2025 GTAI Fiyat Tahmini: Yapay Zeka Destekli Kripto Varlıkların Geleceğinde Yolculuk

Giriş: GTAI'nin Piyasa Konumu ve Yatırım Değeri

GT-Protocol (GTAI), Web3 ekosisteminde devrim niteliğinde bir yapay zekâ odaklı yatırım platformu olarak kuruluşundan bu yana önemli başarılar elde etti. 2025 yılı itibarıyla GT-Protocol'ün piyasa değeri 3.772.847 ABD doları olup, dolaşımdaki yaklaşık 40.576.979 token ile fiyatı 0,09298 ABD doları civarında seyrediyor. "Web3 için AI Katmanı" olarak öne çıkan bu varlık, CeFi, DeFi ve NFT piyasalarında yatırım fırsatlarının demokratikleşmesinde giderek daha merkezi bir rol üstleniyor.

Bu makalede, GT-Protocol'ün 2025-2030 dönemi fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik göstergeler ekseninde profesyonel analiz edilerek, yatırımcılara uzman fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GTAI Fiyat Geçmişi ve Güncel Piyasa Durumu

GTAI Tarihsel Fiyat Seyri

- 2024: İlk lansman, başlangıç fiyatı 0,2 ABD doları

- 2024: 10 Mart 2024'te tüm zamanların en yüksek seviyesi olan 5,4994 ABD doları görüldü

- 2025: Piyasa düşüşüyle 10 Ekim 2025’te tüm zamanların en düşük seviyesi olan 0,0777 ABD doları görüldü

GTAI Güncel Piyasa Durumu

13 Ekim 2025 itibarıyla GTAI, 0,09298 ABD dolarından işlem görmekte olup, son 24 saatte %6,32'lik bir yükseliş kaydetti. Token, 24 saatlik 64.055,54 ABD doları işlem hacmiyle yüksek volatilite sergiliyor. GTAI'nin piyasa değeri 3.772.847,53 ABD doları ile kripto para piyasasında 1.938. sırada bulunuyor.

Token'ın fiyatı son bir yıl içinde %88,32 oranında değer kaybetti. Kısa vadede ise, GTAI son 30 günde %27,85 düşerken, son 24 saatte hafif bir toparlanma gösterdi.

GTAI şu an tüm zamanların en yüksek değerinin oldukça altında işlem görmekte ve bu durum uzun vadeli aşağı yönlü bir trendi işaret ediyor. Son 24 saatte gözlenen yükseliş ise kısa vadede yükseliş eğilimi potansiyelini gündeme getirdi.

Güncel GTAI piyasa fiyatını görmek için tıklayın

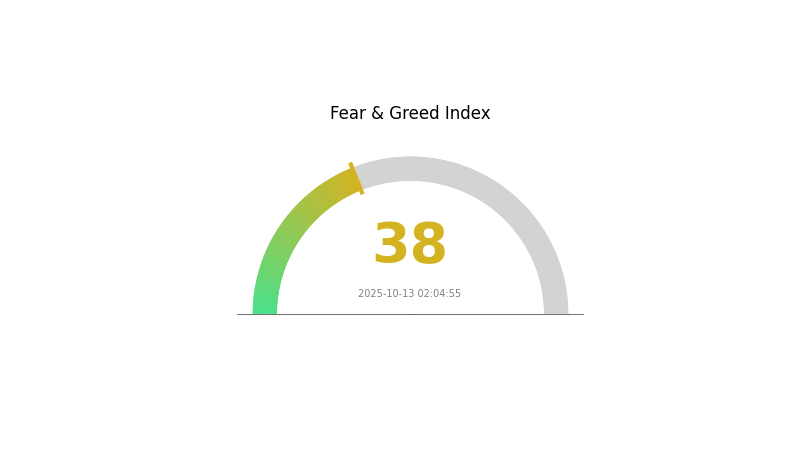

GTAI Piyasa Duyarlılık Endeksi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

