2025 GAMEVIRTUAL Fiyat Tahmini: Dijital oyun ekonomisinde piyasa trendleri ve gelecekteki büyüme potansiyeli üzerine analiz

Giriş: GAMEVIRTUAL'ın Piyasa Konumu ve Yatırım Potansiyeli

GAME by Virtuals (GAMEVIRTUAL), kuruluşundan bu yana bağımsız oyun geliştiricileri için blokzincir tabanlı bir kitlesel fonlama platformu olarak konumlanmıştır. 2025 yılı itibarıyla GAMEVIRTUAL'ın piyasa değeri 16.970.000 $'a ulaşırken, dolaşımdaki token miktarı 1.000.000.000 ve fiyatı yaklaşık 0,01697 $ civarındadır. “Oyun geliştiricilerinin kitlesel fonlama tokenı” olarak tanımlanan bu varlık, oyun sektörü ve NFT piyasasında giderek daha etkili bir rol üstlenmektedir.

Bu makalede, GAMEVIRTUAL'ın 2025-2030 dönemi fiyat hareketleri; geçmiş fiyat verileri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar ışığında profesyonel tahminlerle analiz edilerek yatırımcılara stratejik yatırım yaklaşımları sunulacaktır.

I. GAMEVIRTUAL Fiyat Geçmişi ve Güncel Piyasa Durumu

GAMEVIRTUAL Fiyat Geçmişi

- 2024: Proje başlangıcı, fiyat 27 Aralık'ta tüm zamanların en yüksek seviyesi olan 0,715 $'ı gördü

- 2025: Piyasa düzeltmesi, fiyat 7 Nisan'da tüm zamanların en düşük seviyesi olan 0,0095 $'a indi

- 2025: Toparlanma süreci, fiyat mevcut seviye olan 0,01697 $'a yükseldi

GAMEVIRTUAL Güncel Piyasa Görünümü

GAMEVIRTUAL, şu anda 0,01697 $ seviyesinden işlem görmekte ve 24 saatlik işlem hacmi 19.245,76 $'dır. Token, son 24 saatte %1,61 ve son bir haftada %50,98 oranında yükseliş göstererek pozitif bir ivme yakalamıştır. Piyasa değeri 16.970.000 $ olup, kripto para sıralamasında 1.180. sıradadır. Dolaşımdaki token miktarı 1.000.000.000 olup, toplam ve maksimum arz da bu miktardır. Mevcut fiyat, tüm zamanların en yüksek seviyesine göre %97,63 gerilemiş, en düşük seviyesine göre ise %78,63 yükselmiştir. Tokenın piyasa hakimiyeti %0,00038 ile genel piyasada oldukça düşük bir paya sahiptir.

