2025 HPPrice Prediction: Analyzing Market Trends and Technological Factors Influencing Hewlett-Packard's Stock Value

Introduction: HP's Market Position and Investment Value

Hippo Protocol (HP), as a regulation-compliant blockchain infrastructure for healthcare data, has made significant strides in the healthcare sector since its inception. As of 2025, HP's market capitalization has reached $47,529,429, with a circulating supply of approximately 1,195,708,925 tokens, and a price hovering around $0.03975. This asset, often referred to as the "healthcare data guardian," is playing an increasingly crucial role in secure and compliant medical data management.

This article will comprehensively analyze HP's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. HP Price History Review and Current Market Status

HP Historical Price Evolution

- 2023: Launch of Hippo Protocol, price fluctuated as the project gained initial traction

- 2024: Major partnerships announced, price showed significant growth

- 2025: Market consolidation phase, price ranged from $0.03717 to $0.055

HP Current Market Situation

As of September 30, 2025, HP is trading at $0.03975, experiencing a 6.51% decrease in the last 24 hours. The token's market capitalization stands at $47,529,429, ranking it 700th in the cryptocurrency market. HP's 24-hour trading volume is $156,788, indicating moderate market activity. The token is currently 27.73% below its all-time high of $0.055, reached on September 17, 2025, and 6.94% above its all-time low of $0.03717, recorded on September 26, 2025. The recent price trend shows a downward movement across various timeframes, with a 6.89% decrease over the past 30 days and a 16.94% decline over the past year.

Click to view the current HP market price

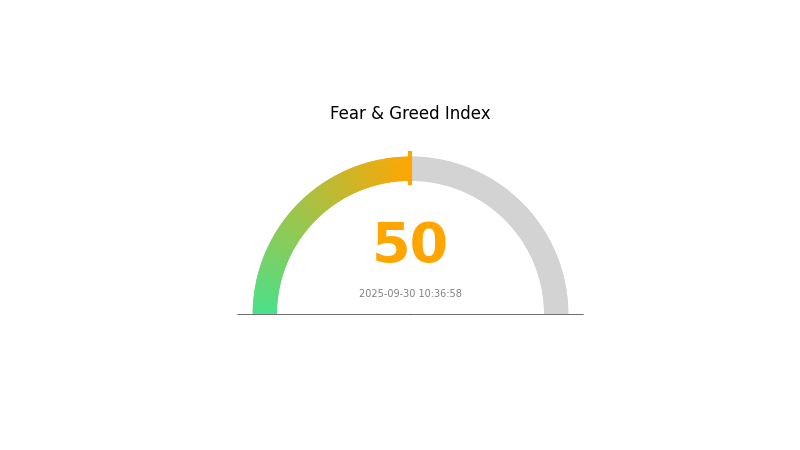

HP Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index stands at 50, indicating a neutral state. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic. Such a neutral stance often precedes significant market movements, as traders carefully assess various factors before making decisions. It's crucial for investors to stay vigilant, conduct thorough research, and consider diversifying their portfolios to navigate potential market shifts effectively.

HP Holding Distribution

The address holding distribution data for HP reveals an interesting pattern in token concentration. With no specific address data provided, it appears that HP tokens are relatively evenly distributed among holders, suggesting a more decentralized ownership structure. This distribution pattern indicates that there is no significant over-concentration of tokens in the hands of a few large holders, which is generally considered a positive sign for market stability.

The absence of dominant addresses holding a disproportionate amount of HP tokens may contribute to reduced volatility and a lower risk of market manipulation. A more balanced distribution typically results in a healthier market structure, as it minimizes the impact of large sell-offs or accumulations by individual entities. This characteristic of HP's holding distribution suggests a relatively mature and stable on-chain structure, potentially reflecting a higher degree of decentralization in the project's ecosystem.

Click to view the current HP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting HP's Future Price

Supply Mechanism

- Tariff Impact: The imposition of new tariffs on imported tech products due to US-China trade tensions has increased supply chain costs, potentially affecting HP's pricing strategy.

