2025 HIGHPrice Prediction: Analyzing Market Trends and Future Valuation of the HIGH Token in a Post-Regulation Crypto Landscape

Introduction: HIGH's Market Position and Investment Value

Highstreet (HIGH), as a decentralized metaverse platform based on MMORPG games, has made significant strides since its inception in 2021. As of 2025, Highstreet's market capitalization has reached $37,562,053, with a circulating supply of approximately 77,591,518 HIGH tokens, and a price hovering around $0.4841. This asset, often referred to as a "metaverse pioneer," is playing an increasingly crucial role in the fields of virtual reality gaming and digital commerce.

This article will comprehensively analyze Highstreet's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. HIGH Price History Review and Current Market Status

HIGH Historical Price Evolution

- 2021: Project launch, price reached all-time high of $38.42

- 2022-2024: Cryptocurrency bear market, price declined significantly

- 2025: Market recovery phase, price rebounded from all-time low of $0.341022

HIGH Current Market Situation

HIGH is currently trading at $0.4841, up 4.8% in the last 24 hours. The token has a market cap of $37,562,053 and a fully diluted valuation of $48,410,000. Despite the recent price increase, HIGH is still down 61.68% over the past year. The token's trading volume in the last 24 hours is $30,172.69, indicating moderate market activity. With a circulating supply of 77,591,518 HIGH tokens, representing 77.59% of the total supply, there is still room for potential supply expansion.

Click to view current HIGH market price

HIGH Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance, with the Fear and Greed Index reaching 64, indicating a "Greed" sentiment. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, it's crucial to remain cautious as extreme greed can lead to market corrections. Traders should consider taking profits or hedging positions. Remember, markets often reverse when everyone is overly confident. Stay vigilant and don't let FOMO cloud your judgment. Always conduct thorough research before making investment decisions.

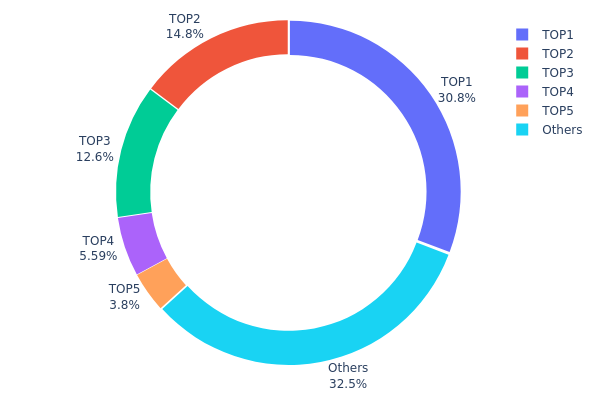

HIGH Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of HIGH tokens across different wallet addresses. Analysis of this data reveals a highly concentrated distribution pattern, with the top 5 addresses controlling 67.46% of the total HIGH supply.

The top address holds a significant 30.76% of all HIGH tokens, followed by the second and third largest holders with 14.75% and 12.58% respectively. This high concentration in a few addresses raises concerns about potential market manipulation and price volatility. Such a distribution structure could lead to increased market instability, as large holders have the power to significantly influence token prices through their trading activities.

This concentration level indicates a relatively low degree of decentralization for HIGH, which may impact its on-chain stability and market dynamics. While some concentration is not uncommon in cryptocurrency markets, the current distribution suggests a need for increased diversification to enhance market resilience and reduce manipulation risks.

Click to view the current HIGH holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2796...b8ceb6 | 30765.42K | 30.76% |

| 2 | 0xe455...5ec8fa | 14757.27K | 14.75% |

| 3 | 0xf977...41acec | 12581.24K | 12.58% |

| 4 | 0xd16e...cb0bda | 5587.09K | 5.58% |

| 5 | 0xb714...03cb27 | 3795.00K | 3.79% |

| - | Others | 32513.98K | 32.54% |

II. Key Factors Influencing HIGH's Future Price

Supply Mechanism

- Halving Effect: Bitcoin undergoes halving every four years until 2140 when new coin production ceases completely. This implies increasingly tight supply.

- Historical Pattern: Previous halvings have led to significant price increases due to reduced supply.

- Current Impact: The next halving is expected to further tighten supply, potentially driving up prices.

Institutional and Major Player Dynamics

- Institutional Holdings: Central banks have been increasing their gold holdings, with annual net purchases exceeding 1000 tons since 2022.

- Corporate Adoption: Major financial institutions and asset management companies have shown increased interest in gold investments.

- Government Policies: Financial sanctions have led to increased gold holdings by economies affected by or at risk of Western sanctions.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions and potential rate cuts significantly influence gold prices.

- Inflation Hedging Properties: Gold has been serving as an effective portfolio diversification tool in the face of economic uncertainties and volatility.

- Geopolitical Factors: Rising geopolitical tensions and uncertainties have been driving investors towards safe-haven assets like gold.

Technical Developments and Ecosystem Building

- ETF Inflows: Gold ETFs have become an increasingly important source of gold demand, with inflows reaching record levels.

- Market Influence: ETFs' influence on gold pricing has increased by 50% compared to the past three years.

- Ecosystem Applications: The retail investment market has shown strong demand for gold products, with varying trends in bars and coins investments.

III. HIGH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.36875 - $0.4852

- Neutral prediction: $0.4852 - $0.50946

- Optimistic prediction: $0.50946 - $0.55 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.45675 - $0.66284

- 2028: $0.48184 - $0.8539

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.73191 - $0.76119 (assuming steady market growth and adoption)

- Optimistic scenario: $0.79046 - $0.82208 (assuming strong market performance and increased utility)

- Transformative scenario: $0.85 - $0.90 (assuming breakthrough developments and mainstream adoption)

- 2030-12-31: HIGH $0.82208 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.50946 | 0.4852 | 0.36875 | 0 |

| 2026 | 0.61669 | 0.49733 | 0.36305 | 2 |

| 2027 | 0.66284 | 0.55701 | 0.45675 | 15 |

| 2028 | 0.8539 | 0.60993 | 0.48184 | 25 |

| 2029 | 0.79046 | 0.73191 | 0.688 | 51 |

| 2030 | 0.82208 | 0.76119 | 0.43388 | 57 |

IV. HIGH Professional Investment Strategies and Risk Management

HIGH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate HIGH tokens during market dips

- Participate in Highstreet's governance to increase engagement

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor Highstreet's development updates and partnerships

- Track overall metaverse and gaming token market sentiment

HIGH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Strategies

- Diversification: Balance HIGH with other metaverse and gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. HIGH Potential Risks and Challenges

HIGH Market Risks

- Volatility: HIGH price may experience significant fluctuations

- Competition: Increasing number of metaverse projects may impact adoption

- Market sentiment: Overall crypto market conditions can affect HIGH's performance

HIGH Regulatory Risks

- Unclear regulations: Evolving legal landscape for metaverse and NFT projects

- Cross-border compliance: Potential challenges in global operations

- Token classification: Risk of being classified as a security

HIGH Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Challenges in handling increased user activity

- Interoperability: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

HIGH Investment Value Assessment

HIGH presents a unique opportunity in the metaverse and gaming sector, with potential for long-term growth. However, investors should be aware of short-term volatility and the project's early stage risks.

HIGH Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about metaverse technology ✅ Experienced investors: Consider a balanced approach, incorporating HIGH into a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence, potentially engage in governance participation

HIGH Trading Participation Methods

- Spot trading: Buy and sell HIGH tokens on Gate.com

- Staking: Participate in staking programs if available

- Governance: Engage in Highstreet's ecosystem through voting and proposals

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, with some analysts forecasting it could reach $100,000 to $250,000 per coin, driven by increased institutional adoption and limited supply.

Why did Highstreet crypto drop?

HIGH's decline reflects technical breakdowns, sector-wide caution, and muted staking incentives. The token faces pressure from market trends and internal factors.

How high will Bitcoin go in 2025?

Based on expert projections, Bitcoin could reach $180,000 by 2025, with some optimistic forecasts suggesting it might even approach $300,000.

What is the hyper price prediction?

The hyper price prediction for 2025-2030 suggests significant growth potential. As a Layer 2 solution for Bitcoin, Hyper aims to enhance scalability and DeFi utility, potentially driving its value upwards in the coming years.

Share

Content