2025 GUSD Fiyat Tahmini: Stablecoin Pazarında İstikrar ve Büyüme Potansiyelinin Analizi

Giriş: GUSD'nin Piyasa Konumu ve Yatırım Değeri

GUSD (GUSD), esnek ve anapara korumalı bir yatırım ürünü olarak, ilk çıktığı günden bu yana istikrarlı getiriler sunmaktadır. 2025 yılı itibarıyla GUSD’nin piyasa değeri 148.102.161 $’a ulaşmış, yaklaşık 148.221.943 token dolaşıma girmiştir ve fiyatı 0,9993 $ seviyesinde seyretmektedir. “Getiri sağlayan sertifika” olarak bilinen bu varlık, Gate ekosistemi içinde istikrarlı getiri sunan önemli bir rol üstlenmektedir.

Bu makalede, 2025’ten 2030’a kadar GUSD’nin fiyat değişimlerini tarihsel eğilimler, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik etmenlerle birlikte analiz edecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GUSD Fiyat Geçmişi ve Güncel Piyasa Durumu

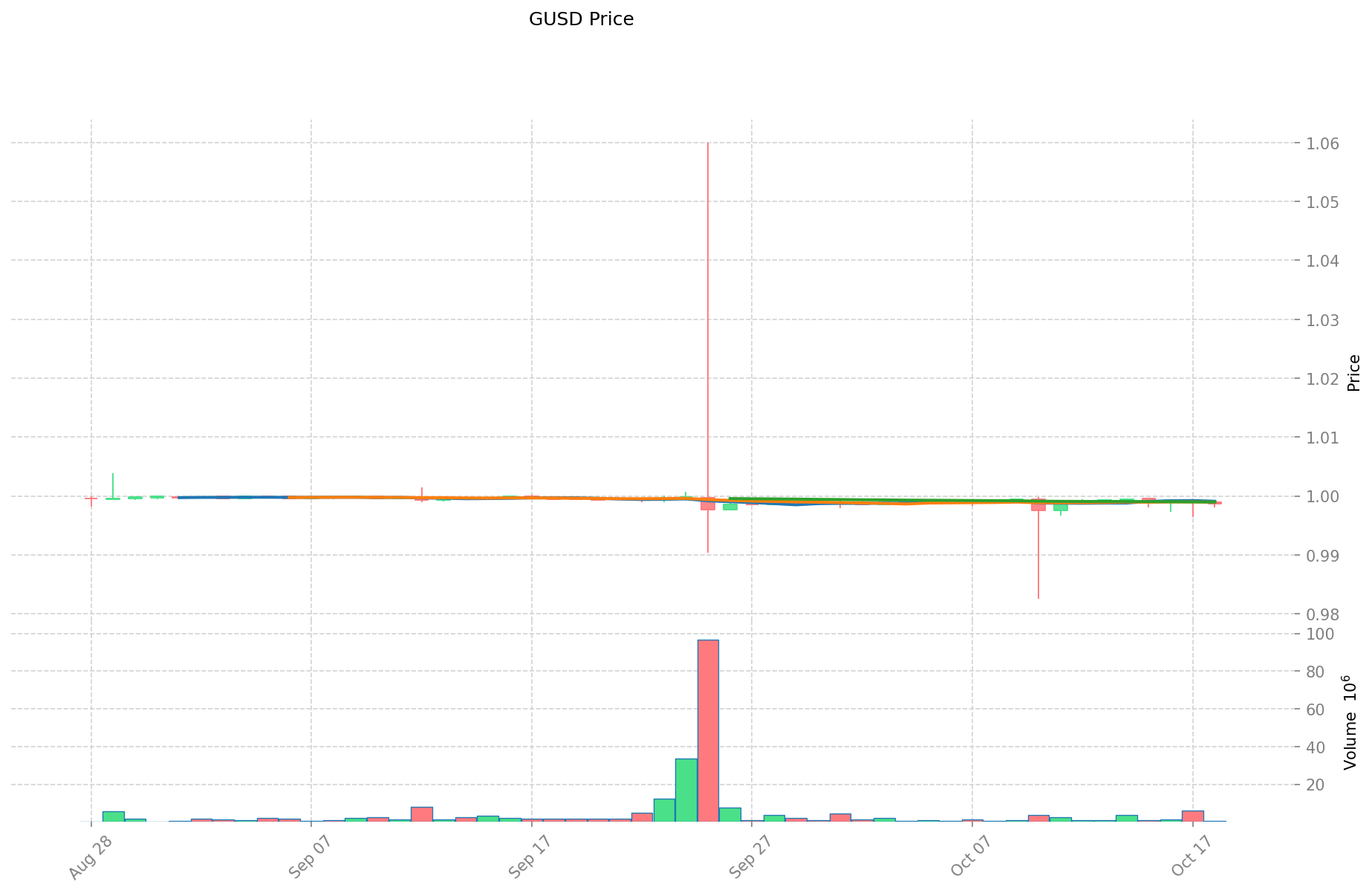

GUSD Tarihsel Fiyat Gelişimi

- 2025: GUSD piyasaya sürüldü, başlangıç fiyatı 1 $ olarak belirlendi

- 2025: 25 Eylül’de 1,06 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: 10 Ekim’de 0,9826 $ ile tüm zamanların en düşük seviyesine geriledi

GUSD Güncel Piyasa Durumu

