, KRL’nin fiyatı ve görünürlüğünü etkileyebilir.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma: Kripto para olarak KRL, diğer dijital varlıklar gibi enflasyona karşı potansiyel bir koruma aracı olarak değerlendirilebilir.

Teknolojik Gelişim ve Ekosistem Genişlemesi

- Ekosistem Büyümesi: Kryll ekosisteminin büyümesi ve yeni iş birlikleri, KRL’nin değerini artırabilir.

- DApp Entegrasyonu: Kryll teknolojisinin çeşitli merkeziyetsiz uygulamalara (DApp) entegre edilmesi, KRL talebini yükseltebilir.

III. 2025-2030 KRL Fiyat Projeksiyonu

2025 Görünümü

- Temkinli tahmin: 0,22313 $ - 0,2975 $

- Tarafsız tahmin: 0,2975 $ - 0,3451 $

- İyimser tahmin: 0,3451 $ - 0,3927 $ (olumlu piyasa koşullarında)

2026-2028 Görünümü

- Piyasa aşaması: Kademeli büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,27608 $ - 0,45898 $

- 2027: 0,29349 $ - 0,48647 $

- 2028: 0,32431 $ - 0,45758 $

- Kilit katalizörler: Artan benimseme, teknolojik ilerleme ve genel kripto piyasası toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,45092 $ - 0,52532 $ (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,52532 $ - 0,61463 $ (güçlü piyasa performansında)

- Dönüştürücü senaryo: 0,61463 $+ (çığır açan benimseme ve kullanım durumlarında)

- 31 Aralık 2030: KRL 0,61463 $ (mevcut projeksiyonlara göre olası zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,3927 | 0,2975 | 0,22313 | 0 |

| 2026 | 0,45898 | 0,3451 | 0,27608 | 15 |

| 2027 | 0,48647 | 0,40204 | 0,29349 | 35 |

| 2028 | 0,45758 | 0,44426 | 0,32431 | 49 |

| 2029 | 0,59972 | 0,45092 | 0,32917 | 51 |

| 2030 | 0,61463 | 0,52532 | 0,27317 | 76 |

IV. Profesyonel KRL Yatırım Stratejileri ve Risk Yönetimi

KRL Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısı ve yüksek risk toleransı olanlar

- Operasyon tavsiyesi:

- Piyasa geri çekilmelerinde KRL biriktirin

- Kısmi kar alma için fiyat hedefleri belirleyin

- KRL’yi güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüş noktalarını belirleme

- RSI (Göreli Güç Endeksi): Aşırı alım/satım bölgelerini tespit etme

- Swing trading için temel noktalar:

- Trend teyidi için işlem hacmini izleyin

- Zarar durdurma emirleriyle riskinizi sınırlayın

KRL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Saldırgan yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklarına yatırım yaparak risk dağıtımı

- Zarar durdurma emirleri: KRL pozisyonlarında olası kayıpları sınırlama

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. KRL için Potansiyel Riskler ve Zorluklar

KRL Piyasa Riskleri

- Oynaklık: KRL fiyatında ciddi dalgalanmalar yaşanabilir

- Likidite: Düşük işlem hacmi giriş-çıkış kolaylığını azaltabilir

- Piyasa duyarlılığı: Kripto piyasasındaki genel ruh hali KRL’yi etkileyebilir

KRL Düzenleyici Riskleri

- Düzenleyici belirsizlik: Kripto regülasyonlarında yaşanan değişimler KRL’yi etkileyebilir

- Uyumluluk zorlukları: Yeni yasal gerekliliklere uyumda güçlükler

- Sınır ötesi kısıtlamalar: Farklı ülkelerdeki mevzuat KRL’nin küresel erişimini sınırlayabilir

KRL Teknik Riskler

- Akıllı kontrat açıkları: Temel yazılımda potansiyel hatalar

- Ağ yoğunluğu: Ethereum ağında yaşanabilecek tıkanıklıklar KRL işlemlerine yansıyabilir

- Teknolojik eskime: Yeni teknolojiler KRL’nin önemini azaltabilir

VI. Sonuç ve Eylem Tavsiyeleri

KRL Yatırım Potansiyeli Değerlendirmesi

KRL, otomatik alım-satım stratejileri pazarında potansiyel barındırıyor; ancak sektörde yoğun rekabet ve regülasyon belirsizlikleri mevcut. Uzun vadeli değer, platformun benimsenmesi ve teknolojik yeniliklere bağlı; kısa vadede ise piyasa oynaklığı ve likidite riskleri ön planda.

KRL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Platformu tanımak için küçük ve kontrollü pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle düzenli alım (dolar maliyet ortalaması) uygulayın ✅ Kurumsal yatırımcılar: Detaylı analiz yapın ve KRL’yi çeşitlendirilmiş portföyünüze eklemeyi değerlendirin

KRL İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden doğrudan KRL alım-satımı

- Staking: KRL staking programlarına katılım (varsa)

- DeFi entegrasyonu: KRL ile merkeziyetsiz finans fırsatlarını keşfedin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Kryll kripto parası kaç dolar?

Ekim 2025’te Kryll (KRL) yaklaşık 0,298 $ değerindedir. Son 24 saatte fiyat %1,23 gerilerken, işlem hacmi 121.194 $’dır.

En yüksek fiyat öngörüsüne sahip kripto para hangisi?

2025 yılında en yüksek fiyat beklentisi Bitcoin (BTC)’dedir. İstikrarlı trendiyle yatırımcıların birinci tercihi olmaktadır.

2025 için KCS fiyat tahmini nedir?

Piyasa analizine göre KCS’nin 2025’te 15,94 $ ile 43,14 $ arasında işlem görmesi bekleniyor ve üst hedefe ulaşması halinde %170,37 artış potansiyeline sahiptir.

2030 için XRP kripto fiyat tahmini nedir?

Küresel varlıkların tokenizasyonu gerçekleşirse, XRP fiyatı 2030’da 473.000 $’a ulaşabilir. Bu tahmin, XRP’nin yaygın benimsenmesi varsayımına dayanmaktadır.

Kripto Pompasına Nerede Katılabilirim? Riskler, Gerçekler ve Daha Güvenli Alternatifler

2025 BANANA Fiyat Tahmini: Küresel Meyve Ekonomisine Yönelik Piyasa Analizi ve Gelecek Beklentileri

2025 yılında Starknet Token (STRK) için fiyat tahmini nedir?

Kripto teknik göstergelerini nasıl yorumlamalı: MACD, RSI ve hacim trendleri nedir?

Kryll (KRL) iyi bir yatırım mı?: Bu otomatik alım satım platformu tokeninin potansiyelini ve risklerini değerlendirmek

APP ve CRO: Mobil pazarlamada kullanıcı etkileşimini ve dönüşüm oranlarını en üst seviyeye çıkarma

Küresel Blok Zinciri Benimsemesi İçin Yeni Bir Dönem: Sei × Xiaomi Önyüklü Kripto Cüzdanının Akıllı Telefon Ekosistemini Nasıl Dönüştüreceği

Do Kwon 15 Yıla Mahkum Edildi: Kripto Tarihindeki En Sert Kararlardan Birinin İçinde

BeatSwap'ı Açıklıyoruz: BTX Çoklu Platform Lansmanı ve Web3 IP Ekonomisinin Geleceği

Fungible Token ile NFT: Farklarını, Değerini ve 2025 Pazar Görünümünü Anlamak

ETH Gas Maliyetlerini Düşürmek İçin Akıllı Stratejiler