2025 GAIN Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: GAIN's Market Position and Investment Value

Griffin AI (GAIN), as the fastest-growing no-code agent builder for DeFi, has powered more than 15,000 live agents since its inception. As of 2025, GAIN's market capitalization has reached $2,704,800, with a circulating supply of approximately 230,000,000 tokens, and a price hovering around $0.01176. This asset, dubbed the "fuel of agentic DeFi," is playing an increasingly crucial role in the $1 trillion DeFi market.

This article will comprehensively analyze GAIN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. GAIN Price History Review and Current Market Status

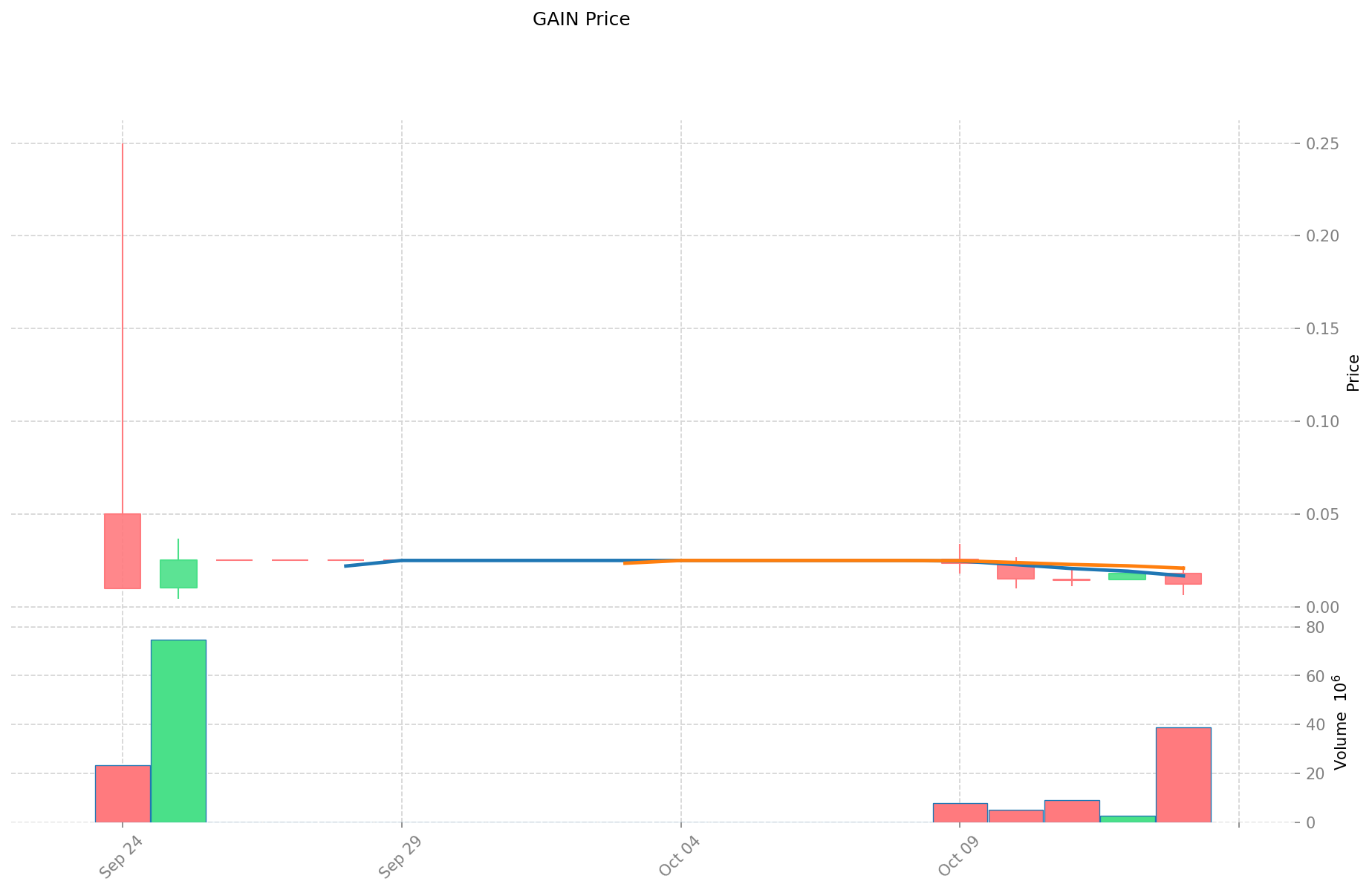

GAIN Historical Price Evolution Trajectory

- 2025: GAIN reached its all-time high of $0.24997 on September 24, marking a significant milestone for the project.

