2025 GST Fiyat Tahmini: Green Satoshi Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: GST'nin Piyasa Konumu ve Yatırım Değeri

Green Satoshi Token (GST), move-to-earn ekosisteminin ana unsurlarından biri olarak faaliyete geçtiğinden bu yana önemli mesafeler kat etti. 2025 yılı itibarıyla GST'nin piyasa değeri 2.619.814 $ seviyesinde olup, dolaşımdaki arzı yaklaşık 1.147.161.857 token ve fiyatı 0,002264 $ civarındadır. "Fitness teşvik token'ı" olarak da bilinen bu varlık, fiziksel aktivitenin oyunlaştırılması ve sağlıklı yaşamın teşviki süreçlerinde giderek daha stratejik bir rol üstleniyor.

Bu makalede, 2025-2030 yılları arasında GST'nin fiyat dinamikleri; tarihsel eğilimler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik etkenlerle birlikte detaylı şekilde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GST Fiyat Geçmişi ve Güncel Piyasa Görünümü

GST'nin Tarihsel Fiyat Gelişimi

- 2022: STEPN’in piyasaya çıkışı, 29 Nisan'da 8,51 $ ile tüm zamanların en yüksek seviyesine ulaşıldı

- 2023: Piyasa konsolidasyonu, fiyat 0,1 $ ile 0,5 $ aralığında dalgalandı

- 2024: Ayı piyasası döngüsü, fiyat 0,1 $’dan 0,01 $’a düştü

GST Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla GST, 0,002264 $ seviyesinde işlem görüyor ve 24 saatlik işlem hacmi 16.328,89 $ olarak kaydedildi. Token son 24 saatte %5,01, son bir saatte ise %6,94 yükseldi. Ancak, uzun vadede ciddi kayıplar yaşandı; son bir haftada %13,99, son 30 günde %24,93, son bir yılda ise %55,64 düşüş görüldü. Mevcut fiyat, 29 Nisan 2022’de kaydedilen 8,51 $'lık zirve seviyesinin %99,97 altında. GST'nin piyasa değeri 2.597.174 $ ve kripto para piyasasında 2184. sırada yer alıyor.

Güncel GST piyasa fiyatını görmek için tıklayın

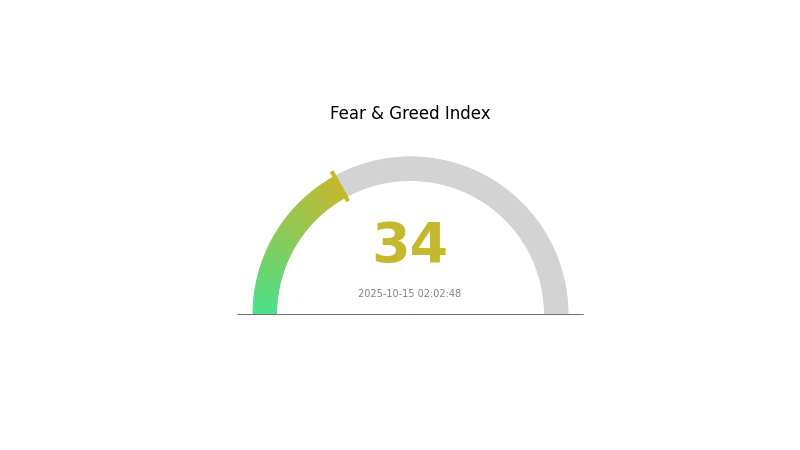

GST Piyasa Duyarlılık Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli davrandığını gösteriyor. Böyle dönemlerde bazı yatırımcılar, "Başkaları açgözlü iken korkak, başkaları korkak iken açgözlü ol" prensibine göre hareket ederek fırsat görebilir. Ancak, yatırım kararı almadan önce mutlaka kendi risk profilinizi değerlendirin ve kapsamlı bir araştırma yapın. Bilgili kalın ve Gate.com’da sorumlu işlem yapın.