19 Ekim 2025 tarihinde GUSD, 0,9993 $ seviyesinden işlem görüyor ve son 24 saatte %0,02’lik bir yükseliş gösteriyor. Token’ın piyasa değeri 148.102.161 $ olup, genel kripto para sıralamasında 327. sırada bulunuyor. 24 saatlik işlem hacmi ise 423.906,71 $’a ulaşmış durumda; bu da piyasa aktivitesinin orta seviyede olduğunu gösteriyor.

GUSD’nin güncel fiyatı, 1 $’lık sabit değerine çok yakın olup, stablecoin olarak istikrarını kanıtlamaktadır. Token, son dönemdeki en düşük seviyesinden toparlanarak, hedef fiyatı etrafında dar bir bantta işlem görmeye devam etmiştir. Toplam arzı 320.000.000 GUSD olan token’ın dolaşımdaki miktarı 148.221.943,61 GUSD olup, dolaşım oranı %46,31’dir.

Piyasa duyarlılığı GUSD için nötrden hafif olumluya doğru seyretmektedir; farklı zaman dilimlerinde küçük kazançlar gözlemlenmiştir. Token, son bir haftada %0,05 artarken son 30 günde %0,03’lük hafif bir düşüş sergilemiştir; bu da fiyat performansında genel bir istikrara işaret eder.

Mevcut GUSD piyasa fiyatını görüntülemek için tıklayın

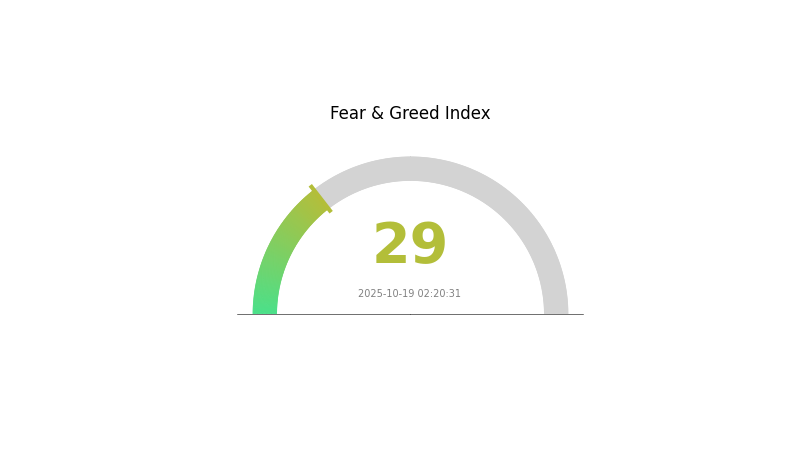

GUSD Piyasa Duyarlılık Endeksi

19 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksi’ni görmek için tıklayın

