2025 GM Fiyat Tahmini: General Motors Hissesi İçin Piyasa Trendleri ve Gelecek Beklentilerinin Analizi

Giriş: GM'in Piyasadaki Konumu ve Yatırım Değeri

Gomble (GM), Web3 oyun ekosisteminin tokeni olarak kurulduğu günden bu yana önemli mesafe kat etti. 2025 yılı itibarıyla GM'in piyasa değeri 2.776.551 $ seviyesine ulaşırken, yaklaşık 276.026.637 dolaşımdaki token ile fiyatı yaklaşık 0,010059 $ civarında seyrediyor. "Proof of SQUAD" altyapısıyla bilinen bu varlık, sosyal oyunlar ve Web3 oyun geliştirme sektörlerinde giderek daha stratejik bir rol üstleniyor.

Bu makalede, GM'in 2025-2030 arasındaki fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar ışığında analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GM Fiyat Geçmişi ve Güncel Piyasa Durumu

GM Tarihsel Fiyat Seyri

- 2025 Mayıs: GM, 0,063288 $ ile tüm zamanların en yüksek seviyesine ulaşarak önemli bir kilometre taşı kaydetti.

- 2025 Eylül: Token, 0,006004 $ ile en düşük seviyesini gördü ve güçlü bir piyasa düzeltmesi yaşandı.

GM Güncel Piyasa Görünümü

GM şu anda 0,010059 $ seviyesinden işlem görüyor ve son 24 saatte %1,58 oranında değer kaybetti. Token, 24 saatte 17.679,17 $ işlem hacmiyle yüksek volatilite gösterdi. GM'in piyasa değeri 2.776.551,95 $ olup, kripto para piyasasında 2.155. sırada bulunuyor.

GM, zirvesinden %84,11 aşağıda, dip seviyesinden ise %67,54 yukarıda seyrediyor. Son bir haftada %16,21'lik sert bir düşüş sergileyerek kısa vade için negatif bir ivme gösterdi. Son 30 günde ise fiyat %13,58 azaldı ve bu, devam eden bir aşağı yönlü trendi yansıtıyor.

Dolaşımdaki GM arzı 276.026.637,77 token olup, toplam 1 milyar adetlik arzın %27,7'sini oluşturuyor. Tam seyreltilmiş piyasa değeri 10.059.000 $ olarak hesaplanıyor.

Son dönemdeki fiyat gerilemesine rağmen, GM 4 borsada listelenmeye devam ediyor ve 24.755 kişilik geniş bir yatırımcı tabanına sahip.

Güncel GM piyasa fiyatını görmek için tıklayın

GM Piyasa Duygu Göstergesi

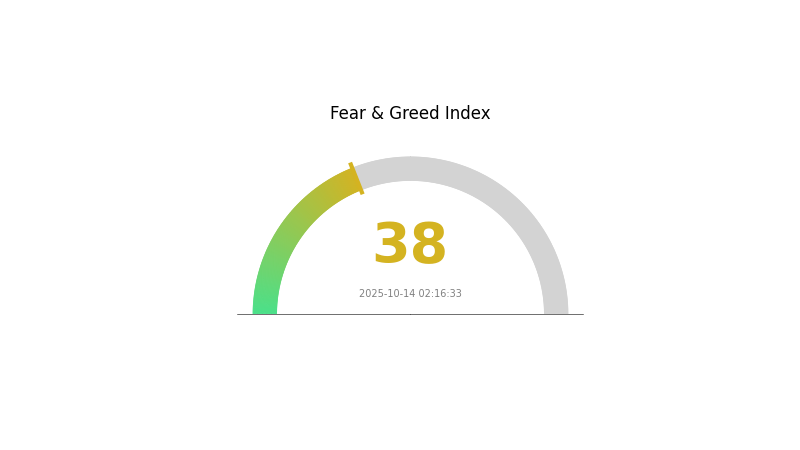

2025-10-14 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcıların temkinli olduğunu ve büyük hamlelerden kaçındığını gösteriyor. Böyle dönemlerde bazı yatırımcılar "diğerleri korkarken açgözlü ol" ilkesine göre pozisyon almayı fırsat olarak görebilir. Ancak, kapsamlı araştırma yapmak ve riskleri etkin şekilde yönetmek büyük önem taşır. Gate.com, bu belirsiz ortamda yatırımcılara yol gösterecek kapsamlı analiz ve araçlar sunar.