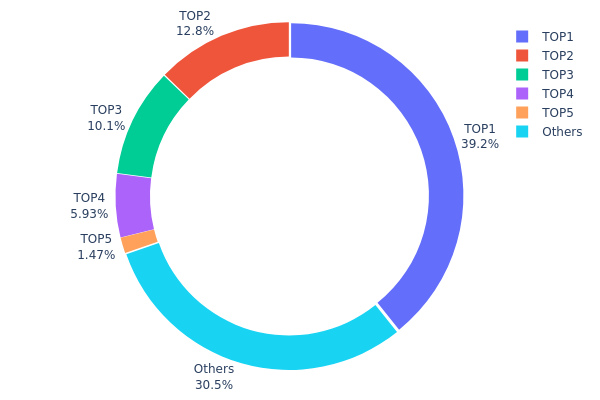

GST Varlık Dağılımı

GST'nin adres varlık dağılımı, sahipliğin yüksek oranda yoğunlaştığını gösteriyor. En büyük adres toplam arzın %39,21’ini elinde bulundururken, ilk beş adres tüm GST token’larının %69,52’sini kontrol ediyor. Bu denli yoğunlaşmış yapı, GST ekosisteminde merkezileşme riskini artırıyor.

Böyle bir yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu açısından endişe yaratıyor. Token’ların yaklaşık %40’ının tek bir adreste olması, bu adresten yapılacak büyük işlemlerin ciddi fiyat dalgalanmalarına neden olabileceği anlamına geliyor. Ayrıca, ilk beş adres toplam arzın üçte ikisinden fazlasını elinde bulundurduğu için küçük yatırımcılar aleyhine koordineli piyasa hareketleri riski oluşabilir.

Bu konsantrasyon, GST'nin mevcut zincir üstü yapılanmasının kripto piyasasındaki ideal desantralizasyon düzeyinden uzak olduğunu gösteriyor. Bu durum, ağın dayanıklılığını zayıflatabilir ve büyük sahipler yönetişimde orantısız etkiye sahip olursa karar alma süreçlerini etkileyebilir. Gelecekteki piyasa dinamiklerini anlamak ve GST'nin uzun vadeli istikrarını değerlendirmek adına üst adreslerin davranışlarını izlemek kritik önemdedir.

Güncel GST Varlık Dağılımı için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x5566...415432 | 83.135,36K | 39,21% |

| 2 | 0x7760...0eb0d2 | 27.119,65K | 12,79% |

| 3 | 0x0d07...b492fe | 21.486,70K | 10,13% |

| 4 | 0xba5a...d8f6a9 | 12.569,36K | 5,92% |

| 5 | 0x08b6...73054c | 3.118,88K | 1,47% |

| - | Diğerleri | 64.548,62K | 30,48% |

II. Gelecekteki GST Fiyatlarını Etkileyecek Temel Faktörler

Arz Mekanizması

- GST Reformu: Hindistan hükümeti, 22 Eylül 2025’te yürürlüğe girecek yeni nesil GST reformunu hayata geçirmeye hazırlanıyor. Yaklaşık 400 ürün için vergi oranları düşürülerek yurt içi tüketimin canlandırılması hedefleniyor.

- Tarihsel Eğilimler: Önceki GST reformları, Hindistan’da tüketim harcamaları ve ekonomik büyümede artış sağlamıştır.

- Güncel Etki: Özellikle binek araçlarda vergi oranının %28’den %18’e düşmesi, otomobil fiyatlarının daha uygun hale gelmesini ve birçok sektörde tüketimin artmasını bekleniyor.

Kurumsal ve Büyük Oyuncu Dinamikleri

- Kurumsal Varlıklar: Uluslararası kredi derecelendirme kuruluşu S&P, Hindistan’ın kredi notunu “BBB-”den “BBB”ye yükselterek ülkenin ekonomik temellerine olan güveni teyit etti.

- Kurumsal Benimseme: Büyük otomotiv şirketleri, özellikle elektrikli araç segmentinde GST reformlarından faydalanmak için stratejilerini yeniden şekillendiriyor.