GTAI endeksinin 38 seviyesine gerilemesiyle kripto piyasalarında korku hakim. Bu temkinli atmosfer, deneyimli yatırımcılar için potansiyel alım fırsatları doğurabilir. Yine de yatırımcıların dikkatli olması, risklerini iyi yönetmesi gerekir. Kimileri bu durumu giriş fırsatı olarak görse de, diğerleri net piyasa sinyallerini bekleyebilir. Piyasa duyarlılığının hızlı değişebileceğini unutmayın; güncel kalın ve portföyünüzü çeşitlendirerek olası riskleri azaltın.

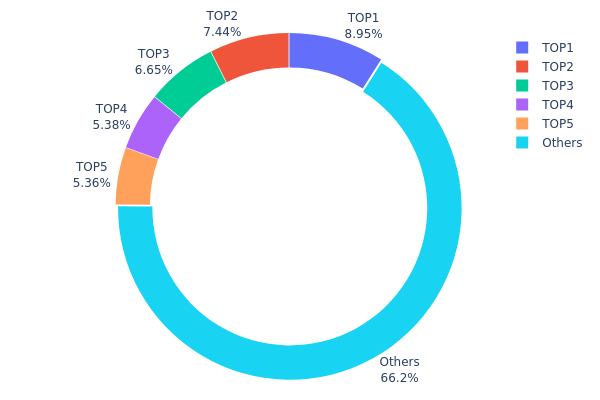

GTAI Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, GTAI tokenlarının cüzdanlar arasında nasıl dağıldığına dair önemli bilgiler sunar. Analiz, ilk 5 adresin toplam arzın %33,76’sını elinde bulundurduğunu ve orta düzeyde bir yoğunlaşma olduğunu gösteriyor. En büyük tek adresin %8,94’lük payı önemli olsa da, piyasaya egemen olacak seviyede değildir.

Bu dağılım, GTAI için dengeli bir piyasa yapısına işaret ediyor. Büyük yatırımcılar fiyatlarda etkili olabilse de, tokenların %66,24’ünün diğer adreslerde bulunması merkeziyetsizliğin sağlıklı düzeyde olduğunu gösteriyor. Bu yapı, tek bir büyük yatırımcının fiyat üzerinde manipülasyon yapma riskini azaltarak piyasa istikrarına katkı sağlayabilir.

Yine de, büyük sahiplerin piyasa üzerinde etkili olabileceklerinin farkında olmak gerekir. Genel olarak, mevcut GTAI adres dağılımı, orta seviyede merkeziyetsizlik ve sağlıklı zincir üstü yapı ile token’ın uzun vadeli istikrarı ve benimsenme potansiyeli açısından olumlu bir işaret sunuyor.

Güncel GTAI Varlık Dağılımı için tıklayın

| En Yüksek | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xf89d...5eaa40 | 6.712,27K | 8,94% |

| 2 | 0xbbbf...7cf4e4 | 5.582,22K | 7,44% |

| 3 | 0x02c0...2dfbad | 4.991,07K | 6,65% |

| 4 | 0xd4c0...d9284a | 4.033,60K | 5,37% |

| 5 | 0x4881...64d188 | 4.022,34K | 5,36% |

| - | Diğerleri | 49.658,51K | 66,24% |

II. GTAI'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Piyasa Duyarlılığı

- Yatırımcı Güveni: GTAI'nin fiyat eğilimleri yatırımcı duyarlılığı ve güveniyle doğrudan şekillenir. GTAI'nin yaygın benimsenmesi veya teknolojik atılımlar hakkındaki olumlu haberler fiyatları yükseltebilir.

- Geçmiş Eğilimler: Piyasa duyarlılığındaki değişimler, fiyat hareketlerinde öncü rol oynar.

- Güncel Etki: Şu anda temkinli bir iyimserlik hakim ve bu durum kademeli fiyat artışını destekleyebilir.

