2025 FRAG Fiyat Tahmini: Kripto para birimi için piyasa trendleri ve olası büyüme faktörlerinin kapsamlı analizi

Giriş: FRAG'ın Piyasa Konumu ve Yatırım Potansiyeli

Fragmetric (FRAG), Solana blokzincirinde öncü bir varlık yönetimi protokolü olarak, kuruluşundan bu yana önemli bir evrim geçirdi. 2025 yılı itibarıyla FRAG'ın piyasa değeri 4.565.200 dolar düzeyindedir; dolaşımdaki arz yaklaşık 202.000.000 token olup, fiyat 0,0226 dolar civarında seyretmektedir. “FRAG-22 standardı” olarak bilinen bu varlık, gelişmiş DeFi stratejileri ve çoklu varlık yönetiminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, FRAG'ın 2025-2030 döneminde fiyat gelişimini kapsamlı biçimde analiz ederek; tarihsel hareketler, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunulacaktır.

I. FRAG Fiyat Geçmişi ve Güncel Piyasa Görünümü

FRAG Tarihsel Fiyat Değişim Süreci

- 2025 Temmuz: FRAG, 0,189 dolar ile tüm zamanların en yüksek seviyesine ulaşarak proje için kritik bir kilometre taşı oldu

- 2025 Ekim: Fiyat keskin şekilde düşerek tüm zamanların en düşük seviyesi olan 0,01055 dolara geriledi

- 2025 3.Çeyrek-4.Çeyrek: Piyasa döngüsü değişti, fiyat zirveden 0,0226 dolar seviyesine indi

FRAG Güncel Piyasa Durumu

12 Ekim 2025 itibarıyla FRAG, 0,0226 dolar seviyesinden işlem görüyor ve bu, zirve seviyesinden %88,04'lük bir düşüş anlamına geliyor. Token, son dönemde ciddi volatilite yaşadı; son 24 saatte %15,35, son bir haftada %29,60 değer kaybetti. 30 günlük performans ise %45,51 gerileme ile istikrarlı bir aşağı yönlü trendi ortaya koyuyor.

FRAG'ın piyasa değeri 4.565.200 dolar, dolaşımdaki arzı 202.000.000 token. Maksimum arz olan 1.000.000.000 FRAG'a göre tam seyreltilmiş değerleme 22.600.000 dolar seviyesinde. Piyasa hakimiyeti %0,00058 ile oldukça düşük; bu da FRAG'ın genel kripto ekosisteminde küçük ölçekli bir varlık olduğunu gösteriyor.

Son 24 saatteki işlem hacmi 2.316.041,97 dolar; fiyat düşüşüne rağmen piyasada orta düzeyde bir hareketlilik mevcut. Token 16 farklı borsada listeleniyor ve yatırımcılar için çeşitli işlem imkanları sunuyor.

Güncel FRAG piyasa fiyatını görmek için tıklayın

FRAG Piyasa Duyarlılık Endeksi

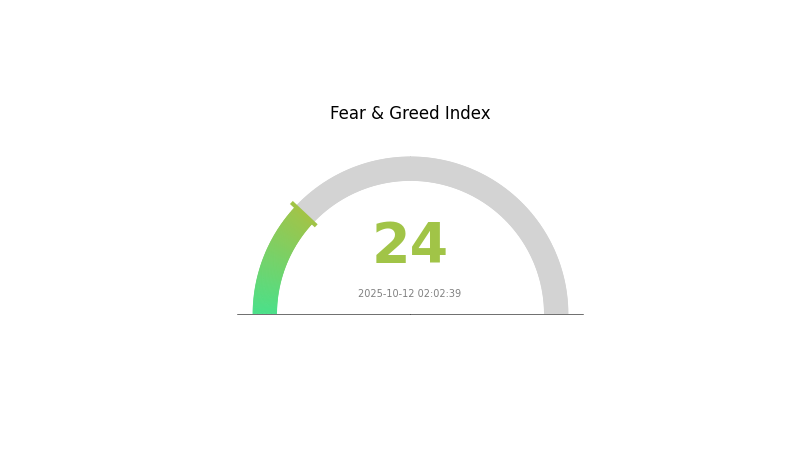

2025-10-12 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda aşırı korku hakim; Korku ve Açgözlülük Endeksi 24 seviyesine geriledi. Bu derece bir kötümserlik, genellikle karşıt yatırımcılar için potansiyel bir alım fırsatına işaret eder. Yine de, yatırım kararlarında temkinli davranmak ve detaylı araştırma yapmak gereklidir. Piyasa duyarlılığı hızla değişebilir; geçmiş performans, geleceği garanti etmez. Sürekli bilgi sahibi olarak, bu belirsiz ortamda riskleri azaltmak için portföyünüzü çeşitlendirmeye özen gösterin.

