2025 EVAA Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Introduction: EVAA's Market Position and Investment Value

EVAA Protocol (EVAA), as a key player in the lending and yield generation space, has made significant strides since its inception. As of 2025, EVAA's market capitalization has reached $355,735,000, with a circulating supply of approximately 6,617,972.4 tokens, and a price hovering around $7.1147. This asset, often referred to as the "DeFi Catalyst," is playing an increasingly crucial role in enhancing TON's decentralized finance (DeFi) ecosystem.

This article will provide a comprehensive analysis of EVAA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. EVAA Price History Review and Current Market Status

EVAA Historical Price Evolution

- 2025: Project launch, price fluctuated between $0.7137 and $9.3432

EVAA Current Market Situation

As of October 24, 2025, EVAA is trading at $7.1147, experiencing a 9.58% decline in the past 24 hours. The token has shown significant volatility, with a 24-hour high of $8.4241 and a low of $5.5. Despite the recent dip, EVAA has demonstrated strong performance over the past week, with a 109.69% increase.

The current market capitalization stands at $47,084,888, ranking EVAA at 648th in the cryptocurrency market. With a circulating supply of 6,617,972.4 EVAA tokens, representing 13.24% of the total supply, the project maintains a relatively low circulation ratio. The fully diluted valuation is $355,735,000, indicating potential for growth as more tokens enter circulation.

Trading volume in the last 24 hours reached $12,115,399, suggesting active market participation. The token's all-time high of $9.3432 was achieved on October 22, 2025, while the all-time low of $0.7137 occurred on October 10, 2025, demonstrating the token's rapid price movement in a short period.

Click to view the current EVAA market price

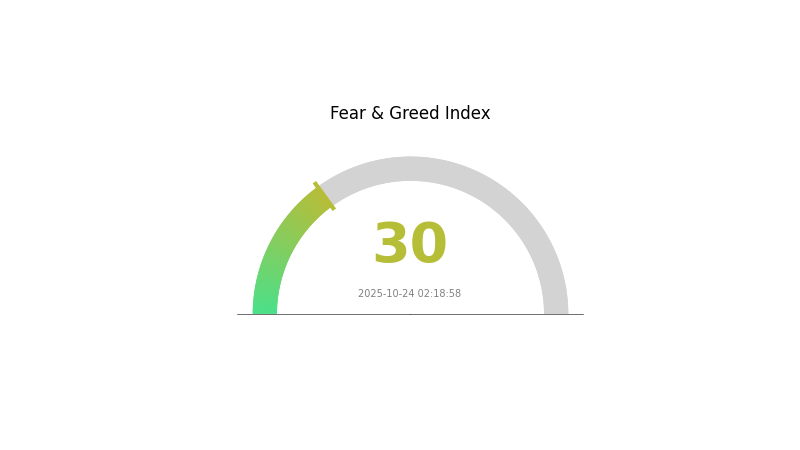

EVAA Market Sentiment Indicator

2025-10-24 Fear and Greed Index: 30 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 30, indicating a state of fear. This suggests investors are approaching the market with hesitation, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto space.

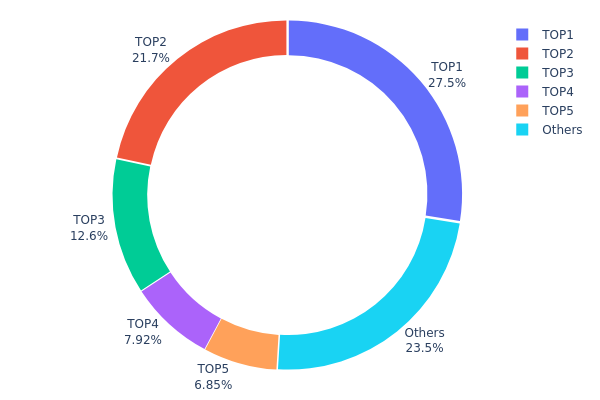

EVAA Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of EVAA tokens. The top 5 addresses collectively hold 76.5% of the total supply, with the largest holder controlling 27.5%. This high concentration suggests a relatively centralized token distribution, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market stability and vulnerability to large-scale movements. The top holders have significant influence over the token's supply, potentially affecting price volatility and liquidity. This concentration also implies a higher risk of market manipulation, as large holders could coordinate actions to influence prices.

While some level of concentration is common in emerging tokens, EVAA's current distribution indicates a need for increased decentralization to enhance market resilience and fairness. As the project develops, monitoring changes in this distribution will be crucial for assessing the token's long-term stability and adoption.

