2025 HBAR Price Prediction: Bullish Outlook as Enterprise Adoption Accelerates

Introduction: HBAR's Market Position and Investment Value

Hedera (HBAR), as a fast, secure, and fair public ledger network, has achieved significant milestones since its inception. As of 2025, Hedera's market capitalization has reached $7.99 billion, with a circulating supply of approximately 42.4 billion tokens, and a price hovering around $0.18839. This asset, often referred to as the "enterprise-grade distributed ledger," is playing an increasingly crucial role in supporting decentralized applications and building point-to-point payment models.

This article will comprehensively analyze Hedera's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. HBAR Price History Review and Current Market Status

HBAR Historical Price Evolution

- 2020: Launch of Hedera mainnet, price remained relatively low around $0.01

- 2021: Bull market surge, HBAR reached all-time high of $0.569229 on September 15

- 2022-2023: Crypto winter, price declined to around $0.05 range

HBAR Current Market Situation

As of October 15, 2025, HBAR is trading at $0.18839, ranking 26th by market capitalization. The token has experienced a 1.23% decrease in the past 24 hours, with a trading volume of $16,864,451. HBAR's market cap stands at $7,988,632,087, with a circulating supply of 42,404,756,555 HBAR out of a total supply of 50,000,000,000.

The token has shown mixed performance across different timeframes:

- 1-hour change: +0.29%

- 7-day change: -14.41%

- 30-day change: -21.65%

- 1-year change: +253.08%

Despite the recent short-term decline, HBAR has demonstrated significant growth over the past year, indicating long-term investor interest in the project.

Click to view the current HBAR market price

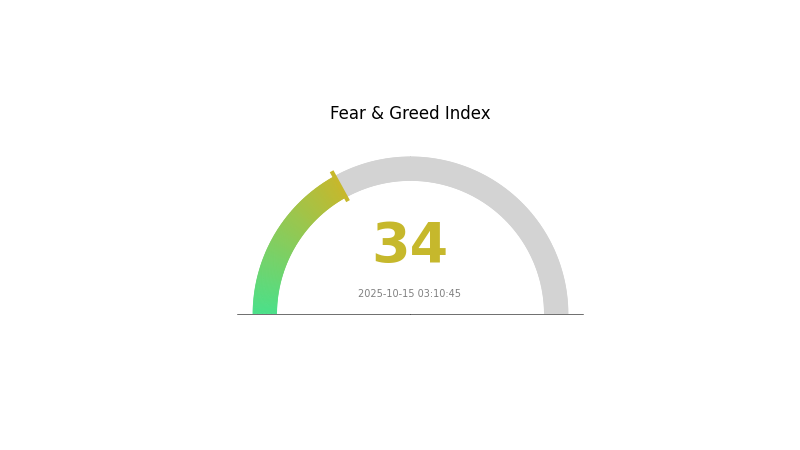

HBAR Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 34. This sentiment suggests that investors are cautious and potentially hesitant to make bold moves in the HBAR market. During such times, it's crucial for traders to remain vigilant and conduct thorough research before making any investment decisions. While fear can present buying opportunities for some, it's essential to approach the market with a well-thought-out strategy and risk management plan.

HBAR Holdings Distribution

The address holdings distribution chart for HBAR reveals an interesting pattern in token ownership. This data provides insights into the concentration of HBAR tokens across different addresses on the network.

Based on the provided data, it appears that HBAR's distribution is relatively decentralized, with no single address holding a disproportionately large percentage of the total supply. This distribution suggests a healthy level of decentralization, which is generally positive for the network's overall stability and resistance to price manipulation.

The absence of highly concentrated holdings reduces the risk of large-scale sell-offs by individual whales, potentially leading to more gradual and organic price movements. This distribution pattern may contribute to a more stable market structure for HBAR, fostering confidence among investors and users of the Hedera network.

Click to view the current HBAR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing HBAR's Future Price

Supply Mechanism

- Block Rewards: The HBAR price is influenced by block rewards, which affect the supply of tokens in circulation.

- Historical Pattern: Past changes in supply have impacted HBAR's price, with reductions in block rewards potentially leading to price increases.

- Current Impact: Any upcoming changes in block rewards or supply mechanisms are expected to influence HBAR's price trajectory.

Institutional and Large Holder Dynamics

- Institutional Holdings: Increased institutional interest, particularly from major players like BlackRock, has significantly impacted HBAR's price.

