2025 FET Fiyat Tahmini: Fetch.ai'nin Gelecekteki Değerini Belirleyen Boğa Eğilimleri ve Ana Etkenler

Giriş: FET’in Piyasadaki Konumu ve Yatırım Potansiyeli

Artificial Superintelligence Alliance (FET), yapay zeka ile blokzincirin birleşimi alanında öncü bir proje olarak, kuruluşundan bu yana dikkate değer ilerlemeler kaydetti. 2025 yılı itibarıyla FET’in piyasa değeri 702.269.439 $’a ulaşırken, dolaşımdaki arzı yaklaşık 2.370.929.909 token ve fiyatı da 0,2962 $ civarında bulunuyor. “Yapay Zeka Destekli Blokzincir Çözümü” olarak anılan bu varlık, özerk ekonomik sistemler ve merkeziyetsiz yapay zeka uygulamalarında giderek daha önemli bir rol üstleniyor.

Bu makalede, FET’in 2025-2030 arasındaki fiyat hareketleri; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde kapsamlı şekilde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. FET Fiyat Geçmişi ve Güncel Piyasa Durumu

FET Tarihsel Fiyat Seyri

- 2020: Piyasa dibinde, 13 Mart’ta en düşük seviye olan 0,00827 $ görüldü

- 2024: Boğa piyasası zirvesinde, 29 Mart’ta en yüksek seviye olan 3,47 $’a çıktı

- 2025: Piyasa düzeltmesinde, fiyat 3,47 $’dan mevcut 0,2962 $’a geriledi

FET Güncel Piyasa Durumu

16 Ekim 2025 tarihi itibarıyla FET, 0,2962 $ seviyesinden işlem görüyor ve piyasa değeri bakımından 117. sırada yer alıyor. Son dönemde token yüksek oynaklık yaşadı; son 24 saatte %5,48 ve son bir haftada %46,33 düşüş kaydetti. 30 günlük ve 1 yıllık fiyat değişimleri ise sırasıyla %53,45 ve %79,79 oranında daha derin bir gerilemeye işaret ederek uzun süren bir düşüş trendini gösteriyor.

FET’in piyasa değeri 702.269.439 $ ve dolaşımdaki arzı 2.370.929.909 FET token. 24 saatlik işlem hacmi 4.967.573 $ ve bu da piyasada orta seviyede bir aktiviteye işaret ediyor. Token, 29 Mart 2024’teki 3,47 $’lık zirvenin %91,47 altında işlem görse de, 13 Mart 2020’deki 0,00827 $’lık dip seviyenin oldukça üstünde bulunuyor.

Kısa vadede piyasa hissiyatı negatif; farklı zaman dilimlerinde yaşanan fiyat düşüşleri bunu doğruluyor. Ancak projenin uzun vadeli yapay zeka ve makine öğrenimi alanındaki potansiyeli, yatırımcıların ilgisini sürdürebilir.

