2025 DOGE Fiyat Tahmini: Olgunlaşan Kripto Piyasasında Dogecoin’in Gelecekteki Konumunu Değerlendirmek

Giriş: DOGE'nin Piyasa Konumu ve Yatırım Değeri

Dogecoin (DOGE), eğlenceli ve kullanıcı dostu bir kripto para birimi olarak 2013’ten beri önemli yol kat etti. 2025 yılı itibarıyla Dogecoin’in piyasa değeri 36,5 milyar dolara yükseldi; dolaşımdaki arzı yaklaşık 150,79 milyar coin’e ulaştı ve fiyatı 0,24 dolar seviyelerinde seyrediyor. Meme coin olarak adlandırılan DOGE, dijital işlemler ve çevrim içi bahşiş sistemlerinde giderek daha önemli bir rol üstleniyor.

Bu makale, Dogecoin’in 2025-2030 dönemi fiyat trendlerini; tarihsel fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle bütünleşik olarak analiz edecek. Yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. DOGE Fiyat Geçmişi ve Güncel Piyasa Durumu

DOGE Tarihsel Fiyat Seyri

- 2013: DOGE, 8 Aralık’ta piyasaya sürüldü; başlangıç fiyatı yaklaşık 0,000559 dolardı.

- 2021: 8 Mayıs’ta, sosyal medyadaki dalgayla 0,731578 dolarla tüm zamanların en yüksek seviyesine ulaştı.

- 2022-2023: Piyasa düzeltmesiyle, fiyat ciddi oranda zirveden geriledi.

DOGE Güncel Piyasa Durumu

9 Eylül 2025 itibarıyla DOGE, 0,24193 dolardan işlem görüyor ve kripto para piyasasında 10. sırada yer alıyor; piyasa değeri 36,48 milyar dolar. 24 saatlik işlem hacmi 57,69 milyon dolar olup piyasada canlı bir işlem ortamı gösteriyor. DOGE, son bir yılda %152,049’luk ciddi bir artış gösterdi. Kısa vadede ise, son 24 saatte %3,3 ve son bir haftada %13,42 yükselerek pozitif ivmesini sürdürüyor. Mevcut fiyat, tarihi zirvenin %66,93 altında olmasına rağmen, piyasa koşulları elverişli kalırsa yükseliş potansiyeli taşıyor.

Güncel DOGE piyasa fiyatını görüntülemek için tıklayın

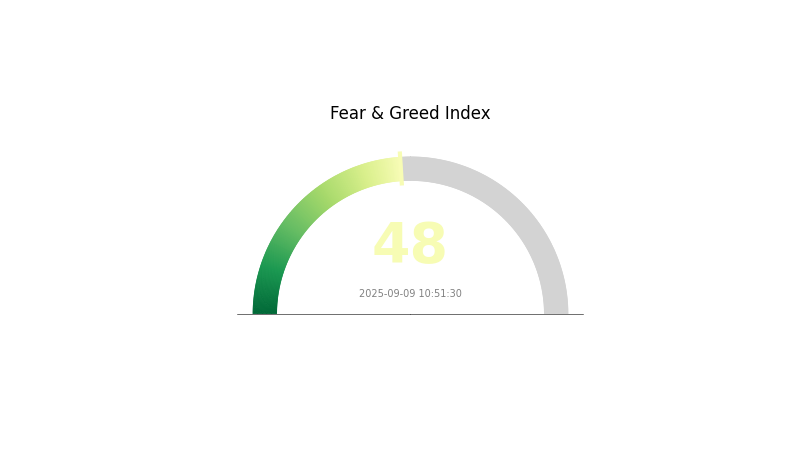

DOGE Piyasa Duyarlılığı Göstergesi

09 Eylül 2025 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Güncel Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

DOGE piyasasındaki duyarlılık 48 seviyesinde ve yatırımcılar ne korkuya ne de aşırı iyimserliğe kapılıyor. Bu istikrarlı ortam, yatırımcıların stratejilerini gözden geçirmeleri ve olası piyasa hareketlerine hazırlık yapmaları için uygun bir zemin oluşturuyor. Nötr pozisyonun, önümüzdeki gelişmelere veya haberlere bağlı olarak hızla değişebileceğini göz önünde bulundurun.

