2025 CLOUD Fiyat Tahmini: Küresel Bulut Bilişim Sektöründe Ortaya Çıkan Pazar Trendleri ve Yatırım Olanakları

Giriş: CLOUD'un Piyasadaki Konumu ve Yatırım Potansiyeli

Sanctum (CLOUD), Solana üzerinde Likid Staking Token’larının (LST) ticareti için geliştirilmiş yenilikçi bir blockchain platformu olarak, başlangıcından bu yana etkileyici bir ilerleme göstermiştir. 2025 itibarıyla CLOUD’un piyasa değeri $22.942.800’e ulaştı; yaklaşık 180.000.000 adet dolaşımdaki token mevcut ve fiyatı $0,12746 civarında seyrediyor. “LST ticaretinde öncü” olarak nitelendirilen bu varlık, merkeziyetsiz finans alanında likiditeyi ve getiri fırsatlarını artırmada giderek daha belirleyici bir rol üstlenmektedir.

Bu makalede, CLOUD’un 2025-2030 yılları arasındaki fiyat hareketleri; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem geliştirmeleri ve makroekonomik faktörler ışığında kapsamlı biçimde incelenecek, profesyonel yatırımcılar için fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. CLOUD Fiyat Geçmişi ve Güncel Durum Değerlendirmesi

CLOUD Tarihsel Fiyat Seyri

- 2024: CLOUD, 14 Kasım’da $0,6297 seviyesine ulaşarak önemli bir dönüm noktası yaşadı.

- 2025: 7 Mayıs’ta $0,06411 ile dip seviyeye gerileyerek keskin bir düşüş gördü.

- 2025: Son 30 günde %44,57’lik yükselişle CLOUD toparlanma sinyalleri verdi.

CLOUD Güncel Piyasa Görünümü

4 Ekim 2025 itibarıyla CLOUD, $0,12746 seviyesinden işlem görmektedir ve son 24 saatte %5,46 oranında değer kaybetmiştir. Toplam piyasa değeri $22.942.800 olup, küresel kripto sıralamasında 1034’üncü sıradadır. Son 24 saatteki işlem hacmi $334.260,29’dur. Bu veri, orta düzeyde bir piyasa hareketliliğine işaret etmektedir. Son 24 saatlik düşüşe rağmen, CLOUD son bir haftada %23,07 ve son 30 günde %44,57 artışla güçlü bir ivme yakalamıştır. Ancak, yıllık bazda fiyatı %67,81 gerilemiştir. Mevcut fiyatı, tüm zamanların en yüksek seviyesinin %79,76 altında ve en düşük seviyesinin %98,81 üzerinde. Bu durum, token'ın sert bir düşüş sonrası toparlanma döneminde olduğunu göstermektedir.

Mevcut CLOUD piyasa fiyatını görmek için tıklayın

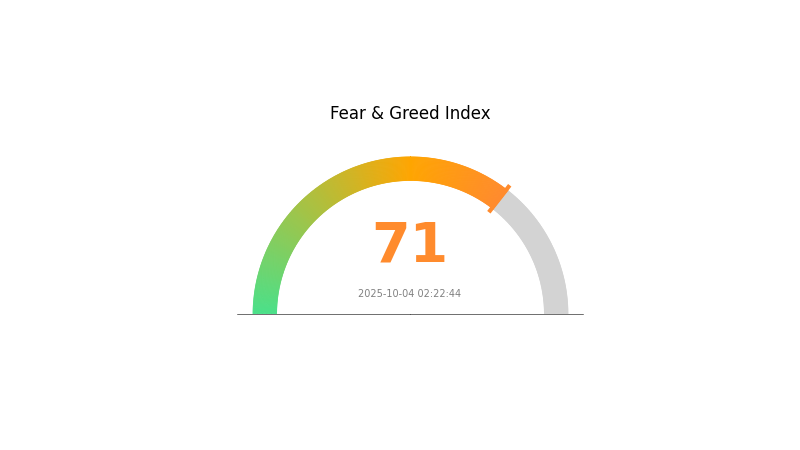

CLOUD Piyasa Duyarlılık Endeksi

2025-10-04 Korku ve Açgözlülük Endeksi: 71 (Açgözlülük)

Mevcut Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda açgözlülük hakim; Korku ve Açgözlülük Endeksi 71 ile oldukça yüksek. Bu seviye, yatırımcıların aşırı iyimser olduğunu ve piyasanın aşırı alım koşullarına yaklaştığını gösteriyor. Güçlü boğa havası kısa vadede fiyatları yükseltebilir; ancak yatırımcıların riskleri göz önünde bulundurması gerekir. Geçmiş veriler, aşırı açgözlülük dönemlerinin genellikle piyasa düzeltmeleriyle sonuçlandığını gösteriyor. Sağduyulu yatırımcılar, bu coşkulu ortamda kar realizasyonu yapmalı veya portföylerini dengeleyerek riskleri azaltmalıdır.

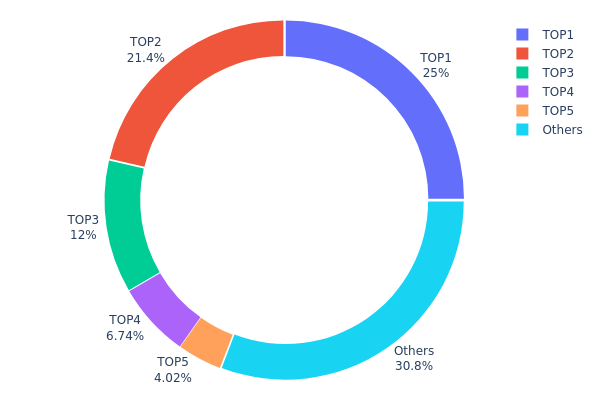

CLOUD Varlık Dağılımı

CLOUD’un adres dağılımı, tokenların büyük bölümünün az sayıda adreste yoğunlaştığını gösteriyor. En büyük adres toplam arzın %25’ine sahipken, ilk 5 adres CLOUD tokenlarının %69,15’ini kontrol ediyor. Bu güçlü yoğunlaşma, ekosistemde güç merkezileşmesi riskini ortaya koyuyor.

Böyle bir dağılım, piyasa istikrarı ve büyük miktarlı satışlar karşısında kırılganlık yaratmaktadır. Başlıca sahipler fiyat üzerinde ciddi etkiye sahip olup, volatiliteyi artırabilir. Ayrıca, bu yoğunlaşma merkeziyetsizlik ilkesini zayıflatabilir. Az sayıda adres, yönetim veya piyasa dinamiklerinde orantısız güç kazanabilir.

Yeni projelerde token yoğunlaşması yaygın olsa da, CLOUD’un mevcut dağılımı piyasa dayanıklılığını artırmak ve manipülasyon riskini azaltmak için daha geniş token yayılımına ihtiyaç olduğunu gösteriyor. Ekosistemin gelişimiyle birlikte bu dağılım değişebilir. Böylece, CLOUD daha merkeziyetsiz ve istikrarlı bir token ekonomisine ilerleyebilir.

Mevcut CLOUD Varlık Dağılımını görmek için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | BdVocC...BJqvD4 | 250.000,00K | 25,00% |

| 2 | How2rJ...9on8hs | 214.126,13K | 21,41% |

| 3 | 8VE2uJ...h86BGk | 120.051,68K | 12,00% |

| 4 | 5jbzpJ...3r14cv | 67.372,28K | 6,73% |

| 5 | 7cAui6...Lx4xR8 | 40.189,83K | 4,01% |

| - | Diğerleri | 308.254,65K | 30,85% |

II. CLOUD’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Rekabeti: Yeni tedarikçilerin girişleriyle mevcut paylar değişerek fiyatları etkileyebilir.

- Arz ve Talep: Belirli bulut hizmetlerine talebin artması, tedarikçilerin fiyatları yükseltmesine neden olabilir.

Makroekonomik Ortam

- Teknolojik Gelişmeler: Bulut bilişim teknolojisinin olgunlaşması ve rekabetin artması, donanım kaynaklarının optimize şekilde yönetilmesi, elastik ölçekleme ve ölçek ekonomileri yoluyla maliyetleri düşürmüştür.

Teknoloji ve Ekosistem Gelişimi

- Maliyet Azaltımı: Bulut servis sağlayıcıları donanım kaynaklarını optimize ederek, elastik ölçekleme teknolojileri ve toplu satın alma avantajları ile maliyetleri aşağı çekmektedir.

- Ekosistem Uygulamaları: E-ticaret ve eğitim gibi büyük sektörler BT yüklerini buluta taşımış olup, üretim gibi işgücü yoğun alanların da bu trendi izlemesi beklenmektedir.

III. 2025-2030 CLOUD Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: $0,08379 - $0,10

- Tarafsız tahmin: $0,12696

- İyimser tahmin: $0,1714 (olumlu piyasa duyarlılığı halinde)

2027-2028 Görünümü

- Piyasa aşaması: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: $0,15359 - $0,19374

- 2028: $0,11417 - $0,20992

- Kilit katalizörler: Artan benimseme ve teknoloji ilerlemeleri

2030 Uzun Vadeli Beklenti

- Temel senaryo: $0,20983 (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: $0,26649 (güçlü benimseme ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: $0,30+ (çığır açıcı yenilikler ve yaygın entegrasyon ile)

- 2030-12-31: CLOUD $0,26649 (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış/Düşüş (%) |

|---|---|---|---|---|

| 2025 | 0,1714 | 0,12696 | 0,08379 | 0 |

| 2026 | 0,1999 | 0,14918 | 0,11785 | 17 |

| 2027 | 0,19374 | 0,17454 | 0,15359 | 36 |

| 2028 | 0,20992 | 0,18414 | 0,11417 | 44 |

| 2029 | 0,22264 | 0,19703 | 0,13792 | 54 |

| 2030 | 0,26649 | 0,20983 | 0,18465 | 64 |

IV. CLOUD Yatırım Stratejileri ve Risk Yönetimi

CLOUD Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli yatırımcılar ve Solana ekosistemine inananlar

- İşlem önerileri:

- Piyasa düşüşlerinde CLOUD token biriktirin

- Stake işlemi ile ek ödüller elde edebilirsiniz

- Tokenları güvenli, saklama hizmeti olmayan cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve muhtemel dönüş noktalarını belirlemek için

- RSI: Aşırı alım ve satım durumlarını izlemek için

- Dalgalı al-sat için dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- Solana ekosistemindeki gelişmeleri yakından izleyin

CLOUD Risk Yönetimi Modeli

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı Likid Staking Token (LST) projelerine dağıtın

- Zarar durdur emri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet önerilir

- Soğuk saklama: Uzun vadeli saklamalar için donanım cüzdanı tercih edilmelidir.

- Güvenlik: İki faktörlü doğrulama ve güçlü şifre kullanımı

V. CLOUD İçin Olası Riskler ve Zorluklar

CLOUD Piyasa Riskleri

- Volatilite: Kripto piyasalarında aşırı fiyat dalgalanmaları

- Rekabet: Solana’da rakip LST platformlarının çıkışı

- Likidite: Piyasa stres dönemlerinde olası likidite sıkıntıları

CLOUD Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel kripto mevzuatlarının değişkenliği

- Uyum zorlukları: SEC veya diğer otoritelerle ilgili potansiyel sorunlar

- Vergilendirme: LST işlemlerinde belirsiz vergi yükümlülükleri

CLOUD Teknik Riskleri

- Akıllı sözleşme açıkları: Sanctum kodunda olası güvenlik zaafları

- Ölçeklenebilirlik: Artan işlem hacmini yönetme zorlukları

- Entegrasyon: Diğer DeFi protokolleriyle uyum sorunları

VI. Sonuç ve Eylem Önerileri

CLOUD Yatırım Potansiyeli Değerlendirmesi

CLOUD, Solana ekosisteminde büyüyen LST alanına erişim sunarak cazip bir yatırım fırsatı oluşturmaktadır. Ancak kısa vadede yüksek volatilite ve düzenleyici belirsizliklere karşı yatırımcıların tedbirli olması gerekmektedir.

CLOUD Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, LST’ler üzerine bilgi edinin

✅ Deneyimli yatırımcılar: Solana portföyünüzün bir kısmını CLOUD’a ayırmayı değerlendirin

✅ Kurumsal yatırımcılar: CLOUD’u çeşitlendirilmiş kripto portföyünüzde değerlendirin

CLOUD İşlem Katılımı Yöntemleri

- Spot işlem: Gate.com üzerinden CLOUD alım-satımı

- Staking: Ek getiri için CLOUD staking programlarına katılım

- DeFi entegrasyonu: Solana tabanlı DeFi protokollerinde CLOUD kullanımı

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. Her yatırımcı kendi risk profilini göz önünde bulundurmalı, profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alamayacağınız tutarda yatırım yapmayınız.

Sıkça Sorulan Sorular

CLOUD yükselir mi?

Evet, CLOUD’un yükselme potansiyeli bulunmaktadır. Tahminler, 2025’te $0,379298 seviyesine ulaşabileceğini ve yakın vadede %9,6’lık bir artış beklediğini göstermektedir.

CLOUD nedir?

CLOUD, Internet Computer Protocol üzerinde geliştirilen bir meme token’dır. ICP ekosisteminin ilk bulut temalı token’ı olup, güncel fiyatı $0,003519 ve dolaşımdaki miktarı 398.875.822 CLOUD token’dır.

CRO için 2030 fiyat tahmini nedir?

CRO için 2030 fiyat tahmini, uzun vadeli piyasa analizlerine dayanarak yaklaşık $9,35 olarak öngörülmektedir.

Constellation kripto için 2025 fiyat tahmini nedir?

Analizlere göre Constellation (DAG), 2025 sonunda $0,071 ile $0,076 arasında işlem görebilir.

2025 MNDE Fiyat Tahmini: Yönetişim Token’ı, Gelişen DeFi Ekosisteminde Yeni Zirvelere Ulaşacak mı?

Sanctum (CLOUD) Yatırım İçin Uygun mu?: Bulut Güvenlik Token Piyasasında Olası Getiri ve Risklerin Değerlendirilmesi

2025 MNDE Fiyat Tahmini: Marinade Finance için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 MSOL Fiyat Tahmini: Marinade Staked SOL'un Potansiyel Büyümesi ve Piyasa Trendlerinin Analizi

Sanctum (CLOUD) iyi bir yatırım mı?: Bu bulut tabanlı güvenlik tokeninin potansiyelini değerlendiriyoruz

2025 FRAG Fiyat Tahmini: Bu oyun token’ı, Metaverse çağında yeni zirvelere ulaşabilir mi?

Dijital Sanatı Keşfedin: Eşsiz NFT Marketplace Deneyimi

Cheems Meme Coin Rehberi Akıllı Yatırımcılar için Temel Bilgiler

Kripto para birimlerinde Proof of Reserves (Rezerv Kanıtı) kavramını anlamak

Sei Network'i Keşfetmek: Hızlı Blockchain Teknolojisinin Detaylı Bir Değerlendirmesi

SOMI Token'ın pratikliği ve fiyat görünümü, yatırımcılar için net bir analiz.