2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ITHACA's Market Position and Investment Value

Ithaca Protocol (ITHACA) has established itself as a non-custodial, composable option protocol since its inception. As of 2025, ITHACA's market capitalization has reached $500,507.5, with a circulating supply of approximately 64,250,000 tokens, and a price hovering around $0.00779. This asset, known as a "decentralized options infrastructure," is playing an increasingly crucial role in the field of DeFi and options trading.

This article will provide a comprehensive analysis of ITHACA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ITHACA Price History Review and Current Market Status

ITHACA Historical Price Evolution

- 2024: ITHACA reached its all-time high of $0.1456 on December 19, marking a significant milestone for the project

- 2025: The market experienced a downturn, with ITHACA's price dropping to its all-time low of $0.004932 on July 2

- 2025: A recovery phase began, with the price rebounding to current levels

ITHACA Current Market Situation

As of October 30, 2025, ITHACA is trading at $0.00779, representing a 0.28% increase in the last 24 hours. The token has shown mixed performance across different timeframes, with a 0.06% gain in the past hour and a 4.76% increase over the last 30 days. However, it has experienced a significant decline of 14.39% in the past week and a substantial 87.84% drop over the past year.

ITHACA's market capitalization currently stands at $500,507.5, with a circulating supply of 64,250,000 tokens out of a total supply of 1,000,000,000. The token's fully diluted valuation is $7,790,000, and it holds a market dominance of 0.00019%.

Trading volume in the last 24 hours reached $58,303.70, indicating moderate market activity. The current price is significantly below the all-time high, suggesting potential for recovery if market conditions improve and the project gains more traction.

Click to view the current ITHACA market price

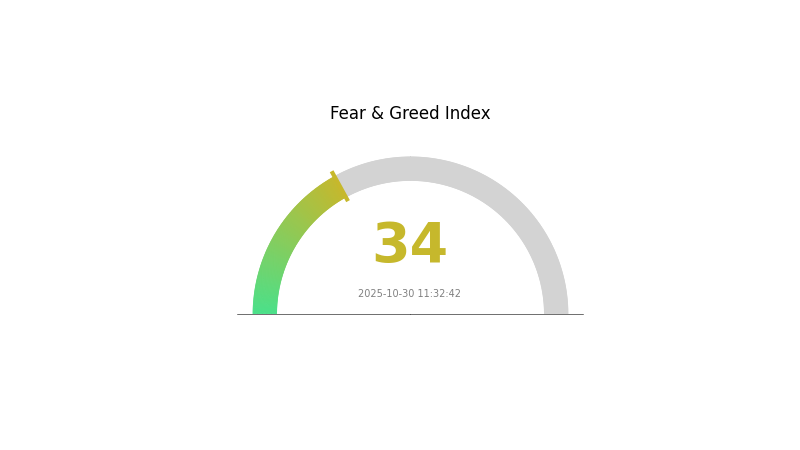

ITHACA Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index at 34. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and what seems like fear today could turn into opportunity tomorrow. Stay informed and trade wisely on Gate.com.

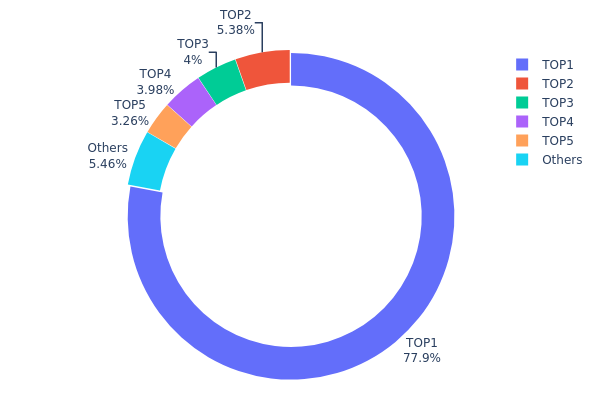

ITHACA Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for ITHACA. The top address holds a staggering 77.92% of the total supply, with 701,317,430 ITHACA tokens. This extreme concentration raises concerns about centralization and potential market manipulation risks.

The subsequent top holders possess significantly smaller portions, ranging from 5.37% to 3.25%. Collectively, the top 5 addresses control 94.51% of ITHACA's supply, leaving only 5.49% distributed among other addresses. This skewed distribution indicates a lack of widespread adoption and poses challenges for market liquidity and price stability.

Such a concentrated holding pattern may lead to increased volatility and susceptibility to large price swings based on the actions of a few major holders. It also suggests that ITHACA's current on-chain structure and decentralization level are suboptimal, potentially impacting its long-term sustainability and market dynamics.

