2025 EGG Price Prediction: Cracking the Shell of Future Market Trends

Introduction: EGG's Market Position and Investment Value

Goose Finance (EGG), as a decentralized exchange token on the Binance Smart Chain, has been making waves since its inception in 2021. As of 2025, Goose Finance's market cap has reached $370,722, with a circulating supply of approximately 47,334,393 tokens, and a price hovering around $0.007832. This asset, often referred to as a "yield farming token," is playing an increasingly crucial role in the decentralized finance (DeFi) ecosystem.

This article will comprehensively analyze Goose Finance's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. EGG Price History Review and Current Market Status

EGG Historical Price Evolution

- 2021: Project launch, price reached all-time high of $172.51 on February 20

- 2024: Market downturn, price hit all-time low of $0.000000991998 on July 14

- 2025: Gradual recovery, price stabilized around $0.007832

EGG Current Market Situation

As of October 31, 2025, EGG is trading at $0.007832, with a market cap of $370,722.97. The 24-hour trading volume stands at $14,443.61. EGG has experienced a 1.76% decrease in the last 24 hours and a 3.44% decline over the past week. The circulating supply is 47,334,393.30 EGG, which is 119.85% of the total supply of 39,494,123 EGG. The fully diluted market cap is $309,317.97. EGG currently ranks 3,707th in the cryptocurrency market, with a market dominance of 0.0000080%.

Click to view the current EGG market price

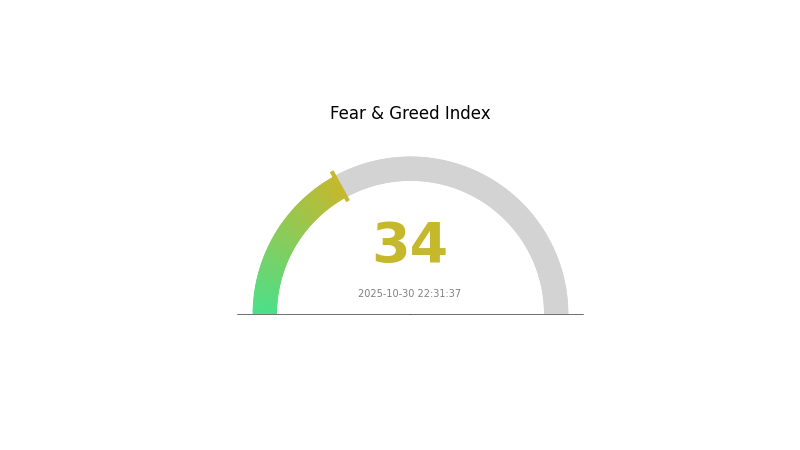

EGG Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 34, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to stay informed and avoid making impulsive decisions. Remember, market cycles are natural, and periods of fear often precede rebounds. Consider using Gate.com's advanced tools to monitor market trends and make informed choices in this uncertain climate.

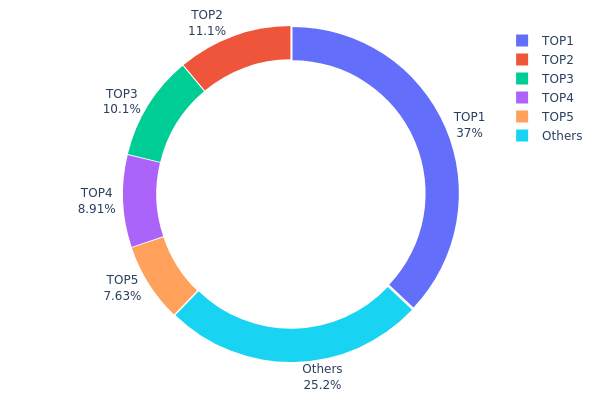

EGG Holdings Distribution

The address holdings distribution data reveals a high concentration of EGG tokens among a few top addresses. The top address holds a significant 37.03% of the total supply, while the top five addresses collectively control 74.79% of all EGG tokens. This concentration raises concerns about the decentralization and potential market manipulation of EGG.

Such a concentrated distribution could lead to increased volatility and susceptibility to large price swings if any of these major holders decide to sell or move their holdings. It also suggests that a small number of entities have substantial influence over the EGG ecosystem, potentially affecting governance decisions and market dynamics.

