2025 ELON Price Prediction: Analyzing Future Growth Potential and Market Trends for Dogelon Mars Token

Introduction: ELON's Market Position and Investment Value

Dogelon Mars (ELON), as a meme-inspired cryptocurrency, has gained significant attention since its inception in 2021. As of 2025, ELON's market capitalization has reached $52,057,348, with a circulating supply of approximately 549,649,971,723,242 tokens, and a price hovering around $0.00000009471. This asset, often referred to as the "interstellar currency," is playing an increasingly crucial role in the realm of community-driven cryptocurrencies and social tokens.

This article will comprehensively analyze ELON's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ELON Price History Review and Current Market Status

ELON Historical Price Evolution

- 2021: ELON launched, price reached ATH of $0.00000259 on October 31

- 2022: Market downturn, price declined significantly

- 2023: Consolidation phase, price fluctuated within a range

ELON Current Market Situation

As of September 30, 2025, ELON is trading at $0.00000009471. The token has experienced a slight decline of 0.61% in the past 24 hours. Over the past week, ELON has shown a positive trend with a 1.98% increase. However, the 30-day and 1-year performance indicate downward pressure, with declines of 7.08% and 32.54% respectively.

ELON's market capitalization currently stands at $52,057,348, ranking it 662nd in the global cryptocurrency market. The token's 24-hour trading volume is $159,164, suggesting moderate liquidity.

The circulating supply of ELON is 549,649,971,723,242 tokens, which represents 54.96% of the total supply of 1,000,000,000,000,000 tokens. This indicates that a significant portion of the tokens are in circulation.

Click to view current ELON market price

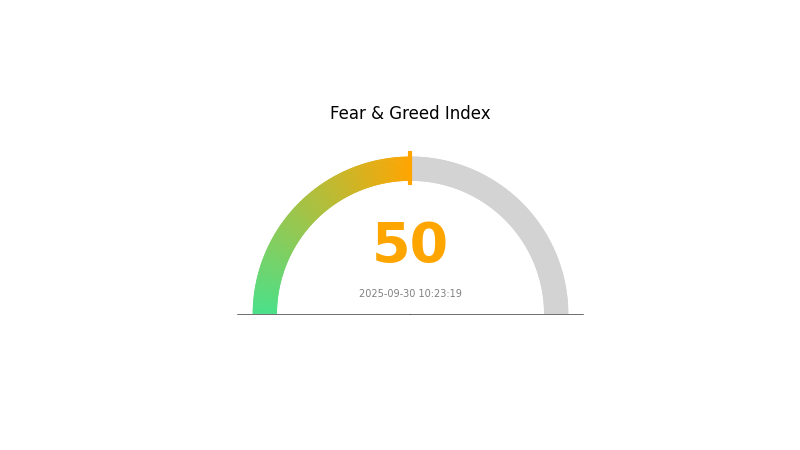

ELON Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index at 50, indicating a neutral sentiment. This balance suggests that investors are neither overly optimistic nor pessimistic about the market's future. Such a neutral stance often presents a good opportunity for traders to reassess their strategies and portfolio allocations. It's important to remember that market sentiment can shift quickly, so staying informed and maintaining a diversified approach is crucial in these conditions.

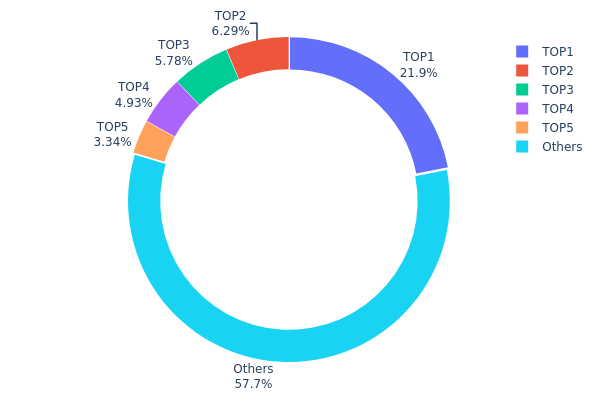

ELON Holdings Distribution

The address holdings distribution data provides insight into the concentration of ELON token ownership. Based on the provided data, we observe a significant concentration of tokens in the top addresses. The largest holder possesses 21.91% of the total supply, while the top 5 addresses collectively control 42.25% of ELON tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. With a single address holding over one-fifth of the supply, there's a risk of large-scale selling pressure or market movements influenced by a few key players. The remaining 57.75% distributed among other addresses suggests some level of wider distribution, but the substantial holdings of top addresses still dominate the token's economics.

