2025 ENA Price Prediction: Bullish Outlook as Adoption and Partnerships Drive Growth

Introduction: ENA's Market Position and Investment Value

Ethena (ENA), as a synthetic dollar protocol built on Ethereum, has emerged as a crypto-native solution for money since its inception. As of 2025, Ethena's market capitalization has reached $3.14 billion, with a circulating supply of approximately 7,156,250,000 tokens, and a price hovering around $0.4384. This asset, dubbed the "Internet Bond," is playing an increasingly crucial role in providing a globally accessible dollar-denominated savings instrument.

This article will comprehensively analyze Ethena's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. ENA Price History Review and Current Market Status

ENA Historical Price Evolution

- 2024: ENA reached its all-time high of $1.5208 on April 11, 2024, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with ENA's price dropping to its all-time low of $0.1299 on October 10, 2025.

ENA Current Market Situation

As of October 15, 2025, ENA is trading at $0.4384, ranking 44th in the cryptocurrency market. The token has experienced a 3% decline in the past 24 hours, with a trading volume of $14,178,859. ENA's market capitalization stands at $3,137,300,000, with a circulating supply of 7,156,250,000 tokens out of a total supply of 15,000,000,000.

The token has shown significant volatility in recent periods:

- 1-hour change: -0.79%

- 7-day change: -19.8%

- 30-day change: -42.91%

Despite the recent downtrend, ENA has managed to maintain a 7.049% increase over the past year, indicating some long-term resilience.

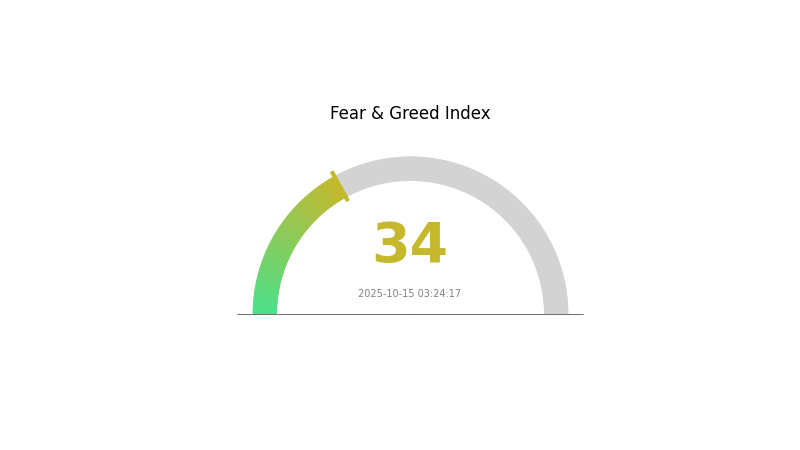

The current market sentiment for cryptocurrencies is characterized by fear, with a VIX index of 34. This suggests a cautious approach from investors in the broader crypto market, which may be influencing ENA's price action.

Click to view the current ENA market price

ENA Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index at 34. This suggests investors are cautious and uncertain about market conditions. During such periods, it's crucial to remain rational and avoid making impulsive decisions. While some may view this as a potential buying opportunity, it's important to conduct thorough research and consider your risk tolerance before taking action. Remember, market sentiment can shift quickly, so stay informed and adjust your strategy accordingly.

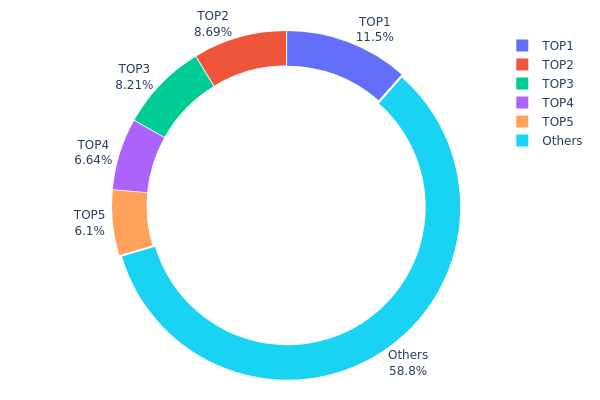

ENA Holdings Distribution

The address holdings distribution chart for ENA reveals a moderately concentrated ownership structure. The top five addresses collectively hold 41.14% of the total supply, with the largest address controlling 11.52%. This level of concentration suggests a significant influence from major holders, but it's not excessively centralized.

The current distribution pattern indicates a potential for market volatility, as large holders could impact prices through substantial trades. However, with 58.86% of tokens held by smaller addresses, there's still a considerable degree of decentralization. This balance between major players and a broader user base contributes to the market's structural stability, reducing the risk of extreme manipulation by any single entity.

Overall, ENA's holdings distribution reflects a maturing market with a mix of institutional involvement and retail participation. While the presence of large holders warrants attention, the spread across numerous smaller addresses suggests growing adoption and a healthier ecosystem resilience.

