2025 BLUM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BLUM's Market Position and Investment Value

Blum (BLUM), as a hybrid exchange offering universal token access through gamification, has made significant strides since its inception. As of 2025, Blum's market capitalization has reached $4,594,213, with a circulating supply of approximately 107,845,392 tokens, and a price hovering around $0.0426. This asset, often referred to as a "universal token access platform," is playing an increasingly crucial role in providing access to both CEX and DEX coins across multiple blockchain networks.

This article will comprehensively analyze Blum's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BLUM Price History Review and Current Market Status

BLUM Historical Price Evolution

- 2025 April: BLUM reached its all-time low of $0.00133, marking the beginning of its market presence

- 2025 June: The project hit a significant milestone with an all-time high of $0.2256, showcasing strong initial market interest

- 2025 October: BLUM experienced a market correction, with the price settling at $0.0426

BLUM Current Market Situation

As of October 12, 2025, BLUM is trading at $0.0426, representing a 24-hour decline of 9.8%. The token has shown mixed performance across different timeframes, with a 7-day increase of 7.91% and a substantial 30-day gain of 39.82%. However, the yearly performance indicates a significant downturn of -62.65%.

BLUM's market capitalization currently stands at $4,594,213.6992, ranking it at 1779 in the global cryptocurrency market. The circulating supply is 107,845,392 BLUM, which represents 10.78% of the total supply of 1 billion tokens.

The token's 24-hour trading volume is $71,447.0760927, indicating moderate market activity. The current price is significantly below its all-time high, suggesting potential for growth if market conditions improve and the project gains more traction.

Click to view the current BLUM market price

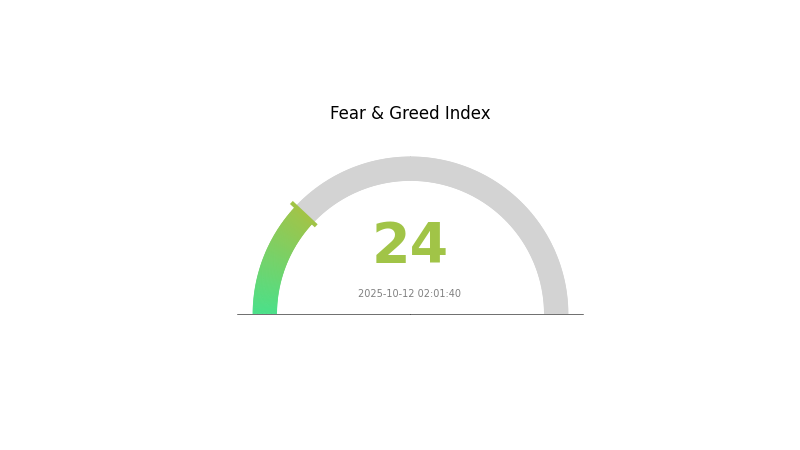

BLUM Market Sentiment Indicator

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 24. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider diversifying their portfolios and implementing risk management strategies. Remember, market sentiment can shift rapidly, so stay informed and adjust your trading approach accordingly. Gate.com offers tools and resources to help navigate these uncertain times.

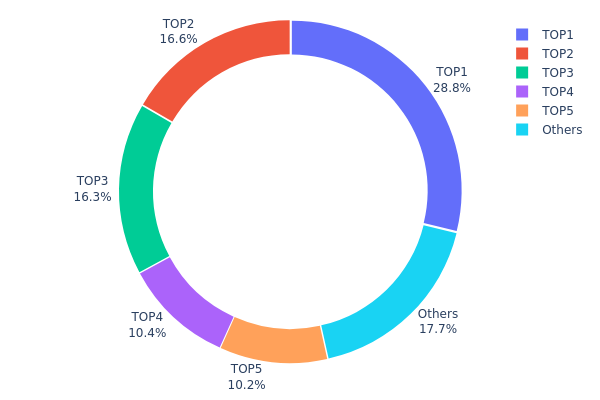

BLUM Holdings Distribution

The address holdings distribution data for BLUM reveals a highly concentrated ownership structure. The top 5 addresses collectively hold 82.3% of the total supply, with the largest holder possessing 28.84% of all tokens. This concentration level raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution suggests that BLUM's market is susceptible to significant price swings based on the actions of a few large holders. The top address, controlling nearly 30% of the supply, could exert substantial influence over the token's price and liquidity. Furthermore, the top three addresses combined hold over 60% of all tokens, indicating a centralized control that contradicts the principles of decentralization often associated with cryptocurrency projects.

This concentration may impact BLUM's on-chain stability and market dynamics. Large holders could potentially coordinate actions, leading to artificial price movements or liquidity issues. For investors and traders, this distribution pattern signals a need for caution, as it implies a higher risk of sudden market shifts and potential lack of price discovery efficiency.