Such a concentrated distribution could impact market stability and liquidity. It may also affect the perceived decentralization of the project, as a significant portion of decision-making power potentially lies with a small number of addresses. This structure warrants careful monitoring by investors and analysts to assess potential risks and market dynamics associated with ELON.

Click to view the current ELON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa023...fc947e | 219141634517.86K | 21.91% |

| 2 | 0x7b73...315860 | 62943146124.06K | 6.29% |

| 3 | 0xcffa...290703 | 57819393231.64K | 5.78% |

| 4 | 0xa7b3...634882 | 49330755179.42K | 4.93% |

| 5 | 0x5438...18a0e6 | 33401301433.84K | 3.34% |

| - | Others | 577363663488.90K | 57.75% |

II. Key Factors Affecting ELON's Future Price

Supply Mechanism

- Annual Supply: ELON has an unlimited supply, with approximately 5 billion coins minted each year.

- Historical Pattern: The large supply has contributed to ELON's low price and high liquidity.

- Current Impact: The continuous minting may put downward pressure on price, but also supports trading activity.

Institutional and Whale Dynamics

- Whale Concentration: A small number of wallets hold a significant portion of ELON supply, with the largest wallet holding up to 28% of total coins.

Macroeconomic Environment

- Inflation Hedging Properties: As a meme coin, ELON has shown high volatility and speculative nature, making its inflation hedging properties uncertain.

Technological Development and Ecosystem Building

- Potential Mining Mechanism Change: Discussions are ongoing about transitioning ELON from Proof of Work (PoW) to Proof of Stake (PoS), which could significantly impact the coin's energy efficiency and accessibility.

III. ELON Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00000150 - $0.00000180

- Neutral prediction: $0.00000180 - $0.00000220

- Optimistic prediction: $0.00000220 - $0.00000250 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00000280 - $0.00000350

- 2028: $0.00000400 - $0.00000500

- Key catalysts: Broader cryptocurrency market trends, technological advancements, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00000550 - $0.00000650 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00000700 - $0.00000800 (with significant technological breakthroughs and mainstream acceptance)

- Transformative scenario: $0.00000900 - $0.00001000 (with revolutionary use cases and widespread integration)

- 2030-12-31: ELON $0.00000900 (potential peak based on optimistic market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 24 |

| 2027 | 0 | 0 | 0 | 47 |

| 2028 | 0 | 0 | 0 | 77 |

| 2029 | 0 | 0 | 0 | 90 |

| 2030 | 0 | 0 | 0 | 117 |

IV. Professional Investment Strategies and Risk Management for ELON

ELON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate ELON during market dips

- Set price targets and regularly rebalance portfolio

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

ELON Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ELON

ELON Market Risks

- High volatility: ELON price can experience significant fluctuations

- Limited liquidity: May face challenges in large-volume trades

- Meme coin status: Susceptible to sentiment-driven price movements

ELON Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of meme coins

- Compliance challenges: May face difficulties in adapting to new regulations

- Market access: Risk of delisting from exchanges due to regulatory pressure

ELON Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Network congestion: High fees and slow transactions during peak periods

- Centralization concerns: Potential influence of large token holders on project direction

VI. Conclusion and Action Recommendations

ELON Investment Value Assessment

ELON presents a high-risk, high-reward opportunity within the meme coin sector. While it has shown significant growth potential, investors should be aware of its volatile nature and speculative characteristics.

ELON Investment Recommendations

✅ Beginners: Limit exposure to a small portion of portfolio, focus on education

✅ Experienced investors: Consider as part of a diversified crypto portfolio, use technical analysis for entry/exit

✅ Institutional investors: Approach with caution, consider for short-term trading strategies if risk appetite allows

ELON Trading Participation Methods

- Spot trading: Buy and hold ELON tokens on Gate.com

- Derivatives: Utilize futures contracts for leveraged exposure (experienced traders only)

- Staking: Participate in yield-generating opportunities if available on supported platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Elon Coin reach $1?

Based on current predictions, it's unlikely Elon Coin will reach $1. The coin would need to gain over 124,000% from its current price, which is not supported by market forecasts.

What will Dogelon Mars be worth in 2025?

Based on current predictions, Dogelon Mars (ELON) is expected to reach a value of $0.00000011 by the end of 2025. This represents potential growth for the meme coin.

Is Dogelon Mars going to skyrocket?

Yes, Dogelon Mars is expected to skyrocket. Predictions show a 403% increase, reaching $0.0₆4843 by October 2025. Current trends indicate significant growth potential.

How much will Dogelon Mars be worth in 2040?

Dogelon Mars is projected to reach $0.000241 on average in 2040, with a potential maximum of $0.000384.

Share

Content