Makroekonomik Ortam

- Para Politikası: Merkez bankalarının faiz ve parasal genişleme politikaları GTAI'nin değerini belirgin şekilde etkileyebilir.

- Enflasyona Karşı Koruma: GTAI, enflasyonist ortamlarda cazibesini artırabilecek bir koruma aracı olma potansiyeli göstermiştir.

- Jeopolitik Etkiler: Uluslararası gelişmeler ve ekonomik politikalar, küresel risk iştahı ve GTAI talebini etkiler.

Teknolojik Gelişim ve Ekosistem Geliştirme

- Protokol Yükseltmeleri: GTAI protokolüne yapılacak önemli güncellemeler işlevselliği artırarak kullanıcı tabanını büyütebilir.

- Ekosistem Uygulamaları: GTAI ekosisteminde DApp ve diğer projelerin gelişimi, kullanım alanı ve talebi artırabilir.

III. GTAI 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,05116 - 0,09301 ABD doları

- Tarafsız tahmin: 0,09301 - 0,10557 ABD doları

- İyimser tahmin: 0,10557 - 0,11812 ABD doları (olumlu piyasa ve artan benimseme varsayımıyla)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan volatiliteyle büyüme dönemi

- Fiyat tahmini aralığı:

- 2027: 0,07212 - 0,17129 ABD doları

- 2028: 0,08702 - 0,16355 ABD doları

- Başlıca katalizörler: Teknolojik ilerleme, piyasa kabulünün yaygınlaşması, potansiyel iş birlikleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,15679 - 0,17718 ABD doları (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,17718 - 0,19756 ABD doları (olumlu piyasa koşulları ve artan kullanım ile)

- Dönüştürücü senaryo: 0,19756 - 0,22000 ABD doları (çığır açan yenilikler ve geniş çaplı benimseme ile)

- 31 Aralık 2030: GTAI 0,19135 ABD doları (yıl sonu hedefi, piyasa dinamiklerine bağlıdır)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11812 | 0.09301 | 0.05116 | 0 |

| 2026 | 0.15202 | 0.10557 | 0.06123 | 13 |

| 2027 | 0.17129 | 0.12879 | 0.07212 | 38 |

| 2028 | 0.16355 | 0.15004 | 0.08702 | 61 |

| 2029 | 0.19756 | 0.15679 | 0.08624 | 68 |

| 2030 | 0.19135 | 0.17718 | 0.12757 | 90 |

IV. GTAI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GTAI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Değer yatırımcıları ve yapay zekâya inananlar

- Uygulama önerileri:

- Piyasa düşüşlerinde GTAI token biriktirin

- GT-Protocol’ün potansiyelini görmek için en az 1-2 yıl bekleyin

- Token’larınızı güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemede kullanılır

- RSI: Aşırı alım veya aşırı satış bölgelerini tespit etmeye yardımcı olur

- Dalgalı al-sat için önemli noktalar:

- Piyasa duyarlılığı ile AI ve Web3 haber akışını izleyin

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

GTAI Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı farklı kripto varlık ve segmentlere yayarak çeşitlendirin

- Zarar durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Yazılım cüzdanı: Resmi GT-Protocol cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulaması, güçlü şifreler ve güncel yazılım kullanımı

V. GTAI İçin Potansiyel Riskler ve Zorluklar

GTAI Piyasa Riskleri

- Volatilite: Kripto piyasalarında yaygın olan yüksek fiyat dalgalanmaları

- Rekabet: Yeni çıkan AI ve Web3 projeleri GTAI'nin pazar payını azaltabilir

- Likitide: Düşük işlem hacmi fiyat istikrarını olumsuz etkileyebilir

GTAI Düzenleyici Riskleri

- Düzenleyici belirsizlik: Farklı ülkelerde değişen regülasyonlar GTAI'nin faaliyetlerini etkileyebilir