Mevcut GAMEVIRTUAL piyasa fiyatını görüntülemek için tıklayın

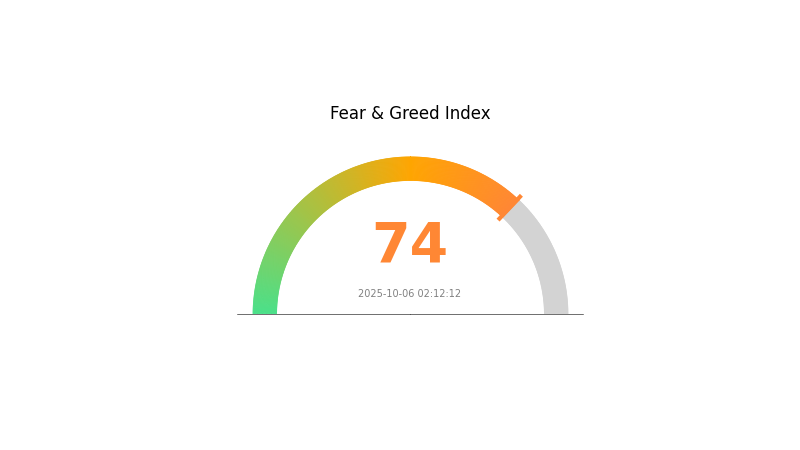

GAMEVIRTUAL Piyasa Duyarlılık Göstergesi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Mevcut Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda yoğun bir iyimserlik hâkim; Korku ve Açgözlülük Endeksi 74 ile güçlü bir açgözlülük atmosferi oluşmuştur. Bu durum, yatırımcıların yükseliş beklentisini artırırken, fiyatların yukarı yönlü hareket edebileceğine işaret eder. Ancak, bu tür aşırı duyarlılık seviyeleri sıkça piyasa düzeltmelerinin öncesinde görülür. Yatırımcıların temkinli davranması, kâr realizasyonu ve risk yönetimi stratejilerine odaklanması gereklidir. Piyasa duyarlılığı hızla değişebileceğinden, dengeli bir yaklaşım benimsemek bu dalgalı ortamda başarı için kritiktir.

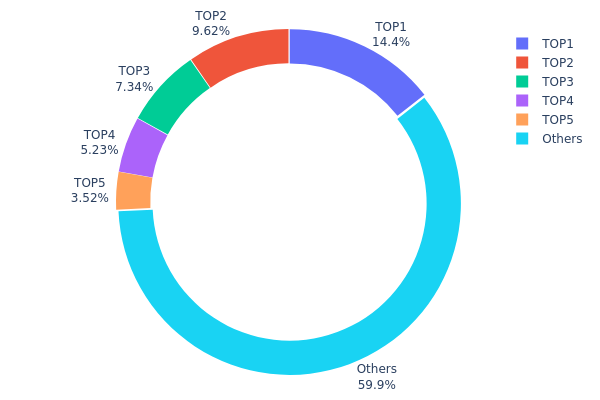

GAMEVIRTUAL Varlık Dağılımı

GAMEVIRTUAL adres varlık dağılımı verileri, orta düzeyde yoğunlaşmış bir sahiplik yapısı göstermektedir. İlk beş adres toplam arzın %40,11'ini elinde bulundururken, en büyük adres %14,40'lık bir paya sahiptir. Bu seviyedeki yoğunlaşma, büyük sahiplerin piyasada etkili olma potansiyeline işaret eder ancak tam merkezileşme anlamına gelmez.

Dağılım, büyük sahiplerle birlikte geniş bir küçük yatırımcı tabanının varlığına işaret etmekte; en büyük beş adres dışında kalanlar toplam tokenların %59,89'unu elinde tutmaktadır. Bu yapı, tekil aktör manipülasyonuna karşı kısmi direnç sağlarken, büyük yatırımcıların hareketlerinin fiyat üzerinde hâlâ etkili olabileceğini gösterir. Birden fazla büyük sahip, büyük işlemler veya sahiplik değişimlerinde volatilitenin artmasına neden olabilir.

Genel olarak, GAMEVIRTUAL'ın mevcut adres dağılımı, orta seviyede merkeziyetsiz bir yapıyı işaret etmektedir. Büyük sahiplerde belirgin bir yoğunlaşma olsa da, küçük adreslerde tutulan yüksek oran, piyasa istikrarı ve likidite açısından uzun vadede fayda sağlamaktadır.

Mevcut GAMEVIRTUAL Varlık Dağılımını görüntülemek için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xd418...5d7789 | 144.005,29K | 14,40% |

| 2 | 0xfad4...788e2e | 96.210,43K | 9,62% |

| 3 | 0x79b1...330099 | 73.384,75K | 7,34% |

| 4 | 0xe01b...ee3846 | 52.314,77K | 5,23% |

| 5 | 0xbaed...e9439f | 35.230,51K | 3,52% |

| - | Diğerleri | 598.633,62K | 59,89% |

II. GAMEVIRTUAL'ın Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Dinamikleri: GAMEVIRTUAL'ın fiyatı, blokzincir ve Web3 ekosistemindeki arz ve talep dengesiyle şekillenmektedir.

- Güncel Etki: Blokzincir ve Web3 sektörlerinde oluşan piyasa duyarlılığı ve güncel haber akışı, arz-talep dengesini belirgin şekilde etkileyebilir.

Teknik Gelişim ve Ekosistem Yapılanması

- Oyun Geliştirme: Oyun geliştirme maliyetleri, fiyatı etkileyen temel faktördür. Kaliteli çevrim içi oyunlar, yüksek insan kaynağı, materyal ve zaman yatırımı gerektirir.

