2025 EURT Price Prediction: Analyzing Market Trends and Factors Influencing Stablecoin Valuation

Introduction: EURT's Market Position and Investment Value

Euro Tether (EURT) as a stable cryptocurrency backed by the euro, has been playing an increasingly important role in the digital asset market since its inception. As of 2025, EURT's market capitalization has reached $4,651,006.85, with a circulating supply of approximately 4,155,281.74 tokens, and a price hovering around $1.1193. This asset, often referred to as a "euro-pegged stablecoin," is playing a crucial role in providing a bridge between traditional finance and the cryptocurrency ecosystem.

This article will comprehensively analyze EURT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price forecasts and practical investment strategies.

I. EURT Price History Review and Current Market Status

EURT Historical Price Evolution

- 2021: EURT reached its all-time high of $1.31 on September 2nd, marking a significant milestone for the stablecoin

- 2022: The token experienced its all-time low of $0.944541 on September 28th, demonstrating volatility despite its stablecoin nature

- 2025: EURT has shown resilience, with current price at $1.1193, reflecting a 3.32% increase over the past year

EURT Current Market Situation

As of October 12, 2025, EURT is trading at $1.1193, with a market cap of $4,651,006.85. The token has experienced a 24-hour trading volume of $36,051.00. Despite being a stablecoin pegged to the Euro, EURT has shown some volatility in recent periods. The token has seen a 2.65% decrease in the last 24 hours and a more significant 4.54% drop over the past week. The monthly performance also indicates a downward trend with a 3.92% decrease. However, the yearly perspective remains positive with a 3.32% increase. The current circulating supply stands at 4,155,281.74 EURT, which is 8.31% of its total supply of 50,000,050 tokens. The fully diluted market cap is $55,965,055.97, indicating potential for growth if the entire supply enters circulation. The market sentiment appears cautious, with the current price being closer to its historical low than its all-time high.

Click to view the current EURT market price

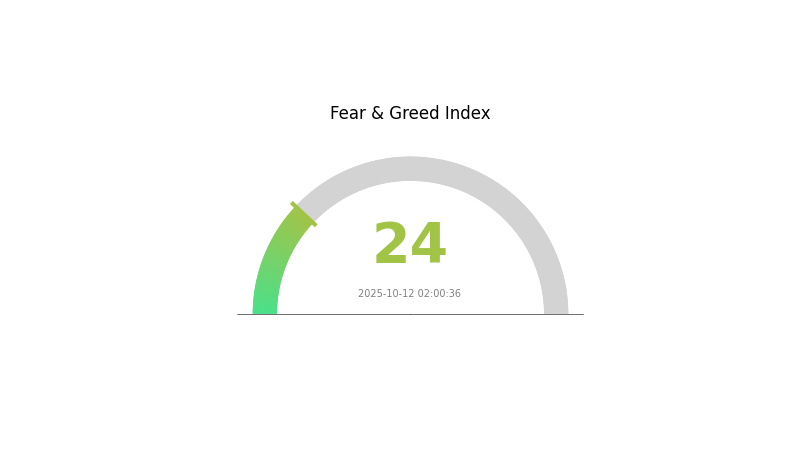

EURT Market Sentiment Indicator

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 24. This indicates a highly pessimistic outlook among investors. Such extreme fear often presents potential buying opportunities for contrarian investors, as assets may be undervalued. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

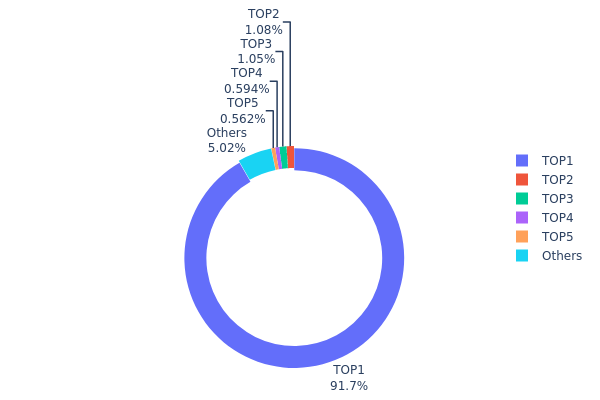

EURT Holdings Distribution

The address holdings distribution data for EURT reveals a highly concentrated ownership structure. The top address holds an overwhelming 91.69% of the total supply, equivalent to 45,846,150 EURT tokens. This extreme concentration raises significant concerns about the token's decentralization and market stability.

The next four largest holders collectively account for only 3.28% of the supply, with individual holdings ranging from 0.56% to 1.08%. All other addresses combined hold a mere 5.03% of EURT tokens. This severe imbalance in token distribution could potentially lead to market manipulation and increased volatility. The dominant address has the power to significantly influence EURT's price and liquidity, potentially undermining the token's integrity and utility in the broader ecosystem.

Such a concentrated holdings structure may deter new investors and limit EURT's adoption, as it contradicts the principles of decentralization often associated with cryptocurrencies. It also exposes the market to substantial risk if the largest holder decides to liquidate their position. Overall, this distribution pattern suggests a need for increased transparency and potential redistribution efforts to enhance EURT's market structure and long-term viability.

