2025 BMT Fiyat Tahmini: Gelecekteki Piyasa Trendleri ve Yatırım Potansiyeli Analizi

Giriş: BMT'nin Piyasa Konumu ve Yatırım Değeri

Bubblemaps (BMT), DeFi tokenları ve NFT'ler için ilk arz denetim aracı olarak, kripto para piyasasında kendine özgü bir konuma sahip olmuştur. 2025 yılı itibarıyla Bubblemaps, yaklaşık 256.180.900 dolaşımdaki token ve 15.473.326,36 $ piyasa değeriyle faaliyet göstermektedir; fiyatı ise 0,0604 $ civarında seyretmektedir. "DeFi ve NFT Denetçisi" olarak anılan bu varlık, blokzincir arz şeffaflığı ve güvenliği alanında giderek daha belirleyici bir rol üstlenmektedir.

Bu makalede, Bubblemaps’in 2025-2030 dönemindeki fiyat eğilimleri kapsamlı biçimde analiz edilmekte; tarihsel fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler birleştirilerek profesyonel fiyat tahminleri ve yatırımcılar için pratik stratejiler sunulmaktadır.

I. BMT Fiyat Geçmişi ve Mevcut Piyasa Durumu

BMT Tarihsel Fiyat Değişimi

- 18 Mart 2025: BMT, tüm zamanların en yüksek seviyesi olan 0,3262 $'a ulaştı

- 30 Eylül 2025: BMT, tüm zamanların en düşük seviyesi olan 0,05479 $'a geriledi

BMT Güncel Piyasa Durumu

06 Ekim 2025 itibarıyla BMT, 0,0604 $ seviyesinden işlem görmektedir ve 24 saatlik işlem hacmi 1.054.171,69 $'dır. Son 24 saatte %0,26 oranında hafif bir yükseliş göstermiştir. BMT'nin piyasa değeri şu anda 15.473.326,36 $ olup, kripto para piyasasında 1.214. sıradadır.

Token fiyatı, farklı zaman dilimlerinde dalgalı bir performans sergilemiştir. Son bir saatte %0,38 artış yaşanırken, 7 günlük değişimde %1,82'lik bir yükseliş görülmektedir. Ancak uzun vadede, BMT son 30 günde %1,69 düşüş ve son bir yılda %36,026 oranında sert bir gerileme kaydetmiştir.

BMT'nin güncel fiyatı, 18 Mart 2025 tarihindeki 0,3262 $'lık tüm zamanların en yüksek seviyesinin oldukça altındadır. Token, 30 Eylül 2025'te görülen 0,05479 $'lık tüm zamanların en düşük seviyesine çok daha yakın işlem görmektedir. Bu tablo, BMT'nin 2025 yılı boyunca genel olarak aşağı yönlü bir trend izlediğini göstermektedir.

Dolaşımdaki BMT arzı 256.180.900 token olup, bu miktar toplam 1.000.000.000 BMT arzının %25,7'sine karşılık gelmektedir. Tam seyreltilmiş piyasa değeri ise 60.400.000 $'dır.

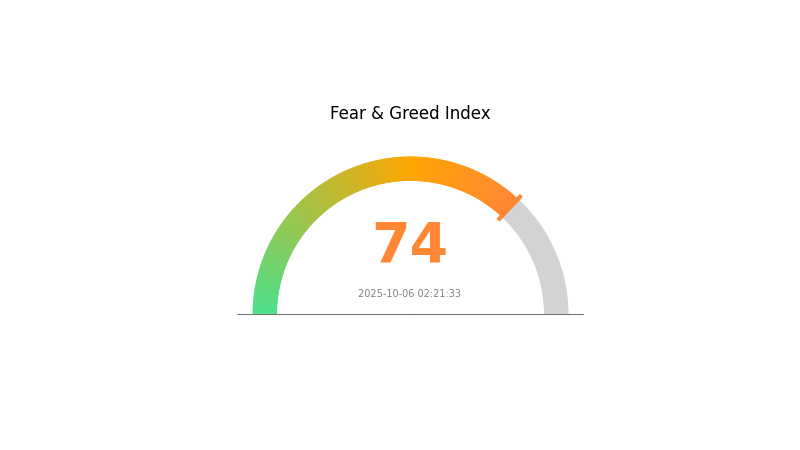

Son dönemdeki fiyat gerilemesine rağmen, kripto para piyasasında genel hissiyat olumlu görünmektedir; Korku ve Açgözlülük Endeksi 'Açgözlülük' seviyesinde ve değeri 74'tür.

Güncel BMT piyasa fiyatını görmek için tıklayın

BMT Piyasa Duyarlılık Göstergesi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda açgözlülük hakim ve Korku ve Açgözlülük Endeksi 74 seviyesinde bulunuyor. Bu, yatırımcıların aşırı iyimser olabileceğini ve piyasanın aşırı alım koşullarına yaklaşabileceğini gösteriyor. Kısa vadede boğa eğilimi fiyatları yukarı itebilir; ancak yatırımcıların risklerini yönetmeleri ve temkinli olmaları gerekmektedir. Kâr almak veya risk yönetimi stratejilerini uygulamak, yatırım güvenliğiniz açısından önemlidir. Unutmayın, aşırı açgözlülük genellikle piyasa düzeltmesinin işaretidir. Piyasa coşkusuyla ani kararlar almaktan kaçının ve dikkatli hareket edin.

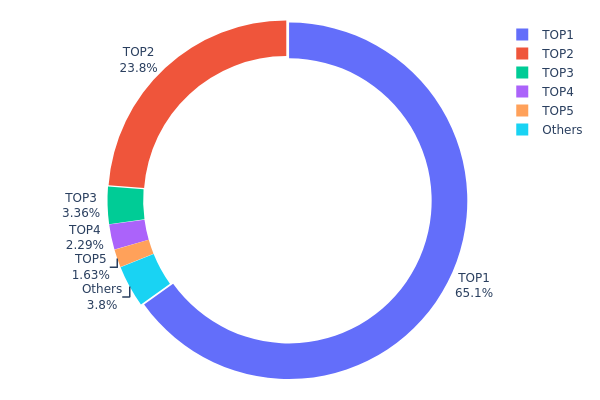

BMT Varlık Dağılımı

BMT'nin adres varlık dağılımı, sahipliğin son derece yoğunlaşmış olduğunu göstermektedir. En büyük adres toplam arzın %65,12'sini elinde bulundururken, ikinci büyük adresin payı %23,79'dur. Yani BMT tokenlarının yaklaşık %89'u yalnızca iki adresin kontrolündedir ve bu oldukça merkezi bir yapı sunar.

Bu yüksek yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu risklerini artırmaktadır. Çok az sayıda adresin bu kadar büyük bir paya sahip olması, büyük sahiplerin tokenlarını satması veya hareket ettirmesi halinde ciddi fiyat dalgalanmalarına yol açabilir. Aynı zamanda bu durum, projenin merkeziyetsizlik iddiasını zayıflatabilir ve uzun vadede yatırımcı güvenini olumsuz etkileyebilir.

Mevcut dağılım yapısı, BMT'nin zincir üzerindeki istikrarının kırılgan olabileceğine işaret ediyor. Az sayıda büyük sahip fiyatı destekleyebilir; fakat token değeri büyük ölçüde bu adreslerin hareketlerine bağlıdır. Yatırımcıların bu durumu yakından izlemesi ve proje ekibinin zamanla daha dengeli bir dağılım için stratejik adımlar atması gerekmektedir.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xeaed...6a6b8d | 331.071,78K | 65,12% |

| 2 | 0xf977...41acec | 120.965,70K | 23,79% |

| 3 | 0x5d36...f67bf0 | 17.093,21K | 3,36% |

| 4 | 0x09f9...917fc5 | 11.623,39K | 2,28% |

| 5 | 0x0d07...b492fe | 8.311,88K | 1,63% |

| - | Diğerleri | 19.317,87K | 3,82% |

II. BMT'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Airdrop Dağıtımı: Erken destekçiler airdrop haklarını talep ettikçe fiyatta satış baskısı oluşabilir.

- Güncel Etki: Kısa vadeli dalgalanmalar üzerinde airdrop talepleri ve piyasa duyarlılığı belirleyicidir.

Kurumsal ve Balina Dinamikleri

- Token Yoğunlaşması: Büyük sahiplerin elindeki yüksek miktarlar, potansiyel toplu satış riski yaratmaktadır.

Makroekonomik Ortam

- Düzenleyici Faktörler: Küresel düzenlemelerdeki değişiklikler, BMT'nin işlem ortamını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Çapraz Zincir Likiditesi: Token'ın gerçek kullanım alanı ve çapraz zincir likiditesi, istikrarlı işlem hacmini destekler.

- Ekosistem Uygulamaları: BubbleMaps, BMT ekosisteminin ana uygulamasıdır.

2025 yılı için BMT tokenlarının fiyat tahmini yükseliş eğilimi göstermektedir. Yatırım stratejileri; piyasa trendleri, teknolojik gelişmeler ve düzenleyici ortam dikkate alınarak oluşturulmalıdır.

III. 2025-2030 BMT Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,0495 $ - 0,06037 $

- Tarafsız tahmin: 0,06037 $ - 0,07 $

- İyimser tahmin: 0,07 $ - 0,07969 $ (güçlü piyasa ivmesi gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,06275 $ - 0,1153 $

- 2028: 0,05037 $ - 0,12011 $

- Kilit katalizörler: Genel kripto piyasası eğilimleri, proje gelişmeleri ve benimsenme oranları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,10849 $ - 0,11337 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,11825 $ - 0,16099 $ (olumlu piyasa koşulları ve daha fazla benimsenme ile)

- Dönüştürücü senaryo: 0,16099 $ - 0,18 $ (çığır açıcı teknoloji ve kitlesel benimsenmeyle)

- 31 Aralık 2030: BMT 0,11337 $ (önemli büyüme sonrası muhtemel denge noktası)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,07969 | 0,06037 | 0,0495 | 0 |

| 2026 | 0,08684 | 0,07003 | 0,05042 | 15 |

| 2027 | 0,1153 | 0,07843 | 0,06275 | 29 |

| 2028 | 0,12011 | 0,09686 | 0,05037 | 60 |

| 2029 | 0,11825 | 0,10849 | 0,08896 | 79 |

| 2030 | 0,16099 | 0,11337 | 0,10997 | 87 |

IV. BMT Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BMT Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olan: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde BMT biriktirin

- Kâr realizasyonu için fiyat hedefleri belirleyin

- Güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Bubblemaps ile ilgili piyasa duyarlılığı ve haberleri takip edin

- Zarar durdur emirleriyle riskleri yönetin

BMT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- İhtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yaparak riski dağıtmak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdanı

- Soğuk saklama: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın

V. BMT için Potansiyel Riskler ve Zorluklar

BMT Piyasa Riskleri

- Yüksek volatilite: BMT fiyatında önemli dalgalanmalar yaşanabilir

- Sınırlı likidite: Büyük hacimli işlemlerde zorluk yaşanabilir

- Piyasa duyarlılığı: Genel kripto piyasası eğilimlerinden etkilenebilir

BMT Düzenleyici Riskler

- Bilinmez düzenlemeler: Yeni kripto düzenlemeleri BMT'yi etkileyebilir

- Sınır ötesi kısıtlamalar: Belirli yargı alanlarında BMT işlemlerine sınırlamalar gelebilir

- Uyum gereksinimleri: Artan KYC/AML önlemleri benimsenme oranını düşürebilir

BMT Teknik Riskler

- Akıllı kontrat açıkları: Akıllı sözleşme kodunda güvenlik açıklarından yararlanılabilir

- Ağ tıkanıklığı: Solana veya BSC üzerinde ölçeklenebilirlik sorunları işlemleri yavaşlatabilir

- Birlikte çalışabilirlik zorlukları: Zincirler arası işlevlerde teknik engeller oluşabilir

VI. Sonuç ve Eylem Önerileri

BMT Yatırım Değeri Değerlendirmesi

BMT, DeFi ve NFT'ler için arz denetim aracı olarak uzun vadeli potansiyel sunarken, kısa vadede piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle risk taşımaktadır.

BMT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi tanımak için küçük ve kademeli yatırım yapmayı değerlendirin ✅ Deneyimli yatırımcılar: Düzenli alım ve belirlenmiş kâr hedefleriyle strateji geliştirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme gerçekleştirin ve BMT'yi çeşitlendirilmiş kripto portföyüne dahil edin

BMT İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında BMT alın veya satın

- Limit emirleri: Belirlenen alım/satım fiyatlarıyla işlemleri otomatik olarak gerçekleştirin

- Staking: Gate.com'da mevcut olduğu takdirde BMT staking programlarına katılabilirsiniz

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli, profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

Sıkça Sorulan Sorular

BNS için 2025 fiyat tahmini nedir?

Analistlerin ortak görüşüne göre, 06 Ekim 2025 itibarıyla BNS için 2025 fiyat tahmini 86 $'dır.

Kripto dünyasında BMT nedir?

BMT, Bubblemaps'in yerel tokenıdır; blokzincir veri görselleştirme platformunda premium özelliklere erişim için kullanılır ve Solana ağında faaliyet göstererek kripto ekosisteminde şeffaflığı teşvik eder.

Beta Bionics'in 2025 hisse fiyatı tahmini nedir?

Piyasa trendlerine göre, Beta Bionics hissesi 2025 yılında 17,82 $ ile 20,37 $ arasında işlem görecek ve ortalama fiyatı 19,09 $ civarında olması bekleniyor.

BMT'nin değeri nedir?

06 Ekim 2025 itibarıyla BMT'nin değeri 0,05963 $'tır; son 24 saatte %3,35 oranında düşüş göstermiştir.

2025 SUPER Fiyat Tahmini: Gelişen blockchain ekosisteminde SUPER Token'ın piyasa trendleri ve gelecekteki değerlemesinin analizi

K21 nedir: Sağlık tanı süreçlerini kökten değiştiren yenilikçi Yapay Zekâ Sistemi

2025 K21 Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

DON vs CHZ: Spor ve Eğlence Sektöründe Blockchain Devlerinin Rekabeti

Aster Merkeziyetsiz Sürekli Sözleşme ve Çok Zincirli Türevler Ticaret Platformu

Bitcoin Birimlerinin Açıklaması: Satoshi Dönüştürme Kılavuzu

Bitcoin fiyatı pound cinsinden, traderların şimdi bilmesi gerekenler.

Kripto para piyasasında Pivot Noktası ticaret stratejilerini ustalıkla kullanmak

Yeni Madenciler İçin En İyi Kripto Madencilik Platformları