Click to view the current ITHACA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x48ca...fb0962 | 701317.43K | 77.92% |

| 2 | 0x81b4...300a17 | 48414.67K | 5.37% |

| 3 | 0xa107...534e75 | 36000.00K | 4.00% |

| 4 | 0x5d76...2f64f4 | 35804.11K | 3.97% |

| 5 | 0x560b...680880 | 29323.48K | 3.25% |

| - | Others | 49140.21K | 5.49% |

II. Key Factors Influencing ITHACA's Future Price

Supply Mechanism

- Market Cycles: ITHACA's price is influenced by major market cycles.

- Historical Pattern: Trading volume patterns during significant price movements have impacted ITHACA's price in the past.

- Current Impact: Investors should pay attention to ITHACA's reaction to external market events, which could affect its current price trends.

Technical Development and Ecosystem Building

- Market Demand: One of the main driving factors for ITHACA's price is market demand.

- Technological Advancements: The development of ITHACA's technology is another crucial factor influencing its future price.

III. ITHACA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00438 - $0.00783

- Neutral prediction: $0.00783 - $0.01088

- Optimistic prediction: $0.01088 - $0.01318 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Growth phase with potential volatility

- Price range forecast:

- 2027: $0.00766 - $0.01476

- 2028: $0.00911 - $0.01653

- Key catalysts: Technological advancements, increased adoption, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.01359 - $0.01684 (assuming steady market growth)

- Optimistic scenario: $0.01684 - $0.02229 (with strong project performance and market conditions)

- Transformative scenario: $0.02229+ (under extremely favorable market conditions and widespread adoption)

- 2030-12-31: ITHACA $0.01581 (average prediction, indicating potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01088 | 0.00783 | 0.00438 | 0 |

| 2026 | 0.01318 | 0.00935 | 0.00496 | 20 |

| 2027 | 0.01476 | 0.01127 | 0.00766 | 44 |

| 2028 | 0.01653 | 0.01301 | 0.00911 | 67 |

| 2029 | 0.01684 | 0.01477 | 0.01359 | 89 |

| 2030 | 0.02229 | 0.01581 | 0.01217 | 102 |

IV. ITHACA Professional Investment Strategies and Risk Management

ITHACA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Dollar-cost averaging to accumulate ITHACA tokens over time

- Hold through market volatility, focusing on the protocol's long-term potential

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Implement strict stop-loss orders to manage downside risk

ITHACA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Options strategies: Use put options to protect against downside risk

- Diversification: Spread investments across different DeFi protocols and assets

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet for active trading

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ITHACA

ITHACA Market Risks

- High volatility: ITHACA's price may experience significant fluctuations

- Liquidity risk: Limited trading volume could impact entry and exit positions

- Competition: Emerging DeFi protocols may challenge ITHACA's market position

ITHACA Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may impact ITHACA's operations

- Compliance challenges: Adapting to evolving global DeFi regulations

- Cross-border restrictions: Potential limitations on ITHACA's accessibility in certain jurisdictions

ITHACA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Possible network congestion on the Arbitrum chain

- Interoperability challenges: Risks associated with cross-chain operations as ITHACA expands to other networks

VI. Conclusion and Action Recommendations

ITHACA Investment Value Assessment

ITHACA presents a unique opportunity in the DeFi options space with its innovative approach to market-making and risk sharing. While it offers significant long-term potential, investors should be aware of the high volatility and regulatory uncertainties in the short term.

ITHACA Investment Recommendations

✅ Beginners: Start with small positions and focus on education about DeFi options ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to ITHACA, using a mix of holding and trading strategies ✅ Institutional investors: Explore ITHACA for diversification in DeFi options exposure, while closely monitoring regulatory developments

ITHACA Participation Methods

- Spot trading: Purchase ITHACA tokens on Gate.com

- Yield farming: Participate in liquidity provision on the Ithaca Protocol

- Options trading: Engage directly with ITHACA's options markets for advanced strategies

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Ithaca Energy a good stock to buy?

Yes, Ithaca Energy is considered a good stock to buy. It has a consensus rating of Buy and positive analyst recommendations, making it a favorable investment option in the current market.

What is the target price for Ithaca Energy?

The target price for Ithaca Energy is 165.75 GBX, with forecasts ranging from 101.00 to 210.00 GBX.

What will be the price of ice in 2025?

The price of Ice (ICE) in 2025 is predicted to reach up to $0.030025. Current projections indicate a bearish sentiment, with potential price fluctuations expected.

What will Aitx stock price be in 2030?

Based on current market analysis, AITX stock price is projected to reach an average of $0.0618 in 2030, with a potential high of $0.0813.

Share

Content