Click to view the current EURT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5754...07b949 | 45846.15K | 91.69% |

| 2 | 0x5c4b...553aef | 540.85K | 1.08% |

| 3 | 0x6916...7733a5 | 526.58K | 1.05% |

| 4 | 0x6ab5...070770 | 297.18K | 0.59% |

| 5 | 0x4fb3...a83128 | 281.18K | 0.56% |

| - | Others | 2508.11K | 5.03% |

II. Key Factors Affecting EURT's Future Price

Supply Mechanism

- Algorithmic Peg: EURT maintains a 1:1 peg to the Euro through an algorithmic mechanism.

- Current Impact: The stability of the Euro-pegged supply mechanism continues to influence EURT's price stability.

Institutional and Whale Dynamics

- National Policies: Regulatory developments in the Eurozone and the US regarding stablecoins and digital currencies may impact EURT adoption and usage.

Macroeconomic Environment

- Monetary Policy Impact: The interest rate differential between the Eurozone and the US remains a core factor influencing EURT's value against other currencies.

- Inflation Hedging Properties: EURT's performance as an inflation hedge depends on the Euro's stability and Eurozone inflation rates.

- Geopolitical Factors: Political uncertainties in France and other Eurozone countries may affect EURT's perceived stability and demand.

Technical Development and Ecosystem Building

- Ecosystem Applications: The growth of DApps and projects utilizing EURT within the Ethereum ecosystem may drive increased adoption and demand.

III. EURT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.67 - $0.90

- Neutral prediction: $0.90 - $1.12

- Optimistic prediction: $1.12 - $1.66 (requires sustained market stability)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2026: $0.86 - $1.75

- 2027: $0.94 - $2.24

- Key catalysts: Wider acceptance of stablecoins, regulatory clarity

2030 Long-term Outlook

- Base scenario: $2.00 - $2.68 (assuming steady market growth)

- Optimistic scenario: $2.68 - $3.72 (with accelerated adoption and favorable regulations)

- Transformative scenario: $3.72+ (under extremely favorable conditions and widespread integration)

- 2030-12-31: EURT $3.72 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.65656 | 1.1193 | 0.67158 | 0 |

| 2026 | 1.74879 | 1.38793 | 0.86052 | 24 |

| 2027 | 2.24276 | 1.56836 | 0.94102 | 40 |

| 2028 | 2.59156 | 1.90556 | 1.77217 | 70 |

| 2029 | 3.10302 | 2.24856 | 1.77636 | 100 |

| 2030 | 3.71935 | 2.67579 | 1.49844 | 139 |

IV. EURT Professional Investment Strategies and Risk Management

EURT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable Euro exposure

- Operation suggestions:

- Allocate a portion of portfolio to EURT as a hedge against Euro volatility

- Regularly rebalance to maintain desired Euro exposure

- Store EURT in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor Euro exchange rate fluctuations

- Pay attention to macroeconomic events affecting the Eurozone

EURT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Offline storage of private keys

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for EURT

EURT Market Risks

- Euro volatility: EURT value may fluctuate with Euro exchange rates

- Limited liquidity: Potential challenges in large-scale trading

- Market sentiment: Shifts in stablecoin preferences may impact demand

EURT Regulatory Risks

- Stablecoin regulations: Potential new laws affecting EURT operations

- Euro monetary policy changes: May impact EURT's backing and stability

- Cross-border transaction rules: Could affect EURT's usability in certain regions

EURT Technical Risks

- Smart contract vulnerabilities: Potential security issues in the underlying code

- Blockchain network congestion: May affect transaction speed and costs

- Integration challenges: Possible issues with new platforms or services

VI. Conclusion and Action Recommendations

EURT Investment Value Assessment

EURT offers a stable digital representation of the Euro, providing potential value for those seeking Euro exposure in the crypto space. However, investors should be aware of regulatory uncertainties and market risks associated with stablecoins.

EURT Investment Recommendations

✅ Beginners: Consider small allocations to understand stablecoin dynamics ✅ Experienced investors: Use EURT for Euro-denominated crypto trading or as part of a diversified stablecoin portfolio ✅ Institutional investors: Explore EURT for treasury management or as a Euro-pegged trading pair

EURT Participation Methods

- Spot trading: Buy and sell EURT on Gate.com

- Savings: Explore staking or yield-generating opportunities if available

- Payment: Use EURT for Euro-denominated transactions where accepted

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the euro price prediction for 2025?

Based on forecasts, the euro is expected to trade between 1.15 and 1.25 against the US dollar by the end of 2025. Major investment banks project EUR/USD in the range of 1.19-1.25, citing potential dollar weakness.

What will tether be worth in 2030?

Based on current predictions, Tether could reach €1.10 by 2030, assuming a 5% price change. However, exact values are uncertain in the volatile crypto market.

What is the market cap of EURT?

The market cap of EURT is $13.35 million as of October 12, 2025. This represents the total value of all circulating EURT tokens.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, based on current market trends and expected growth in the crypto sector.

Share

Content