Click to view the current ENA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc4e5...fdf79b | 1728492.51K | 11.52% |

| 2 | 0x2146...47f1d0 | 1303082.83K | 8.68% |

| 3 | 0x1dc5...ac0901 | 1231887.04K | 8.21% |

| 4 | 0xb2af...d98298 | 996693.71K | 6.64% |

| 5 | 0xa527...edd666 | 914341.83K | 6.09% |

| - | Others | 8825502.09K | 58.86% |

II. Key Factors Influencing ENA's Future Price

Supply Mechanism

- Token Buyback: StablecoinX announced a $360 million funding plan to purchase ENA tokens, reducing net token release from 41.6% to 34.6% of circulating supply over the next 12 months.

- Historical Pattern: This buyback program is expected to alleviate short-term selling pressure and strengthen bullish sentiment.

- Current Impact: The planned $260 million public market acquisition will account for approximately 8% of ENA's circulating supply, creating strong demand-side catalysts.

Institutional and Whale Activity

- Institutional Holdings: StablecoinX plans to acquire ENA tokens at an average rate of $5 million per day over the next six weeks.

- Enterprise Adoption: Ethena is planning to launch iUSDe, a version of USDe designed for TradFi entities such as retirement funds.

Macroeconomic Environment

- Hedge Against Inflation: ENA's performance in inflationary environments is closely tied to market sentiment, with potential for higher yields during bull markets.

Technological Development and Ecosystem Building

- Fee Switch Mechanism: This governance proposal, once activated, will direct a portion of protocol revenue to sENA token holders, creating a more direct value accumulation channel.

- Converge Chain L2: The launch of this Layer 2 solution is expected to drive ENA price growth.

- Ecosystem Applications: The development of USDtb, a stablecoin compliant with the GENIUS Act, is underway.

III. ENA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.36834 - $0.4385

- Neutral forecast: $0.4385 - $0.47139

- Optimistic forecast: $0.47139 - $0.50428 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.31545 - $0.77737

- 2028: $0.34858 - $0.98539

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.82787 - $0.9893 (assuming steady market growth)

- Optimistic scenario: $0.9893 - $1.15073 (assuming strong market performance)

- Transformative scenario: Above $1.15073 (extreme favorable conditions)

- 2030-12-31: ENA $0.9893 (potential year-end price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.50428 | 0.4385 | 0.36834 | 0 |

| 2026 | 0.65523 | 0.47139 | 0.33469 | 7 |

| 2027 | 0.77737 | 0.56331 | 0.31545 | 28 |

| 2028 | 0.98539 | 0.67034 | 0.34858 | 52 |

| 2029 | 1.15073 | 0.82787 | 0.56295 | 88 |

| 2030 | 1.03876 | 0.9893 | 0.80133 | 125 |

IV. ENA Professional Investment Strategies and Risk Management

ENA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate ENA during market dips

- Set up regular buying plans to average costs

- Store ENA in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to synthetic dollar protocols

- Set strict stop-loss orders to manage downside risk

ENA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Use of stablecoins: Allocate a portion to stablecoins for capital preservation

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ENA

ENA Market Risks

- Price volatility: Synthetic dollar protocols may experience significant price swings

- Liquidity risk: Potential challenges in buying or selling large amounts quickly

- Competition: Emergence of other synthetic dollar protocols may impact ENA's market share

ENA Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of synthetic dollar protocols

- Compliance challenges: Adapting to evolving global financial regulations

- Legal status: Possibility of legal challenges to the protocol's operations

ENA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol's code

- Network congestion: Ethereum network issues could affect ENA transactions

- Oracle failures: Reliance on external data sources for price feeds may pose risks

VI. Conclusion and Action Recommendations

ENA Investment Value Assessment

ENA presents a unique value proposition as a synthetic dollar protocol on Ethereum, offering potential for growth in the evolving DeFi landscape. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

ENA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about synthetic assets ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider ENA as part of a diversified crypto strategy

ENA Participation Methods

- Spot trading: Buy and hold ENA on reputable exchanges like Gate.com

- Yield farming: Explore potential yield opportunities within the Ethena ecosystem

- Staking: Participate in any available staking programs to earn additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Ena good to buy?

Yes, Ena appears to be a promising investment in 2025. Its innovative technology and growing market presence suggest potential for significant returns. However, always conduct thorough research before investing.

Is ENA a buy or sell?

ENA is currently a sell. Short-term indicators suggest selling, despite some conflicting signals. Market trends indicate potential downward pressure on the price.

What's the highest ENA coin price ever?

The highest ENA coin price ever was $1.52, reached on April 11, 2024.

How much is the ENA price?

As of 2025-10-15, the ENA price is $0.4664. It has increased by 12.98% in the past 24 hours, with a trading volume of $746.65 million.

Share

Content