- Teknolojik İlerlemler: Teknolojinin gelişmesi ve piyasa olgunlaşması ile birlikte, çevrim içi oyunlarda fiyatlandırma daha önemli hale gelmektedir.

- Kullanıcı Talebi: Kullanıcı ihtiyaçlarındaki değişim ve rekabet, çevrim içi oyun sektörünün büyümesini tetiklemektedir.

- Ekosistem Uygulamaları: GAMEVIRTUAL'ın ekosistemi içindeki merkeziyetsiz uygulamalardaki (DApp) rolü, değerini ve fiyatını doğrudan etkileyebilir.

III. GAMEVIRTUAL 2025-2030 Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,01526 $ - 0,01696 $

- Tarafsız tahmin: 0,01696 $ - 0,02000 $

- İyimser tahmin: 0,02000 $ - 0,02239 $ (güçlü piyasa toparlanması ve proje gelişmeleri ile)

2026-2027 Beklentisi

- Piyasa dönemi beklentisi: Konsolidasyon ve büyüme potansiyeli

- Fiyat aralığı öngörüleri:

- 2026: 0,01377 $ - 0,02125 $

- 2027: 0,01575 $ - 0,02660 $

- Belirleyici faktörler: Proje dönüm noktaları, genel kripto piyasası eğilimleri ve artan benimseme

2028-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,02293 $ - 0,03058 $ (istikrarlı piyasa büyümesi ve proje ilerlemesi varsayımıyla)

- İyimser senaryo: 0,03058 $ - 0,0425 $ (güçlü piyasa koşulları ve proje başarıları ile)

- Dönüştürücü senaryo: 0,0425 $ üstü (dikkat çekici proje atılımları ve yaygın benimseme)

- 31 Aralık 2030: GAMEVIRTUAL 0,0425 $ (iyimser öngörüye göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,02239 | 0,01696 | 0,01526 | 0 |

| 2026 | 0,02125 | 0,01967 | 0,01377 | 15 |

| 2027 | 0,0266 | 0,02046 | 0,01575 | 20 |

| 2028 | 0,02965 | 0,02353 | 0,02094 | 38 |

| 2029 | 0,03457 | 0,02659 | 0,0226 | 56 |

| 2030 | 0,0425 | 0,03058 | 0,02293 | 80 |

IV. GAMEVIRTUAL Profesyonel Yatırım Stratejisi ve Risk Yönetimi

GAMEVIRTUAL Yatırım Stratejisi

(1) Uzun Vadeli Tutma Modeli

- Uygun yatırımcı tipi: Yüksek risk toleranslı uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde GAMEVIRTUAL tokenları biriktirin

- Fiyat hedefleri oluşturup yatırımınızı düzenli olarak gözden geçirin

- Tokenlarınızı güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Modeli

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve olası giriş/çıkış noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım durumlarını takip edin

- Al-sat için önemli noktalar:

- Gamestarter platformu ile ilgili piyasa duyarlılığını ve haberleri izleyin

- Kesin stop-loss ve kar alma seviyeleri belirleyin

GAMEVIRTUAL Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla oyun ve NFT projesine dağıtın

- Stablecoin kullanımı: Piyasa zirvelerinde kârı stablecoinlere dönüştürün

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk cüzdan çözümü: Uzun vadeli saklama için donanım cüzdanları kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü parolalar ve düzenli yazılım güncellemeleri

V. GAMEVIRTUAL'a Yönelik Riskler ve Zorluklar

GAMEVIRTUAL Piyasa Riskleri

- Yüksek oynaklık: Oyun tokenlarında büyük fiyat dalgalanmaları yaşanabilir

- Rekabet: Blokzincir oyun platformlarının sayısının artması piyasa payını azaltabilir

- Piyasa duyarlılığı: Kripto piyasasındaki duyarlılık değişimleri GAMEVIRTUAL'ın fiyatını etkileyebilir

GAMEVIRTUAL Düzenleyici Riskler

- Belirsiz düzenlemeler: Oyun ve NFT alanında mevzuat değişikliği ihtimali

- Sınır ötesi uyum: Uluslararası mevzuata uyumda yaşanan zorluklar

- Vergi etkileri: Değişen vergi yasaları yatırımcıları ve platformu etkileyebilir

