2025 DAI Price Prediction: Will Stablecoin Maintain Its Dollar Peg in a Volatile Crypto Market?

Introduction: DAI's Market Position and Investment Value

Dai (DAI), as the largest decentralized stablecoin on Ethereum, has achieved significant milestones since its inception in 2017. As of 2025, Dai's market capitalization has reached $4.54 billion, with a circulating supply of approximately 4.54 billion coins, maintaining a price of around $0.99981. This asset, hailed as the "DeFi foundation," is playing an increasingly crucial role in decentralized finance (DeFi) applications.

This article will comprehensively analyze Dai's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

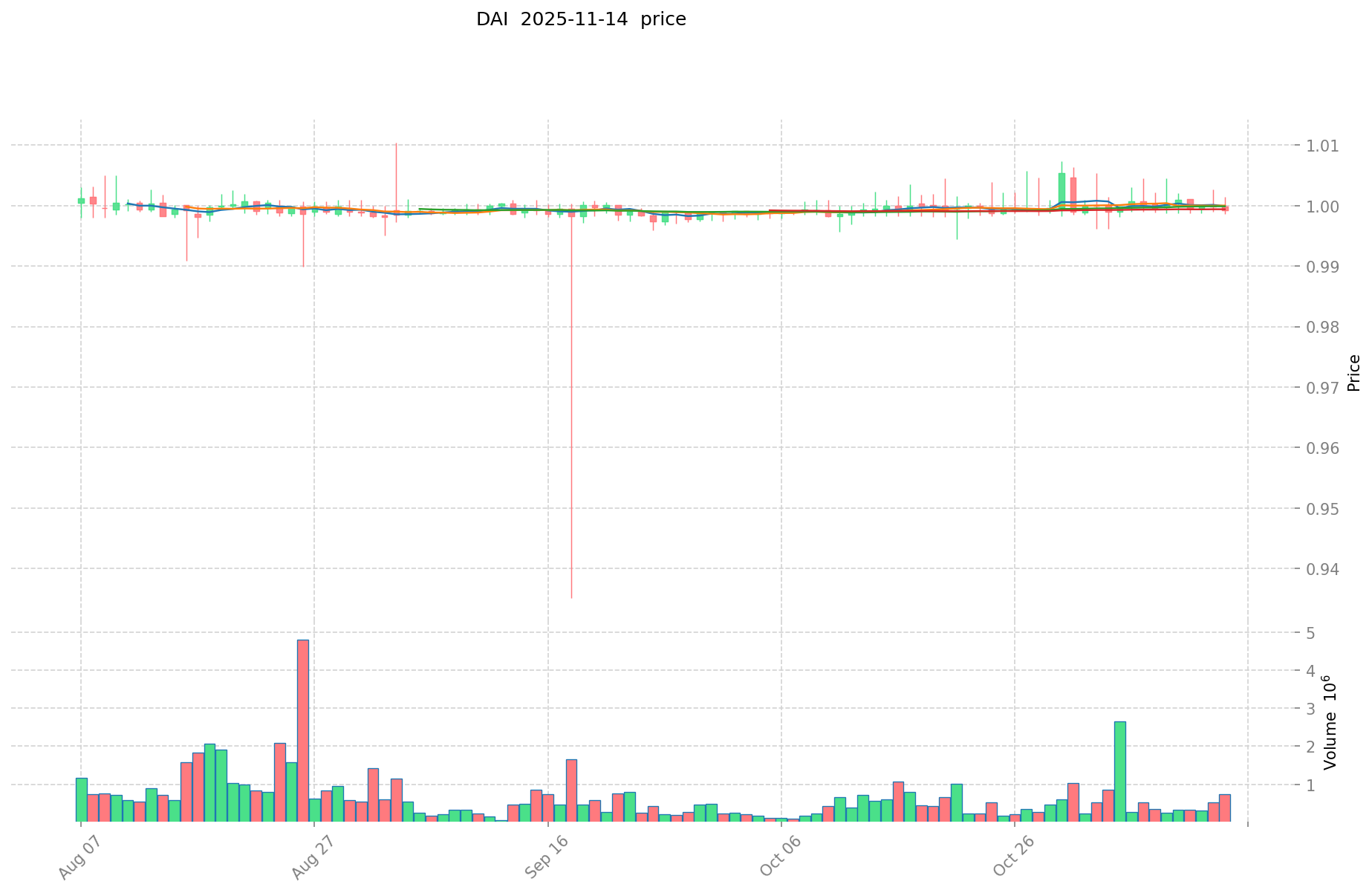

I. DAI Price History Review and Current Market Status

DAI Historical Price Evolution Trajectory

- 2017: DAI launched, price stabilized around $1

- 2020: COVID-19 market crash, price briefly spiked to $1.22

- 2023: Crypto winter, price dipped to $0.88196

DAI Current Market Situation

As of November 14, 2025, DAI is trading at $0.99981, maintaining its peg to the US dollar with minimal deviation. The 24-hour trading volume stands at $407,496.38, indicating steady market activity. DAI's market capitalization is $4,538,828,448, ranking it 34th among all cryptocurrencies. The circulating supply of 4,539,690,989.71427 DAI matches its total supply, reflecting full circulation. Despite minor price fluctuations, DAI has demonstrated resilience, with a 0.18% increase over the past year, affirming its stability as a stablecoin in the volatile crypto market.

Click to view the current DAI market price

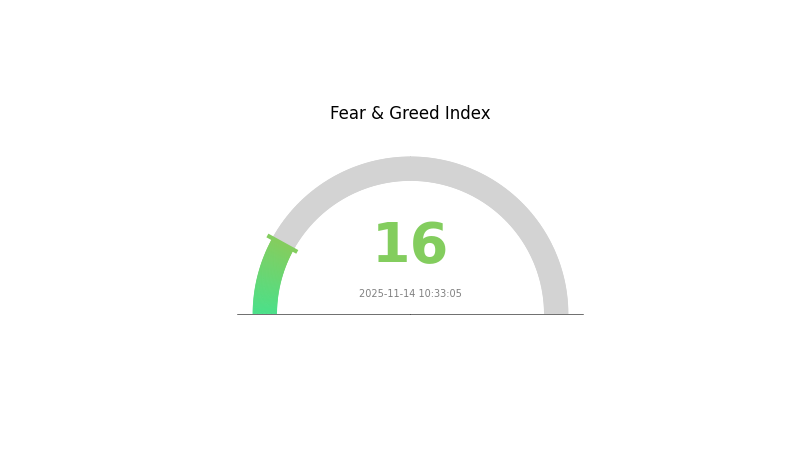

DAI Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 16. This indicates a high level of uncertainty and pessimism among investors. Such low levels often present potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiments can shift rapidly in the crypto space.

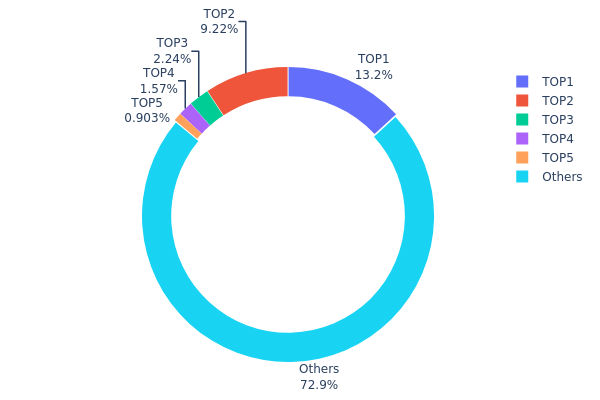

DAI Holdings Distribution

The address holdings distribution data reveals significant concentration in DAI ownership. The top address holds 13.16% of the total supply, while the top 5 addresses collectively control 27.08% of all DAI tokens. This level of concentration suggests a relatively centralized distribution, which could potentially impact market dynamics.

Such concentration may lead to increased volatility and susceptibility to large-scale market movements. If any of these major holders were to liquidate their positions, it could cause substantial price fluctuations. Additionally, this concentration may raise concerns about market manipulation, as these large holders could potentially influence DAI's price or liquidity.

However, it's worth noting that 72.92% of DAI is held by addresses outside the top 5, indicating a degree of distribution among smaller holders. This distribution pattern reflects a balance between centralized control and wider adoption, which is crucial for DAI's stability and role as a decentralized stablecoin in the cryptocurrency ecosystem.

Click to view the current DAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 597516.34K | 13.16% |

| 2 | 0xf6e7...853042 | 418733.15K | 9.22% |

| 3 | 0x4ded...b05b8b | 101820.26K | 2.24% |

| 4 | 0x7378...4c1ca6 | 71081.60K | 1.56% |

| 5 | 0x47ac...a6d503 | 40999.97K | 0.90% |

| - | Others | 3309819.28K | 72.92% |

II. Key Factors Affecting DAI's Future Price

Supply Mechanism

- Collateralized Debt Position (CDP): DAI is created when users lock up collateral assets in smart contracts and mint DAI against them.

- Historical Pattern: Changes in collateral requirements and stability fees have historically influenced DAI supply and price stability.

- Current Impact: Recent adjustments to collateral types and ratios may affect DAI issuance and overall supply.

Institutional and Whale Dynamics

- Institutional Holdings: Major DeFi protocols and DAOs hold significant amounts of DAI in their treasuries.

- Corporate Adoption: Several blockchain-based companies use DAI for treasury management and operational expenses.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies on interest rates and quantitative easing may affect DAI's attractiveness as a stable store of value.

- Inflation Hedging Properties: DAI's stability mechanism aims to maintain purchasing power parity with the US dollar, potentially making it an inflation hedge.

Technical Development and Ecosystem Building

- Multi-Collateral DAI: Ongoing improvements to the multi-collateral system enhance stability and diversification.

- DAI Savings Rate (DSR): Updates to the DSR mechanism influence DAI demand and utility within the ecosystem.

- Ecosystem Applications: DAI is widely used in DeFi protocols for lending, borrowing, and liquidity provision, contributing to its overall demand and utility.

III. DAI Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.98 - $1.01

- Neutral forecast: $0.99 - $1.01

- Optimistic forecast: $1.00 - $1.02 (requires increased DeFi adoption)

2027-2028 Outlook

- Expected market phase: Stable growth

- Price range predictions:

- 2027: $0.99 - $1.01

- 2028: $0.99 - $1.01

- Key catalysts: Expansion of DAI use cases in DeFi protocols

2029-2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (assuming continued stability in the crypto market)

- Optimistic scenario: $1.00 - $1.02 (assuming widespread adoption in traditional finance)

- Transformative scenario: $1.00 - $1.03 (assuming DAI becomes a global reserve currency)

- 2030-12-31: DAI $1.01 (potential slight premium due to high demand)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. Professional Investment Strategies and Risk Management for DAI

DAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operation suggestions:

- Maintain a portion of portfolio in DAI for stability

- Use DAI as a hedge against market volatility

- Store DAI in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Monitor for potential trend changes

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor DAI/USD peg closely

- Consider arbitrage opportunities between different platforms

DAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of crypto portfolio

- Aggressive investors: 15-20% of crypto portfolio

- Professional investors: 25-30% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Use of DeFi protocols: Earn yield on DAI holdings to offset potential risks

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use multi-factor authentication, regular security audits

V. Potential Risks and Challenges for DAI

DAI Market Risks

- Depegging risk: Potential deviation from $1 USD peg

- Liquidity risk: Possible challenges in large-scale conversions

- Market sentiment risk: Fluctuations due to overall crypto market conditions

DAI Regulatory Risks

- Increased stablecoin scrutiny: Potential regulatory changes affecting DAI

- Cross-border transaction limitations: Possible restrictions on DAI usage

- Compliance requirements: Evolving KYC/AML regulations for stablecoin users

DAI Technical Risks

- Smart contract vulnerabilities: Potential exploits in the underlying code

- Collateral stability: Risks associated with collateral assets backing DAI

- Oracle failures: Inaccurate price feeds affecting DAI's stability mechanism

VI. Conclusion and Action Recommendations

DAI Investment Value Assessment

DAI offers a stable store of value within the volatile crypto market, backed by a decentralized governance model. While it presents lower volatility compared to other cryptocurrencies, investors should remain aware of potential risks associated with stablecoins and the broader DeFi ecosystem.

DAI Investment Recommendations

✅ Beginners: Consider DAI as an entry point to understand stablecoins and DeFi ✅ Experienced investors: Utilize DAI for portfolio stabilization and DeFi participation ✅ Institutional investors: Explore DAI for treasury management and DeFi yield opportunities

DAI Participation Methods

- Direct purchase: Buy DAI on Gate.com

- DeFi protocols: Participate in lending and borrowing using DAI

- Yield farming: Explore DAI liquidity provision in various DeFi platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is DAI a good investment?

Yes, DAI is a stable and reliable investment. As a decentralized stablecoin, it maintains a steady value, offering a safe haven in the volatile crypto market.

Will Dash hit $1000 again?

Yes, Dash could potentially reach $1000 again. With ongoing development and increased adoption, Dash may see significant price growth in the coming years.

What is the price prediction for DAI in 2040?

DAI is expected to maintain its $1 peg in 2040, as it's designed to be a stablecoin. However, its purchasing power may change due to inflation.

Is DAI safe to hold?

Yes, DAI is generally considered safe to hold. As a stablecoin pegged to the US dollar, it maintains a steady value and is backed by collateral, making it a reliable option for crypto investors seeking stability.

Share

Content