2025 ETH Fiyat Tahmini: Kurumsal Benimsenme ve Layer 2 Ölçeklendirme Çözümleri, Ethereum'un Yeni Zirvelere Ulaşmasını Sağlayabilir

Giriş: ETH'nin Piyasa Konumu ve Yatırım Potansiyeli

Ethereum (ETH), akıllı sözleşme alanında öncü platform olarak 2015'te faaliyete geçtiğinden bu yana önemli başarılar elde etti. 2025 yılı itibarıyla Ethereum'un piyasa değeri 528,91 milyar ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 120,71 milyon coin ve fiyatı 4.381,83 ABD doları seviyesinde seyrediyor. "Dünya Bilgisayarı" olarak anılan bu varlık, merkeziyetsiz finans (DeFi), benzersiz tokenler (NFT) ve merkeziyetsiz uygulamalar (dApp) ekosistemlerinde giderek daha kritik bir rol üstleniyor.

Bu makalede, Ethereum'un 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel analizlerle incelenecek; yatırımcılara uzman fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. ETH Fiyat Geçmişi ve Güncel Piyasa Durumu

ETH Fiyatının Tarihsel Gelişimi

- 2015: İlk lansman, başlangıç fiyatı $0,432979

- 2017: İlk büyük boğa sezonu, fiyat $1.432,88'e yükseldi

- 2018-2020: Kripto kışı, fiyat yaklaşık $100 seviyelerine geriledi

- 2021: Yeni tüm zamanların zirvesi $4.891,70

- 2022-2024: Piyasa düzeltmesi ve toparlanma

- 2025: 25 Ağustos'ta belirlenen yeni zirve $4.946,05

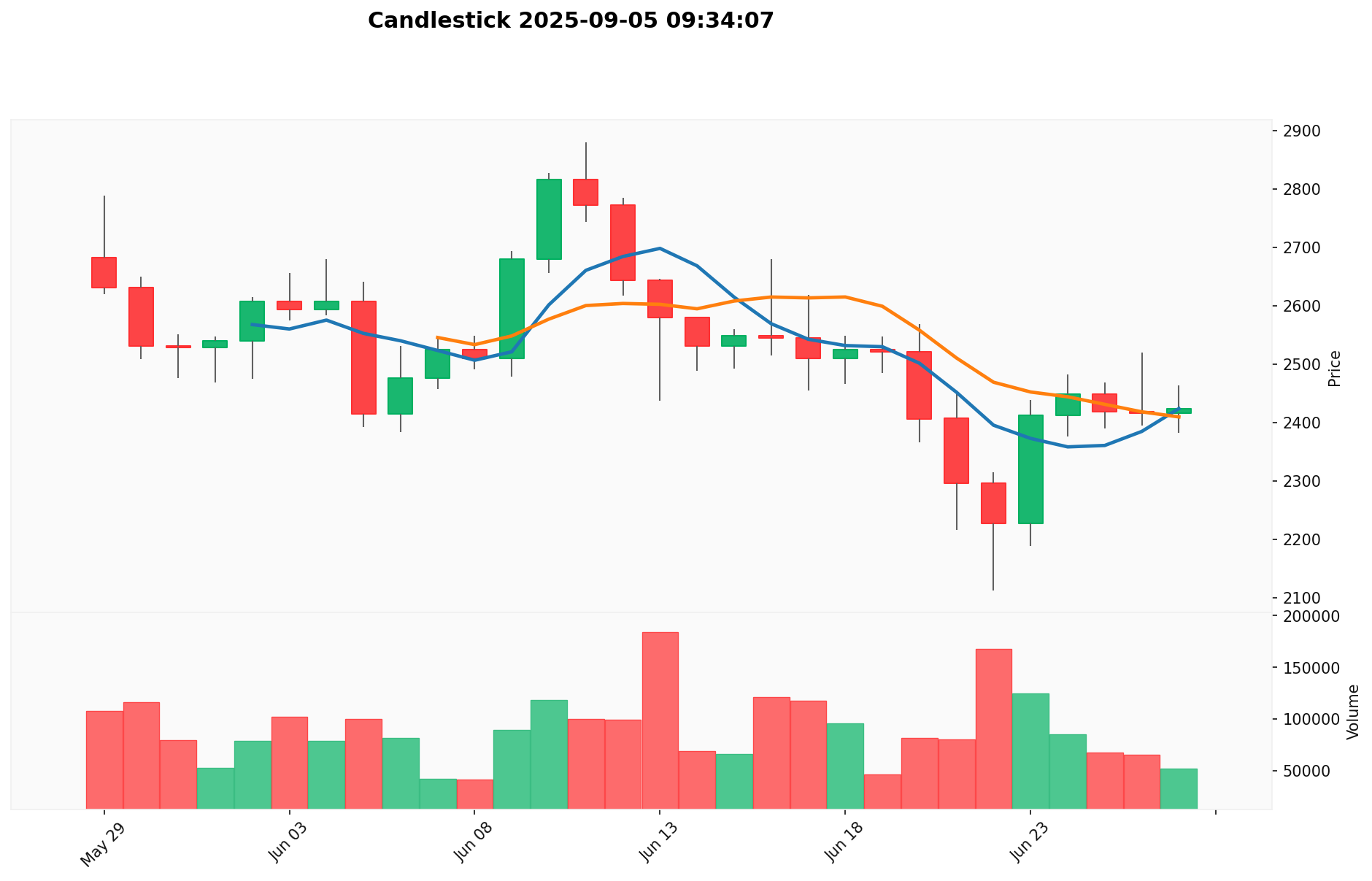

ETH Güncel Piyasa Durumu

5 Eylül 2025 itibarıyla Ethereum (ETH) $4.381,83 seviyesinden işlem görüyor ve 24 saatlik işlem hacmi $1.253.152.443. Son 24 saatte fiyat %0,08 oranında hafif bir düşüş gösterdi. ETH'nin piyasa değeri $528.909.754.969 olup, kripto para piyasasında %12,90 pay ile ikinci sırada yer alıyor.

ETH'nin farklı zaman dilimlerindeki fiyat performansı:

- 1 saat: -%0,36

- 24 saat: -%0,08

- 7 gün: +%0,97

- 30 gün: +%20,84

- 1 yıl: +%78,61

Mevcut fiyat, 25 Ağustos 2025'teki $4.946,05'lik zirvenin %11,41 altında. Dolaşımdaki ETH arzı 120.705.220,19 olup, bu rakam aynı zamanda toplam arzı ifade etmektedir; çünkü Ethereum, Proof of Stake'e geçişle birlikte sabit maksimum arzı kaldırmıştır.

Güncel ETH piyasa fiyatını görüntüleyin

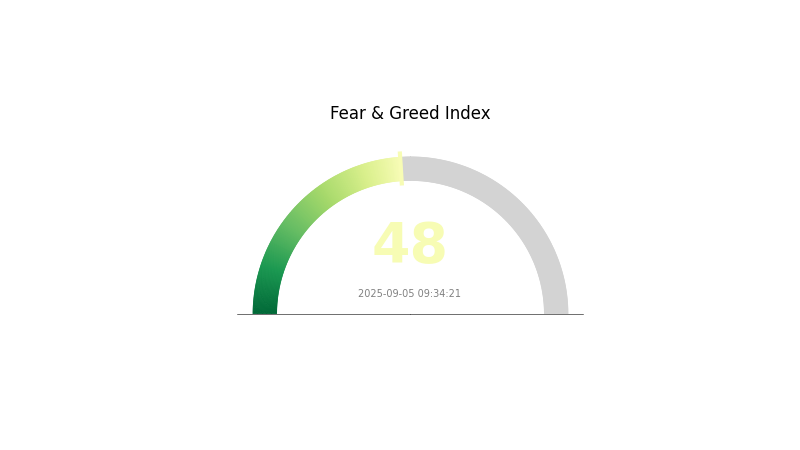

ETH Piyasa Duyarlılığı Endeksi

2025-09-05 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında duyarlılık dengede; Korku ve Açgözlülük Endeksi'nin 48 olması, yatırımcıların Ethereum'un geleceği konusunda ne aşırı iyimser ne de aşırı kötümser olduğunu gösteriyor. Bu orta düzeydeki duyarlılık, genellikle istikrarlı bir yatırım ortamı sunar. Ancak, nötr dönemler bazen ani fiyat hareketlerinin habercisi olabilir; bu nedenle piyasa katılımcıları dikkatli olmalıdır.

ETH Varlık Dağılımı

Adres varlık dağılımı tablosu, ETH sahipliğinin adresler arasında nasıl yoğunlaştığını gösterir. Verilere göre, en büyük adresler ETH'nin büyük bölümünü elinde tutuyor. Lider adres, toplam arzın %56,61'ini yani 68.330,81K ETH'yi kontrol ediyor. Bu yüksek yoğunlaşma, potansiyel piyasa manipülasyonu ve merkezileşme risklerini gündeme getiriyor.

İlk 5 adres toplam arzın %61,72'sini yönetirken, geri kalan %38,28 diğer adreslere dağılmış durumda. Bu dengesiz dağılım, Ethereum ekosisteminde servet yoğunlaşmasının yüksek olduğunu gösteriyor. Böyle bir yapı, piyasa dinamiklerini etkileyerek volatiliteyi ve büyük sahiplerin tetikleyebileceği ani hareketlere karşı hassasiyeti artırabilir.

Ethereum'un teknolojisi merkeziyetsizliği teşvik etse de, mevcut adres dağılımı merkezi bir sahiplik yapısına işaret ediyor. Bu yoğunlaşma, ağın dayanıklılığını zayıflatabilir ve yönetişim ile karar alma süreçlerinde merkeziyetsizliğin önünde engel oluşturabilir. Yatırımcılar, Ethereum'un uzun vadeli istikrarını ve gelişim potansiyelini değerlendirirken bu yapısal özellikleri göz önünde bulundurmalıdır.

Güncel ETH Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...7705fa | 68330.81K | 56.61% |

| 2 | 0xc02a...756cc2 | 2258.13K | 1.87% |

| 3 | 0xbe0e...4d33e8 | 1996.01K | 1.65% |

| 4 | 0x40b3...18e489 | 1177.79K | 0.98% |

| 5 | 0x4904...74e97e | 738.18K | 0.61% |

| - | Others | 46204.38K | 38.28% |

II. ETH'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Proof of Stake (PoS): Ethereum'un PoS'a geçişi, yeni ETH üretimini ciddi şekilde azalttı ve varlığı deflasyonist bir yapıya taşıdı.

- Mevcut Etki: Arz artışının yavaşlaması, zaman içinde ETH fiyatı üzerinde yukarı yönlü baskı oluşturması bekleniyor.

Kurumsal ve Whale Dinamikleri

- Kurumsal Benimseme: Büyük şirketler, çeşitli blok zinciri uygulamaları için Ethereum'u entegre ediyor.

- Devlet Politikaları: Farklı ülkeler, Ethereum dahil kripto paralar için düzenleyici çerçeveler oluşturuyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Ethereum, giderek enflasyona karşı bir koruma aracı olarak değerlendiriliyor.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: Ethereum, çok sayıda dApp ve DeFi projesine ev sahipliği yaparak platformun faydasını ve değerini artırıyor.

Üç. 2025-2030 Yılı {Coin} Fiyat Öngörüleri

2025 Görünümü

- Temkinli tahmin: $2.758 - $3.500

- Nötr tahmin: $3.500 - $4.378

- İyimser tahmin: $4.378 - $4.860 (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel boğa piyasası dönemi

- Fiyat aralığı tahmini:

- 2027: $3.015 - $6.549

- 2028: $4.166 - $6.475

- Temel katalizörler: Artan benimseme, teknolojik yenilikler, düzenleyici netlik

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $6.052 - $7.475 (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: $7.475 - $8.897 (güçlü boğa trendleri varsayımıyla)

- Dönüştürücü senaryo: $8.897 - $9.792 (son derece olumlu piyasa koşulları)

- 2030-09-05: {Coin} $7.474 (projeksiyon ortalama fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4859.7243 | 4378.13 | 2758.2219 | 0 |

| 2026 | 4803.684236 | 4618.92715 | 3233.249005 | 5 |

| 2027 | 6548.71491327 | 4711.305693 | 3015.23564352 | 7 |

| 2028 | 6474.51184860525 | 5630.010303135 | 4166.2076243199 | 28 |

| 2029 | 8896.82378152908375 | 6052.261075870125 | 5386.51235752441125 | 38 |

| 2030 | 9791.650581596481731 | 7474.542428699604375 | 5680.652245811699325 | 70 |

IV. ETH Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ETH Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli yatırımcılar, blok zinciri teknolojisine inananlar

- Operasyon önerileri:

- Kısa vadeli dalgalanmayı azaltmak için dolar maliyeti ortalaması (DCA) uygulayın

- Piyasa döngülerinde pozisyonu koruyun, temel gelişmelere odaklanın

- Varlık güvenliği için donanım cüzdanı kullanın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım seviyelerini izleyin

- Dalgalı alım-satım için ana noktalar:

- Kilit destek ve direnç seviyelerini takip edin

- Ağ yükseltmeleri ve önemli ekosistem gelişmelerini izleyin

ETH Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Portföyün %1-5'i

- Orta riskli yatırımcılar: Portföyün %5-10'u

- Agresif yatırımcılar: Portföyün %10-20'si

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla kripto para ve geleneksel varlık arasında dağıtın

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Ledger Nano X veya Trezor Model T

- Yazılım cüzdanı seçeneği: MetaMask (aktif alım-satım ve DeFi işlemleri için)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın ve özel anahtarları çevrimdışı saklayın

V. ETH Potansiyel Riskler ve Zorluklar

ETH Piyasa Riskleri

- Yüksek volatilite: Ani fiyat dalgalanmaları büyük kazanç veya kayıplara yol açabilir

- Piyasa duyarlılığı: Haberler ve genel kripto trendlerine bağlı olarak hızlı değişimler görülebilir

- Rekabet: Yeni blok zinciri platformları Ethereum'un liderliğini tehdit edebilir

ETH Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel düzenlemelerin gelişimi ETH'nin benimsenmesini ve kullanımını etkileyebilir

- Menkul kıymet sınıflandırması: ETH'nin bazı ülkelerde menkul kıymet olarak değerlendirilme ihtimali

- Vergi etkileri: Değişen vergi mevzuatı ETH işlemlerini ve varlıklarını etkileyebilir

ETH Teknik Riskler

- Ölçeklenebilirlik sorunları: Yüksek talep dönemlerinde ağ tıkanıklığı yaşanabilir

- Akıllı sözleşme açıkları: Merkeziyetsiz uygulamalarda güvenlik zafiyetleri oluşabilir

- Yükseltme riskleri: Büyük ağ güncellemelerinde teknik sorunlar ortaya çıkabilir

VI. Sonuç ve Eylem Önerileri

ETH Yatırım Değeri Analizi

Ethereum, akıllı sözleşme altyapısı ve geniş ekosistemiyle uzun vadede güçlü potansiyele sahip lider bir blok zinciri platformudur. Ancak, kısa vadeli fiyat dalgalanmaları ve teknik zorluklar önemli riskler barındırmaktadır.

ETH Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif alım-satım arasında dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: ETH'yi çeşitlendirilmiş bir kripto portföyüne dahil edin ve uzun vadeli değer potansiyeline odaklanın

ETH Katılım Yöntemleri

- Doğrudan satın alma: Güvenilir kripto para borsalarından ETH alın

- ETH tabanlı ETF'ler: ETH'yi takip eden borsa yatırım fonlarına yatırım yapın (uygun piyasalarda)

- DeFi katılımı: Ethereum üzerinde geliştirilen merkeziyetsiz finans protokollerine katılın

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre hareket etmeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

2025 ARB Fiyat Tahmini: Arbitrum'un Yerel Token'ı İçin Gelecek Trendler, Piyasa Dinamikleri ve Büyüme Potansiyeli Analizi

2025 ARB Fiyat Tahmini: Arbitrum'un Yerel Token'ı İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

On-chain veri analizi, Ethereum’un piyasa eğilimlerini nasıl gözler önüne serer?

2025 BOBA Fiyat Tahmini: Layer-2 Ölçeklendirme Çözümü Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Değerlendirilmesi

2025 OP Fiyat Tahmini: Yükseliş Trendleri ve Optimism'in Gelecekteki Değerini Etkileyen Temel Unsurlar

On-Chain Veri Analizi, Kripto Piyasa Davranışındaki Eğilimleri Nasıl Açığa Çıkarır?

Gate Perp DEX: Kripto Tüccarları İçin En İyi Yüksek Performanslı Merkeziyetsiz Sürekli Ticaret Platformu

Ethereum'u Zincir Üzerinde Staking Yapma: 2025 için ETH Staking Getirileri ve Minimum Gereksinimler Rehberi

Gate Meme Go: Yeni Başlayanlar için Sıfır Ücretli Web3 Meme Token Ticaret Platformu

Meme Coin'ları Nasıl Alınır? Gate Meme Go için Tam Kılavuz

ETH nasıl stake edilir? Gate’in yeni zincir üstü staking rehberi