2025 CLEAR Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: CLEAR’ın Piyasadaki Konumu ve Yatırım Potansiyeli

Everclear (CLEAR), İlk Takas Katmanı olarak, kurumsal aktörlerin likidite parçalanmasını kuruluşundan bu yana etkin biçimde çözüyor. 2025 yılı itibarıyla CLEAR’ın piyasa değeri 3.554.190 $ seviyesine ulaşırken, yaklaşık 207.000.000 dolaşımdaki token ve 0,01717 $ civarında bir fiyatla işlem görüyor. “Likidite Takas Çözümü” kimliğiyle öne çıkan bu varlık, L2 üzerinde zincirler arası akışların netleştirilip açık artırmaya çıkarıldığı likidite piyasası işleyişinde giderek daha önemli bir rol üstleniyor.

Bu makale, 2025-2030 dönemi için CLEAR’ın fiyat eğilimlerini; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşulları bir araya getirerek kapsamlı biçimde analiz edecek ve yatırımcılara profesyonel fiyat tahminleri ile uygulanabilir yatırım stratejileri sunacaktır.

I. CLEAR Fiyat Geçmişi ve Mevcut Piyasa Durumu

CLEAR’ın Tarihsel Fiyat Gelişimi

- 2025: Everclear’ın lansmanı, fiyat 16 Ocak’ta 0,07681 $ ile zirve yaptı

- 2025: Piyasa düzeltmesi, fiyat 9 Nisan’da 0,01339 $’a geriledi

- 2025: Toparlanma, 13 Ekim itibarıyla fiyat 0,01717 $ seviyesinde

CLEAR Güncel Piyasa Durumu

13 Ekim 2025 itibarıyla CLEAR, 0,01717 $’dan işlem görüyor ve son 24 saatte %13,4 yükseldi. Token, yıl boyunca önemli dalgalanmalar yaşarken, 24 saatlik işlem hacmi 16.590,43 $ oldu. CLEAR’ın piyasa değeri 3.554.190 $ ve küresel kripto para sıralamasında 1.985. sırada yer alıyor. Mevcut fiyat, 16 Ocak 2025’te görülen 0,07681 $’lık zirvenin %77,64 altında. Son dönemdeki artışlara karşın, CLEAR son bir yılda %85,41 oranında değer kaybetti; bu da token için zorlayıcı bir piyasa ortamı anlamına geliyor.

Güncel CLEAR piyasa fiyatını görmek için tıklayın

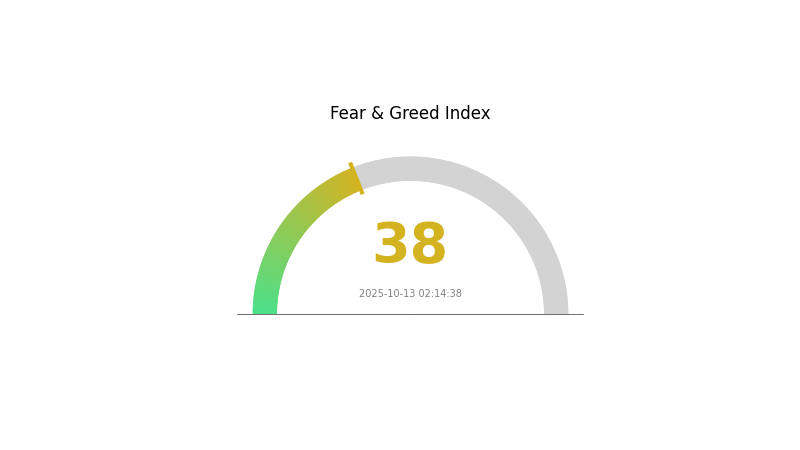

CLEAR Piyasa Duyarlılık Endeksi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 38 seviyesinde bulunuyor. Bu, yatırımcıların belirsizlik ve temkinli bir tutum içinde olduğunu gösteriyor. Bu gibi dönemlerde soğukkanlılığınızı korumalı, ani kararlar almaktan kaçınmalısınız. Korku, bazı yatırımcılar için alım fırsatı anlamına gelebilir; ancak detaylı araştırma yapmak ve riskleri titizlikle yönetmek gereklidir. Piyasa duyarlılığı hızlı değişebilir; bu nedenle güncel kalmak ve uzun vadeli düşünmek, zorlu dönemleri aşmak için kritik önemdedir.