GM Varlık Dağılımı

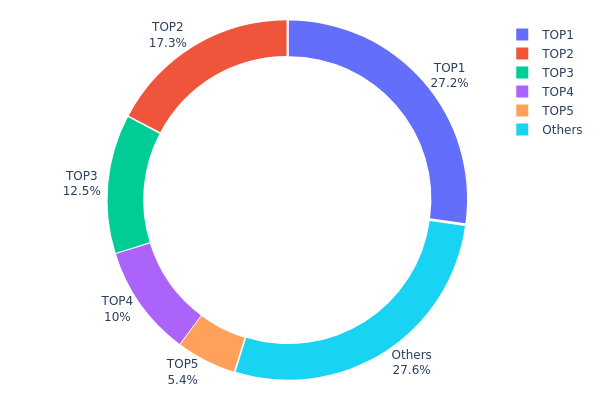

Adres bazında varlık dağılımı, GM tokenlerinin farklı cüzdanlarda ne kadar yoğunlaştığını ortaya koyar. Analizler, toplam arzın %72,39'unun ilk beş adreste toplandığını ve büyük bir yoğunlaşma olduğunu gösteriyor. En büyük sahip %27,18 ile başı çekerken, ikinci en büyük adres %17,31 ile onu izliyor ve bu da dolaşımdaki arz üzerinde belirleyici bir etki yaratıyor.

Böylesi bir yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı konusunda endişelere neden olur. Tokenlerin önemli bir kısmının az sayıda adreste toplanması, büyük satış ya da transferlerde piyasada keskin dalgalanmalara yol açabilir. Ayrıca, eğer token bazlı bir yönetişim yapısı varsa, bu merkezileşme karar alma süreçlerini etkileyebilir.

Buna karşın, toplam GM arzının %27,61'i diğer adreslerde bulunuyor; bu da bir miktar daha yaygın piyasa katılımı olduğunu gösteriyor. Ancak mevcut yapı, merkeziyetsizliğin düşük olduğunu ve büyük yatırımcıların başlatabileceği sert piyasa hareketlerine karşı tokenin kırılgan olabileceğini gösteriyor.

Güncel GM Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x33bc...789945 | 271.840,03K | 27,18% |

| 2 | 0x8c3a...8eaeb8 | 173.133,33K | 17,31% |

| 3 | 0x49ea...698493 | 125.000,00K | 12,50% |

| 4 | 0xc4c4...fc1c2f | 100.000,00K | 10,00% |

| 5 | 0xcebc...eafefb | 54.000,00K | 5,40% |

| - | Diğerleri | 276.026,64K | 27,61% |

II. GM'in Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Sabit Arz: GM'in toplam arzı sınırlı; bu durum kıtlık yaratarak fiyat üzerinde zamanla baskı oluşturabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Bazı şirketlerin GM'i çeşitli uygulamalarda kullanmaya ilgi göstermesi, talep ve fiyat dinamiklerini etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: GM, diğer kripto varlıklar gibi enflasyona karşı potansiyel bir koruma olarak değerlendirilebilir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Ekosistem Uygulamaları: GM, çeşitli merkeziyetsiz uygulamalara (DApp) ve blokzincir projelerine entegre edilerek kullanım alanını ve potansiyel kullanıcı tabanını genişletiyor.

III. GM 2025-2030 Fiyat Öngörüleri

2025 Görünümü

- Ihtiyatlı tahmin: 0,00905 $ - 0,01006 $

- Tarafsız tahmin: 0,01006 $ - 0,01031 $

- İyimser tahmin: 0,01031 $ - 0,01056 $ (pozitif piyasa duyarlılığı gerekli)

2027-2028 Görünümü

- Piyasa beklentisi: Büyüme fazı olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,00596 $ - 0,01574 $

- 2028: 0,01119 $ - 0,01740 $

- Temel tetikleyiciler: Artan benimseme, piyasa toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01632 $ - 0,01876 $ (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,01876 $ - 0,02514 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,02514 $ üstü (aşırı olumlu piyasa koşullarında)

- 2030-12-31: GM 0,02514 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,01056 | 0,01006 | 0,00905 | 0 |

| 2026 | 0,01217 | 0,01031 | 0,00856 | 2 |

| 2027 | 0,01574 | 0,01124 | 0,00596 | 11 |

| 2028 | 0,0174 | 0,01349 | 0,01119 | 34 |

| 2029 | 0,02208 | 0,01544 | 0,00973 | 53 |

| 2030 | 0,02514 | 0,01876 | 0,01632 | 86 |

IV. GM İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GM Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Uzun vade odaklı ve risk toleransı yüksek yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde GM biriktirin