Güncel FET piyasa fiyatını görüntülemek için tıklayın

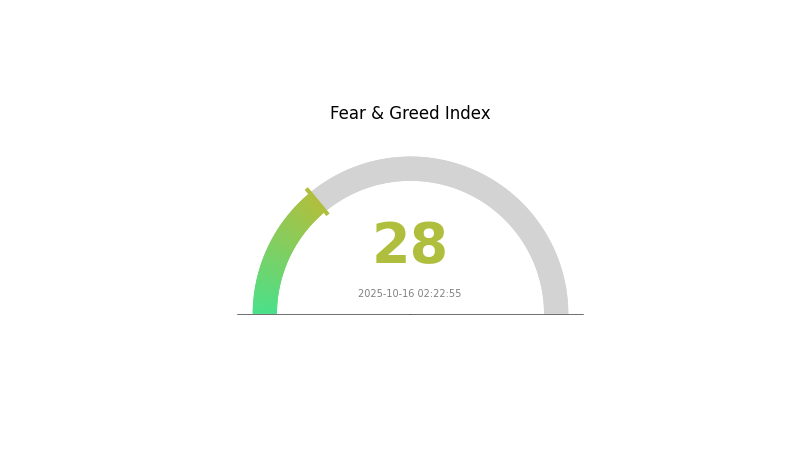

FET Piyasa Duyarlılık Endeksi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve piyasa koşullarıyla ilgili belirsizlik yaşadığını gösteriyor. Böyle dönemlerde bazı yatırımcılar, “başkaları açgözlü olduğunda korkak, başkaları korktuğunda ise açgözlü olun” felsefesiyle fırsat arayabiliyor. Yine de yatırım kararı almadan önce kapsamlı araştırma yapılmalı ve risk toleransı dikkatle göz önünde bulundurulmalıdır.

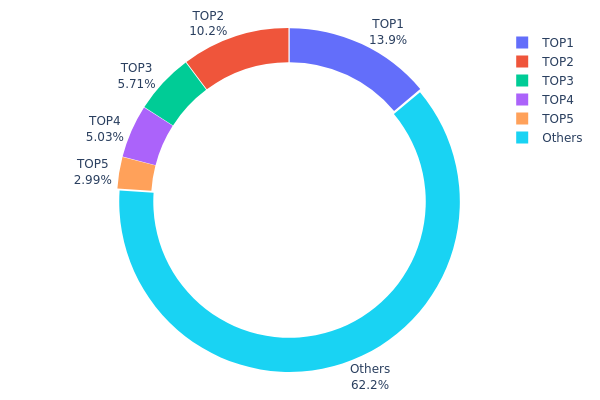

FET Varlık Dağılımı

FET adres varlık dağılımı, sahiplikte makul düzeyde bir yoğunlaşmaya işaret ediyor. En büyük 5 adres, toplam arzın %37,83’ünü elinde tutarken, en büyük adresin payı %13,89 seviyesinde. Bu yoğunluk, piyasada büyük yatırımcıların etkisinin belirgin olduğunu gösteriyor.

Yoğunlaşma aşırı olmasa da, bu yapı piyasa dinamiklerine etki edebilir. Büyük yatırımcıların alım-satım işlemleri, fiyat oynaklığını artırabilir. Yine de FET tokenlerinin %62,17’sinin diğer adreslere dağılmış olması, merkeziyetsizlikten kaynaklanan risklerin azaltılmasına yardımcı olabilir.

Bu dağılım, FET için dengeli bir piyasa yapısına işaret ediyor; büyük yatırımcılar ve geniş bir küçük sahip tabanı bir arada. Orta düzeydeki merkeziyetsizlik, ekosistemin genel istikrarına katkı sunarken, büyük oyuncuların hareketleriyle oluşabilecek dalgalanmalara da zemin hazırlıyor.

Güncel FET varlık dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 377.099,10K | 13,89% |

| 2 | 0xf58d...b645dc | 277.549,57K | 10,22% |

| 3 | 0x9478...b626cc | 155.041,22K | 5,71% |

| 4 | 0x3378...e9e863 | 136.444,51K | 5,02% |

| 5 | 0x5a8d...66166a | 81.214,82K | 2,99% |

| - | Diğerleri | 1.687.144,68K | 62,17% |

II. FET’in Gelecekteki Fiyatını Etkileyen Ana Faktörler

Piyasa Dinamikleri

- Piyasa Oynaklığı: Kripto para piyasası yüksek oynaklığa sahip olup, FET’in fiyatı ve işlem hacmi üzerinde doğrudan etki yaratabilir.

- Geçmiş Eğilimler: FET’in gelecekteki performansı, Bitcoin’in haftalık hakimiyetinde yaşanacak dönüşlerle tetiklenen altcoin sezonlarının zamanlamasına bağlı olabilir.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Benimsenme: Kurumsal yatırımcıların yüksek hacimli alımları, kripto piyasasında fiyat artışlarının ana itici gücüdür.

Makroekonomik Ortam

- Küresel Ekonomik Koşullar: Küresel ekonomik dalgalanmalar ve piyasa hissiyatı, FET’in fiyatı ve performansı üzerinde etkili olabilir.

- Düzenleyici Ortam: Düzenleyici değişiklikler, kripto piyasasında fiyat hareketlerinin başlıca belirleyicisidir.

Teknik Gelişim ve Ekosistem Oluşumu

- Teknolojik Yenilik: Fetch.ai’nin başarısı, yapay zeka ve blokzincir teknolojilerinde gerçekleştirdiği inovasyonlara bağlıdır.

- Ağ Yükseltmeleri: Fetch.ai ağındaki sürekli gelişim ve güncellemeler, FET’in değerini doğrudan etkileyebilir.

- Ekosistem Uygulamaları: Fetch.ai’nin merkeziyetsiz makine öğrenimi ağı; IoT ve akıllı altyapı sektörlerinde özgün avantajlar sunuyor.

III. 2025-2030 FET Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,15952 $ - 0,25 $

- Tarafsız tahmin: 0,25 $ - 0,30 $

- İyimser tahmin: 0,30 $ - 0,34562 $ (olumlu piyasa koşulları ve artan benimsenme ile)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan benimsenme ile büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,31413 $ - 0,46538 $

- 2028: 0,4138 $ - 0,63136 $

- Temel katalizörler: Teknolojik ilerlemeler, stratejik ortaklıklar ve genişleyen blokzincir entegrasyonu

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,37994 $ - 0,58452 $ (istikrarlı piyasa büyümesi ve yaygın benimsenme varsayımıyla)

- İyimser senaryo: 0,58452 $ - 0,70000 $ (güçlü ekosistem gelişimi ve stratejik ortaklıklar ile)

- Dönüştürücü senaryo: 0,70000 $ - 0,80664 $ (çığır açan uygulamalar ve kitlesel benimsenme ile)

- 2030-12-31: FET 0,80664 $ (iyimser projeksiyonlara göre potansiyel zirve)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,34562 | 0,2954 | 0,15952 | 0 |

| 2026 | 0,45512 | 0,32051 | 0,26923 | 8 |

| 2027 | 0,46538 | 0,38782 | 0,31413 | 30 |

| 2028 | 0,63136 | 0,4266 | 0,4138 | 44 |

| 2029 | 0,64007 | 0,52898 | 0,42318 | 78 |

| 2030 | 0,80664 | 0,58452 | 0,37994 | 97 |

IV. FET için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

FET Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Uzun vadeli yatırımcılar ve yapay zeka teknolojisine inananlar

- Öneriler:

- Piyasa düşüşlerinde FET biriktirin

- Fiyat hedefleri belirleyin ve bu hedeflere sadık kalın

- Tokenlerinizi donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve muhtemel dönüş noktalarını tespit edin

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Kısa vadeli al-sat için:

- Yapay zeka ve blokzincir haberlerini takip ederek katalizörleri belirleyin

- Zarar durdur emirleriyle riskinizi sınırlayın

FET Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla yapay zeka ve blokzincir projesine dağıtın

- Opsiyon işlemleri: Düşüş riskine karşı put opsiyonları kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın

V. FET için Olası Riskler ve Zorluklar

FET Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sert fiyat hareketleri yaygındır

- Rekabet: Diğer yapay zeka tabanlı blokzincir projeleri pazar payı elde edebilir

- Piyasa hissiyatı: Genel kripto piyasası trendleri FET fiyatını etkileyebilir

FET Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Devletler yapay zeka ve kriptoya daha sıkı düzenlemeler getirebilir

- Token sınıflandırması: FET bazı ülkelerde menkul kıymet olarak sınıflandırılabilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyonlar FET’in benimsenmesini kısıtlayabilir