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 29 seviyesinde ve piyasada korkunun hakim olduğunu gösteriyor. Bu durum, yatırımcıların çekimser ve riskten kaçınan bir tavırda olduğunu, karşıt pozisyonda olanlar için ise alım fırsatları doğurabileceğini işaret ediyor. Ancak, bu koşullarda kapsamlı araştırma ve temkinli hareket etmek kritik önem taşır. Unutmayın, piyasa duyarlılığı hızla değişebilir ve geçmiş performans gelecekteki sonuçları garanti etmez. Riskinizi yönetmek için portföyünüzü çeşitlendirin ve güncel kalmaya özen gösterin.

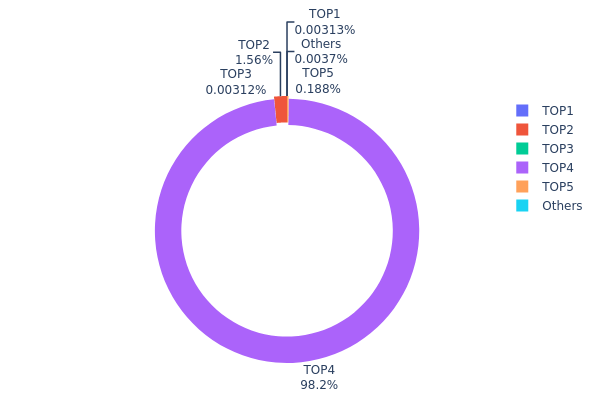

GUSD Varlık Dağılımı

GUSD’nin adres bazlı varlık dağılımı, sahiplikte aşırı bir yoğunlaşmaya işaret ediyor. En büyük adres olan 0xc882...84f071, toplam GUSD arzının %98,23’ünü elinde bulunduruyor ve piyasadaki merkeziyet oranını ciddi biçimde artırıyor.

İkinci en büyük sahip olan 0x843a...e313e2 adresi toplam arzın %1,56’sına sahipken, kalan adresler çok küçük miktarlarda varlık bulunduruyor. Bu dağılım, piyasada tek bir varlık sahibinin token arzı ve fiyat dinamikleri üzerinde ciddi bir etkiye sahip olabileceği anlamına gelir. Bu konsantrasyon, fiyat oynaklığını artırabilir ve piyasa manipülasyonuna zemin hazırlayabilir; bu da token’ın istikrarını ve yatırımcı güvenini zedeleyebilir.

Piyasa açısından bakıldığında, GUSD’deki bu yüksek konsantrasyon düşük merkeziyetsizlik derecesini gösterir ve zincir üzerindeki yapısal istikrar konusunda endişe yaratır. Ayrıca likiditeyi olumsuz etkileyebilir ve GUSD’nin merkeziyetsiz finans uygulamalarında daha geniş çapta benimsenmesinin önünde engel oluşturabilir.

Mevcut GUSD Varlık Dağılımı’nı görüntülemek için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc553...c8f9dc | 10,00K | 0,00% |

| 2 | 0x843a...e313e2 | 5.000,00K | 1,56% |

| 3 | 0x54bc...f3120f | 10,00K | 0,00% |

| 4 | 0xc882...84f071 | 314.367,72K | 98,23% |

| 5 | 0x0d07...b492fe | 600,44K | 0,18% |

| - | Diğerleri | 11,84K | 0,029999999999987% |

II. GUSD’nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Sabitlenmiş Arz: GUSD, ABD dolarına endeksli stablecoin’dir, 1:1 oranı korur.

- Tarihsel Eğilim: GUSD’nin arzı, sabitini korumak için tarih boyunca piyasa talebine göre ayarlanmıştır.

- Güncel Etki: GUSD arzında önemli değişiklikler genellikle piyasa talebine veya düzenleyici gerekliliklere bağlı olarak gerçekleşir ve bu da erişilebilirliğini ve benimsenmesini etkileyebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük finans kurumları stablecoin rezervlerinde GUSD bulundurabilir.

