2025 FITFI Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: FITFI'nin Piyasa Konumu ve Yatırım Değeri

Step.app (FITFI), Fitness Finance (FitFi) alanında öne çıkan bir oyuncu olarak, 2022’deki çıkışından bu yana dikkat çekici bir ilerleme kaydetti. 2025 itibarıyla FITFI’nin piyasa değeri 3.842.872,5 ABD doları, dolaşımdaki token miktarı ise yaklaşık 4.172.500.000 olup, fiyatı 0,000921 ABD doları civarındadır. “Move-to-Earn Öncüsü” olarak bilinen FITFI, fitness ile blokzincir teknolojisinin birleşiminde giderek daha önemli bir rol üstleniyor.

Bu makalede, FITFI’nin 2025-2030 dönemi fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırım stratejileriyle kapsamlı biçimde değerlendirilecektir.

I. FITFI Fiyat Geçmişi ve Güncel Piyasa Durumu

FITFI Tarihsel Fiyat Seyri

- 2022: FITFI, lansmandan kısa süre sonra 5 Mayıs’ta 0,731881 ABD dolarıyla tüm zamanların en yüksek seviyesine ulaştı.

- 2023-2024: Token, genel kripto piyasasındaki düşüş trendini takip ederek sert bir değer kaybı yaşadı.

- 2025: FITFI, 12 Ekim’de 0,0008582 ABD dolarıyla tüm zamanların en düşük seviyesini gördü ve zirvesinden dramatik biçimde düştü.

FITFI Güncel Piyasa Görünümü

13 Ekim 2025’te FITFI, 0,000921 ABD doları seviyesinden işlem görüyor ve son 24 saatte %5,43’lük bir artış kaydetti. Token’ın piyasa değeri 3.842.872,5 ABD doları, tamamen seyreltilmiş değeri ise 4.236.600 ABD doları. Günlük pozitif performansa rağmen, FITFI uzun vadede büyük kayıplar yaşadı; son bir haftada %22,71, son bir ayda %36,44 değer kaybetti. Dolaşımdaki FITFI arzı 4.172.500.000 ile toplam arzın %90,71’ine denk geliyor (maksimum arz: 4.600.000.000). Mevcut fiyat, tüm zamanların zirvesine kıyasla %99,87’lik bir düşüşü temsil ediyor ve token için zorlu bir piyasa ortamını gösteriyor.

Güncel FITFI piyasa fiyatını görüntülemek için tıklayın

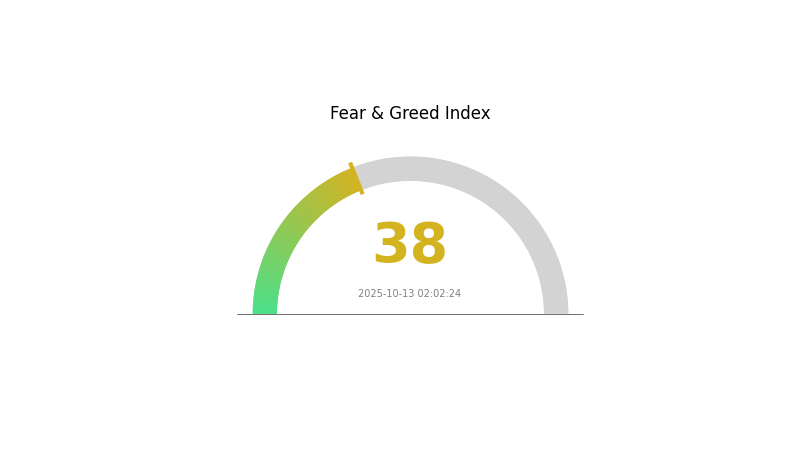

FITFI Piyasa Duyarlılığı Göstergesi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

Kripto para piyasasında şu anda korku hakim ve Korku ve Açgözlülük Endeksi 38 düzeyinde. Bu, yatırımcılarda temkinli bir yaklaşım olduğunu, piyasa istikrarı veya son fiyat dalgalanmalarına dair kaygıların öne çıktığını gösteriyor. Böyle dönemlerde bazı yatırımcılar düşük fiyatlardan varlık toplama fırsatı görürken, diğerleri daha korumacı bir tutum sergileyebilir. Belirsizlik ortamında yatırımcıların mutlaka kapsamlı araştırma yaparak, risk profillerini gözeterek karar vermeleri gerekir.

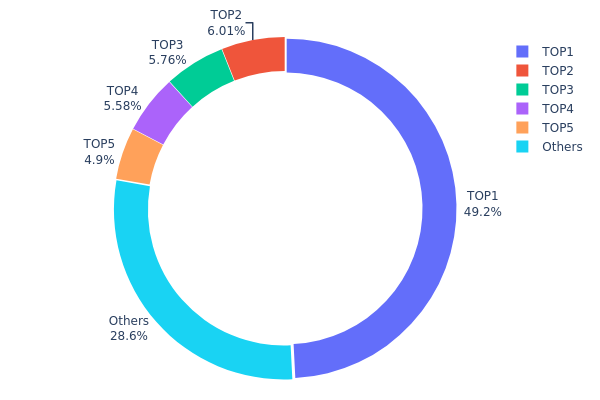

FITFI Varlık Dağılımı

FITFI adres varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısına işaret etmektedir. En büyük adres, toplam arzın %49,19’una karşılık gelen 2.262.835.610 FITFI token tutmakta. Bu konsantrasyon, merkezileşme ve olası piyasa manipülasyonu endişelerini artırıyor.

İlk beş adresin her biri %4,89 ila %6,00 aralığında paylara sahip ve toplamda %22,22’lik kısmı elinde bulunduruyor. Bu ilk beş adres, tüm FITFI tokenlarının %71,41’ini kontrol ediyor; kalan %28,59 ise diğer tüm adreslere yayılmış durumda. Yani merkeziyetsizlik oranı oldukça sınırlı.

Böyle bir yoğunlaşma, birkaç büyük adresin işlemleriyle yüksek fiyat oynaklığını tetikleyebilir. Ayrıca, proje yönetimi ve karar süreçlerinde az sayıda aktörün etkinliği, kripto projelerinde beklenen merkeziyetsizlik prensibine ters düşebilir.

Güncel FITFI Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xcd9e...8ac436 | 2.262.835,61K | 49,19% |

| 2 | 0x0a80...2449a2 | 276.230,70K | 6,00% |

| 3 | 0xa893...3213b3 | 265.037,74K | 5,76% |

| 4 | 0xb890...2c5f53 | 256.450,34K | 5,57% |

| 5 | 0x7aad...f695fa | 225.215,98K | 4,89% |

| - | Diğerleri | 1.314.229,64K | 28,59% |

II. FITFI'nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Geçmiş Eğilimler: Fiyat değişimleri, arz ve talep dinamikleriyle belirli aralıklarda şekillendi.

- Güncel Durum: FITFI fiyatı şu an 0,003902-0,009948 ABD doları bandında dalgalanıyor ve bu, yukarı yönlü bir potansiyele işaret ediyor.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Benimseme: FITFI, fintech yeniliği olarak ödemeler ve mutabakatlarda hızlı, güvenli ve pratik çözümler sunuyor. Sektördeki ilerlemelerle kurumsal ilgi görebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Merkeziyetsiz bir varlık olarak FITFI, küresel dijital ekonomideki talep değişimlerinden etkilenebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Teknolojik İnovasyon: Fintech alanındaki yenilikçi yapısı, FITFI’nin sektörle birlikte büyüme potansiyelini güçlendiriyor.

- Ekosistem Uygulamaları: GameFi ve ekonomik sistem gelişmeleri, FITFI ekosistemi ve değer önerisini etkileyebilir.

III. 2025-2030 FITFI Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00071 - 0,00092 ABD doları

- Tarafsız tahmin: 0,00092 - 0,00107 ABD doları

- İyimser tahmin: 0,00107 - 0,00125 ABD doları (olumlu piyasa ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa fazı: Benimsenmenin artmasıyla olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,0008 - 0,0014 ABD doları

- 2028: 0,00082 - 0,00154 ABD doları

- Başlıca katalizörler: Proje kilometre taşları, genel kripto piyasası trendleri ve FITFI kullanımının artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00111 - 0,00182 ABD doları (istikrarlı piyasa ve proje gelişimiyle)

- İyimser senaryo: 0,00182 - 0,00226 ABD doları (güçlü piyasa ve yaygın benimsenmeyle)

- Dönüştürücü senaryo: 0,00226 ABD dolarının üzerinde (istisnai proje başarısı ve elverişli piyasa koşullarıyla)

- 31 Aralık 2030: FITFI 0,00161 ABD doları (ortalama tahmin, yüksek büyüme potansiyeli gösteriyor)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00107 | 0,00092 | 0,00071 | 0 |

| 2026 | 0,00125 | 0,00099 | 0,0006 | 8 |

| 2027 | 0,0014 | 0,00112 | 0,0008 | 22 |

| 2028 | 0,00154 | 0,00126 | 0,00082 | 37 |

| 2029 | 0,00182 | 0,0014 | 0,00111 | 53 |

| 2030 | 0,00226 | 0,00161 | 0,00119 | 76 |

IV. FITFI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

FITFI Yatırım Stratejileri

(1) Uzun Vadeli Tutma

- Kimler için: Yüksek risk toleranslı uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde FITFI biriktirin

- Ödül kazanmak ve yönetime katılmak için token stake edin

- Tokenları güvenli, kişisel bir cüzdanda saklayın

(2) Aktif Alım-Satım

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI: Aşırı alım/satım seviyelerini tespit edin

- Swing trade için önemli noktalar:

- Kayıpları sınırlamak için kesin stop-loss belirleyin

- Belirlediğiniz fiyat hedeflerinde kâr alın

FITFI Risk Yönetimi

(1) Varlık Dağılımı Prensipleri

- Koruyucu yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün en çok %15’i

(2) Riskten Korunma

- Çeşitlendirme: Yatırımları çeşitli kripto varlıklara dağıtın

- Stop-loss kullanımı: Olası kayıpları sınırlayın

(3) Güvenli Saklama

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Donanım cüzdanında uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifre kullanımı

V. FITFI’nin Karşılaşabileceği Riskler ve Zorluklar

FITFI Piyasa Riskleri

- Yüksek volatilite: FITFI fiyatı sert dalgalanmalar gösterebilir

- Düşük likidite: İşlem hacmi düşük olabilir, bu da fiyat oynaklığını artırır

- Piyasa duyarlılığı: Genel kripto piyasası trendleri FITFI’yi etkiler

FITFI Düzenleyici Riskler

- Belirsiz düzenleme ortamı: Move-to-earn projelerini etkileyebilecek yeni kurallar

- Sınır aşan uyum: Farklı ülkelerde değişen regülasyonlar

- Vergisel etkiler: Kripto varlıklar ve ödüller için gelişen vergi politikaları

FITFI Teknik Riskleri

- Akıllı sözleşme riskleri: Protokoldeki açıklar ya da yazılım hataları

- Ölçeklenebilirlik sorunları: Yüksek kullanım dönemlerinde ağ tıkanıklığı

- Blokzincir altyapısına bağımlılık: Temel blokzincirde yaşanacak sorunlar FITFI’yi olumsuz etkileyebilir

VI. Sonuç ve Eylem Önerileri

FITFI Yatırım Değeri Analizi

FITFI, move-to-earn segmentinde özgün bir fırsat sunarken, piyasa oynaklığı ve regülasyon belirsizliği nedeniyle yüksek risk barındırır. Proje, kullanıcı büyümesini sürdürebilir ve teknik engelleri aşabilirse uzun vadede potansiyeli yüksektir.

FITFI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp ekosistemi öğrenmeye öncelik tanıyın

✅ Deneyimli yatırımcılar: Stake ve alım-satımı dengeleyen bir yaklaşım izleyin

✅ Kurumsal yatırımcılar: Detaylı inceleme yapıp büyük işlemler için OTC’yi değerlendirin

FITFI Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden FITFI alış/satış

- Stake etme: FITFI stake programlarına katılım ve ödül kazanımı

- Move-to-earn: Step.app platformunda fiziksel aktiviteyle ödül elde etme

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatle almalı ve profesyonel danışmana başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

FITFI için tüm zamanların en yüksek fiyatı nedir?

FITFI için tüm zamanların en yüksek fiyatı, 26 Ocak 2023’te 0,0383313 ABD dolarıdır.

2025’te hangi meme coin patlama yapacak?

Shiba Inu’nun 2025’te patlama yapacağı öngörülüyor. Güçlü topluluk desteği ve viral trendlerle popülerliğini korumakta. Tahminler, sürdürülebilir ilgi ve piyasa dinamiklerine dayanıyor.

2025’te hangi kripto yükselişe geçecek? Forbes tahmini nedir?

Forbes, 2025’te Bitcoin DeFi’ın yükseleceğini ve Bitcoin Layer 2 çözümlerinde kilitli toplam değerin büyük artış göstereceğini öngörüyor.

Hisse senedi fiyat tahmini için en iyi yapay zeka hangisidir?

Hibrit GARCH-LSTM modelleri, istatistiksel analizle ileri düzey yapay zekayı birleştirerek hisse senedi fiyatlarında en isabetli tahminleri sunar.

UDS ve KAVA: İki Önde Gelen Merkeziyetsiz Finans Platformunun Karşılaştırılması

2025 SUPER Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

GM vs KAVA: Sabah alışkanlıkları pazarını dönüştüren kahve devlerinin karşılaşması

Is Four (FORM) iyi bir yatırım mı?: Bu yeni teknoloji hissesinin potansiyelini ve risklerini analiz etmek

Kripto fon akışının, tutma alışkanlıkları ve borsa bakiyeleri üzerindeki etkisi nedir?

CHEEL vs UNI: Üniversite Espor Liglerinde Liderlik Yarışı

NFT Nadirliğini Keşfetmek: Nadirlik Puanlarını Verimli Şekilde Kontrol Etme Yöntemleri

Blockchain Düğümlerinin İşleyişi: Ayrıntılı Bir Rehber

DeFi Endeks Fonlarına Akıllı Yatırım Stratejileri

Blokzincirde DAG'ı Keşfetmek: Yönlendirilmiş Döngüsüz Grafik Kavramını Anlamak

DePIN'in Temelleri: Merkeziyetsiz Fiziksel Altyapı Ağları Hakkında Kapsamlı Bir Rehber