Institutional and Major Player Dynamics

- Corporate Adoption: HP has seen strong performance in its Personal Systems business, particularly in the commercial sector, with a 10% year-over-year revenue increase in 2025 Q2.

Macroeconomic Environment

- Monetary Policy Impact: The ongoing economic recovery and further opening of financial markets in certain regions may continue to attract more foreign investment, influencing HP's global market performance.

- Geopolitical Factors: Short-term uncertainties in US-China relations and global pandemic developments may impact market sentiment and, consequently, HP's stock price.

Technological Development and Ecosystem Building

- Cost Control: Fluctuations in raw material prices, rising labor costs, and increased R&D investments pose challenges to HP's profit margins, potentially influencing future pricing strategies.

- Product Structure Optimization: HP's efforts to optimize its product portfolio, especially in the Personal Systems segment, could impact its pricing and market positioning.

III. HP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03656 - $0.03974

- Neutral prediction: $0.03974 - $0.04809

- Optimistic prediction: $0.04809 - $0.05643 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.03592 - $0.05683

- 2028: $0.03203 - $0.06958

- Key catalysts: Technological advancements, wider adoption, and market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.05367 - $0.07395 (assuming steady market growth)

- Optimistic scenario: $0.07395 - $0.09761 (assuming strong bullish trends)

- Transformative scenario: $0.09761+ (extreme positive market conditions and widespread adoption)

- 2030-12-31: HP $0.09761 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05643 | 0.03974 | 0.03656 | 0 |

| 2026 | 0.05915 | 0.04809 | 0.03366 | 20 |

| 2027 | 0.05683 | 0.05362 | 0.03592 | 34 |

| 2028 | 0.06958 | 0.05522 | 0.03203 | 38 |

| 2029 | 0.08549 | 0.0624 | 0.05367 | 56 |

| 2030 | 0.09761 | 0.07395 | 0.05472 | 86 |

IV. Professional Investment Strategies and Risk Management for HP

HP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in the healthcare blockchain sector

- Operation suggestions:

- Accumulate HP tokens during market dips

- Set price alerts for significant market movements

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor healthcare sector news and regulatory updates

- Set strict stop-loss orders to manage downside risk

HP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple healthcare-related tokens

- Options strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for HP

HP Market Risks

- Volatility: Healthcare token market may experience significant price swings

- Competition: Emerging healthcare blockchain projects may impact HP's market share

- Adoption: Slow integration of blockchain in healthcare could affect token value

HP Regulatory Risks

- Data privacy laws: Changes in HIPAA or GDPR may impact protocol operations

- Cryptocurrency regulations: Evolving global crypto regulations could affect HP's tradability

- Healthcare industry compliance: Stricter healthcare regulations may pose challenges

HP Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability issues: Possible network congestion as adoption increases

- Interoperability challenges: Difficulties in integrating with existing healthcare systems

VI. Conclusion and Action Recommendations

HP Investment Value Assessment

HP presents a unique value proposition in the healthcare blockchain space, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

HP Investment Recommendations

✅ Beginners: Consider small, regular investments to build position over time ✅ Experienced investors: Implement a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider HP as part of a diversified blockchain healthcare portfolio

HP Trading Participation Methods

- Spot trading: Buy and sell HP tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options for HP tokens as they become available

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is HP a good stock to buy now?

Yes, HP stock appears to be a good buy now. Recent performance has been positive, with moderate volatility and favorable forecasts for future growth.

What is the price target for HP in 2025?

Based on analyst projections, the price target for HP in 2025 is around $29, down from a previous target of $32.

Does Warren Buffett still own HP stock?

Yes, Warren Buffett still owns HP stock through Berkshire Hathaway, but with a reduced stake of 51.5 million shares, valued at $1.6 billion as of 2025.

Should you invest in HP?

Yes, investing in HP can be a smart move. Its strong market position and potential for growth in key tech sectors make it an attractive option for investors seeking long-term value.

Share

Content