Click to view the current BLUM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQB1zw...pWOv3v | 279959.08K | 28.84% |

| 2 | UQBxJP...BMQGiG | 161100.00K | 16.59% |

| 3 | UQBaYR...ycVHZ5 | 158100.00K | 16.28% |

| 4 | UQDd-y...O6dF6j | 100805.48K | 10.38% |

| 5 | UQBQsI...xdUeQJ | 99168.24K | 10.21% |

| - | Others | 171468.09K | 17.7% |

II. Key Factors Influencing BLUM's Future Price

Supply Mechanism

- Limited Supply: The total supply cap of 10 billion BLUM tokens may create scarcity, potentially driving long-term demand.

- Historical Pattern: Not enough information provided.

- Current Impact: The limited supply is expected to create a scarcity effect, which could positively influence the price in the long term.

Institutional and Whale Dynamics

- Institutional Holdings: Not enough information provided.

- Corporate Adoption: Not enough information provided.

- National Policies: Regulatory developments, such as ETF approvals and government policies, can significantly impact BLUM's price.

Macroeconomic Environment

- Monetary Policy Impact: Not enough information provided.

- Inflation Hedging Properties: Not enough information provided.

- Geopolitical Factors: Ongoing geopolitical tensions may affect BLUM's price as part of the broader cryptocurrency market.

Technological Development and Ecosystem Building

- Hybrid Exchange Model: Combining on-chain security with off-chain efficiency, providing users with more flexible trading options.

- Ecosystem Applications: The platform's social features and Blum Points contribute to user value and ecosystem growth.

III. BLUM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03877 - $0.0426

- Neutral prediction: $0.0426 - $0.04707

- Optimistic prediction: $0.04707 - $0.05155 (requires favorable market conditions)

2026-2028 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.02919 - $0.06967

- 2027: $0.03385 - $0.06946

- 2028: $0.05241 - $0.07286

- Key catalysts: Increased adoption, technological advancements, market sentiment improvement

2029-2030 Long-term Outlook

- Base scenario: $0.06839 - $0.08207 (assuming steady market growth)

- Optimistic scenario: $0.08207 - $0.09575 (assuming strong market performance)

- Transformative scenario: $0.09575 - $0.10505 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: BLUM $0.10505 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05155 | 0.0426 | 0.03877 | 0 |

| 2026 | 0.06967 | 0.04707 | 0.02919 | 10 |

| 2027 | 0.06946 | 0.05837 | 0.03385 | 36 |

| 2028 | 0.07286 | 0.06392 | 0.05241 | 49 |

| 2029 | 0.09575 | 0.06839 | 0.05745 | 60 |

| 2030 | 0.10505 | 0.08207 | 0.07632 | 92 |

IV. BLUM Professional Investment Strategy and Risk Management

BLUM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors looking for potential growth in hybrid exchange platforms

- Operation suggestions:

- Accumulate BLUM tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Telegram community activity and user growth

- Track new feature releases and partnerships

BLUM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automated sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for BLUM

BLUM Market Risks

- High volatility: BLUM price may experience significant fluctuations

- Competition: Other hybrid exchanges may emerge and gain market share

- User adoption: Slow growth in user base could impact token value

BLUM Regulatory Risks

- Unclear regulations: Hybrid exchanges may face regulatory scrutiny

- Cross-border compliance: Challenges in adhering to multiple jurisdictions' laws

- Token classification: Potential for BLUM to be classified as a security

BLUM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the platform

- Scalability issues: Challenges in handling increased transaction volume

- Integration complexities: Difficulties in maintaining connections with multiple chains

VI. Conclusion and Action Recommendations

BLUM Investment Value Assessment

BLUM presents an innovative approach to cryptocurrency trading through its hybrid exchange model. While it offers potential long-term value in simplifying multi-chain access, short-term risks include market volatility and regulatory uncertainties.

BLUM Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the platform features ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

BLUM Trading Participation Methods

- Spot trading: Available on Gate.com for direct BLUM/USDT pairs

- Telegram mini-app: Engage with the platform's unique features directly through Telegram

- P2P trading: Utilize Blum's localized peer-to-peer trading options for fiat on/off ramps

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is Blum's expected price?

Blum's expected price is projected to reach $0.28 by the end of 2025. Analysts predict it will continue growing, potentially hitting $0.40 by 2032.

How much will a Blum token be worth?

Based on current projections, a Blum token is expected to be worth $0.05061 by 2025 and could reach $0.06460 by 2030. However, actual value may vary depending on market conditions and adoption rates.

What is Blum crypto price prediction?

Blum crypto is predicted to reach $0.18 by 2029, $0.21 by 2030, and $0.28 by 2031. Experts forecast significant growth, with prices potentially hitting $0.40 by 2032.

How much is Blum coin worth in 2025?

Based on market data, Blum coin's value in 2025 fluctuates between $0.02771 and $0.1218, with significant price movements throughout the year.

Share

Content