2025 IQ Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Everipedia Token

Introduction: IQ's Market Position and Investment Value

IQ (IQ), as a knowledge ecosystem powered by blockchain and AI, has been providing comprehensive insights into Web3 and blockchain technology since its inception. As of 2025, IQ's market capitalization has reached $53,710,416, with a circulating supply of approximately 23,444,092,890 tokens, and a price hovering around $0.002291. This asset, known as the "Web3 Knowledge Hub," is playing an increasingly crucial role in simplifying and expanding access to blockchain technology.

This article will comprehensively analyze IQ's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. IQ Price History Review and Current Market Status

IQ Historical Price Evolution

- 2018: IQ token launched, initial price around $0.0025

- 2021: Bull market peak, price reached all-time high of $0.01641 on March 27, 2024

- 2025: Market correction, price dropped to all-time low of $0.00222 on October 10, 2025

IQ Current Market Situation

As of October 23, 2025, IQ is trading at $0.002291, down 2.38% in the last 24 hours. The token has experienced significant volatility over the past year, with a 64.21% decline from its price one year ago. IQ's market capitalization currently stands at $53,710,416, ranking it 584th among all cryptocurrencies. The circulating supply is 23,444,092,890 IQ tokens, representing 39.07% of the maximum supply of 60 billion tokens. Trading volume in the last 24 hours has been relatively low at $12,909, indicating limited market activity. The current price is 86.04% below its all-time high, suggesting potential for recovery if market conditions improve and the project gains more traction.

Click to view the current IQ market price

IQ Market Sentiment Indicator

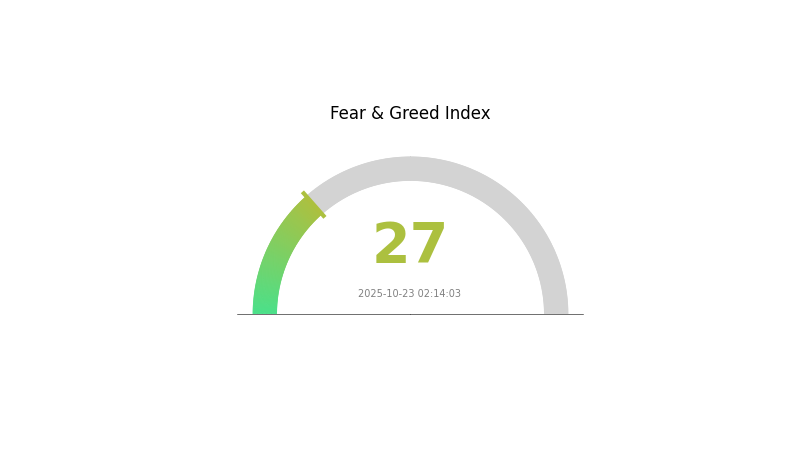

2025-10-23 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index hovering at 27. This indicates a cautious atmosphere among investors, potentially signaling undervaluation of assets. Historically, such periods of fear have presented opportunities for long-term investors to accumulate. However, it's crucial to conduct thorough research and exercise caution in this volatile market. Stay informed and consider diversifying your portfolio to navigate these uncertain times effectively.

IQ Holdings Distribution

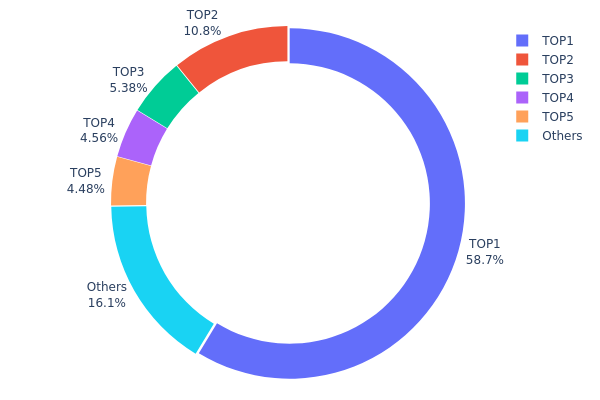

The address holdings distribution data reveals a highly concentrated ownership structure for IQ tokens. The top address holds a staggering 58.67% of the total supply, indicating significant centralization. The second-largest holder accounts for 10.83%, while the remaining top 5 addresses control between 4-5% each. Collectively, the top 5 addresses hold 83.91% of all IQ tokens, leaving only 16.09% distributed among other holders.

This extreme concentration raises concerns about market manipulation and price volatility. With a single address controlling over half the supply, there's a potential for large-scale market movements if this holder decides to sell or transfer tokens. The high concentration also implies a low level of decentralization, which may impact the token's governance and overall market stability.