- Fiyat hedefleri belirleyin, plana sadık kalın

- Tokenleri kişisel cüzdanınızda güvenle saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit edin

- RSI: Aşırı alım/satım koşullarını takip edin

- Swing trading için temel noktalar:

- Risk yönetimi için zarar durdur emirleri kullanın

- Belirlediğiniz seviyelerde kar alın

GM Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Farklı kripto varlıklara yatırım yapın

- Zarar durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Seçenekleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama kullanın, özel anahtarınızı çevrimdışı saklayın

V. GM İçin Olası Riskler ve Zorluklar

GM Piyasa Riskleri

- Volatilite: Kripto piyasalarında sık görülen ani fiyat dalgalanmaları

- Likitide: Büyük işlemlerde likidite bulmakta zorluk yaşanabilir

- Rekabet: Diğer oyun tokenleri GM'in pazar payını etkileyebilir

GM Regülasyon Riskleri

- Belirsiz düzenlemeler: Değişen kripto politikaları GM'in faaliyetlerini etkileyebilir

- Sınır ötesi uyum: Farklı ülkelerdeki regülasyonlara uyum sağlama gerekliliği

- Vergilendirme: Kripto varlıklar için değişen vergi mevzuatı

GM Teknik Riskler

- Akıllı kontrat açıkları: Güvenlik zafiyetleri veya yazılım hataları

- Ölçeklenebilirlik: Yoğun kullanımda ağ tıkanıklığı riski

- Birlikte çalışabilirlik: Diğer blokzincirlerle entegrasyon sorunları

VI. Sonuç ve Eylem Önerileri

GM Yatırım Değeri Değerlendirmesi

GM, başarılı bir mobil oyun şirketinin desteğiyle Web3 oyun sektöründe öne çıkan bir fırsat sunuyor. Ancak, kripto piyasasındaki yüksek volatilite ve regülasyon belirsizliklerinin yatırımcılar tarafından mutlaka göz önünde bulundurulması gerekir.

GM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp bilgi edinmeye odaklanmalı

✅ Deneyimli yatırımcılar: Maliyet ortalaması yapmalı ve net çıkış stratejileri belirlemeli

✅ Kurumsal yatırımcılar: Derinlemesine analiz yapmalı, büyük işlemler için OTC (tezgahüstü) seçeneklerini değerlendirmeli

GM Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com'da GM token alım-satımı

- Staking: Uygunsa staking programlarına katılım

- DeFi entegrasyonu: GM token ile merkeziyetsiz finans çözümlerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

GM için 2025 fiyat hedefi nedir?

Piyasa eğilimleri ve uzman tahminlerine göre, GM'in 2025 fiyat hedefi yaklaşık 0,15 $ ile 0,20 $ arasında öngörülmektedir.

GM şu anda iyi bir yatırım mı?

Evet, GM 2025 yılı için umut vadediyor. Yükselen benimseme ve pozitif piyasa havası ile web3 alanında yer almak isteyenler için cazip bir yatırım fırsatı sunabilir.

GM hissesi neden düşüyor?

GM hissesi, piyasa oynaklığı, sektörle ilgili zorluklar veya şirkete özgü gelişmeler nedeniyle düşüş yaşayabilir. Ekonomik belirsizlik, rekabet veya tüketici eğilimlerindeki değişiklikler de etkili olabilir.

GM'in şimdiye kadar ulaştığı en yüksek hisse fiyatı nedir?

GM'in en yüksek hisse fiyatı, piyasa oynaklığı ve ekonomik gelişmeler öncesinde, 7 Ocak 2022'de 67,21 $ olarak kaydedildi.

2025 B3 Fiyat Tahmini: Uzman Analizi ve Brezilya Borsası Performansına Yönelik Tahmin

Xterio (XTER) İyi Bir Yatırım mı?: Web3 oyun token pazarında performans, potansiyel ve riskleri analiz etmek

2025 MATR1X Fiyat Tahmini: Dijital Varlık Pazarında Gelecek Trendler ve Potansiyel Büyüme Analizi

The Game Company (GMRT) iyi bir yatırım mı?: Mobil oyun sektöründe yükselen bu şirketin potansiyelini değerlendiriyoruz

2025 BEAT Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

2025 PORTAL Fiyat Tahmini: Gelişmekte Olan Blockchain Platformu İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025