- Uyum zorlukları: Uluslararası regülasyonlara uyumda yaşanabilecek güçlükler

- Yasal statü: Bazı ülkelerde menkul kıymet olarak sınıflandırılma riski

GTAI Teknik Riskleri

- Akıllı sözleşme açıkları: Kodda oluşabilecek hatalar veya güvenlik açıkları

- Ölçeklenebilirlik problemleri: Kullanıcı sayısı ve ağ yükü arttıkça ortaya çıkabilecek zorluklar

- Entegrasyon karmaşıklıkları: Mevcut Web2 ve Web3 platformlarıyla sorunsuz entegrasyonun sağlanması

VI. Sonuç ve Eylem Önerileri

GTAI Yatırım Değeri Değerlendirmesi

GT-Protocol, CeFi, DeFi ve NFT piyasalarında yapay zekâ tabanlı portföy yönetimi ve alım-satımda büyük bir dönüşüm potansiyeline sahip. AI ve Web3 sektörlerindeki uzun vadeli büyüme fırsatlarına rağmen, yatırımcılar kısa vadeli volatiliteye ve erken aşama risklere karşı dikkatli olmalı.

GTAI Yatırım Önerileri

✅ Yeni başlayanlar: Küçük yatırımlar ile başlayarak teknoloji bilgisini artırın ✅ Deneyimli yatırımcılar: Risk toleransına göre portföylerinin belirli bir bölümünü ayırmayı değerlendirsin ✅ Kurumsal yatırımcılar: Kapsamlı analizle GTAI’yi çeşitlendirilmiş kripto stratejilerine dahil etmeyi göz önünde bulundursun

GTAI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden GTAI token alım-satımı

- Staking: GT-Protocol tarafından sunuluyorsa staking programları

- DeFi entegrasyonu: Uygun olduğunda GTAI token ile DeFi fırsatlarını değerlendirme

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

GRT 10 ABD dolarına ulaşabilir mi?

GRT'nin 2025’te 10 ABD dolarına ulaşması beklenmez; tahminler bu seviyenin 2030’a kadar hedeflenebileceğini gösteriyor. Mevcut piyasa trendleri ve öngörüler, kısa vadede GRT'nin 10 ABD dolarına ulaşmasını desteklemiyor.

GTAI kripto nedir?

GTAI, kripto alım-satım ve yatırım stratejilerinde yapay zekâ kullanan merkeziyetsiz bir uygulamadır ve yatırım kararlarını geliştirmek için blokzincir altyapısı üzerinde çalışır.

2025’te hangi meme coin patlama yapar (fiyat tahmini)?

Shiba Inu'nun, güçlü topluluk desteği ve viral etkisi ile 2025’te fiyatında patlama yapacağı öngörülüyor. Sürdürülebilir ilgi ve piyasa dinamikleri popülerliğini koruyor.

Gravity kriptonun geleceği var mı?

Gravity kriptonun geleceği belirsizdir; 2025-2030 döneminde 0,005685 ABD doları seviyesine ulaşabileceği tahmin ediliyor. Uzun vadeli başarısı, genel piyasa koşulları ve teknolojik ilerlemelere bağlıdır.

AI kripto tokenleri nedir: 2025'in En İyi Seçimleri

Proje Omega Hisse Gerçek mi? Yatırımcıların Bilmesi Gerekenler

2025 GLM Fiyat Tahmini: Chatllama Token’ın Değerlemesine Yön Veren Temel Faktörler ve Piyasa Trendlerinin Analizi

2025 OORT Fiyat Tahmini: Gelecekteki Trendler, Piyasa Analizi ve Merkeziyetsiz Depolama Tokenı İçin Yatırım Perspektifi

WLD vs GRT: Merkeziyetsiz Finans Alanında Kripto Hakimiyeti Yarışı

WSDM Nedir: Web Arama ve Veri Madenciliğinin Temellerini Keşfetmek

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi