2025 CATI Fiyat Tahmini: Merkeziyetsiz Varlık Ekosisteminde Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Analizi

Giriş: CATI'nin Piyasa Konumu ve Yatırım Değeri

Catizen (CATI), GameFi ekosisteminde Play-to-Airdrop modelinin öncüsü olarak kurulduğu günden bu yana dikkate değer bir ilerleme kaydetti. 2025 yılı itibarıyla CATI'nin piyasa değeri 16.807.540 USD olup, dolaşımdaki arzı yaklaşık 206.000.000 token ve fiyatı 0,08159 USD civarında seyrediyor. "Meow Universe yenilikçisi" olarak anılan bu varlık, gündelik oyunlar ile blokzincir entegrasyonu alanında giderek daha önemli bir rol üstleniyor.

Bu makale, CATI'nin 2025-2030 yılları arasında fiyat hareketlerini; geçmiş trendler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejilerle kapsamlı şekilde analiz edecektir.

I. CATI Fiyat Geçmişi ve Güncel Piyasa Durumu

CATI Tarihsel Fiyat Gelişim Seyri

- 2024: Proje lansmanı, fiyat 20 Eylül'de 1,1274 USD ile zirve yaptı

- 2025: Piyasa düşüşü, fiyat 21 Haziran'da tüm zamanların en düşük seviyesi olan 0,06783 USD'ye geriledi

- 2025: Kademeli toparlanma, güncel fiyat 0,08159 USD civarında sabit

CATI Güncel Piyasa Durumu

06 Ekim 2025 (UTC) itibarıyla CATI, 0,08159 USD seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 742.564,54 USD. Token son 24 saatte %1 oranında hafif bir düşüş yaşadı. CATI'nin piyasa değeri 16.807.540 USD olup, genel sıralamada 1.184'üncü sırada yer alıyor.

Dolaşımdaki arz 206.000.000 CATI olup, bu miktar maksimum arz olan 1.000.000.000 CATI'nin %20,6'sına denk geliyor. Tam seyreltilmiş piyasa değeri ise 81.590.000 USD olarak hesaplanıyor.

Son fiyat hareketlerinde, CATI farklı zaman dilimlerinde karmaşık bir performans sergiledi:

- 1 saat: +%0,97

- 24 saat: -%1

- 7 gün: -%2,76

- 30 gün: -%4,3

- 1 yıl: -%84,42

Mevcut fiyat, 20 Eylül 2024 tarihinde kaydedilen 1,1274 USD'lik tüm zamanların en yüksek değerinin oldukça altında olup, zirveden bu yana ciddi bir düzeltmeye işaret ediyor.

Güncel CATI piyasa fiyatını görüntülemek için tıklayın

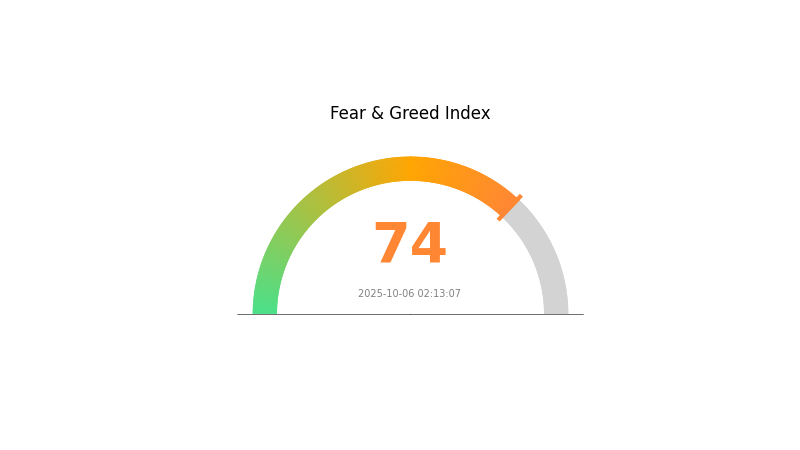

CATI Piyasa Duyarlılığı Göstergesi

2025-10-06 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim ve Korku ve Açgözlülük Endeksi 74 seviyesine ulaştı. Bu yüksek iyimserlik, yatırımcıların giderek daha fazla güven duyduğunu ve varlık fiyatlarının yükselmesine yol açabileceğini gösteriyor. Ancak tecrübeli yatırımcılar, aşırı açgözlülüğün çoğunlukla piyasa düzeltmelerinden önce geldiğini bilir. Bu nedenle, FOMO odaklı kararlardan kaçınmak ve dikkatli hareket etmek önemlidir. Portföyünüzü çeşitlendirin ve kazançlarınızı korumak için zararı durdur emirleri kullanın. Her zaman detaylı araştırma yaparak riskinizi akıllıca yönetin.

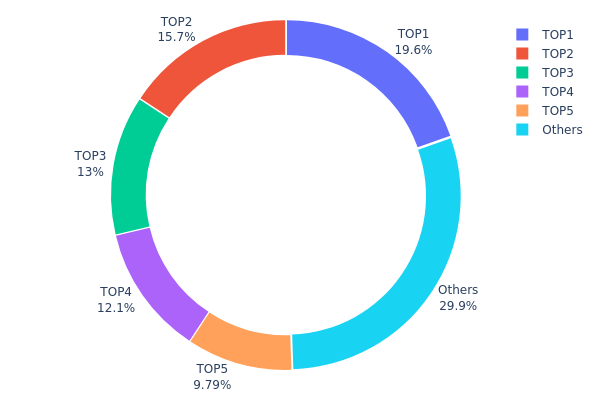

CATI Varlık Dağılımı

CATI'nin adres varlık dağılımı grafiği, tokenların büyük bir kısmının birkaç üst adres arasında yoğunlaştığını gösteriyor. İlk beş adres toplam CATI arzının %70,1'ini elinde bulundururken, en büyük sahip %19,58 oranında bulunuyor. Bu yüksek yoğunlaşma, nispeten merkezi bir token dağıtımına işaret ediyor ve piyasa dinamikleri ile fiyat istikrarı üzerinde etkili olabilir.

Böyle bir yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riskini artırabilir. Büyük sahipler ("balinalar"), ticaret faaliyetleriyle piyasayı ciddi şekilde etkileyebilir. Bununla birlikte, CATI tokenlarının %29,9'u diğer adreslere dağıtılmış olup, ekosistemde daha geniş bir katılım olduğunu gösteriyor.

Piyasa yapısı açısından, bu dağılım CATI'nin zincir üzerindeki istikrarının ve merkeziyetsizliğinin iyileştirilebileceğini gösteriyor. Özellikle erken aşamalardaki birçok kripto projede yoğunlaşma yaygın olsa da, daha dengeli bir token dağılımı uzun vadeli sürdürülebilirlik ve manipülasyon risklerinin azalması için daha sağlıklıdır.

Güncel CATI Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | EQAQqB...vAdZox | 195.833,33K | 19,58% |

| 2 | EQCWfR...Rddbp4 | 157.333,65K | 15,73% |

| 3 | EQAnbL...iMDdME | 129.586,89K | 12,95% |

| 4 | UQD4uG...tTYCQx | 120.586,77K | 12,05% |

| 5 | EQCEFQ...Ovcin- | 97.916,67K | 9,79% |

| - | Diğerleri | 298.742,69K | 29,9% |

II. CATI'nin Gelecekteki Fiyatına Etki Eden Temel Faktörler

Arz Mekanizması

- Toplam Arz: CATI tokenlarının toplam arzı ve dağıtım oranı, kıtlık ve fiyat dalgalanmasını doğrudan etkiler.

- Tarihsel Model: Yatırımcılar, CATI'nin toplam arzı ve dağıtım oranını yakından takip etmeli; çünkü bu faktörler geçmişte kıtlık ve fiyat değişimlerinde başrolü oynamıştır.

- Güncel Etki: Mevcut arz mekanizmasının, proje geliştikçe CATI fiyatına etki etmeye devam etmesi beklenmektedir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: Catizen'ın oyuncu kitlesi büyüdükçe ve yeni özellikler sunuldukça, kurumsal ilgi artabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: CATI, dijital bir varlık olarak diğer kripto paralar gibi enflasyona karşı potansiyel bir koruma aracı olarak görülebilir.

Teknik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: Catizen ekosisteminin genişlemesi ve yeni özelliklerin devreye alınması, CATI'nin değerini doğrudan etkileyecek.

- Kullanıcı Katılımı: CATI, hızla değişen piyasada rekabetçi kalmak için kullanıcı katılımını sürdürmeli ve kendini farklılaştırmalıdır.

III. 2025-2030 CATI Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,06695 USD - 0,08165 USD

- Tarafsız tahmin: 0,08165 USD - 0,09635 USD

- İyimser tahmin: 0,09635 USD - 0,11303 USD (güçlü piyasa toparlanması gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,06667 USD - 0,1293 USD

- 2028: 0,07831 USD - 0,14394 USD

- Başlıca katalizörler: Artan benimsenme ve teknolojik ilerlemeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,12955 USD - 0,15093 USD (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,15093 USD - 0,22337 USD (olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,22337 USD - 0,25000 USD (çığır açıcı yenilikler varsayımıyla)

- 31 Aralık 2030: CATI 0,15093 USD (%84 artış, 2025'e göre)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,09635 | 0,08165 | 0,06695 | 0 |

| 2026 | 0,11303 | 0,089 | 0,08455 | 9 |

| 2027 | 0,1293 | 0,10101 | 0,06667 | 23 |

| 2028 | 0,14394 | 0,11516 | 0,07831 | 41 |

| 2029 | 0,1723 | 0,12955 | 0,12437 | 58 |

| 2030 | 0,22337 | 0,15093 | 0,08301 | 84 |

IV. CATI için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CATI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde CATI biriktirin

- Kısmi kar almak için fiyat hedefleri belirleyin

- Tokenları özel anahtar ile güvenli cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit için kullanın

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı işlem için ana noktalar:

- Potansiyel zararları sınırlamak için zararı durdur emirleri koyun

- Önceden belirlenen direnç seviyelerinde kar alın

CATI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları farklı kripto varlıklara dağıtın

- Zararı durdur emirleri: Potansiyel zararları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama çözümü: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama aktive edin, güçlü şifreler kullanın

V. CATI için Potansiyel Riskler ve Zorluklar

CATI Piyasa Riskleri

- Yüksek oynaklık: Fiyat dalgalanmaları aşırı olabilir

- Kısıtlı likidite: Büyük işlemlerde zorluk yaratabilir

- Rekabet: Diğer GameFi projeleri pazar payını etkileyebilir

CATI Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: Sıkılaşan regülasyon ihtimali

- Sınır ötesi uyum: Farklı ülkelerde değişen düzenleyici yapılar

- Vergilendirme etkileri: Kripto varlıklar için değişen vergi yasaları

CATI Teknik Riskleri

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ağ tıkanıklığı: İşlem hızı ve maliyetleri üzerinde etkili olabilir

- Teknolojik eskime: Blokzincir teknolojisindeki hızlı yenilikler

VI. Sonuç ve Eylem Önerileri

CATI Yatırım Değeri Değerlendirmesi

CATI, PLAY-TO-AIRDROP modeliyle GameFi alanında yenilikçi bir yaklaşım sunuyor. Genişleyen gündelik oyun pazarında büyüme potansiyeli bulunsa da, yatırımcıların kripto piyasasındaki yüksek oynaklık ve regülasyon risklerini göz önünde bulundurması gerekir.

CATI Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, teknoloji ve piyasa dinamiklerini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: CATI'yi çeşitlendirilmiş bir kripto portföyünde değerlendirin, risk yönetimi stratejileri uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, yapılandırılmış ürünler veya OTC piyasalar üzerinden pozisyon alın

CATI Katılım Yöntemleri

- Spot alım-satım: Gate.com'da CATI alıp satabilirsiniz

- Staking: Varsa Staking programlarına katılın

- GameFi katılımı: Catizen ekosistemine dahil olarak ödül kazanın

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular (SSS)

CATI tekrar yükselir mi?

Evet, CATI'nin tekrar yükselmesi bekleniyor. Tahminler, 2029'da 6,55 USD'ye ve 2030'da 1,69-4 USD aralığına ulaşabileceğini öngörüyor; bu yükselişte kullanım alanı ve GameFi sektöründeki büyüme etkili olacaktır.

CATI coin için tahmin nedir?

CATI'nin önümüzdeki yıl 0,05844 USD ile 0,083708 USD aralığında işlem görmesi ve %1,21'lik potansiyel bir artış sergilemesi bekleniyor.

CATI coin'in gelecekteki fiyatı nedir?

Mevcut piyasa analizlerine göre, CATI coin'in Ekim 2025'te 0,06237 USD seviyesine ulaşması öngörülüyor; bu, kripto para piyasasındaki düşüş eğilimini yansıtıyor.

1 CATI token kaç dolar?

06 Ekim 2025 (UTC) itibarıyla 1 CATI token yaklaşık olarak 0,082909 USD değerindedir. Bu fiyat, CATI'nin USD cinsinden güncel piyasa değerini ifade etmektedir.

GameFi (GAFI) Yatırım İçin Uygun mu?: 2023 Yılında Blockchain Oyun Tokenlarının Potansiyeli ve Risklerinin Analizi

2025 HMSTR Fiyat Tahmini: Hamster Token’ın Büyüme Dinamikleri ve Piyasa Potansiyeli Analizi

2025 GMT Fiyat Tahmini: STEPN’in Yerel Token’ı İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 BIGTIME Fiyat Tahmini: Oyun Token’ının gelecekteki değerini belirleyecek büyüme potansiyeli ile piyasa faktörlerinin kapsamlı analizi

2025 GAME2 Fiyat Tahmini: Oyun Tokeni'nin Piyasa Trendleri ve Gelecekteki Değerleme Potansiyelinin Analizi

2025 MAVIA Fiyat Tahmini: Gelecek Büyüme Analizi ve Yatırımcılar İçin Potansiyel Getiri Oranı

Merkeziyetsiz Alım Satımın Keşfi: Cosmos Platformuna Kapsamlı Bir Rehber

Dogecoin madenciliği teknikleriyle maksimum kâr elde edin

Gelişmiş MPC Cüzdan Teknolojisi sayesinde kripto para güvenliği daha üst seviyeye taşınıyor

Linea'yı Keşfetmek: Layer 2 Ölçeklendirme Çözümlerinin Geleceği

IOTA'yı Keşfedin: Merkeziyetsiz Defter Teknolojisine Kapsamlı Bir Rehber