- Kurumsal Benimseme: Kripto sektöründe faaliyet gösteren şirketler, GUSD’yi ticaret veya hazine yönetimi için kullanabilir.

- Ulusal Politikalar: ABD’de stablecoin’lere yönelik düzenlemeler, GUSD’nin benimsenmesi ve kullanımını doğrudan etkileyebilir.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın faiz ve enflasyon politikaları, GUSD gibi USD’ye sabitlenmiş stablecoin’lere olan talebi etkileyebilir.

- Enflasyona Karşı Koruma: USD’ye sabitli GUSD’nin değeri, diğer kripto paralara göre enflasyon trendlerinden etkilenebilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler, istikrarlı varlıklara olan talebi artırabilir ve GUSD bu kapsamda öne çıkabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Blockchain Yükseltmeleri: GUSD’nin temelini oluşturan Ethereum ağında yapılacak iyileştirmeler, işlem hızı ve ücretlerini etkileyebilir.

- Ekosistem Uygulamaları: GUSD’nin DeFi platformlarına ve ödeme sistemlerine entegrasyonu, kullanım alanını ve talebini artıracaktır.

III. 2025-2030 GUSD Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,98-1,00 $

- Nötr tahmin: 0,99-1,01 $

- İyimser tahmin: 1,00-1,02 $ (DeFi platformlarında GUSD’nin yaygınlaşması ile)

2027-2028 Görünümü

- Piyasa fazı: Stablecoin kullanımının yaygınlaşmasına paralel büyüme beklentisi

- Fiyat aralığı tahmini:

- 2027: 0,99-1,01 $

- 2028: 0,99-1,01 $

- Başlıca katalizörler: Daha fazla blockchain ağı ile entegrasyon, düzenleyici netlik

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99-1,01 $ (istikrar ve piyasa güveninin devamı halinde)

- İyimser senaryo: 1,00-1,02 $ (sınır ötesi işlemlerde yaygınlaşma ile)

- Dönüştürücü senaryo: 1,00-1,03 $ (GUSD’nin önde gelen stablecoin olması ile)

- 31 Aralık 2030: GUSD 1,01 $ (talepteki artış nedeniyle hafif prim)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. GUSD Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GUSD Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: İstikrarlı getiri arayan temkinli yatırımcılar

- Öneriler:

- Düzenli olarak USDT/USDC stake ederek GUSD üretin

- Günlük getirileri yeniden yatırarak bileşik kazanç elde edin

- GUSD’yi Gate Web3 cüzdanında güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım bölgelerini belirleyin

- Dalgalı işlem için dikkat edilmesi gerekenler:

- Kesin zararı durdur ve kar al seviyeleri belirleyin

- Fiyata etki edebilecek Gate ekosistemi gelişmelerini takip edin

GUSD Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %5-10’u

- Orta düzey yatırımcılar: Portföyün %10-20’si

- Aggresif yatırımcılar: Portföyün %20-30’u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı stablecoin ve getiri sağlayan varlıklara fon dağıtımı

- Düzenli dengeleme: Piyasa koşulları ve risk toleransına göre portföyünüzü güncelleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 cüzdanı

- Soğuk saklama seçeneği: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı aktif edin, güçlü şifreler kullanın ve yazılımlarınızı güncel tutun

V. GUSD İçin Potansiyel Riskler ve Zorluklar

GUSD Piyasa Riskleri

- Temel varlıklardaki oynaklık: Gate ekosistemi geliri veya RWA performansındaki değişiklikler

- Likidite riski: Piyasa stresi anında üretim ve geri alımda dengesizlikler

- Getiri rekabeti: Diğer stablecoin veya DeFi protokollerinin daha yüksek getiriler sunması

GUSD Düzenleyici Riskler

- Stablecoin düzenlemeleri: GUSD’nin operasyonlarını etkileyebilecek yeni kurallar

- Sınır ötesi kısıtlamalar: Belirli ülkelerde GUSD kullanımına yönelik sınırlamalar

- Vergilendirme belirsizlikleri: Stablecoin getirilerinin değişken vergi uygulamaları