Such a skewed distribution suggests that IQ's on-chain structure is currently imbalanced, potentially affecting its resilience to market shocks and limiting widespread participation in the ecosystem. This concentration pattern warrants close monitoring, as any significant changes in the top holders' positions could have substantial effects on IQ's market dynamics and long-term sustainability.

Click to view the current IQ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x75f5...02ee4a | 11588066.65K | 58.67% |

| 2 | 0x1bf5...4e16ba | 2139514.79K | 10.83% |

| 3 | 0xf25d...22d732 | 1063431.85K | 5.38% |

| 4 | 0xf977...41acec | 900000.00K | 4.55% |

| 5 | 0x5639...d6b654 | 885309.16K | 4.48% |

| - | Others | 3173845.87K | 16.09% |

II. Key Factors Affecting IQ's Future Price

Supply Mechanism

-

Consumer Demand: The future price of IQ is closely tied to consumer demand trends. As the market evolves from "satisfying basic needs" to "regular quality upgrades," this shift could potentially impact IQ's value.

-

Historical Patterns: Past consumer behavior indicates a growing preference for quality and brand innovation, which may influence IQ's price trajectory.

-

Current Impact: The trend towards cautious consumption in the current economic climate could affect IQ's price, with consumers prioritizing transparency and simplicity in products.

Institutional and Whale Dynamics

- Corporate Adoption: Companies focusing on consumer insights and innovative marketing strategies may increasingly adopt IQ-related technologies, potentially driving up demand and price.

Macroeconomic Environment

- Inflation Hedging Properties: In the current inflationary environment, IQ's performance as a potential hedge against inflation could impact its price.

Technological Development and Ecosystem Building

-

Channel Innovation: The rise of new retail channels, such as discount stores and content-based e-commerce platforms, could create new opportunities for IQ-related products and services, potentially affecting its value.

-

Ecosystem Applications: The integration of IQ in smart home applications and the growing trend of IoT devices could expand its ecosystem and influence its price.

III. IQ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00195 - $0.00215

- Neutral prediction: $0.00215 - $0.00235

- Optimistic prediction: $0.00235 - $0.00245 (requires favorable market conditions)

2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00197 - $0.00282

- 2027: $0.00239 - $0.00291

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00330 - $0.00408 (assuming steady market growth)

- Optimistic scenario: $0.00408 - $0.00518 (assuming strong market performance)

- Transformative scenario: $0.00518 - $0.00600 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: IQ $0.00518 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00245 | 0.00229 | 0.00195 | 0 |

| 2026 | 0.00282 | 0.00237 | 0.00197 | 3 |

| 2027 | 0.00291 | 0.0026 | 0.00239 | 13 |

| 2028 | 0.00391 | 0.00275 | 0.00215 | 20 |

| 2029 | 0.00483 | 0.00333 | 0.0019 | 45 |

| 2030 | 0.00518 | 0.00408 | 0.0033 | 77 |

IV. Professional Investment Strategies and Risk Management for IQ

IQ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate IQ tokens during market dips

- Stay informed about IQ ecosystem developments

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor trading volume for confirmation of price movements

IQ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official IQ wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for IQ

IQ Market Risks

- Volatility: Cryptocurrency markets can experience extreme price fluctuations

- Competition: Other AI and blockchain knowledge platforms may emerge

- Adoption: Slow uptake of EOAI technology could impact token value

IQ Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may affect IQ's operations

- Token classification: Potential for IQ to be classified as a security

- Cross-border restrictions: Varying international regulations may limit global use

IQ Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the IQ ecosystem

- Scalability challenges: EOAI may face issues handling increased user demand

- Integration complexities: Difficulties in implementing cross-chain functionality

VI. Conclusion and Action Recommendations

IQ Investment Value Assessment

IQ presents a unique value proposition in the blockchain knowledge and AI space. Long-term potential lies in the success of EOAI and ecosystem growth, while short-term risks include market volatility and technology adoption challenges.

IQ Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate IQ as part of a diversified blockchain technology portfolio

IQ Trading Participation Methods

- Spot trading: Purchase IQ tokens on Gate.com

- Staking: Participate in staking programs if offered by the IQ ecosystem

- Ecosystem participation: Engage with IQ.wiki and IQGPT.com to understand the project's utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does IQ coin have a future?

Yes, IQ coin has a promising future. Projections indicate it could reach a maximum price of $0.010697 by 2030, showing significant growth potential in the coming years.

What is the price prediction for IQ stock?

IQ stock is predicted to reach $1.56 by November 19, 2025, representing a potential decrease from current levels. This forecast is based on current market analysis and trends.

Will IQ stock recover?

IQ stock showed signs of recovery in late 2024. Analysts predict potential for further growth in 2025, but stock performance remains uncertain.

Is Qi a good coin?

Yes, Qi shows promise. Its growing ecosystem and low price suggest potential for future value appreciation, making it an attractive investment option in 2025.

Share

Content