GAMEVIRTUAL Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda olası güvenlik açıkları veya hatalar

- Ölçeklenebilirlik sorunları: Gamestarter platformunda yoğun kullanıcı trafiği ile başa çıkma zorlukları

- Blokzincirler arası uyumluluk: Zincirler arası işlevsellikteki sınırlamalar büyümeyi zorlaştırabilir

VI. Sonuç ve Eylem Tavsiyeleri

GAMEVIRTUAL Yatırım Değeri Değerlendirmesi

GAMEVIRTUAL, blokzincir oyun sektöründe yüksek risk ve yüksek getiri potansiyeli sunar. Uzun vadede Gamestarter platformunun büyümesi önemli avantaj yaratırken, kısa vadeli riskler arasında piyasa oynaklığı ve düzenleyici belirsizlikler öne çıkar.

GAMEVIRTUAL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük yatırım miktarlarıyla başlayın, oyun ekosistemini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif alım-satımı birleştiren dengeli stratejiyi tercih edin ✅ Kurumsal yatırımcılar: Derinlemesine inceleme yapın, GAMEVIRTUAL'ı çeşitlendirilmiş kripto oyun portföyüne dahil edin

GAMEVIRTUAL Katılım Seçenekleri

- Spot işlem: Gate.com üzerinden GAMEVIRTUAL token alım-satımı yapabilirsiniz

- Staking: Gamestarter platformunun sunduğu staking programlarına katılabilirsiniz

- NFT alım-satım: Gamestarter ekosisteminde NFT işlemleri gerçekleştirebilirsiniz

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarını göz önünde bulundurarak dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alacağınızdan fazlasını yatırmayın.

Sıkça Sorulan Sorular

VeChain 1 $'a ulaşır mı?

Bu ihtimal mevcut olmakla birlikte, VeChain'in 2025'e kadar 1 $'a yükselmesi pek olası değildir. Mevcut değerinden ciddi bir artış gerektirir. Ancak, kripto piyasasında sürprizler her zaman yaşanabilir.

Game hissesi alınır mı?

Evet, Game hissesi yatırım için uygun görülmektedir. Analistlerin yarısı Güçlü Al, diğer yarısı ise Al tavsiyesi vermekte ve genel görüş Olumlu yöndedir.

Fun tokenları 1 sent olur mu?

Mevcut tahminlere göre FUN tokenlarının 1 sent seviyesine ulaşması beklenmemektedir. Öngörülen en yüksek fiyat yaklaşık 0,116952 $ olup, bu da 0,01 $ seviyesinin altında kalmaktadır.

2030'da hangi kripto 1000 kat artar?

Bitcoin, 2030 yılına kadar 1000 kat artış potansiyeline sahip olup; boğa senaryosunda piyasa değeri 4 trilyon $ seviyesine ulaşabilir.

Gala Games (GALA) iyi bir yatırım mı?: Bu blockchain oyun tokeninin potansiyeli ve risklerinin analizi

Splinterlands (SPS) iyi bir yatırım mı?: Bu Blockchain oyun token’ının potansiyeli ve risklerinin analizi

Nine Chronicles (WNCG) iyi bir yatırım mı?: Bu Blockchain oyun tokeninin potansiyeli ve risklerinin detaylı analizi

Virtuals tarafından geliştirilen GAME (GAMEVIRTUAL) yatırım için uygun mu?: Bu yeni nesil oyun token’ının potansiyelini ve risklerini değerlendiriyoruz

ESPORTS ile ENJ: Blockchain Oyun Döneminde Dijital Eğlencenin Hakimiyeti İçin Rekabet

PWAR vs ENJ: Geliştiriciler ve oyuncular açısından iki blockchain oyun platformunun karşılaştırılması

Testnet ortamında, kolayca erişilebilen musluk ile ücretsiz MATIC token talep edin

Blockchain Düğümlerinin İşleyişini Anlamak

Flash Kredileri Anlamak: DeFi'de Teminatsız Borçlanma Üzerine Kapsamlı Bir Rehber

MetaMask ile ERC20 Token Yönetimi: Bir Rehber

Dijital Varlıkların Güvenli Saklanması: Kripto Saklama Çözümlerinde En İyi Uygulamalar