While the presence of a 25.21% distribution among "Others" indicates some level of wider participation, the overall structure points to a relatively centralized token economy. This concentration may impact the stability of EGG's on-chain structure and could be a factor for investors to consider when assessing the token's long-term prospects and resistance to market manipulation.

Click to view the current EGG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe70e...7f2e57 | 17619.18K | 37.03% |

| 2 | 0xb815...b90a16 | 5286.17K | 11.11% |

| 3 | 0xd1b5...d8d8d3 | 4814.61K | 10.12% |

| 4 | 0x3378...6cd804 | 4237.86K | 8.90% |

| 5 | 0x19e7...e03019 | 3630.55K | 7.63% |

| - | Others | 11982.92K | 25.21% |

II. Key Factors Affecting EGG's Future Price

Supply Mechanism

- Laying Hen Inventory: The number of laying hens in production directly affects egg supply.

- Culling Rate: The rate at which older hens are removed from production impacts supply.

- Current Impact: Changes in hen inventory and culling rates are expected to influence egg prices.

Macroeconomic Environment

- Monetary Policy Impact: The strength of the US dollar, influenced by Federal Reserve policies, affects agricultural commodity pricing, including eggs.

- Inflation Hedging Properties: Eggs may be viewed as a hedge against inflation due to their essential nature in consumer diets.

Technical Development and Ecosystem Building

- Production Efficiency: Technological improvements in egg production methods could impact supply and pricing.

- Supply Chain Innovations: Advancements in transportation and packaging may affect egg distribution and pricing.

III. EGG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00721 - $0.00783

- Neutral prediction: $0.00783 - $0.00967

- Optimistic prediction: $0.00967 - $0.01151 (requires positive market sentiment)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00880 - $0.01228

- 2027: $0.00659 - $0.01614

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.01356 - $0.01538 (assuming steady market growth)

- Optimistic scenario: $0.01632 - $0.02245 (assuming strong market performance)

- Transformative scenario: $0.02245+ (under extremely favorable conditions)

- 2030-12-31: EGG $0.02245 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01151 | 0.00783 | 0.00721 | 0 |

| 2026 | 0.01228 | 0.00967 | 0.0088 | 23 |

| 2027 | 0.01614 | 0.01098 | 0.00659 | 39 |

| 2028 | 0.01532 | 0.01356 | 0.00936 | 72 |

| 2029 | 0.01632 | 0.01444 | 0.00823 | 83 |

| 2030 | 0.02245 | 0.01538 | 0.01492 | 95 |

IV. Professional Investment Strategies and Risk Management for EGG

EGG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate EGG during market dips

- Set price targets for partial profit-taking

- Store EGG in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

EGG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for EGG

EGG Market Risks

- High volatility: EGG price can experience significant fluctuations

- Liquidity risk: Limited trading pairs may affect price stability

- Competition: Increasing number of DeFi projects on BSC

EGG Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of DeFi projects

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax treatments for DeFi tokens

EGG Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: BSC network congestion during high demand

- Dependence on PancakeSwap: Risks associated with the underlying DEX

VI. Conclusion and Action Recommendations

EGG Investment Value Assessment

EGG presents a high-risk, high-reward opportunity within the DeFi space. Long-term potential exists for yield farming and governance participation, but short-term volatility and regulatory uncertainties pose significant risks.

EGG Investment Recommendations

✅ Novice: Limit exposure, focus on education and small test transactions ✅ Experienced investors: Consider as part of a diversified DeFi portfolio ✅ Institutional investors: Conduct thorough due diligence, implement risk management strategies

EGG Participation Methods

- Spot trading: Purchase EGG on Gate.com

- Yield farming: Stake EGG in Goose Finance liquidity pools

- Governance: Participate in protocol decision-making processes

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high are egg prices going to get?

Egg prices are projected to rise by 20% in 2025, significantly outpacing general food inflation due to ongoing avian flu impacts.

Why are eggs $8 now?

Eggs are $8 due to a supply shortage caused by bird flu outbreaks, increased production costs, and high demand.

Share

Content