2025 FORM Fiyat Tahmini: Merkeziyetsiz Finansın ve Token Değerlemesinin Geleceğinde Yol Almak

Giriş: FORM'un Piyasadaki Konumu ve Yatırım Değeri

Four (FORM), BNB Chain DeFi ekosisteminde önde gelen aktörlerden biri olarak, 2024'te BinaryX'ten yeniden markalaşmasının ardından kayda değer bir ilerleme göstermiştir. 2025 yılı itibarıyla FORM'un piyasa değeri 346.353.600 $'a ulaşırken, dolaşımdaki arzı yaklaşık 381.867.255 token ve fiyatı yaklaşık 0,907 $ seviyesindedir. "Adil Lansman Öncüsü" olarak anılan bu varlık, GameFi, IGO Launchpad'leri ve merkeziyetsiz finans çözümlerinde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, 2025-2030 dönemi için FORM'un fiyat hareketleri; geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar çerçevesinde kapsamlı olarak incelenecek, yatırımcılara profesyonel fiyat öngörüleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. FORM Fiyat Geçmişi ve Güncel Piyasa Durumu

FORM'un Tarihsel Fiyat Seyri

- 2024: BinaryX (BNX)'ten Four (FORM)'a yeniden markalaşma, fiyat 1,55 $'dan açıldı

- 2025 Şubat: Fiyat 0,14 $ ile tüm zamanların en düşük seviyesine geriledi, önemli bir piyasa düzeltmesi gerçekleşti

- 2025 Ağustos: FORM 4,19 $ ile zirve yaptı ve güçlü bir piyasa toparlanması sergiledi

FORM'un Güncel Piyasa Görünümü

17 Ekim 2025 itibarıyla FORM, 0,907 $ seviyesinden işlem görüyor ve son 24 saatte %8,53 oranında düşüş yaşadı. Token'ın piyasa değeri 346.353.600 $ ile kripto piyasasında 203. sırada yer alıyor. FORM son 30 günde %54,25 düşüşle ciddi volatilite gösterdi; buna rağmen yıllık bazda %42,89 artıda. Mevcut fiyat, en yüksek seviyesinden %78,35 aşağıda olup, kısa vadede düşüş trendini, uzun vadede ise kazançların korunduğunu gösteriyor.

Mevcut FORM piyasa fiyatını görmek için tıklayın

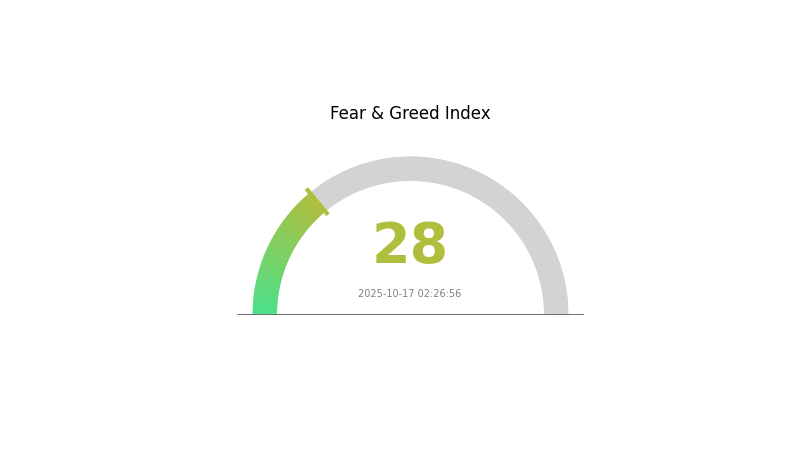

FORM Piyasa Duyarlılığı Göstergesi

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu durum, son piyasa oynaklığı veya dışsal etkiler nedeniyle yatırımcıların temkinli davrandığını gösteriyor. Böyle dönemlerde bazı yatırımcılar uzun vadeli fırsatlar arayabilirken, bazıları daha korumacı bir tutum sergileyebilir. Yatırımcılar, iyi araştırma ve kendi risk iştahlarına göre karar vermeli; çünkü kripto piyasasında duyarlılık hızlı değişebilir.

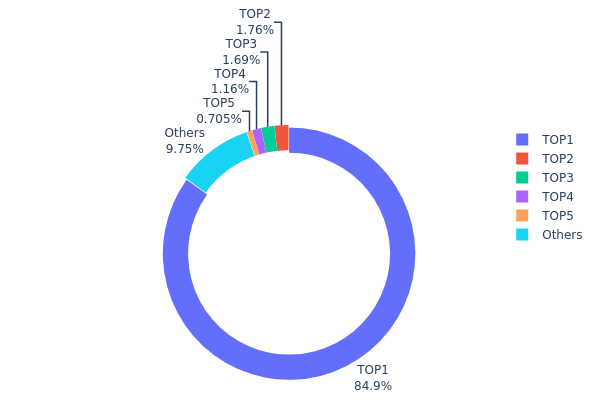

FORM Varlık Dağılımı

FORM varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres, toplam arzın %84,93'ünü elinde bulundururken, bu 251.243,32K FORM tokenına denk geliyor. Bu yoğunlaşma, merkezileşme ve piyasa manipülasyonu risklerini artırıyor.

Diğer büyük adreslerin payı çok daha düşük; ikinci ve üçüncü en büyük adresler sırasıyla %1,75 ve %1,69 paya sahip. En büyük beş adresin toplamı, arzın %90,22'sini oluştururken, geri kalan %9,78 ise tüm diğer adresler arasında dağılmış. Bu dengesiz dağılım, FORM ekosisteminde yaygın benimsemenin ve merkeziyetsizliğin sınırlı olduğunu gösteriyor.

Böyle bir yoğun sahiplik, fiyat oynaklığını artırabilir ve büyük satışlarda piyasa istikrarını zedeleyebilir. Ayrıca, projenin yönetişim yapısı ve karar süreçleri açısından da soru işaretleri doğuruyor; çünkü tek bir varlık, token arzı üzerinde orantısız bir güç sahibi.

Güncel FORM Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 251.243,32K | 84,93% |

| 2 | 0x68ab...eba29c | 5.198,71K | 1,75% |

| 3 | 0x4368...26f042 | 5.012,34K | 1,69% |

| 4 | 0xb0a3...7e4411 | 3.427,74K | 1,15% |

| 5 | 0x1ab4...8f8f23 | 2.084,76K | 0,70% |

| - | Diğerleri | 28.844,98K | 9,78% |

II. FORM'un Gelecekteki Fiyatlarını Etkileyen Temel Faktörler

Arz Mekanizması

- Arz ve Talep Dengesi: Piyasa fiyatlarını belirleyen ana unsur, arz ile talep arasındaki ilişkidir. Talep arzı geçtiğinde fiyatlar yükselir, arz talebi aştığında ise fiyatlar düşer.

- Tarihsel Seyir: Geçmişteki arz değişimleri, spot ve vadeli işlemler piyasalarındaki arz-talep dengesi ve fiyat beklentilerindeki değişimlere yansımıştır.

- Güncel Etki: Şu anki arz-talep dengesi ve piyasa beklentileri, FORM fiyat hareketlerini belirleyen ana etmenlerdir.

Makroekonomik Ortam

- Para Politikası Etkisi: Gelecekteki fiyat eğilimleri; emtia fiyatlarındaki gecikmeli etkiler, uluslararası petrol fiyatlarındaki zayıflık ve OPEC+ üretim politikaları gibi unsurlardan etkilenmektedir.

- Enflasyon Korumalı Yapı: Temel emtia enflasyonu trend seviyelerine gerilerken, hizmet enflasyonu ABD ve Euro Bölgesi'nde pandemi öncesi ortalamanın üzerinde seyretmektedir.

- Jeopolitik Faktörler: Jeopolitik gerilimler, demografik değişiklikler ve iklim dönüşümü gibi yapısal etkenler tedarik zinciri kırılganlığını artırmakta, enflasyon yönetimini zorlaştırmaktadır.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Gelişimi: FORM ekosisteminin büyümesi ve ilerlemesi, 2025-2030 dönemi fiyat rotasında belirleyici olacaktır.

- Piyasa Kullanımı: FORM'un çeşitli piyasa uygulamalarında kullanılabilirliği ve entegrasyonu, değer ve talep üzerinde doğrudan etkili olacaktır.

III. 2025-2030 FORM Fiyat Tahmini

2025 Beklentisi

- İhtiyatlı tahmin: 0,85042 $ - 0,9047 $

- Tarafsız tahmin: 0,9047 $ - 1,10 $

- İyimser tahmin: 1,10 $ - 1,29372 $ (güçlü piyasa toparlanması ve yaygın benimseme gerektirir)

2027-2028 Beklentisi

- Piyasa fazı: Artan volatiliteyle birlikte büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,78879 $ - 1,61188 $

- 2028: 1,32243 $ - 1,95609 $

- Başlıca katalizörler: Teknolojik ilerlemeler, daha geniş piyasa kabulü ve düzenleyici açıklık potansiyeli

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 1,66681 $ - 1,89183 $ (istikrarlı piyasa büyümesi ve benimseme senaryosu)

- İyimser senaryo: 1,89183 $ - 2,11685 $ (hızlı benimseme ve elverişli piyasa şartları senaryosu)

- Dönüştürücü senaryo: 2,11685 $ - 2,50 $ (çığır açan kullanım örnekleri ve yaygın entegrasyon senaryosu)

- 2030-12-31: FORM 2,04318 $ (mevcut projeksiyonlara göre potansiyel zirve)

| 年份 | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,29372 | 0,9047 | 0,85042 | 0 |

| 2026 | 1,18715 | 1,09921 | 0,92334 | 21 |

| 2027 | 1,61188 | 1,14318 | 0,78879 | 26 |

| 2028 | 1,95609 | 1,37753 | 1,32243 | 52 |

| 2029 | 2,11685 | 1,66681 | 0,86674 | 84 |

| 2030 | 2,04318 | 1,89183 | 1,5513 | 109 |

IV. FORM İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

FORM Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- İzlenebilecek adımlar:

- Piyasa düşüşlerinde FORM token biriktirin

- Kâr almak için fiyat hedefleri belirleyin

- Token'ları güvenli, kişisel saklama cüzdanlarında muhafaza edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım bölgelerini belirlemede yardımcı olur

- Swing trading için dikkat edilecekler:

- BNB Chain ekosistemindeki gelişmeleri izleyin

- Önemli ortaklık duyurularını veya ürün lansmanlarını takip edin

FORM Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı DeFi projelerine yaymak

- Zarar durdur emirleri: Olası kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama çözümü: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, benzersiz ve güçlü şifre kullanımı

V. FORM İçin Potansiyel Riskler ve Zorluklar

FORM Piyasa Riskleri

- Volatilite: Kripto piyasalarında yoğun fiyat dalgalanmaları

- Rekabet: BNB Chain üzerindeki DeFi projelerinin artışı

- Piyasa duyarlılığı: Genel kripto piyasa trendlerine karşı hassasiyet

FORM Regülasyon Riskleri

- Regülasyon belirsizliği: DeFi projelerine yönelik değişen küresel düzenlemeler

- Uyumluluk zorlukları: Adil lansman platformlarıyla ilgili olası sorunlar

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal durum

FORM Teknik Riskler

- Akıllı sözleşme açıkları: Olası güvenlik açıkları ve yazılım hataları

- Ölçeklenebilirlik sorunları: Yüksek ağ talebini karşılamada yaşanabilecek zorluklar

- Birlikte çalışabilirlik sorunları: Zincirler arası işlevsellikteki kısıtlamalar

VI. Sonuç ve Eylem Önerileri

FORM'un Yatırım Değeri Değerlendirmesi

FORM, BNB Chain ekosisteminde yüksek riskle birlikte yüksek potansiyele sahip bir yatırım fırsatı sunar. Uzun vadeli değer önerisi, gelişen DeFi ve GameFi çözümlerine dayanırken; kısa vadeli riskler arasında piyasa oynaklığı ve düzenleyici belirsizlikler yer alıyor.

FORM Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın ve ekosistemi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Maliyet ortalaması stratejisini değerlendirin ve net kâr hedefleri koyun ✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapın ve büyük pozisyonlar için OTC (tezgah üstü) işlemleri düşünün

FORM'a Katılım Yöntemleri

- Spot işlem: Gate.com'dan FORM token alımı

- Staking: Uygunsa, getiri çiftçiliği veya likidite sağlama

- Ekosistem katılımı: Four.meme platformu ve ilişkili DeFi ürünlerinde aktif olmak

Kripto para yatırımları son derece yüksek risk içermektedir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarını dikkate alarak vermeli ve profesyonel finansal danışmanlara danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

FORM hissesi için fiyat tahmini nedir?

FORM hissesi için fiyat tahmini, mevcut piyasa analizine göre 13 Kasım 2025 tarihinde 49,41 $'dır.

2025'te hangi kripto 1000x kazandıracak?

MoonBull ($MOBU), yenilikçi 23 aşamalı yapısı ve güçlü topluluk desteğiyle 2025'te 1000x getiri potansiyeline sahip olarak öne çıkmaktadır.

2025'te hangi kripto yükselişe geçecek?

Bitcoin'in liderliğinde, fiyatının 225.000 $'a ulaşması bekleniyor. Ethereum ve Solana da 2025'te ciddi büyüme potansiyeli taşıyor.

Hangi kripto 10.000 $'a ulaşabilir?

Bitcoin, piyasa hakimiyeti ve kurumsal kabulü ile 10.000 $'a ulaşma potansiyeli en yüksek kriptodur. Ethereum da akıllı sözleşme özellikleri ve DeFi ekosistemiyle bu alanda öne çıkmaktadır.

Kripto 2025'te Yeniden Yükselir mi?

XLM Kripto Fiyatı: Stellar Lumens A$1'e Ulaşabilir mi?

Power Ledger Kripto: POWR Bir Boğa Geri Dönüşünü Canlandırabilir mi?

CRO nedir: Dönüşüm Oranı Optimizasyonunun Dijital Pazarlama Başarısına Etkisi

2025 DEEP Fiyat Tahmini: Dijital Ekonomi Geliştirilmiş Protokollerinin Gelecek Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 COTI Fiyat Tahmini: Gelişen kripto para ekosisteminde piyasa trendleri ve geleceğe yönelik potansiyelin değerlendirilmesi

Magic Eden’i Keşfetmek: NFT Pazaryeri Genel Görünümü ve Kullanım İpuçları

Web3 işlemlerinde güvenli dijital cüzdan

Grass Airdrop'u Hakkında Eksiksiz Kılavuz: Ödül Almanın Adımları

Web3 Token Değerlemesi: Tam Kapsamlı Rehber

BGSC nedir: Kan Gazı ve Serum Kimyası Analizine Kapsamlı Bir Rehber