FRAG Varlık Dağılımı

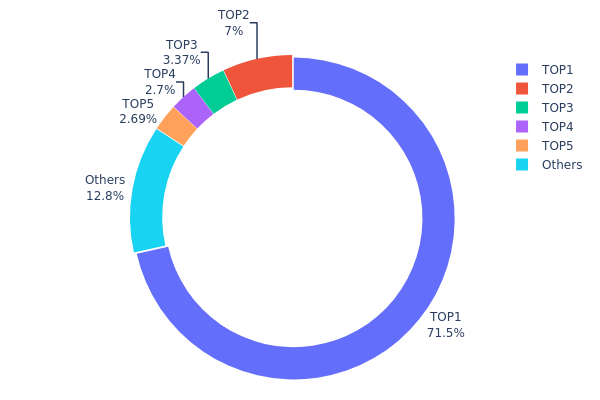

Adres bazlı varlık dağılımı verileri, FRAG tokenlerinde ciddi bir merkezileşme olduğunu ortaya koyuyor. En büyük adres, toplam arzın %71,48’ini elinde bulunduruyor. İlk 5 adresin ise tüm tokenların %87,22’sini kontrol etmesi bu yoğunlaşmayı daha da belirginleştiriyor.

Böyle bir dağılım, piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. Ana sahip, büyük alım/satımlarla fiyatı ciddi şekilde etkileyebilir. Bu merkezileşme, blokzincir projelerinin merkeziyetsizlik ilkeleriyle çelişiyor.

Piyasa yapısı açısından bu yoğunlaşma, FRAG ekosisteminin likiditesinin düşük ve istikrarsız olabileceğini gösteriyor. Az sayıda adresin yüksek paya sahip olması, işlem hacmini kısıtlayabilir ve fiyatları büyük işlemlere karşı daha hassas hale getirebilir; bu da küçük yatırımcıların ilgisini azaltabilir ve doğal piyasa büyümesini sınırlayabilir.

Güncel FRAG Varlık Dağılımını görmek için tıklayın

| En Yüksek | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | F8ngMX...CXAse4 | 714.842,88K | 71,48% |

| 2 | BTj8Pn...JZbzRu | 70.000,00K | 7,00% |

| 3 | A77HEr...oZ4RiR | 33.656,77K | 3,36% |

| 4 | 71hPbt...p4ehgi | 27.035,40K | 2,70% |

| 5 | 5MQGiz...3Vm7iC | 26.856,72K | 2,68% |

| - | Diğerleri | 127.607,38K | 12,78% |

II. FRAG'ın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşumu

- Proje Gelişim Planı: Planlanan güncellemeler ve yeni özelliklerin uygulamaya alınması FRAG fiyatını olumlu etkileyebilir.

- Piyasa Rekabeti: FRAG'ın blokzincir sektöründe yenilikçi olup rakiplerinden farklılaşabilmesi, piyasa konumu ve fiyatı üzerinde belirleyici olacaktır.

- Ekosistem Büyümesi: FRAG ekosisteminin büyümesi, platformda geliştirilen DApp’ler ve projeler talebi ve fiyatı artırabilir.

Makroekonomik Ortam

- Piyasa Duyarlılığı: Genel kripto piyasası trendleri ve yatırımcı güveni FRAG fiyat hareketlerinde ana rol oynayacaktır.

- Sektör Anlatıları: TON ekosisteminde olduğu gibi yeni anlatılar, FRAG’ın algılanan değerini ve fiyatını etkileyebilir.

III. FRAG 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,02154 – 0,02291 dolar

- Tarafsız tahmin: 0,02291 – 0,02417 dolar

- İyimser tahmin: 0,02417 – 0,02543 dolar (olumlu piyasa koşulları gerektirir)

2026-2027 Görünümü

- Piyasa fazı beklentisi: Kademeli büyüme

- Fiyat aralığı tahmini:

- 2026: 0,02224 – 0,03601 dolar

- 2027: 0,02799 – 0,04303 dolar

- Temel katalizörler: Artan kullanım ve teknolojik yenilikler

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,03656 – 0,04489 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,04489 – 0,05158 dolar (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,05158 – 0,05387 dolar (olağanüstü piyasa koşulları ve yaygın benimsenmeyle)

- 31 Aralık 2030: FRAG 0,05387 dolar (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,02543 | 0,02291 | 0,02154 | 1 |

| 2026 | 0,03601 | 0,02417 | 0,02224 | 6 |

| 2027 | 0,04303 | 0,03009 | 0,02799 | 33 |

| 2028 | 0,03985 | 0,03656 | 0,02486 | 61 |

| 2029 | 0,05158 | 0,03821 | 0,02522 | 69 |

| 2030 | 0,05387 | 0,04489 | 0,02694 | 98 |

IV. FRAG Profesyonel Yatırım Stratejileri ve Risk Yönetimi

FRAG Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde FRAG token biriktirin

- Kâr almak için fiyat hedefleri belirleyin

- Token’ları güvenli bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI: Aşırı alım/aşırı satım noktalarını belirleyin