- 2025: The market experienced a sharp correction, with GAIN's price dropping to its all-time low of $0.00424 on September 25.

- 2025: Recent market cycle saw GAIN's price fluctuating between its high and low points within a short period.

GAIN Current Market Situation

As of October 14, 2025, GAIN is trading at $0.01176, experiencing significant volatility in recent periods. The token has seen a 3.06% increase in the last hour but a substantial 34.3% decrease over the past 24 hours. The weekly and monthly performances show even more dramatic declines, with -52.88% and -88.90% respectively. GAIN's market cap currently stands at $2,704,800, with a circulating supply of 230,000,000 tokens out of a total supply of 1,000,000,000. The 24-hour trading volume is $516,992.38075, indicating active market participation. Despite recent downturns, GAIN maintains a market dominance of 0.00028%, reflecting its niche position in the broader cryptocurrency market.

Click to view the current GAIN market price

GAIN Market Sentiment Indicator

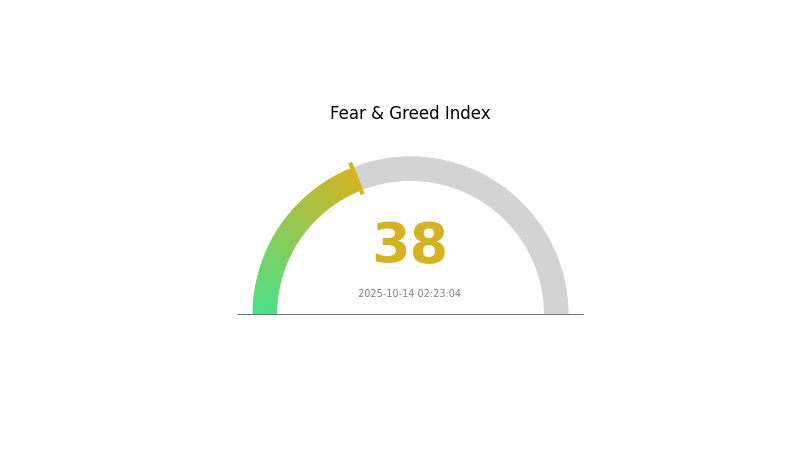

2025-10-14 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 38, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can signal a good time to invest for contrarians, it's crucial to conduct thorough research and manage risks. Gate.com offers various tools and resources to help traders navigate market conditions. Remember, market sentiment can shift quickly, so stay informed and trade responsibly.

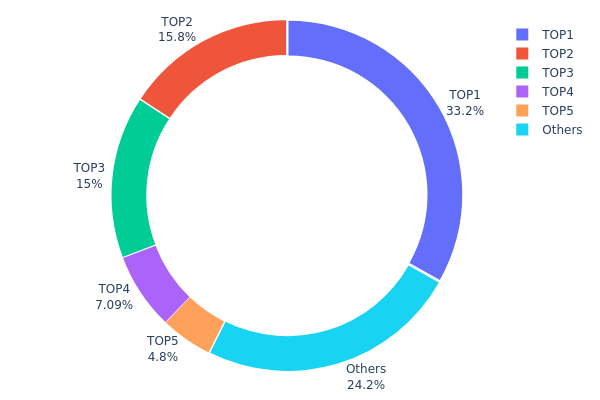

GAIN Holdings Distribution

The address holdings distribution data for GAIN reveals a highly concentrated ownership structure. The top address holds a substantial 33.17% of the total supply, with the top five addresses collectively controlling 75.8% of all GAIN tokens. This concentration level raises concerns about potential market manipulation and price volatility.

Such a centralized distribution pattern could have significant implications for GAIN's market dynamics. With a small number of addresses wielding considerable influence, the risk of large-scale sell-offs or coordinated price movements increases. This concentration may also deter smaller investors, potentially impacting liquidity and overall market stability.

From a broader perspective, this distribution suggests a relatively low degree of decentralization for GAIN. While blockchain technology aims to promote distributed ownership, the current state of GAIN's holdings indicates a more centralized structure. This could pose challenges for the token's long-term sustainability and its ability to maintain a balanced, resilient market ecosystem.

Click to view the current GAIN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 173669.68K | 33.17% |

| 2 | 0x08a0...1705cf | 82540.09K | 15.76% |

| 3 | 0x6e0b...bed395 | 78518.52K | 14.99% |

| 4 | 0xa39c...b3c709 | 37103.19K | 7.08% |

| 5 | 0xdf8a...fe5978 | 25148.97K | 4.80% |

| - | Others | 126539.02K | 24.2% |

II. Key Factors Affecting GAIN's Future Price

Supply Mechanism

- GAIN AI Act: The U.S. Senate passed a bipartisan amendment called the GAIN AI Act, requiring advanced AI chip manufacturers to prioritize U.S. domestic customers before exporting to countries of concern like China.

- Current Impact: This policy change may restrict the supply of advanced AI chips to China, potentially affecting GAIN's price and adoption in the Chinese market.

Institutional and Whale Movements

- Enterprise Adoption: Smart robot company Zhiyuan Robotics announced a collaboration with global ODM enterprise Longqi Technology to deploy nearly 1,000 robots, marking one of the largest orders in China's industrial embodied AI robot sector.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve is likely to continue cutting interest rates in October, with most Fed officials expecting at least two more rate cuts by year-end.

- Geopolitical Factors: Trade tensions between the U.S. and China may escalate, with former President Trump announcing plans to impose 100% tariffs on Chinese imports starting November 1st.

Technical Development and Ecosystem Building

- AI Advancements: The 7th Artificial Intelligence Application Industry Expo (ACE 2025) is being held from October 10th to 12th, 2025, in Shanghai, showcasing the latest developments in AI technology.

- Ecosystem Applications: The 2025 China Computer Conference (CNCC 2025) will be held from October 22nd to 25th in Harbin, focusing on the theme "Digital Intelligence Empowerment, Infinite Possibilities" and highlighting advancements in the computing field.

III. GAIN Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01139 - $0.01174

- Neutral forecast: $0.01174 - $0.01338

- Optimistic forecast: $0.01338 - $0.01503 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range predictions:

- 2027: $0.01218 - $0.01811

- 2028: $0.01417 - $0.02299

- Key catalysts: Broader cryptocurrency market trends, technological advancements, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.01819 - $0.02044 (assuming steady market growth)

- Optimistic scenario: $0.02044 - $0.02534 (assuming strong market performance and increased GAIN utility)

- Transformative scenario: Above $0.02534 (given exceptional market conditions and breakthrough developments)

- 2030-12-31: GAIN $0.02534 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01503 | 0.01174 | 0.01139 | 0 |

| 2026 | 0.01954 | 0.01338 | 0.01151 | 13 |

| 2027 | 0.01811 | 0.01646 | 0.01218 | 39 |

| 2028 | 0.02299 | 0.01728 | 0.01417 | 46 |

| 2029 | 0.02074 | 0.02014 | 0.01692 | 71 |

| 2030 | 0.02534 | 0.02044 | 0.01819 | 73 |

IV. GAIN Professional Investment Strategies and Risk Management

GAIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate GAIN tokens during market dips

- Set price targets and take partial profits

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor DeFi market sentiment and adoption of AI agents

- Pay attention to new partnerships and integrations announced by Griffin AI

GAIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GAIN with other DeFi and AI-related tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Transfer to hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GAIN

GAIN Market Risks

- High volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Emerging AI and DeFi projects may challenge Griffin AI's market position

- Adoption rate: Slow uptake of AI agents in DeFi could impact GAIN's value

GAIN Regulatory Risks

- Uncertain regulations: Evolving DeFi regulations may affect Griffin AI's operations

- Cross-border compliance: Varying international crypto laws could limit global expansion

- Token classification: Potential for GAIN to be classified as a security in some jurisdictions

GAIN Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Rapid growth may strain the Griffin AI infrastructure

- AI performance issues: Underperforming AI agents could damage platform reputation

VI. Conclusion and Action Recommendations

GAIN Investment Value Assessment

GAIN presents a high-risk, high-potential opportunity in the rapidly evolving DeFi and AI intersection. Long-term value lies in Griffin AI's innovative approach to DeFi automation, but short-term volatility and adoption challenges pose significant risks.

GAIN Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding the technology

✅ Experienced investors: Consider allocating a portion of DeFi portfolio to GAIN, actively manage positions

✅ Institutional investors: Conduct thorough due diligence, potentially engage in strategic partnerships with Griffin AI

Ways to Participate in GAIN Trading

- Spot trading: Buy and sell GAIN tokens on Gate.com

- Staking: Participate in GAIN staking programs if available

- DeFi integration: Use Griffin AI agents to interact with DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GAIN stock a good buy?

GAIN stock is rated 'Buy' by analysts with a $14.0 price target. It shows potential for growth, but always check current market data before investing.

What is GAIN's price target?

GAIN's price target is $14.00, with estimates ranging from $13.00 to $14.50, based on analyst projections for 2026.

What is Gain Therapeutics stock price prediction?

Gain Therapeutics stock is predicted to reach an average price of $3.888 in 2025, with a potential high of $5.4919 and a low of $2.284.

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price among cryptocurrencies, based on market analysis and historical trends.

Share

Content