2025 GAS Price Prediction: Navigating the Future of Energy Costs in an Evolving Market

Introduction: GAS's Market Position and Investment Value

Gas (GAS), as the fuel token for the NEO blockchain network, has played a crucial role since its inception in 2017. As of 2025, Gas has achieved a market capitalization of $155,768,938, with a circulating supply of approximately 65,093,580 tokens and a price hovering around $2.393. This asset, often referred to as the "lifeblood of NEO," is playing an increasingly vital role in powering smart contracts and transactions within the NEO ecosystem.

This article will provide a comprehensive analysis of Gas's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GAS Price History Review and Current Market Status

GAS Historical Price Evolution Trajectory

- 2018: GAS reached its all-time high of $91.94 on January 15, 2018

- 2020: GAS hit its all-time low of $0.621309 on March 13, 2020

- 2024: GAS experienced significant price fluctuations, dropping from around $4.30 to $2.39

GAS Current Market Situation

As of November 16, 2025, GAS is trading at $2.393, with a market capitalization of $155,768,938. The token has seen a 1.61% increase in the last 24 hours, but has experienced a decline of 5.14% over the past week and 7.09% over the last month. The current price represents a significant 44.21% decrease from a year ago. The circulating supply of GAS is 65,093,580.54 tokens, with no maximum supply limit. GAS currently ranks 293rd in the cryptocurrency market, with a market dominance of 0.0045%.

Click to view the current GAS market price

GAS Market Sentiment Indicator

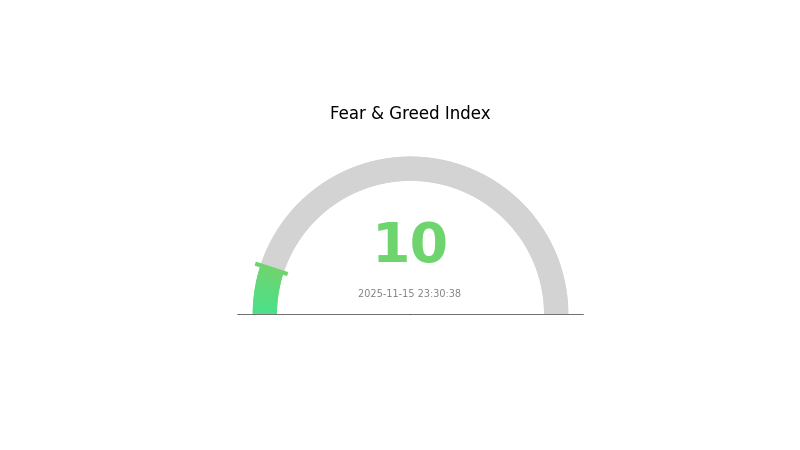

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 10. This indicates a highly pessimistic outlook among investors, potentially signaling oversold conditions. Historically, such extreme fear levels have often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should carefully assess risks and consider dollar-cost averaging strategies in this uncertain climate.

GAS Holdings Distribution

The address holdings distribution data for GAS reveals important insights into the token's ownership structure and market dynamics. While specific data points are not provided, we can analyze the general implications of such distributions.

Address holdings distribution typically shows the concentration of tokens among different wallet addresses. A healthy distribution would ideally show a diverse range of holders, with no single address or small group of addresses controlling a disproportionate amount of the total supply. This diversity is crucial for maintaining market stability and reducing the risk of price manipulation.

In the case of GAS, the distribution pattern could indicate the level of decentralization within the ecosystem. A well-distributed token suggests a more robust and resilient network, as it reduces the influence of large individual stakeholders. Conversely, a highly concentrated distribution might raise concerns about potential market volatility and the risk of large sell-offs impacting price stability.

Click to view the current GAS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting the Future Price of GAS

Supply Mechanism

- Fixed Supply: GAS has a fixed total supply, which creates scarcity and potentially supports long-term value.

- Historical Pattern: Limited supply has historically contributed to price stability and potential appreciation during periods of increased demand.

- Current Impact: The fixed supply continues to provide a foundation for potential price growth as adoption and utility increase.

Institutional and Whale Dynamics

- Enterprise Adoption: Some businesses are exploring NEO and GAS for smart contract and decentralized application development, which could drive demand.

Macroeconomic Environment

- Inflation Hedge Potential: As a digital asset with a fixed supply, GAS may be viewed as a hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- NEO N3: The upgrade to NEO N3 has improved the overall ecosystem, potentially increasing GAS utility and demand.

- Ecosystem Applications: The NEO ecosystem continues to develop decentralized applications and projects that utilize GAS, which could drive adoption and value.

III. GAS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.24 - $2.00

- Neutral prediction: $2.00 - $3.00

- Optimistic prediction: $3.00 - $3.47 (requires significant NEO ecosystem growth)

2026-2027 Outlook

- Market stage expectation: Consolidation and gradual growth

- Price range forecast:

- 2026: $1.76 - $3.02

- 2027: $2.35 - $3.06

- Key catalysts: Increased adoption of NEO smart contracts, DeFi expansion on NEO

2028-2030 Long-term Outlook

- Base scenario: $3.00 - $4.00 (assuming steady NEO network development)

- Optimistic scenario: $4.00 - $4.74 (with rapid NEO ecosystem expansion)

- Transformative scenario: $5.00+ (with major enterprise adoption and breakthrough use cases)

- 2030-12-31: GAS $3.91 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.4684 | 2.392 | 1.24384 | 0 |

| 2026 | 3.01811 | 2.9302 | 1.75812 | 22 |

| 2027 | 3.06338 | 2.97415 | 2.34958 | 24 |

| 2028 | 4.19608 | 3.01877 | 2.74708 | 26 |

| 2029 | 4.22069 | 3.60742 | 3.21061 | 50 |

| 2030 | 4.73601 | 3.91406 | 3.79663 | 63 |

IV. Professional Investment Strategies and Risk Management for GAS

GAS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NEO ecosystem supporters

- Operation suggestions:

- Accumulate GAS during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined price targets

GAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Use to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for GAS

GAS Market Risks

- High volatility: Significant price fluctuations are common

- Limited liquidity: Lower trading volume compared to major cryptocurrencies

- NEO ecosystem dependency: GAS value closely tied to NEO's success

GAS Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting GAS

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrency transactions

GAS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in NEO ecosystem

- Network congestion: Possible transaction delays during high activity periods

- Technological obsolescence: Risk of being overtaken by more advanced blockchain platforms

VI. Conclusion and Action Recommendations

GAS Investment Value Assessment

GAS offers potential long-term value as the utility token of the NEO ecosystem but faces short-term volatility and ecosystem-dependent risks.

GAS Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a balanced portfolio approach, including GAS for diversification

✅ Institutional investors: Conduct thorough due diligence on NEO ecosystem before significant allocation

Ways to Participate in GAS Trading

- Spot trading: Buy and sell GAS on Gate.com

- Staking: Participate in NEO staking to earn GAS rewards

- DeFi: Explore decentralized finance options within the NEO ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for gas prices?

Gas prices are expected to decrease by 10-15% in the next quarter due to network upgrades and improved scalability solutions.

Are gas prices expected to rise or fall?

Gas prices are expected to rise due to increasing network activity and demand for blockchain transactions in the coming years.

What is the future prediction for gas?

Gas prices are expected to become more efficient and predictable with Ethereum's ongoing upgrades, potentially decreasing costs for users in the long term.

How much would gas be in 2025?

Gas prices in 2025 are projected to be around 30-50 Gwei on average, with potential spikes during high network congestion periods.

Share

Content