- Ulusal Politikalar: Hindistan hükümeti, zor durumdaki yerli ihracatçılara destek sağlarken, ihracat üzerindeki etkileri azaltmak amacıyla vergi indirimi seçeneklerini değerlendiriyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Hindistan Merkez Bankası, yıl içinde faiz oranlarını 100 baz puan indirdi; enflasyonun kontrol altına alınması sayesinde yıl sonuna kadar ilave faiz indirimleri bekleniyor.

- Enflasyondan Korunma Özellikleri: GST reformları, temel ürünlerin fiyatlarını daha uygun hale getirerek enflasyonla mücadeleye katkı sağlıyor.

- Jeopolitik Faktörler: Hindistan, AB ve İngiltere başta olmak üzere farklı ülkelerle ticaret anlaşmaları imzalayarak dış ticaretini çeşitlendiriyor ve tek bir pazara bağımlılığını azaltıyor.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Dijital Entegrasyon: Elektronik fatura ve dijital vergi yönetimi platformlarının uygulanması, vergi uyumunu artırıyor ve idari yükü azaltıyor.

- Ekonomik Reformlar: “Beş vergi bir arada” yaklaşımı dahil, dolaylı vergilendirmede yapılan reformlar vergi sisteminin sadeleşmesini ve iş yapma kolaylığının artmasını sağlıyor.

- Ekosistem Uygulamaları: Hindistan’da borsada işlem gören şirketler arasında önemli paya sahip finans ve tüketici sektörleri, bu reformlardan yararlanarak büyüme potansiyeli taşıyor.

III. 2025-2030 GST Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00115 $ - 0,00226 $

- Nötr tahmin: 0,00226 $ - 0,00251 $

- İyimser tahmin: 0,00251 $ - 0,00276 $ (move-to-earn alanında sürekli büyüme gerektirir)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Konsolidasyon ve büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,00208 $ - 0,00348 $

- 2028: 0,00242 $ - 0,00433 $

- Temel katalizörler: Move-to-earn uygulamalarının yaygınlaşması ve GST ekosisteminde teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00325 $ - 0,00404 $ (istikrarlı piyasa büyümesi ve kullanıcı kabulü varsayımıyla)

- İyimser senaryo: 0,00404 $ - 0,00493 $ (move-to-earn pazarında hızlı büyüme koşuluyla)

- Dönüştürücü senaryo: 0,00493 $+ (move-to-earn kavramının ana akımda tam olarak yer bulması gibi çok olumlu şartlarda)

- 31 Aralık 2030: GST 0,00404 $ (2025 seviyesine göre %78 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00276 | 0,00226 | 0,00115 | 0 |

| 2026 | 0,00344 | 0,00251 | 0,00151 | 10 |

| 2027 | 0,00348 | 0,00298 | 0,00208 | 31 |

| 2028 | 0,00433 | 0,00323 | 0,00242 | 42 |

| 2029 | 0,00431 | 0,00378 | 0,00325 | 66 |

| 2030 | 0,00493 | 0,00404 | 0,00226 | 78 |

IV. GST Profesyonel Yatırım Stratejisi ve Risk Yönetimi

GST Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Move-to-earn alanında uzun vadeli büyüme arayan yatırımcılar

- Öneriler:

- Piyasa gerilemelerinde GST biriktirin

- STEPN ekosisteminde yer alarak ek ödüller kazanın

- Token'ları saklayıcı olmayan güvenli cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve giriş/çıkış noktalarını belirleyin

- RSI: Aşırı alım/aşırı satım bölgelerini takip edin

- Dalgalı işlem için ana başlıklar:

- Net stop-loss ve kar alma seviyeleri belirleyin

- STEPN ekosistemi güncellemelerini ve kullanıcı artışını yakından takip edin

GST Risk Yönetimi Çerçevesi

(1) Varlık Dağıtım İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları farklı move-to-earn projelerine yaymak

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama: Uzun vadeli varlıklar için donanım cüzdanları kullanın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü parola kullanımı

V. GST için Potansiyel Riskler ve Zorluklar

GST Piyasa Riskleri

- Yüksek oynaklık: GST fiyatında ciddi dalgalanmalar görülebilir

- Rekabet: Yeni move-to-earn projeleri STEPN’in pazar payını azaltabilir

- Kullanıcı ilgisi: Move-to-earn uygulamalarına olan ilginin azalması token değerini olumsuz etkileyebilir

