2025 DMTR Fiyat Tahmini: Dijital Para Token Devriminde Piyasa Trendleri ve Büyüme Potansiyelini Değerlendirmek

Giriş: DMTR'nin Piyasa Konumu ve Yatırım Değeri

Dimitra (DMTR), küresel tarım teknolojisini demokratikleştirmeye odaklanan bir blockchain platformu olarak 2021’den bu yana dikkat çekici gelişmeler kaydetmiştir. 2025 yılı itibarıyla Dimitra’nın piyasa değeri 17.181.249 $’a ulaşmış, yaklaşık 679.100.776 dolaşımdaki token ile fiyatı 0,0253 $ seviyesinde seyretmektedir. “AgriTech Yenilikçisi” olarak anılan bu varlık, dünya genelinde tarım uygulamalarında dönüşümün öncüsü konumuna yükselmektedir.

Bu makale, Dimitra'nın 2025-2030 dönemi fiyat hareketlerini; geçmiş trendler, piyasa arz-talep dengeleri, ekosistem gelişimi ve makroekonomik faktörler ışığında analiz ederek yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunmaktadır.

I. DMTR Fiyat Geçmişi ve Mevcut Piyasa Durumu

DMTR Tarihsel Fiyat Gelişimi

- 2021: Proje başlangıcı, fiyat 23 Eylül’de 5,95 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2022: Piyasa düşüşü, fiyat 17 Aralık’ta 0,00269344 $ ile en düşük seviyesini gördü

- 2025: Piyasa toparlandı, güncel fiyat 0,0253 $

DMTR Güncel Piyasa Durumu

DMTR şu anda 0,0253 $ seviyesinden işlem görürken, son 24 saatte %1,15 değer kazandı. Token son bir hafta ve bir ayda sırasıyla %96,2 ve %108,48 oranında yükseldi. Ancak bir yıl öncesine göre hâlâ %72,98 geride. Güncel piyasa değeri 17.181.249 $ olup, DMTR kripto para piyasasında 1.173’üncü sıradadır. Dolaşımdaki 679.100.776 DMTR token, toplam arzın %67,91’ini oluşturuyor ve projenin tam seyreltilmiş değeri 25.300.000 $’dır.

Güncel DMTR piyasa fiyatını görüntüleyin

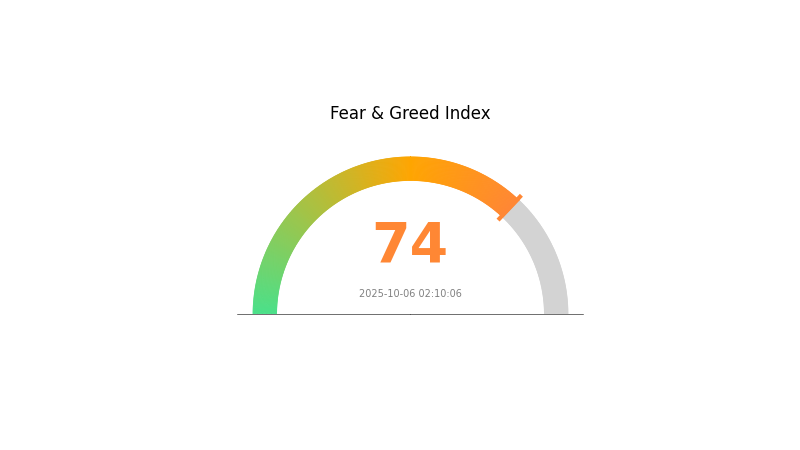

DMTR Piyasa Duyarlılık Göstergesi

2025-10-06 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim; Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu durum, yatırımcıların iyimserliğini artırarak fiyatları yukarı çekebilir. Ancak aşırı açgözlülük genellikle piyasa düzeltmelerinin öncüsüdür. Yatırımcılar temkinli olmalı, kâr realizasyonu veya risk yönetimi stratejileri uygulamalıdır. Unutmayın, piyasa duyarlılığı hızla değişebilir; kapsamlı analizlere dayalı, duygudan bağımsız rasyonel kararlar almak önemlidir.

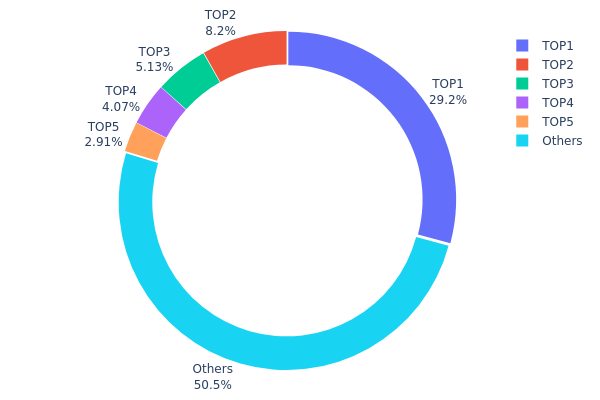

DMTR Varlık Dağılımı

DMTR’nin adres varlık dağılımı incelendiğinde, tokenlerin büyük kısmının az sayıda büyük sahibi arasında yoğunlaştığı görülüyor. En büyük adres toplam arzın %29,18’ini elinde bulundururken, ilk 5 adres toplamda %49,46 DMTR tokenine sahip. Bu yoğunlaşma, olası piyasa manipülasyonu ve fiyat oynaklığı açısından risk teşkil ediyor.

Merkeziyetçi bu yapı, büyük sahiplerin işlem hacmiyle fiyatları anlamlı ölçüde etkileyebilmesine neden olur ve piyasada dalgalanma riskini artırır. Yüksek konsantrasyon, DMTR’nin zincir üstü yapısının ideal merkeziyetsizlik seviyesinden uzak olabileceğine işaret eder ve dışsal şoklara karşı dayanıklılığını zayıflatabilir.

Yine de DMTR tokenlerinin %50’den fazlası diğer adresler arasında dağılmış durumda; bu, piyasada daha geniş bir katılım olduğunu gösteriyor. Mevcut dağılım, büyük oyuncularla birlikte küçük yatırımcıların da aktif olduğu bir piyasa yapısını yansıtır. Fiyat istikrarı açısından pozitif olsa da merkeziyetsizlik ve adil dağılım bakımından gelişime açıktır.

Güncel DMTR Varlık Dağılımı için tıklayın

| En Yüksek | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xe642...5a69a2 | 291.896,62K | 29,18% |

| 2 | 0xd621...d19a2c | 81.974,87K | 8,19% |

| 3 | 0x2933...fa4625 | 51.336,88K | 5,13% |

| 4 | 0x3cc9...aecf18 | 40.681,40K | 4,06% |

| 5 | 0x9642...2f5d4e | 29.054,31K | 2,90% |

| - | Diğerleri | 505.055,92K | 50,54% |

II. DMTR'nin Gelecek Fiyatına Etki Eden Temel Faktörler

Arz Mekanizması

- Mevcut trend: DMTR’de yükseliş eğilimi sürmekte, fiyatlar direnç seviyelerini istikrarlı biçimde aşmaktadır.

- Geçmiş örüntü: DMTR fiyatı tüm hareketli ortalamaların üstünde; bu, yükselen trend ve alım ivmesine işaret eder.

- Mevcut etki: Arz dinamikleri DMTR için olumlu fiyat görünümünü desteklemektedir.

Kurumsal ve Balina Hareketleri

- Piyasa duyarlılığı: DMTR, fiyat sıçraması potansiyeliyle yüksek riskli bir varlık olarak kabul edilmekte; belirsizlikler devam etmektedir.

Makroekonomik Ortam

- Enflasyon koruması: DMTR dijital bir varlık olarak, diğer kripto paralar gibi enflasyona karşı koruma aracı olarak görülebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Piyasa benimsemesi: DMTR fiyatı, kullanıcı benimsemesi ve platformdaki dengeyle şekillenmektedir.

- Ekosistem uygulamaları: DMTR’nin gelecekteki fiyatı, ekosisteminin ve ilgili uygulamalarının gelişimiyle yakından bağlantılıdır.

III. DMTR 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01469 $ - 0,02532 $

- Tarafsız tahmin: 0,02532 $ - 0,02747 $

- İyimser tahmin: 0,02747 $ - 0,02962 $ (olumlu piyasa duyarlılığı ve artan benimseme ile)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan benimsemeyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,02695 $ - 0,03623 $

- 2028: 0,02837 $ - 0,04174 $

- Temel tetikleyiciler: Teknolojik ilerlemeler, yaygın piyasa kabulleri ve olası iş ortaklıkları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,03494 $ - 0,04089 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,04089 $ - 0,05269 $ (güçlü piyasa performansı ve artan kullanım ile)

- Dönüştürücü senaryo: 0,05269 $+ (büyük kurumsal benimseme gibi olumlu koşullar altında)

- 2030-12-31: DMTR 0,03903 $ (2030 için öngörülen ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,02962 | 0,02532 | 0,01469 | 0 |

| 2026 | 0,03049 | 0,02747 | 0,02088 | 8 |

| 2027 | 0,03623 | 0,02898 | 0,02695 | 14 |

| 2028 | 0,04174 | 0,03261 | 0,02837 | 28 |

| 2029 | 0,04089 | 0,03717 | 0,03494 | 46 |

| 2030 | 0,05269 | 0,03903 | 0,02615 | 53 |

IV. DMTR İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

DMTR Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Tarım teknolojisiyle ilgilenen uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde DMTR biriktirin

- Projede gelişim için en az 1-2 yıl elde tutun

- Tokenleri güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve giriş/çıkış noktalarını belirlemede kullanılır

- RSI: Aşırı alım/aşırı satım koşullarını takip edin

- Dalgalı alım-satım için ipuçları:

- Kâr hedefi ve zarar-durdur seviyeleri net şekilde belirleyin

- Proje gelişmelerini ve tarım teknolojisi haberlerini izleyin

DMTR Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-8’i

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: DMTR’yi diğer kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk depolama: Büyük miktarlar için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama, güçlü şifreler kullanın

V. DMTR İçin Potansiyel Riskler ve Zorluklar

DMTR Piyasa Riskleri

- Oynaklık: Küçük hacimli kripto paralarda sıkça görülen yüksek fiyat dalgalanmaları

- Likidite: Düşük işlem hacmi, giriş-çıkışları zorlaştırabilir

- Rekabet: Tarım teknolojisini hedefleyen diğer blockchain projeleri

DMTR Mevzuat Riskleri

- Belirsiz düzenlemeler: Gelecekteki kripto para mevzuatının potansiyel etkisi

- Tarım sektörü uyumluluğu: Uluslararası farklı tarım standartlarına uyum gerekliliği

- Veri gizliliği: Blokzincirde hassas tarım verisi yönetimi

DMTR Teknik Riskler

- Ölçeklenebilirlik: Artan ağ kullanımı ile ilgili olası sınırlamalar

- Akıllı sözleşme açıkları: Platform kodunda hata veya istismar riski

- Entegrasyon zorlukları: IoT ve uydu teknolojisi ile entegrasyon sorunları

VI. Sonuç ve Eylem Önerileri

DMTR Yatırım Değeri Değerlendirmesi

DMTR, tarım uygulamalarında uzun vadeli dönüşüm potansiyeli sunarken, kısa vadede piyasa oynaklığı ve proje gelişim zorlukları nedeniyle risk taşır.

DMTR Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, proje ve tarım teknolojisi hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Orta düzeyde pozisyon düşünebilir, proje gelişimini aktif olarak izleyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, derinlemesine analiz için proje ekibiyle iletişime geçin

DMTR Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden DMTR token satın alın

- Staking: Proje tarafından sunuluyorsa staking programına katılın

- DeFi entegrasyonu: DMTR token ile ilgili merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

DMTR kripto nedir?

DMTR, Dimitra blockchain platformunda yer alan, küçük çiftçileri desteklemek için geliştirilen bir kripto paradır. Tarım kaynaklarına erişimi demokratikleştirmeyi hedefler.

Om Mantra tekrar yükselir mi?

Evet, Om Mantra’nın yeniden yükselme potansiyeli bulunuyor. Piyasa trendleri ve proje gelişmeleri önümüzdeki yıllarda olası fiyat artışını işaret ediyor.

2025’te hangi meme coin patlama yapacak (fiyat tahmini)?

Mevcut trendler ve piyasa analizlerine göre Bitcoin Hyper, PEPENODE ve ApeCoin’in 2025’te yükselmesi bekleniyor.

Hamster Kombat coin 1 $’a ulaşır mı?

Hamster Kombat ciddi büyüme gösterdi; ancak 1 $ seviyesine ulaşması kesin değil. Analistler daha fazla değerlenme potansiyeli öngörse de, mevcut trendler yakın dönemde 1 $’ı garanti etmiyor.

2025 Kripto Spot Pazarında Alfa Nerede Bulunur

Gate Launchpad Ika (IKA) ile Tanışıyor: Sui Üzerinde Gizlilik Hesaplamanın Geleceği

Pi'den GBP'ye: Fiyat ve Tahmin

2025 CHZ Fiyat Tahmini: Chiliz, Kripto Spor Piyasasında Yeni Zirvelere Çıkacak mı?

2025 STEEM Fiyat Tahmini: Halving Sonrası Piyasada Bu Kripto Varlık Yeni Zirvelere Ulaşabilir mi?

2025 yılında Litecoin (LTC) için güncel varlık tutarı ve fon akışı durumu nedir?

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025