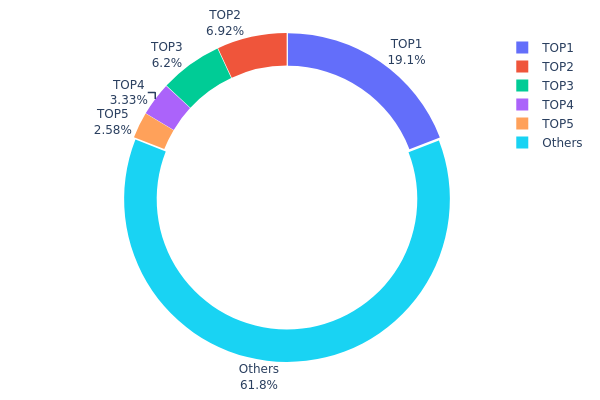

DOGE Varlık Dağılımı

Adres bazlı dağılım verileri, DOGE sahipliğinde belirgin bir yoğunlaşmaya işaret ediyor. En büyük adres, toplam arzın %19,13’ünü elinde bulundururken; ilk 5 adres, tüm DOGE tokenlarının %38,16’sını kontrol ediyor. Böylesi bir yoğunlaşma, piyasa manipülasyonu ve dalgalanma risklerini artırıyor.

Bununla birlikte, toplam DOGE arzının %61,84’ü diğer adreslere yayılmış durumda. Bu, küçük yatırımcıların piyasadaki etkisini gösteriyor ve kısmen merkeziyetsizliği destekliyor. Ancak, büyük sahiplerin hacimli işlemlerle piyasa üzerinde ciddi etkiler yaratma potansiyeli göz ardı edilmemeli.

Mevcut dağılım modeli, DOGE’un piyasa yapısının merkeziyetçi ve yaygın dağılım arasında bir dengeye sahip hibrit bir yapıda olduğunu gösteriyor. Bu yapı, büyük sahiplerin işlemlerine karşı fiyat duyarlılığını artırırken, aynı zamanda daha geniş bir kullanıcı kitlesinden doğal piyasa hareketlerini de mümkün kılıyor.

Güncel DOGE Varlık Dağılımı tablosunu görüntülemek için tıklayın

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | DEgDVF...s1pMke | 28.856.003,45K | 19,13% |

| 2 | DE5opa...X6EToX | 10.435.337,34K | 6,92% |

| 3 | D8ZEVb...bd66TX | 9.358.648,71K | 6,20% |

| 4 | DDTtqn...iXYdGG | 5.031.001,97K | 3,33% |

| 5 | AC8azE...gmP5hQ | 3.892.824,27K | 2,58% |

| - | Diğerleri | 93.286.820,66K | 61,84% |

II. DOGE’nin Gelecek Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Enflasyonist Model: Bitcoin’in sınırlı arzının aksine, Dogecoin’in arzı sınırsızdır ve yılda yaklaşık 5 milyar yeni coin piyasaya sürülmektedir.

- Tarihsel Seyir: Enflasyonist yapı, DOGE fiyatında zaman içinde kademeli bir seyreltmeye yol açmıştır.

- Güncel Etki: Süregelen arz artışı, talep büyümesi arzın önüne geçmedikçe DOGE fiyatında baskı oluşturabilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: Tesla, DOGE ile ürün satışını kabul ederek daha geniş bir kurumsal benimsemenin önünü açıyor.

- Ulusal Politikalar: Özellikle meme coin’lere yönelik büyük ekonomilerdeki regülasyonlar DOGE’un piyasa performansını ciddi şekilde etkileyebilir.

Makroekonomik Çevre

- Para Politikası Etkisi: 2025 Eylül ayında beklenen faiz indirimleri, genel piyasa toparlanmasını teşvik edebilir ve DOGE benzeri meme coin’lere olumlu yansıyabilir.

- Enflasyona Karşı Koruma Özelliği: DOGE, diğer bazı kripto varlıkların aksine, geleneksel olarak enflasyondan korunma aracı olarak değerlendirilmemektedir.

Teknik Gelişim ve Ekosistem İnşası

- Topluluk Odaklılık: Dogecoin topluluğu, “Do Only Good Everyday” (Her Gün Sadece İyi Şeyler Yap) mottosuyla yardımsever projelere ve yeni başlayanlara dostça bir ortam sunmaya odaklanır.

- Pratik Kullanım Alanları: DOGE, hızlı işlemleri ve düşük ücretleri sayesinde içerik üreticilerine bahşişten, bağışlara ve giderek artan sayıda işletmede günlük alışverişlere kadar geniş bir kullanım alanı sunmaktadır.

III. 2025-2030 Dönemi DOGE Fiyat Tahminleri

2025 Görünümü

- İhtiyatlı tahmin: 0,14 – 0,20 dolar

- Nötr tahmin: 0,20 – 0,28 dolar

- İyimser tahmin: 0,28 – 0,32 dolar (kalıcı piyasa toparlanması ve artan benimseme varsayımıyla)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Konsolidasyon döneminin ardından kademeli büyüme

- Fiyat aralığı tahmini:

- 2027: 0,25 – 0,37 dolar

- 2028: 0,32 – 0,45 dolar

- Başlıca katalizörler: Teknolojik inovasyonlar, e-ticarette artan kabul ve pozitif regülasyon gelişmeleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,40 – 0,50 dolar (istikrarlı büyüme ve sürekli benimseme varsayımıyla)

- İyimser senaryo: 0,50 – 0,65 dolar (güçlü boğa piyasası ve anlamlı ana akım entegrasyon ile)

- Daha ileri senaryo: 0,65 – 0,80 dolar (devrimsel kullanım alanları ve küresel entegrasyon ile)

- 31 Aralık 2030: DOGE 0,65547 dolar (iyimser öngörülere göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Yıllık Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,3211 | 0,24143 | 0,14727 | 0 |

| 2026 | 0,41346 | 0,28127 | 0,26439 | 16 |

| 2027 | 0,37515 | 0,34736 | 0,25705 | 43 |

| 2028 | 0,44796 | 0,36126 | 0,32152 | 49 |

| 2029 | 0,50576 | 0,40461 | 0,2549 | 67 |

| 2030 | 0,65547 | 0,45519 | 0,39146 | 88 |

IV. Profesyonel DOGE Yatırım Stratejileri ve Risk Yönetimi

DOGE Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk iştahına ve sabra sahip yatırımcılar

- Operasyonel öneriler:

- Düşüşlerde DOGE biriktirin

- Fiyat hedefleri oluşturup kısmi kar alın

- Uzun vadede donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası geri dönüş seviyelerini tespit edin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım bölgelerini belirleyin

- Salınımlı al-satın temel noktaları:

- Sosyal medya duyarlılığını ve ünlü etkilerini izleyin

- Düşüş riskini yönetmek için zarar durdur (stop-loss) emirleri kullanın

DOGE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün en fazla %15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlığa dağıtın

- Opsiyon sözleşmeleri: Düşüş riskini sınırlamak için satım opsiyonlarını kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk cüzdan: Büyük varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. DOGE için Potansiyel Riskler ve Zorluklar

DOGE Piyasa Riskleri

- Yüksek oynaklık: Fiyatlar hızla değişebilir ve ciddi zararlar doğurabilir

- Meme odaklı talep: Fiyat, büyük oranda sosyal medya trendlerinden etkilenir

- Balina yoğunlaşması: Büyük sahiplerin piyasayı manipüle etme gücü vardır

DOGE Regülasyon Riskleri

- Artan inceleme: Meme coin’ler için sıkı regülasyon ihtimali

- Vergi etkileri: Değişen vergi düzenlemeleri DOGE işlemlerini etkileyebilir

- Sınır ötesi kısıtlamalar: Bazı ülkeler DOGE işlemlerini kısıtlayabilir veya yasaklayabilir

DOGE Teknik Riskler

- Ağ tıkanıklığı: Yüksek işlem hacmi gecikmelere yol açabilir

- Akıllı sözleşme açıkları: DeFi uygulamalarında güvenlik riski oluşabilir

- Ölçeklenebilirlik sorunları: Yeni jenerasyon blokzincirlere kıyasla işlem kapasitesi düşük

VI. Sonuç ve Eylem Önerileri

DOGE Yatırım Değeri Değerlendirmesi

Dogecoin, güçlü topluluk ve mizah kültürüyle yüksek riskli ancak yüksek getiri potansiyeli sunar. Uzun vadeli değeri benimsenme ve kullanım alanı gelişimine bağlıdır. Kısa vadede ise aşırı volatilite ve regülasyon belirsizliği önemli risklerdir.

DOGE Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük tutarlarla yatırım yapın

✅ Deneyimli yatırımcılar: Maliyet ortalaması ve net çıkış stratejileri uygulayın

✅ Kurumsal yatırımcılar: DOGE’yi çeşitlendirilmiş portföyünüzde küçük ve spekülatif bir bileşen olarak değerlendirin

DOGE İşlem Katılım Yöntemleri

- Spot alım satım işlemleri: Gate.com’da DOGE alım satımı yapın

- Vadeli işlemler: Kaldıraçlı DOGE işlemlerinde dikkatli olun

- Staking: DOGE staking programlarına katılın

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırım kararınızı kendi risk profilinize göre vermeniz ve profesyonel finansal danışmanlardan görüş almanız önerilir. Yalnızca kaybetmeyi göze alabileceğiniz tutarda yatırım yapın.

Sıkça Sorulan Sorular

DOGE 2025’te ne kadar olacak?

Piyasa trendleri temel alındığında DOGE’nin 2025 yılında 0,23 ile 0,34 dolar arasında seyretmesi, ortalama fiyatın ise 0,28 dolar civarında olması öngörülüyor.

DOGE 10 doları görecek mi?

10 dolara ulaşmak oldukça zor olsa da, DOGE’nin artan benimsenmesi ve olası piyasa akımları önemli fiyat artışlarına yol açabilir. Ancak bunun için 1,44 trilyon dolarlık muazzam bir piyasa değerine ulaşması gerekir ve bu, birçok faktöre bağlı yüksek bir spekülasyon olur.

DOGE 20 dolara ulaşabilir mi?

Bu olası görünmese de, DOGE’nin aşırı bir boğa piyasasında 20 doları görmesi mümkündür. DOGE’nin 20 doları görmesi için piyasa büyüklüğünün ve yaygın kullanımın artması gerekir.

DOGE 3 doları görebilir mi?

Evet, Bitcoin’in 220.000-250.000 dolar bandına yükselmesi ve ABD Merkez Bankası'nın faiz indirmesiyle DOGE 3 doları görebilir. Bu senaryonun gerçekleşmesi genel piyasa dinamiği ve para politikası gelişmelerine bağlıdır.

kripto neden çöküyor ve toparlanacak mı?

DOGE 10 $'a Ulaşabilir Mi

Doge Günü 2025: Dogecoin Fiyatı ve Ticaret Fırsatları Üzerindeki Etkisi

2025 BRETT Fiyat Tahmini: Gelecek Piyasa Eğilimleri, Karşılaşılabilecek Zorluklar ve Büyüme Potansiyelinin Analizi

2025 DOGE Fiyat Tahmini: Dogecoin’in Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

2025 DADDY Fiyat Tahmini: Bu Gelişen Token İçin Yükseliş Eğilimi ve Öne Çıkan Büyüme Faktörleri

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi