2025 CITYPrice Prediction: An Analysis of Emerging Market Trends and Investment Opportunities in Urban Real Estate

Introduction: CITY's Market Position and Investment Value

Manchester City Fan Token (CITY), as a utility token for fan engagement in the sports industry, has made significant strides since its launch in 2021. As of 2025, CITY's market capitalization has reached $11,349,864, with a circulating supply of approximately 11,539,106 tokens, and a price hovering around $0.9836. This asset, often referred to as a "fan engagement token," is playing an increasingly crucial role in sports fan participation and club decision-making processes.

This article will provide a comprehensive analysis of CITY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CITY Price History Review and Current Market Status

CITY Historical Price Evolution Trajectory

- 2021: CITY token launched, price reached all-time high of $36.19 on August 27

- 2023: Market downturn, price declined significantly

- 2025: Price hit all-time low of $0.80237 on June 23

CITY Current Market Situation

As of October 8, 2025, CITY is trading at $0.9836, with a 24-hour trading volume of $72,480.90. The token has experienced a 1.57% decrease in the last 24 hours. CITY's market cap currently stands at $11,349,864.66, ranking it #1355 in the cryptocurrency market.

The token is currently 97.28% below its all-time high of $36.19, set on August 27, 2021. However, it has shown a 22.59% increase from its all-time low of $0.80237, recorded on June 23, 2025.

CITY's circulating supply is 11,539,106 tokens, which represents 58.46% of its total supply of 19,740,000 tokens. The fully diluted market cap is $19,416,264.00.

In terms of recent price trends, CITY has shown negative performance across various timeframes:

- 1 hour: -0.26%

- 24 hours: -1.57%

- 7 days: -1.45%

- 30 days: -3.44%

- 1 year: -55.55%

These figures indicate a bearish sentiment in both short-term and long-term perspectives for the CITY token.

Click to view the current CITY market price

CITY Market Sentiment Indicator

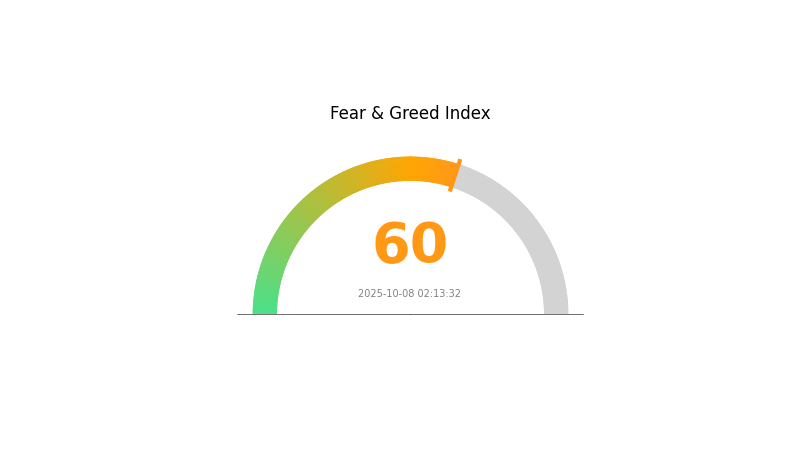

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of optimism as the Fear and Greed Index reaches 60, indicating a "Greed" sentiment. This level suggests that investors are becoming increasingly confident, potentially driving prices higher. However, it's essential to remain cautious, as excessive greed can lead to market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to manage risk. As always, conduct thorough research and stay informed about market trends before making any investment decisions.

CITY Holdings Distribution

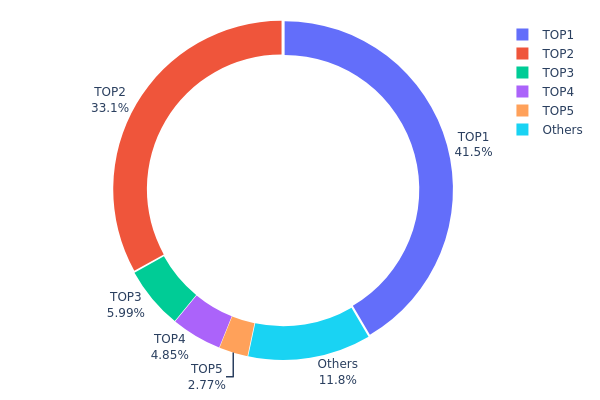

The address holdings distribution data reveals a highly concentrated ownership structure for CITY tokens. The top two addresses collectively hold 74.59% of the total supply, with the largest holder controlling 41.54% and the second-largest holding 33.05%. This significant concentration raises concerns about potential market manipulation and centralization of power within the CITY ecosystem.

The top five addresses account for 88.2% of all CITY tokens, leaving only 11.8% distributed among other holders. This extreme concentration could lead to increased price volatility and susceptibility to large-scale sell-offs if major holders decide to liquidate their positions. Furthermore, it may compromise the project's decentralization goals and raise questions about its governance structure and decision-making processes.

Such a concentrated distribution pattern suggests that CITY's on-chain structure may be less stable and more vulnerable to sudden changes. It also indicates a low level of decentralization, which could be a potential red flag for investors seeking projects with more balanced token distributions and reduced risk of market manipulation.

Click to view the current CITY holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 8200.89K | 41.54% |

| 2 | 0xF977...41aceC | 6524.16K | 33.05% |

| 3 | 0xc368...816880 | 1183.07K | 5.99% |

| 4 | 0x8791...988062 | 957.78K | 4.85% |

| 5 | 0x76eC...78Fbd3 | 545.93K | 2.77% |

| - | Others | 2328.16K | 11.8% |

II. Key Factors Affecting Future CITY Prices

Supply Mechanism

- Policy Space: The strength and scope of government policies significantly impact market recovery rhythms.

- Historical Patterns: Past supply changes have shown to be a core factor influencing price trends.

- Current Impact: Different cities and projects are expected to continue diverging trends based on supply dynamics.

Institutional and Whale Movements

- Enterprise Adoption: The level of urbanization and real estate market maturity affects institutional involvement.

- National Policies: Policy changes, especially those related to credit and leverage, play a crucial role in price movements.

Macroeconomic Environment

- Monetary Policy Impact: Changes in economic conditions, both domestic and international, influence development costs and supply-demand relationships.

- Inflation Hedging Properties: Real estate often serves as a hedge against inflation, affecting its attractiveness as an asset.

- Geopolitical Factors: International trade positions and global supply chain dynamics impact the overall economic environment.

Technological Development and Ecosystem Building

- Innovation-Driven Growth: The transition from real estate and debt-driven growth to innovation and new productive forces is shaping the economic landscape.

- Ecosystem Applications: The development of the tertiary industry and circulation capabilities directly affects the commercial environment and indirectly influences property prices.

III. CITY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.63934 - $0.9836

- Neutral prediction: $0.9836 - $1.28852

- Optimistic prediction: $1.28852 - $1.48824 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2027: $0.9185 - $1.85013

- 2028: $1.02774 - $1.88155

- Key catalysts: Technological advancements, broader market recovery, and expanded use cases

2030 Long-term Outlook

- Base scenario: $0.98557 - $1.79194 (assuming steady growth and market stability)

- Optimistic scenario: $1.79194 - $1.91738 (assuming strong adoption and favorable market conditions)

- Transformative scenario: Above $1.91738 (extreme positive developments in the crypto market and CITY ecosystem)

- 2030-12-31: CITY $1.91738 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.28852 | 0.9836 | 0.63934 | 0 |

| 2026 | 1.48824 | 1.13606 | 0.72708 | 15 |

| 2027 | 1.85013 | 1.31215 | 0.9185 | 33 |

| 2028 | 1.88155 | 1.58114 | 1.02774 | 60 |

| 2029 | 1.85254 | 1.73135 | 1.16 | 76 |

| 2030 | 1.91738 | 1.79194 | 0.98557 | 82 |

IV. CITY Professional Investment Strategies and Risk Management

CITY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Fan token enthusiasts and long-term Manchester City supporters

- Operation suggestions:

- Accumulate CITY tokens during market dips

- Participate actively in club decisions to maximize token utility

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Utilize to spot trend changes and potential entry/exit points

- Key points for swing trading:

- Monitor club news and performance for potential price impacts

- Set strict stop-loss and take-profit levels

CITY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple fan tokens and crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for CITY

CITY Market Risks

- High volatility: Fan token prices can fluctuate dramatically based on team performance

- Limited liquidity: May face challenges in executing large trades without significant price impact

- Correlation with broader crypto market: Subject to overall cryptocurrency market trends

CITY Regulatory Risks

- Uncertain regulatory landscape: Fan tokens may face scrutiny from financial regulators

- Potential classification changes: Risk of being categorized as securities in some jurisdictions

- Cross-border compliance issues: Varying regulations across different countries

CITY Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying token contract

- Blockchain network issues: Dependence on the Chiliz Chain's performance and security

- Wallet compatibility: Ensure compatibility with various wallet solutions for seamless transactions

VI. Conclusion and Action Recommendations

CITY Investment Value Assessment

CITY offers unique engagement opportunities for Manchester City fans but carries significant volatility and regulatory uncertainties. Long-term value is tied to the club's success and fan token adoption, while short-term risks include market volatility and potential regulatory changes.

CITY Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about fan token utility ✅ Experienced investors: Consider CITY as part of a diversified crypto portfolio, actively participate in club decisions ✅ Institutional investors: Conduct thorough due diligence on regulatory implications and liquidity before significant investments

CITY Trading Participation Methods

- Spot trading: Buy and sell CITY tokens on Gate.com

- Staking: Participate in staking programs if available to earn additional rewards

- Fan engagement: Utilize CITY tokens for voting and accessing exclusive club benefits

Cryptocurrency investments are extremely high-risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price target for Citigroup?

The price target for Citigroup is $106.88, based on the 12-month average of analyst ratings. Some analysts have set targets of $95.00 and $108.00.

What is coti crypto price prediction?

COTI's price is predicted to reach $0.4237 by 2026 and $1.34 by 2030. Short-term outlook is bearish with support at $0.0501.

What crypto has the highest price prediction?

Bitcoin (BTC) is predicted to have the highest price in 2025. It remains the top choice for investors, supported by its consistent trend.

What is Citigroup Bitcoin price prediction?

Citigroup predicts Bitcoin's price will reach $181,000 within the next year, based on their latest market analysis as of October 2025.

Share

Content