GST Regülasyon Riskleri

- Belirsiz regülasyonlar: Move-to-earn projelerine karşı düzenleyici müdahaleler ihtimali

- Vergilendirme: Kazanılan token’ların vergilendirilmesiyle ilgili net olmayan durumlar

- Bölgesel kısıtlamalar: Bazı ülkelerde STEPN kullanımı kısıtlanabilir veya yasaklanabilir

GST Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hack riski

- Ölçeklenebilirlik: STEPN ağı yoğun kullanımda tıkanıklık yaşayabilir

- Mobil cihaz bağımlılığı: Akıllı telefondaki teknik sorunlar kullanımda kesinti yaratabilir

VI. Sonuç ve Eylem Önerileri

GST Yatırım Değeri Değerlendirmesi

GST, move-to-earn alanında farklı bir potansiyel sunuyor ancak yüksek volatilite ve benimseme engelleriyle karşı karşıya. STEPN'in inovasyonlarını sürdürmesi halinde uzun vadede potansiyel var, ancak kısa vadeli riskler yüksektir.

GST Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, STEPN ekosistemini öğrenmeye öncelik verin ✅ Deneyimli yatırımcılar: Tutma ve aktif işlem stratejilerini dengeleyin ✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapın, STEPN ile iş birliği fırsatlarını değerlendirin

GST İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden GST alıp satın

- Staking: Mümkünse GST staking programlarına katılın

- Uygulama içi kazanç: STEPN uygulamasında fiziksel aktiviteyle GST kazanın

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

GST 1 $’a ulaşır mı?

GST'nin yakın vadede 1 $ seviyesine ulaşması beklenmemektedir. Mevcut öngörüler, kısa sürede bu değerin yakalanamayacağını gösteriyor. Uzun vadeli projeksiyonlar ise belirsizliğini koruyor.

GST iyi bir yatırım mı?

GST, move-to-earn projelerine yatırım yapmak isteyenler için iyi bir seçenek olabilir. Fitness ve kripto alanında büyüme potansiyeli, kripto portföylerini çeşitlendirmek isteyenler için GST’yi cazip kılıyor.

GST ne kadar yükselebilir?

Mevcut piyasa beklentilerine ve büyüme trendlerine göre GST, 2024 sonunda 0,0380 $’a, 2025’te ise 0,0513 $’a kadar ulaşabilir.

GST token iyi bir yatırım mı?

GST token’ın yatırım potansiyeli belirsizliğini koruyor. Ciddi değer kaybı yaşanmasına rağmen, son piyasa hareketleri kısmi bir toparlanma sinyali veriyor; bu nedenle risk seven yatırımcılar için spekülatif ama kazanç potansiyeli olan bir seçenek olabilir.

Undeads Games (UDS) iyi bir yatırım mı?: Bu Blockchain oyun token’inin potansiyeli üzerine bir analiz

StepN (GMT) iyi bir yatırım mı?: Move-to-earn kripto projesinin potansiyeli ve riskleri üzerine analiz

2025 CATI Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Catizen (CATI) iyi bir yatırım mı?: Bu kedi temalı kripto paranın potansiyelini ve risklerini inceliyoruz

2025 FITFI Fiyat Tahmini: Değişken kripto piyasasında Fitness-to-Earn tokenlarının geleceğinde yol haritası çizmek

2025 LOA Fiyat Tahmini: Yükseliş Eğilimleri ve Token’ın Gelecekteki Değerini Belirleyen Temel Faktörler

Blockchain Hashing'i Anlamak: Web3 Meraklılarına Yönelik Kapsamlı Rehber

Bitcoin'in Proof of Work (İş Kanıtı) Konsensüs Mekanizmasını Anlamak

DeFi'de Flash Loan'ların Mekanizması ve Sağladığı Avantajlar

Seed Phrase’lerin Güvenli Kullanımı: Web3’te Kapsamlı Bir Rehber

Ücretsiz Dogecoin’i Kazanın: Harcama Yapmadan Madencilik İçin İpuçları