GUSD Teknik Riskler

- Akıllı sözleşme açıkları: GUSD üretim/geri alım mekanizmasındaki olası güvenlik açıkları

- Oracle hataları: GUSD’nin sabitini etkileyen hatalı fiyat verileri

- Ağ tıkanıklığı: Yoğun trafik dönemlerinde üretim veya geri alımda gecikmeler

VI. Sonuç ve Eylem Önerileri

GUSD Yatırım Değeri Değerlendirmesi

GUSD, Gate ekosistemi ve gerçek dünya varlıkları desteğiyle istikrar ve getiri potansiyelini bir araya getiriyor. Düzenli getiri sunarken, stablecoin’lerle ilgili düzenleyici belirsizlikler ve piyasa riskleri yatırımcılar için dikkate alınması gereken faktörlerdir.

GUSD Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Ürünü tanımak için küçük tutarlı bir yatırım yapın ✅ Deneyimli yatırımcılar: GUSD’yi çeşitlendirilmiş stablecoin portföyünde değerlendirin ✅ Kurumsal yatırımcılar: Hazine yönetimi ve getiri optimizasyonu için GUSD’yi inceleyin

GUSD Katılım Yöntemleri

- Doğrudan üretim: Gate.com’da USDT/USDC stake ederek GUSD üretimi

- İkincil piyasa işlemleri: Gate.com spot piyasasında GUSD alımı

- Getiri çiftçiliği: Gate.com’un DeFi ekosisteminde GUSD ile ek getiri elde etme

Kripto para yatırımları oldukça yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcıların kararlarını kendi risk toleranslarıyla vermesi ve profesyonel finans danışmanlarıyla görüşmesi önerilir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

GUSD iyi bir yatırım mı?

Evet, GUSD umut vadeden bir yatırımdır. Stablecoin olması sayesinde dalgalı kripto piyasasında istikrar ve düzenli getiri potansiyeli sunar.

Gemini Dollar iyi bir yatırım mı?

Evet, Gemini Dollar (GUSD) umut vadeden bir yatırımdır. ABD dolarına sabitli stablecoin olarak dalgalı kripto piyasasında istikrar ve düzenli getiri potansiyeli sağlar.

2025’te 1 Dogecoin’in değeri ne olur?

Mevcut eğilimler ve piyasa analizlerine göre, 2025’te 1 Dogecoin yaklaşık 0,50 $ ile 0,75 $ arasında olabilir ve bu popüler kripto para için önemli bir büyüme potansiyeli anlamına gelir.

En yüksek fiyat tahminine sahip kripto para hangisi?

Bitcoin (BTC), kripto paralar arasında genellikle en yüksek fiyat tahminine sahip olup, bazı analistler 2030 yılına kadar 500.000 $ veya daha fazlasını öngörmektedir.

GUSD Nedir? Gemini Dolar Stabilcoin'i için Yeni Başlayanlar Rehberi

GUSD: Gate'de Gemini'nin Stablecoin'ini Nasıl Mint, İade Edebilir ve Kar Edebilirsiniz

Dai Fiyat Analizi 2025: Stabilcoin Pazarının Eğilimleri ve Görünümü

USDe Fiyat Tahmini: 2025 Ethena Stabilcoin Pazar Analizi ve Yatırım Stratejisi

Gate'de USD1 stablecoin: WLFI Token için Analiz ve Yatırım Fırsatları

2025'te Gate'de GUSD: Gemini Dolarının Avantajları ve Fırsatları

Xenea Günlük Bilgi Yarışması Cevabı 24 Aralık 2025

Hotbit platformunun kapanmasının ardından fonlarınızı nasıl çekebilirsiniz

Yapay Zekâ, 2025 yılında büyüme gösterecek 10 kripto parayı öngörüyor | Uzman Analizleri

SMTX nedir: Yüzey Montaj Teknolojisi X ve modern elektronik üretiminde kullanım alanları hakkında kapsamlı bir rehber

SOIL Nedir: Dünya Ekosistemlerinin ve Tarımsal Verimliliğin Temelini Anlamak