Click to view the current EVAA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x483a...c5c36d | 8250.00K | 27.50% |

| 2 | 0x5aa5...352fd4 | 6497.21K | 21.65% |

| 3 | 0x448d...2c3596 | 3779.44K | 12.59% |

| 4 | 0x3b8b...082c73 | 2375.00K | 7.91% |

| 5 | 0xe4e5...a9aa22 | 2055.56K | 6.85% |

| - | Others | 7042.79K | 23.5% |

II. Key Factors Influencing EVAA's Future Price

Supply Mechanism

- Short-term Unlocking: The expectation of short-term token unlocking has influenced EVAA's price, causing about 30% price fluctuation in the past week.

- Current Impact: As trading depth increases and more exchanges list EVAA, the market liquidity is expected to improve, potentially stabilizing the price.

Institutional and Whale Dynamics

- Exchange Listings: Multiple exchanges, including Gate.com, have listed EVAA, which may impact its price and market accessibility.

Macroeconomic Environment

- Global Economic Recovery: As the global economy gradually recovers, especially post-pandemic, the demand for EVAA and related technologies may increase, potentially influencing its price.

Technological Development and Ecosystem Building

- TON Ecosystem Dynamics: EVAA's price is closely tied to the developments and dynamics within the TON ecosystem.

- Ecosystem Applications: The growth of DApps and projects within the TON ecosystem could significantly impact EVAA's value and adoption.

III. EVAA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $4.58 - $6.00

- Neutral prediction: $6.00 - $8.00

- Optimistic prediction: $8.00 - $10.53 (requires strong market momentum and positive developments in the crypto sector)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range prediction:

- 2026: $6.54 - $11.59

- 2027: $7.25 - $14.40

- Key catalysts: Expanding use cases, technological advancements, and broader market acceptance

2030 Long-term Outlook

- Base scenario: $13.00 - $16.00 (assuming steady growth and adoption)

- Optimistic scenario: $16.00 - $18.00 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $18.00 - $20.00 (assuming breakthrough innovations and mainstream integration)

- 2030-12-31: EVAA $15.64 (projected average price, indicating significant growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 10.53167 | 7.1644 | 4.58522 | 0 |

| 2026 | 11.59092 | 8.84803 | 6.54755 | 24 |

| 2027 | 14.40947 | 10.21948 | 7.25583 | 43 |

| 2028 | 14.90051 | 12.31447 | 6.40353 | 73 |

| 2029 | 17.68974 | 13.60749 | 8.84487 | 91 |

| 2030 | 16.90051 | 15.64862 | 8.60674 | 119 |

IV. EVAA Professional Investment Strategies and Risk Management

EVAA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate EVAA tokens during market dips

- Stay informed about EVAA Protocol developments

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

EVAA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication and keep private keys secure

V. Potential Risks and Challenges for EVAA

EVAA Market Risks

- High volatility: EVAA price may experience significant fluctuations

- Limited trading history: Lack of long-term price data for analysis

- Market sentiment: Susceptible to broader crypto market trends

EVAA Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting DeFi protocols

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax treatment of DeFi tokens and activities

EVAA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Oracle dependency: Risks associated with reliance on external data sources

- Network congestion: Possible transaction delays on underlying blockchains

VI. Conclusion and Action Recommendations

EVAA Investment Value Assessment

EVAA Protocol shows promise in the DeFi lending and yield space, with potential for long-term growth. However, it faces short-term risks due to market volatility and regulatory uncertainties.

EVAA Investment Recommendations

✅ Beginners: Consider small, experimental positions to learn about DeFi

✅ Experienced investors: Allocate a portion of DeFi portfolio, monitor closely

✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified DeFi strategy

EVAA Participation Methods

- Spot trading: Purchase EVAA tokens on Gate.com

- DeFi engagement: Participate in EVAA Protocol's lending and yield features

- Governance: Hold EVAA tokens for potential future governance rights

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will AVAX ever reach $1000?

While possible, AVAX reaching $1000 is unlikely. It would require unprecedented growth, innovation, and market adoption beyond current projections.

Can VeChain reach $3?

Yes, VeChain has the potential to reach $3. Analysts forecast a significant surge, with some predicting a 2,700% increase in the short term, aligning with Bitcoin's bull run.

Can AVAX reach $5000?

While ambitious, reaching $5000 for AVAX is unlikely in the near future. It would require a massive market cap increase, surpassing current leaders.

What will AVAX be worth in 2025?

In 2025, AVAX is expected to trade between $17.7 and $91.1, with $20.2 as a key support level. The exact value remains uncertain.

Share

Content