- Corporate Adoption: The adoption of Hedera Hashgraph technology by enterprises has been a key driver for HBAR's value.

- National Policies: Regulatory developments, especially in the United States, have been influencing HBAR's market performance.

Macroeconomic Environment

- Monetary Policy Impact: Global economic conditions and market volatility affect HBAR's price, with central bank policies playing a role in overall crypto market sentiment.

- Inflation Hedging Properties: HBAR's performance in inflationary environments may influence its attractiveness as a potential hedge.

Technological Development and Ecosystem Building

- Distributed Ledger Technology Advancements: HBAR's price is influenced by developments and upgrades in distributed ledger technology, particularly improvements to the Hashgraph consensus algorithm's efficiency and security.

- Protocol Updates: Changes and updates to the Hedera protocol can impact HBAR's price and adoption.

- Ecosystem Applications: The development of DApps and ecosystem projects on the Hedera network contributes to HBAR's value proposition and potential price growth.

III. HBAR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.17319 - $0.18825

- Neutral prediction: $0.18825 - $0.22496

- Optimistic prediction: $0.22496 - $0.26167 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.21593 - $0.29792

- 2028: $0.23136 - $0.31704

- Key catalysts: Expanded use cases, technological advancements, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.30133 - $0.339 (assuming steady market growth)

- Optimistic scenario: $0.339 - $0.48816 (assuming strong adoption and favorable regulatory environment)

- Transformative scenario: $0.48816 - $0.55 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: HBAR $0.339 (79% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.26167 | 0.18825 | 0.17319 | 0 |

| 2026 | 0.32169 | 0.22496 | 0.17322 | 19 |

| 2027 | 0.29792 | 0.27332 | 0.21593 | 45 |

| 2028 | 0.31704 | 0.28562 | 0.23136 | 51 |

| 2029 | 0.37667 | 0.30133 | 0.18683 | 59 |

| 2030 | 0.48816 | 0.339 | 0.24408 | 79 |

IV. Professional HBAR Investment Strategies and Risk Management

HBAR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate HBAR during market dips

- Set a target holding period of at least 3-5 years

- Store HBAR in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

HBAR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet solution: Official Hedera wallet with multi-factor authentication

- Security precautions: Never share private keys, use strong passwords, and enable all available security features

V. Potential Risks and Challenges for HBAR

HBAR Market Risks

- High volatility: HBAR price can experience significant fluctuations

- Competition: Other blockchain platforms may outperform Hedera in adoption or technology

- Market sentiment: Negative news or overall crypto market downturns can impact HBAR price

HBAR Regulatory Risks

- Uncertain regulatory environment: Changing cryptocurrency regulations may affect HBAR's usage and value

- Compliance challenges: Hedera may face difficulties adhering to evolving global regulatory standards

- Taxation issues: Unclear or unfavorable tax treatment of HBAR transactions and holdings

HBAR Technical Risks

- Network security: Potential vulnerabilities in the Hedera network could be exploited

- Scalability challenges: Hedera may face difficulties in maintaining high TPS as network usage grows

- Smart contract risks: Bugs or exploits in smart contracts built on Hedera could impact the ecosystem

VI. Conclusion and Action Recommendations

HBAR Investment Value Assessment

HBAR presents a compelling long-term value proposition due to its high-performance network and growing adoption. However, short-term risks include market volatility and regulatory uncertainties.

HBAR Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time

✅ Experienced investors: Consider a mix of long-term holding and strategic trading based on technical analysis

✅ Institutional investors: Explore partnerships with Hedera and allocate a portion of crypto portfolio to HBAR

HBAR Trading Participation Methods

- Spot trading: Buy and sell HBAR on Gate.com's spot market

- Staking: Participate in HBAR staking programs for passive income

- DeFi: Explore decentralized finance applications built on the Hedera network

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Will HBAR reach $10?

HBAR has a 16.4% chance of reaching $10 within 10 years. Mathematical models suggest it could potentially hit $10 by 2038, based on network growth and adoption projections.

How much will HBAR be worth in 2025?

Based on market trends and expert analysis, HBAR is projected to reach approximately $0.25 by 2025, showing potential for growth in the coming years.

Can HBAR hit $5?

Yes, HBAR could potentially hit $5 if it achieves significant market adoption and investment, reaching a market cap similar to Ethereum's current size.

Can HBAR reach $3?

While possible, HBAR reaching $3 is unlikely in the near term. It would require a 14x increase in market cap to $127 billion, which is a significant challenge given current market conditions.

Share

Content