FET Teknik Riskler

- Akıllı sözleşme açıkları: Kodda oluşan hatalar güvenlik sorunlarına yol açabilir

- Ölçeklenebilirlik zorlukları: Ağ büyüdükçe ve yeni kullanım alanları eklendikçe sorunlar yaşanabilir

- Yapay zeka entegrasyonunun karmaşıklığı: AI ile blokzincir arasında sorunsuz entegrasyon sağlamak güç olabilir

VI. Sonuç ve Eylem Önerileri

FET Yatırım Değeri Değerlendirmesi

FET, yapay zeka ve blokzincir teknolojisini birleştirerek benzersiz bir değer sunuyor. Uzun vadeli potansiyeli yüksek; ancak kısa vadeli oynaklık ve düzenleyici riskler göz ardı edilmemeli.

FET Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kademeli olarak küçük ve düzenli yatırımlar ile pozisyon oluşturun ✅ Deneyimli yatırımcılar: Temel tutum etrafında dengeli alım-satım stratejisi uygulayın ✅ Kurumsal yatırımcılar: FET’i çeşitlendirilmiş yapay zeka ve blokzincir portföyüne dahil edin

FET İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com’da FET token alıp-satın

- Staking: Ağ doğrulama ile pasif gelir elde edin

- DeFi entegrasyonu: FET ile merkeziyetsiz finans olanaklarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, risk toleranslarına göre karar vermeli ve profesyonel danışmanlık almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Fetch.ai 100 $’a ulaşır mı?

Fetch.ai’nin yakın zamanda 100 $’a ulaşması beklenmemektedir. Mevcut piyasa trendleri ve tahminler, FET için bu seviyeyi öngörmemektedir.

FET 50 $’a ulaşabilir mi?

İddialı olmakla birlikte, FET’in kısa vadede 50 $’a çıkması pek olası değildir. Mevcut seviyelerden %2.965 oranında artış gerektirir; bu da belirgin piyasa gelişmeleri ve yaygın benimseme olmadan son derece zordur.

FET coin’in geleceği var mı?

FET coin, gelecek için umut vaat ediyor. Yenilikçi AI tabanlı blokzincir teknolojisi ve artan benimseme, uzun vadeli değer artışı potansiyelini gösteriyor.

Fetch.ai 2030’da ne kadar değerlenir?

Mevcut tahminlere göre Fetch.ai, 2030 yılında 16,23 $’a ulaşabilir. Bu öngörü, FET’in önümüzdeki yıllarda önemli bir büyüme potansiyeli taşıdığına işaret ediyor.

2025 TAO Fiyat Tahmini: Gelişen Kripto Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Bittensor (TAO) iyi bir yatırım mı?: Bu yapay zeka tabanlı kripto paranın potansiyeli ve risklerinin analizi

Yapay Zeka Teknolojisinin Sınırlarını Keşfetmek: AITECH Nedir?

2025 IQPrice Tahmini: Bir Sonraki Boğa Döngüsünde Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Act I: The AI Prophecy (ACT) Yatırım İçin Uygun mu?: Yapay Zeka Token Pazarında Riskler ve Olası Getiriler Üzerine Analiz

2025 ALCH Fiyat Tahmini: Alchemy Token'ın Büyüme Potansiyeli, Piyasa Dinamikleri ve Uzun Vadeli Görünümü Analizi

NFT Nadirliği Hakkında Bilgi: Nadirlik Skorları Nasıl Hesaplanır

Testnet ortamında, kolayca erişilebilen musluk ile ücretsiz MATIC token talep edin

Blockchain Düğümlerinin İşleyişini Anlamak

Flash Kredileri Anlamak: DeFi'de Teminatsız Borçlanma Üzerine Kapsamlı Bir Rehber

MetaMask ile ERC20 Token Yönetimi: Bir Rehber