- Swing trading için ana noktalar:

- Zarar durdur emirleriyle riskleri yönetin

- Belirlenen direnç seviyelerinde kâr alın

FRAG Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden fazla DeFi protokolüne yatırım yapın

- Zarar durdur emirleri: Otomatik satış emirleriyle potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulama ve özgün şifre kullanımı

V. FRAG için Potansiyel Riskler ve Zorluklar

FRAG Piyasa Riskleri

- Volatilite: Kripto piyasasında sık yaşanan büyük fiyat dalgalanmaları

- Likitlik: Büyük işlemlerin fiyatı etkilemeden gerçekleştirilmesinde zorluklar

- Rekabet: Yeni DeFi protokolleri Fragmetric’in piyasa konumunu tehdit edebilir

FRAG Düzenleyici Riskler

- Mevzuat belirsizliği: Değişen küresel regülasyonlar DeFi protokollerini etkileyebilir

- Uyumluluk gereksinimleri: KYC/AML uygulama ihtiyacı doğabilir

- Vergilendirme: DeFi ödülleri ve işlemlerinin vergisel durumu net olmayabilir

FRAG Teknik Riskler

- Akıllı kontrat açıkları: Protokoldeki güvenlik açıkları veya hatalar

- Ölçeklenebilirlik: Solana ağında yoğun talep dönemlerinde tıkanıklık riski

- Birlikte çalışabilirlik: Diğer blokzincirlerle entegrasyon zorlukları

VI. Sonuç ve Öneriler

FRAG Yatırım Değeri Değerlendirmesi

Fragmetric (FRAG), Solana üzerinde gelişmiş bir varlık yönetimi protokolü olarak özgün bir değer sunar. Yenilikçi DeFi stratejileri ve yüksek getiri potansiyeli taşırken, yatırımcıların kripto piyasasındaki ciddi volatilite ve düzenleyici belirsizliklere dikkat etmesi gerekir.

FRAG Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayıp teknolojiyi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: FRAG’ı çeşitlendirilmiş bir DeFi portföyüne dahil edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, mevzuat değişikliklerini yakından takip edin

FRAG Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden FRAG token alın

- Staking: Fragmetric’in likidite havuzlarında ödül elde edin

- Yield farming: FRAG-22 standardı ile gelişmiş DeFi stratejilerini kullanın

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerini göz önünde bulundurmalı ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alamayacağınız tutarda yatırım yapmayın.

Sıkça Sorulan Sorular

Hisse Senedi Fiyat Tahmini İçin En İyi Yapay Zeka Hangisidir?

GARCH-LSTM modeli, istatistiksel analiz ve derin öğrenmeyi birleştirerek hisse senedi fiyat tahmininde en iyi yapay zekalardan biri olarak öne çıkıyor.

2030 İçin XRP Fiyat Tahmini Nedir?

2030 yılında XRP’nin 90 ila 120 dolar aralığına ulaşması bekleniyor; bu tahmin mevcut piyasa trendleri ve kripto sektöründeki büyüme beklentileri ile uyumludur.

En Yüksek Fiyat Tahmini Olan Kripto Para Hangisidir?

Bitcoin, zirvede 139.249 dolar ile en yüksek fiyat tahminine sahip. Chainlink ise 59,67 dolar ile ikinci sıradadır.

Shiba Inu 2030’da Hangi Fiyata Ulaşacak?

Analistlere göre, piyasa trendleri ve Bitcoin’in performansına bağlı olarak Shiba Inu’nun 2030’da 0,00010 dolara ulaşma potansiyeli bulunuyor.

2025 yılında SOL’un rakiplerinden hangi ana özelliklerle ayrıştığı nedir?

ML vs SOL: Veri Analizinde Makine Öğrenimi ile İstatistiksel Öğrenmenin Karşılaştırılması

Meteora (MET) teknik dokümanı, protokolün temel işleyiş mantığı ve kullanım alanlarıyla ilgili hangi bilgileri sunuyor?

2030 yılına kadar Jupiter (JUP) kripto piyasasında nasıl bir evrim geçirecek?

PLSPAD ve SOL: Merkeziyetsiz Finans alanında Blockchain platformlarının rekabeti

2025 LIQ Fiyat Tahmini: Likidite Protokol Tokenlerinin Geleceğini Belirleyen Yükseliş Trendleri ve Temel Etkenler

Bitcoin fiyatı pound cinsinden, traderların şimdi bilmesi gerekenler.

Kripto para piyasasında Pivot Noktası ticaret stratejilerini ustalıkla kullanmak

Yeni Madenciler İçin En İyi Kripto Madencilik Platformları

Blockchain’de Kriptografik Hashleme’nin Temelleri: Kapsamlı Bir Rehber

Ethereum fiyatı düşüşte, bu uzun vadeli long aç fırsatı olabilir.