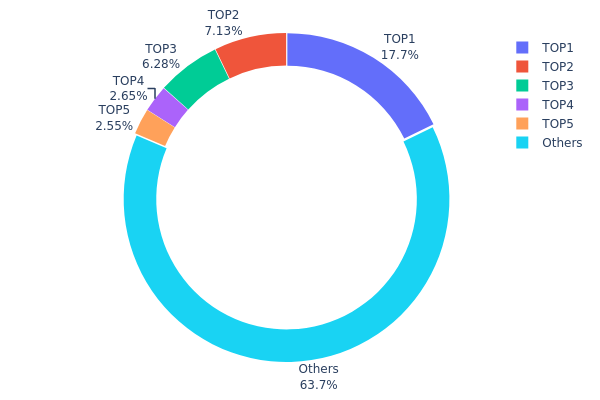

CLEAR Varlık Dağılımı

CLEAR’ın adres varlık dağılımı, orta düzeyde yoğunlaşmış bir sahiplik yapısı ortaya koyuyor. En büyük adres toplam arzın %17,72’sini tutarken, sonraki dört büyük adres ilave %18,59’luk bir paya sahip. Bu yoğunlaşma, az sayıdaki büyük yatırımcının token dinamiklerinde etkili olabileceğini gösteriyor.

İlk 5 adresin toplam kontrolü %36,31 iken, %63,69’luk kısım daha geniş bir adres kitlesine yayılmış durumda. Bu yapı, büyük yatırımcılar ile küçük yatırımcılar arasında bir denge oluştuğunu gösteriyor. Böyle bir dağılım, tek bir büyük adresin etkisiyle aşırı fiyat oynaklığı riskini azaltarak piyasa istikrarını güçlendirebilir; ancak üst düzey sahiplerin eşgüdümlü hamleleri fiyatları etkileyebilir.

Mevcut dağılım, CLEAR için orta düzeyde bir merkezsizleşme gösteriyor. Tamamen dağılmamış olsa da, aşırı yoğunlaşmış projelere göre daha sağlıklı zincir üstü bir ekosistem sunuyor. Bu denge, uzun vadeli istikrarı ve organik fiyat oluşumunu destekleyebilir.

Güncel CLEAR Varlık Dağılımını görmek için tıklayın

| En | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x4d50...246625 | 129687,19K | 17,72% |

| 2 | 0x8898...0e63c6 | 52200,63K | 7,13% |

| 3 | 0x7c01...b21056 | 45941,45K | 6,27% |

| 4 | 0xd4ca...b2c229 | 19423,00K | 2,65% |

| 5 | 0x5a01...e49d24 | 18652,19K | 2,54% |

| - | Diğerleri | 465768,53K | 63,69% |

II. CLEAR’ın Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Ortam

- Para Politikası Etkisi: Başta faiz kararları olmak üzere, büyük merkez bankalarının politika beklentileri CLEAR fiyatı üzerinde etkili olacaktır.

- Enflasyona Karşı Koruma: CLEAR’ın enflasyonist ortamlardaki performansı, yatırımcı nezdinde cazibesini etkileyebilir.

- Jeopolitik Faktörler: Küresel gelişmeler ve çatışmalar, CLEAR’ın dijital varlık olarak değerini etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: CLEAR ağı üzerinde büyük DApp ve projelerin geliştirilmesi, benimsenme ve değer açısından kritik rol oynayacaktır.

III. 2025-2030 Dönemi CLEAR Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01213 $ - 0,01709 $

- Tarafsız tahmin: 0,01709 $ - 0,02068 $

- İyimser tahmin: 0,02068 $ - 0,02427 $ (olumlu piyasa ve proje gelişmeleri gerektirir)

2027-2028 Öngörüsü

- Piyasa fazı: Artan benimsenmeyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,022 $ - 0,03127 $

- 2028: 0,02313 $ - 0,03728 $

- Başlıca katalizörler: Teknolojik gelişme, artan kullanım ve piyasa eğilimleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,02967 $ - 0,03805 $ (istikrarlı piyasa büyümesi ve proje ilerlemesiyle)

- İyimser senaryo: 0,03805 $ - 0,04386 $ (hızlı adaptasyon ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,04386 $ - 0,05213 $ (oldukça elverişli ortam ve yenilikçi atılımlar ile)

- 31 Aralık 2030: CLEAR için potansiyel tepe fiyat 0,05213 $

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,02427 | 0,01709 | 0,01213 | 0 |

| 2026 | 0,02564 | 0,02068 | 0,01096 | 20 |

| 2027 | 0,03127 | 0,02316 | 0,022 | 34 |

| 2028 | 0,03728 | 0,02721 | 0,02313 | 58 |

| 2029 | 0,04386 | 0,03225 | 0,02967 | 87 |

| 2030 | 0,05213 | 0,03805 | 0,02702 | 121 |

IV. CLEAR Yatırım Stratejileri ve Risk Yönetimi

CLEAR Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Yüksek risk toleransı olan ve takas katmanı teknolojisinin uzun vadeli potansiyeline inananlar

- Öneriler:

- Piyasa düşüşlerinde CLEAR biriktirin

- Kısmi kar realizasyonu için hedef fiyatlar belirleyin

- Tokenlarınızı özel anahtar kontrollü güvenli cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirlemek için kullanın

- Göreceli Güç Endeksi (RSI): Aşırı alım/satım koşullarını izleyin

- Dalgalı alım-satım için:

- Piyasa duyarlılığını ve Everclear ile ilgili haberleri takip edin

- Zarar durdur emirleriyle riskleri yönetin

CLEAR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Birden fazla Layer 2 ve birlikte çalışabilirlik projesine yatırım dağıtın

- Opsiyon stratejileri: Olası düşüşlere karşı opsiyon kullanmayı değerlendirin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik: İki faktörlü doğrulama, benzersiz şifreler ve yazılım güncellemeleri

V. CLEAR’ın Karşılaşabileceği Riskler ve Zorluklar

CLEAR Piyasa Riskleri

- Oynaklık: Kripto piyasasındaki dalgalanmalar CLEAR fiyatını ciddi ölçüde etkileyebilir

- Rekabet: Yeni takas katmanı çözümleri Everclear’ın payını azaltabilir

- Likidite: Düşük işlem hacmi, yüksek kayma ve fiyat etkisi yaratabilir

CLEAR Regülasyon Riskleri

- Regülasyon belirsizliği: Farklı ülkelerdeki değişen mevzuatlar Everclear’ın işleyişini etkileyebilir

- Uyum gereklilikleri: Zincirler arası çözümlere yönelik artan denetim ek uyum maliyetleri doğurabilir

- Hukuki riskler: Zincirler arası işlemler ve likidite sağlama ile ilgili olası hukuki sorunlar

CLEAR Teknik Riskler

- Akıllı sözleşme açıkları: Everclear’ın akıllı sözleşmelerinde olası hata veya açıklar

- Ölçeklenebilirlik: İşlem hacmi arttıkça performansı sürdürme zorlukları

- Birlikte çalışabilirlik: Yeni blockchain ağları ve protokolleriyle uyumluluk sorunları

VI. Sonuç ve Eylem Önerileri

CLEAR Yatırım Değeri Analizi

Everclear (CLEAR), kripto ekosisteminde likidite parçalanmasını çözen ilk takas katmanı olarak uzun vadede güçlü bir değer önerisi sunar. Ancak kısa vadede piyasa oynaklığı, regülasyon belirsizlikleri ve teknik riskler önemli tehditler olarak öne çıkıyor.

CLEAR Yatırım Önerileri

✅ Yeni başlayanlar: Teknolojiyi öğrenirken küçük ve kademeli yatırımlarla piyasa deneyimi kazanın ✅ Deneyimli yatırımcılar: Ortalama maliyetle alım ve proje gelişmelerini aktif takip stratejisi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı analiz ve Everclear ile stratejik iş birliklerini değerlendirin

CLEAR İşlem Katılım Yöntemleri

- Spot alım-satım: CLEAR token’ı Gate.com üzerinden satın alın

- Staking: Varsa Staking programlarına katılarak ek ödül kazanın

- Likidite sağlama: Desteklenen Layer 2 ağlarında likidite havuzlarına katkıda bulunun

Kripto para yatırımları yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı risk toleransınıza göre dikkatlice verin ve profesyonel finansal danışmanlardan destek alın. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

Clear Secure hisse senedi alınır mı?

Clear Secure güçlü kalite notuna sahip olsa da değer notu düşük. Yatırım kararı öncesi finansal hedeflerinizi netleştirin.

Clear hisse fiyatı için tahmin nedir?

Clear hisse fiyatı için beklenti olumlu; analistlerin ortalama hedefi 36,17 $ ve bu, mevcut seviyeden %17’lik potansiyel artışa işaret ediyor.

2025’te Clear Secure hisse fiyatı için tahmin nedir?

Analist öngörülerine göre, Clear Secure’ın 2025 yılı kazançları 135,58 milyon $ ile 152,86 milyon $ aralığında olacak. Ancak, belirli bir hisse fiyatı hedefi paylaşılmamış.

2030’da Clearpool için fiyat tahmini nedir?

Mevcut eğilimlere göre, Clearpool fiyatının 2030’da en fazla 1,24 $’a ulaşması bekleniyor.

2025 SPrice Tahmini: Gelecekteki Piyasa Trendleri ve Yatırım Fırsatlarının Analizi

Sui'nin zincir üstü veri analizi, 2025 yılında platformun büyümesini nasıl gözler önüne seriyor?

Zincir üstü veri analizi, 2025 yılında Sui'nin performansını nasıl ortaya koyuyor?

2025 yılında on-chain veri analizi, Aster'ın balina hareketlerini nasıl açığa çıkarıyor?

H vs APT: İnsan Zekası ile Advanced Persistent Threats (APT) Arasındaki Karmaşık Mücadeleyi Açığa Çıkarmak

AVAX'ın zincir üstü verileri, 2030 yılındaki fiyatını nasıl öngörecek?

Kripto Piyasasında Manipülasyondan Korunmak: Pump and Dump Dolandırıcılıklarını Tespit Etmek

Etkili ticaret stratejileri geliştirmek için Shooting Star mum formasyonunu ustalıkla kullanmak

EVM Cüzdan Adresinizi Bulmak: Kolay Bir Kılavuz

Ethereum Ağ Yükseltmesi: ETH2.0 Staking’e Dair Kapsamlı Bilgiler

Core Blockchain’i Anlamak: Profesyonel Rehberiniz