2025 FRAX Price Prediction: Will This Stablecoin Maintain Its Dollar Peg in a Volatile Crypto Market?

Introduction: FRAX's Market Position and Investment Value

Frax (FRAX), as a pioneering modular rollup blockchain, has made significant strides since its inception. As of 2025, FRAX's market capitalization has reached $118,977,948, with a circulating supply of approximately 90,892,245 tokens, and a price hovering around $1.309. This asset, often hailed as the "fractal scaling solution," is playing an increasingly crucial role in the field of layer 2 blockchain solutions and decentralized finance.

This article will provide a comprehensive analysis of FRAX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FRAX Price History Review and Current Market Status

FRAX Historical Price Evolution Trajectory

- 2021: FRAX reached its all-time high of $1.14 on February 7, marking a significant milestone for the stablecoin.

- 2023: FRAX experienced its all-time low of $0.874536 on March 11, demonstrating volatility in the stablecoin market.

- 2025: Current market cycle, price fluctuating between $1.245 and $1.408 in the past 24 hours.

FRAX Current Market Situation

As of October 20, 2025, FRAX is trading at $1.309, showing a 1.05% decrease in the last 24 hours. The token's market capitalization stands at $118,977,948, ranking it 373rd in the overall cryptocurrency market. FRAX has a circulating supply of 90,892,245 tokens, which represents 64.05% of its total supply of 141,909,178 FRAX. The token's 24-hour trading volume is $16,530, indicating moderate market activity. FRAX has experienced significant price declines across various time frames, with a 13.81% decrease over the past week and a substantial 50.94% drop over the last 30 days. The current price represents a 33.62% decrease from a year ago, suggesting a challenging market environment for FRAX.

Click to view the current FRAX market price

FRAX Market Sentiment Indicator

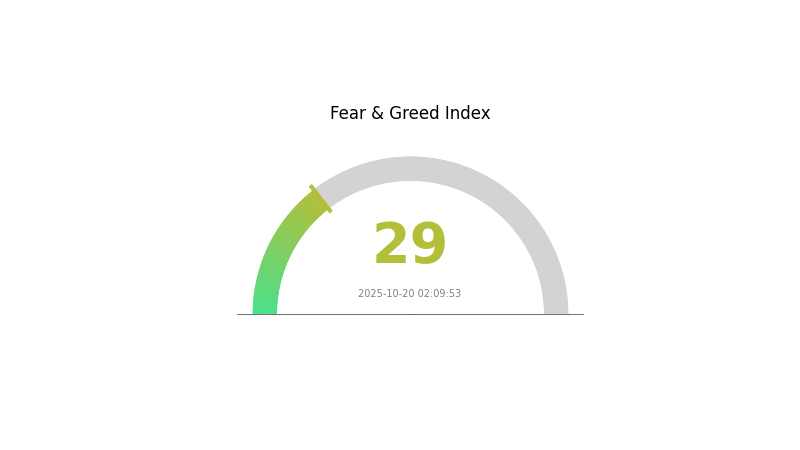

2025-10-20 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the Fear and Greed Index registering at 29. This indicates a cautious sentiment among investors, potentially signaling an opportune moment for strategic entries. While fear dominates, it's essential to remember that market cycles often present opportunities for those who can maintain a level head. As always, thorough research and risk management are crucial when navigating these uncertain waters. Stay informed and consider diversifying your portfolio to mitigate potential risks.

FRAX Holdings Distribution

The address holdings distribution data for FRAX is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Typically, this distribution would provide insights into the level of decentralization and the potential influence of large holders on the market.

Without specific data on address holdings, it's challenging to assess whether FRAX tokens are overly concentrated in a few wallets or widely distributed among many holders. This lack of information also makes it difficult to evaluate the potential impact on market structure, price volatility, or the risk of market manipulation.

In the absence of concrete distribution data, it's crucial for investors and analysts to seek alternative metrics and on-chain data to gauge the health and stability of FRAX's ecosystem. Regular monitoring of trading volumes, liquidity pools, and network activity can provide some indication of the token's market dynamics and user engagement.

Click to view the current FRAX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting FRAX's Future Price

Supply Mechanism

- Algorithmic Peg: FRAX uses an algorithmic mechanism to maintain its peg to the US dollar.

- Historical Pattern: Supply changes have historically influenced FRAX's price stability and market confidence.

- Current Impact: Any changes in the supply mechanism may affect FRAX's stability and adoption rate.

Institutional and Whale Dynamics

- Institutional Holdings: Major DeFi protocols and crypto investment firms have shown interest in FRAX as a stablecoin option.

- Enterprise Adoption: Some decentralized finance platforms have integrated FRAX as a supported stablecoin.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve decisions on interest rates and quantitative easing may influence stablecoin demand, including FRAX.

- Inflation Hedging Properties: As a USD-pegged stablecoin, FRAX may see increased demand during periods of high inflation.

Technical Development and Ecosystem Building

- Cross-chain Integration: FRAX has been expanding its presence across multiple blockchain networks, enhancing its utility and reach.

- Ecosystem Applications: FRAX is utilized in various DeFi protocols for lending, borrowing, and yield farming activities.

III. FRAX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.11 - $1.31

- Neutral prediction: $1.31 - $1.55

- Optimistic prediction: $1.55 - $1.78 (requires favorable market conditions and increased FRAX adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $1.17 - $2.63

- 2028: $2.12 - $2.37

- Key catalysts: Broader stablecoin adoption, DeFi ecosystem expansion, and regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $2.32 - $2.58 (assuming steady market growth and FRAX ecosystem development)

- Optimistic scenario: $2.58 - $2.97 (assuming strong DeFi growth and FRAX becoming a leading stablecoin)

- Transformative scenario: $2.97+ (extreme favorable conditions such as mass adoption of cryptocurrencies and FRAX becoming a dominant stablecoin)

- 2030-12-31: FRAX $2.58 (97% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.78024 | 1.309 | 1.11265 | 0 |

| 2026 | 2.30148 | 1.54462 | 1.0349 | 18 |

| 2027 | 2.63458 | 1.92305 | 1.17306 | 46 |

| 2028 | 2.36997 | 2.27882 | 2.1193 | 74 |

| 2029 | 2.83576 | 2.32439 | 1.97573 | 77 |

| 2030 | 2.96709 | 2.58008 | 1.90926 | 97 |

IV. FRAX Professional Investment Strategies and Risk Management

FRAX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational suggestions:

- Dollar-cost averaging to accumulate FRAX over time

- Hold for at least 3-5 years to ride out market volatility

- Store in a secure hardware wallet or custodial solution

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

FRAX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses on exchanges

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use offline storage for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. FRAX Potential Risks and Challenges

FRAX Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price swings

- Liquidity: Lower trading volumes may lead to slippage during large trades

- Correlation: High correlation with other cryptocurrencies may limit diversification benefits

FRAX Regulatory Risks

- Regulatory uncertainty: Evolving regulations may impact FRAX's operations and value

- Compliance challenges: Changing regulatory requirements may increase operational costs

- Geographical restrictions: Certain jurisdictions may limit or ban FRAX trading

FRAX Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Network congestion: High transaction volumes may lead to slower processing times

- Technological obsolescence: Emerging technologies may outpace FRAX's development

VI. Conclusion and Action Recommendations

FRAX Investment Value Assessment

FRAX offers potential long-term value as a stablecoin alternative, but faces short-term risks due to market volatility and regulatory uncertainties.

FRAX Investment Recommendations

✅ Beginners: Start with small investments, focus on learning and understanding the technology ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance, actively monitor market conditions ✅ Institutional investors: Conduct thorough due diligence, consider FRAX as part of a diversified crypto portfolio

FRAX Trading Participation Methods

- Spot trading: Buy and sell FRAX on Gate.com

- Staking: Participate in FRAX staking programs for potential yields

- DeFi integration: Explore decentralized finance protocols that support FRAX

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is frax Share a good investment?

Yes, Frax Share (FXS) could be a good investment in 2025. As the governance token of the Frax ecosystem, it has potential for growth alongside the expanding DeFi sector.

What is frax backed by?

Frax is backed by a combination of collateral assets and algorithmic mechanisms. It uses a fractional-algorithmic model, with part of its value supported by crypto assets and part by its own stability protocols.

Does Flux crypto have a future?

Yes, Flux crypto has a promising future. Its decentralized cloud infrastructure and focus on Web3 applications position it well for growth in the evolving blockchain ecosystem.

What is the price prediction for XRP in 2030?

XRP is predicted to reach $5 to $7 by 2030, driven by increased adoption in cross-border payments and partnerships with major financial institutions.

Share

Content